BTCFi is the most noteworthy track in the Bitcoin financial application field. As one of the leading lending protocols in the BTCFi vertical, Colend is about to be listed on the cryptocurrency exchange Gate.io through the Startup Program.

Currently, the Bitcoin sidechain market is developing rapidly, with Core being the fastest-growing Bitcoin sidechain, accounting for 74% of the entire Bitcoin mining hash rate. The Colend protocol is built on Core and aims to redefine how BTC holders release asset production value. As the protocol with the highest total locked value (TVL) on the current BTCFi platform (with over $200 million TVL in just six months), Colend effectively combines on-chain innovation and security with a ve(3,3) decentralized governance system, providing the crypto community with a fair and easily accessible decentralized financial solution.

BTCFi: Transforming Bitcoin into a Productive Asset

By transforming Bitcoin from a "digital gold" store of value into a "productive asset" that can generate returns through lending and staking, BTCFi further unleashes Bitcoin's potential. This transformation can also increase miner income, enhancing the long-term security of the Bitcoin network. Currently, BTCFi accounts for less than 1% of the total market capitalization of cryptocurrencies, indicating significant growth potential in this vertical, with Colend expected to play a leading role.

Utilizing Core's dual-staking model, Colend achieves seamless integration with the broader DeFi ecosystem, enhancing Bitcoin's utility in DeFi. Its main features include decentralized and immutable transactions, liquidity pools with various dynamic interest rates, and a flexible collateral system.

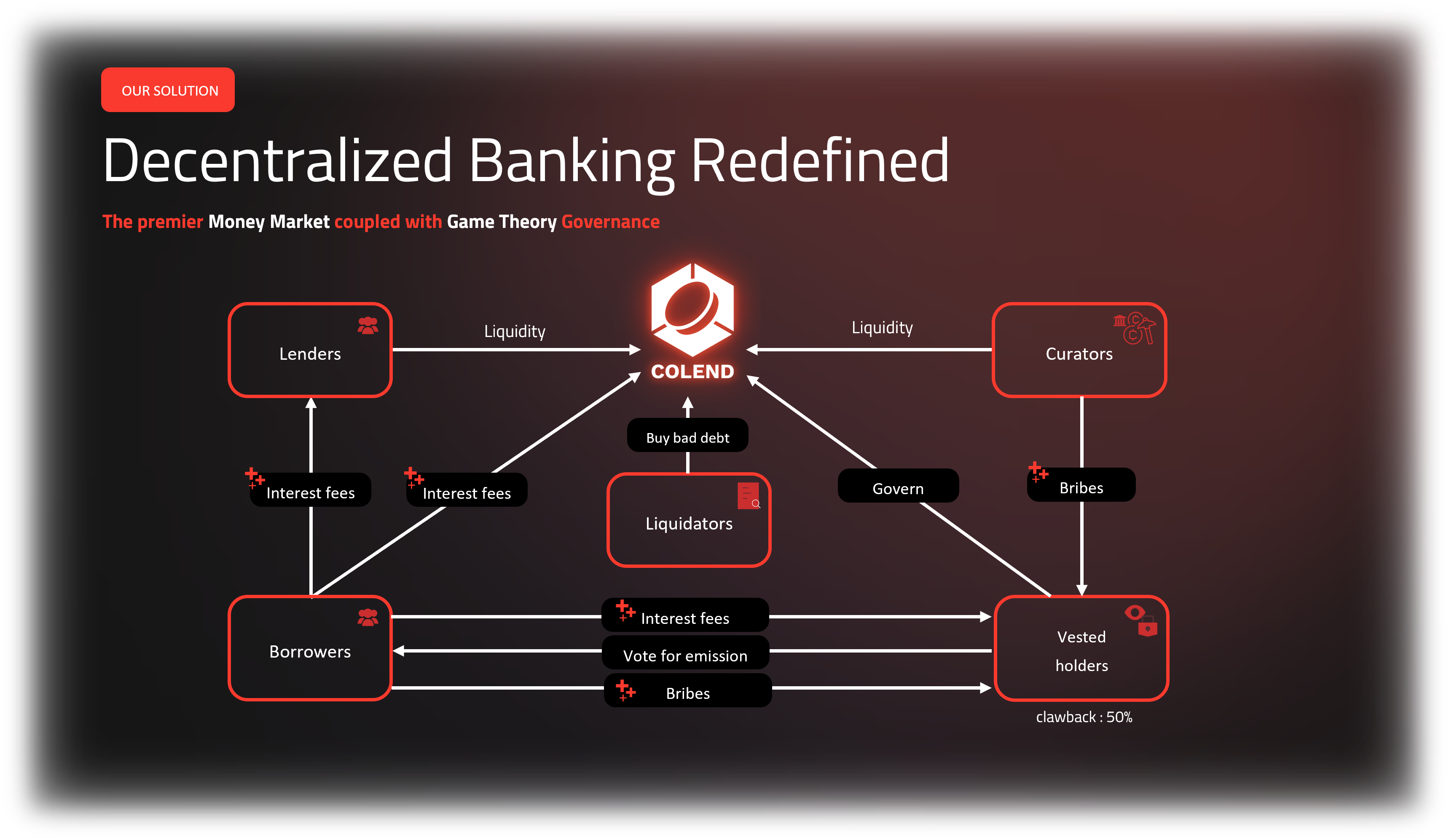

Community-Driven Governance Model

The Colend project token CLDN is about to be listed on the cryptocurrency exchange Gate.io through the Startup program. CLND is the core of the Colend ecosystem, offering various utilities such as community governance, financial incentives, LP Farming, and DAO buybacks. The ve(3,3) model used by Colend allows users to lock their CLND tokens into xCLND to grant necessary voting rights, thereby promoting community participation and expanding value. By participating in voting, xCLND holders can influence the protocol's annual percentage yield (APY), creating a community-driven decision-making and optimization feedback loop that continuously enhances the ecosystem.

Additionally, Colend's designed "bribe" system further strengthens its governance model by allowing Curators and Liquidity Suppliers to provide incentives to xCLND holders to vote in support of specific assets to increase APY. In practice, this governance model creates a self-sustaining "flywheel effect," aligning the interests of users and liquidity providers, thereby synchronizing voting participation, liquidity, and yield. By integrating this flywheel mechanism into the ve(3,3) governance model, Colend fosters a dynamic, self-reinforcing BTCFi ecosystem, providing income opportunities for CLND token holders and enhancing the protocol's attractiveness.

Promising Future Growth Prospects for BTCFi

Thanks to the upcoming upgrades of Core and the influx of institutional liquidity, Colend is expected to continue its expansion. According to Defillama data, Colend is currently among the top three in the BTCFi market and in the top ten for stablecoin APY, with indicators such as TVL and trading volume showing a certain leading advantage in the market. Coupled with its community-driven ve(3,3) governance model, Colend's position as a strategic foundation for the future BTCFi industry is further solidified.

As BTC liquidity is gradually released in the future, the application scenarios of the BTCFi ecosystem will also gain greater growth potential.

About Colend

Colend is a leading BTCFi lending protocol in the crypto market, providing decentralized financial solutions on Core. As the protocol with the highest TVL on the Bitcoin sidechain, Colend combines innovation and security with a ve(3,3) decentralized governance system. Its CLND token is about to be listed on Gate.io, providing more access to the protocol and supporting an inclusive, community-driven governance model. As a BTCFi project that does not overly rely on venture capital, Colend positions itself as a leader in the BTCFi field and continuously strives to provide the community with fairer and more accessible decentralized financial channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。