BTCFi is striving to unlock the trillion-dollar market potential of Bitcoin by injecting new vitality into the Bitcoin ecosystem through decentralized financial means.

Written by: Ac-Core, YBB Capital Researcher

TL;DR

- The broader context of BTCFi is: 1. The narrative of Ethereum and Ethereum killer chains is gradually weakening, and infrastructure development has reached saturation, leaving the industry overall lacking fresh narratives, with only superficial jargon remaining; 2. Compared to other public chains, BTC has not formed a comprehensive resource monopoly;

- The main scaling solutions for BTC include state channels, sidechains, Rollups, UTXO+ client validation, large blocks, and other asset protocols, but various scaling solutions must collectively face the technical challenges of meeting "orthodoxy" validation;

- The prerequisites for BTCFi's development are: cross-chain interoperability, solutions for Layer 2 scaling, smart contract functionality, and infrastructure and development tools that do not require one-click redundant construction;

- The main challenges facing BTCFi are: the limitations of the Bitcoin protocol and liquidity issues, security and trust issues of cross-chain bridges, the difficulty of accurately capturing prices with oracles, and finding a development path unique to BTCFi.

1. BTCFi

1.1 What is BTCFi

The Bitcoin chain was once the least active public chain, with a market value reaching a trillion dollars but long in a "dormant" state. "Fi" stands for Finance, thus the purpose of BTCFi is to establish a decentralized financial market for Bitcoin within this trillion-dollar market, allowing BTC holders to directly use Bitcoin-related financial derivative tools such as staking, lending, and market-making to generate yield, effectively bringing DeFi into the native Bitcoin ecosystem to activate more financial value.

1.2 Background

The year 2023 is a crucial year for the Bitcoin ecosystem to officially reach its peak, with various tokens represented by BRC20 triggering a significant wealth effect and stimulating market FOMO. Looking at the current state of the industry, aside from the inscriptions that are a broken cart, another reason the Bitcoin ecosystem can rise is that the narrative capabilities of Ethereum and Ethereum killer chains are gradually weakening, and infrastructure development has reached saturation, leaving the industry overall lacking fresh narratives and only superficial jargon remaining. The Bitcoin ecosystem has also perfectly replicated the development path of Ethereum, but the essential challenge it faces is how to expand the block without undermining Bitcoin's native consensus or causing a hard fork.

As of October 1, data statistics show frequent financing situations in the Bitcoin ecosystem, with 14 public financing rounds totaling over $71.1 million. Currently, BTCFi's only opportunity is that, for both users and VCs, the Bitcoin ecosystem is still full of opportunities, and compared to other public chains, it has not formed a comprehensive resource monopoly. Non-VC financing assets have also given birth to numerous protocol assets such as BRC20, ORC20, ARC20, SRC20, and CAT20. We explore from digital gold BTC to the controversial BTCFi, questioning whether Bitcoin's Fi is a false proposition, with the core discussion point being how to ensure asset security and adopt effective scaling methods.

1.3 The First Market Trigger Point: Index Asset Protocols

Index assets can be broadly divided into BRC20's non-UTXO bound assets and ARC20's UTXO bound assets. The ARC20 fungible token standard is based on Bitcoin's smallest unit, "Satoshi," with each token equivalent to 1 Satoshi, ensuring the minimum value of the token is 1 Satoshi. This standard is applied to the Bitcoin blockchain through the Atomicals protocol, enabling colored coin technology to be realized within the Bitcoin ecosystem, allowing these tokens to be split and combined like regular Bitcoin, paving the way for the future potential of AVM.

Other Asset Protocols

- ORC20: A token standard based on the Ordinals protocol extended from Bitcoin. The Ordinals protocol allows users to assign unique markings to individual Satoshis (the smallest unit of Bitcoin) on the Bitcoin network. ORC20 aims to create a token standard similar to Ethereum's ERC20, allowing users to issue and trade tokens on the Bitcoin network;

- SRC20: Another Bitcoin token standard launched with a similar idea to ORC20, but unlike it, SRC20 emphasizes a simpler and more efficient token issuance and transfer mechanism. It attempts to reduce transaction costs and improve efficiency by optimizing the complexity of token contracts, and can be used to build token protocols on the Bitcoin blockchain;

- CAT20: A similar token standard primarily used for issuing custom tokens (Custom Asset Tokens). Compared to ORC20 and SRC20, CAT20's functionality is more focused on creating custom tokens for individuals or businesses on the Bitcoin chain. It allows users to define the total supply, name, and other parameters of the token, and circulate it within the Bitcoin network for creating and managing digital assets.

2. Layer 2 Scaling Solutions: Who Will Capture BTCFi's Market Potential

The development of BTCFi is inseparable from DeFi, and the further expansion of DeFi relies on blockchain scaling. However, there is currently no unified and clear division of paths for blockchain scaling, and the trade-offs between feasibility, decentralization, and security among different paths remain controversial, all facing a common technical challenge: compliance with Bitcoin's "orthodoxy" validation.

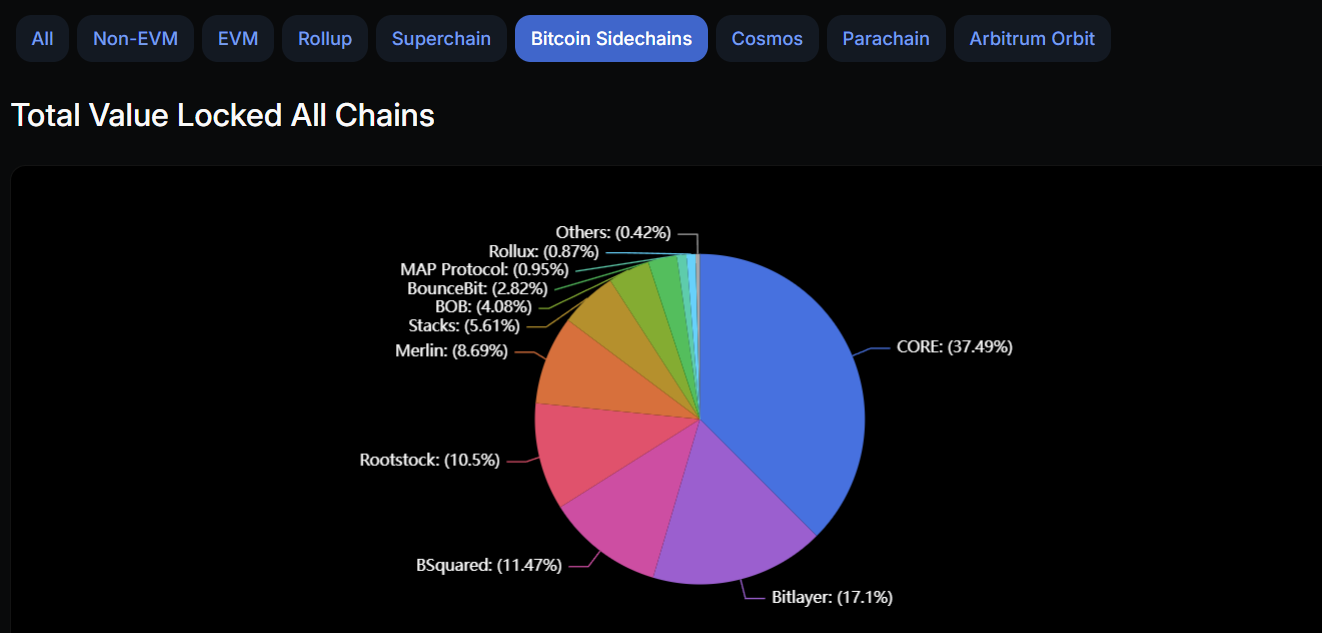

Source: DeFiLlama: Bitcoin Sidechains / Total Value Locked All Chains

By observing the relevant data from DeFiLlama on November 5, 2024, we can also find that among the current sidechain-related projects, the four projects CORE, Bitlayer, BSquared, and Rootsock have the highest TVL share, totaling 76.56%. Currently, BTCFi, compared to similar yield-generating strategies and "ETHFi," exhibits the following similar characteristics:

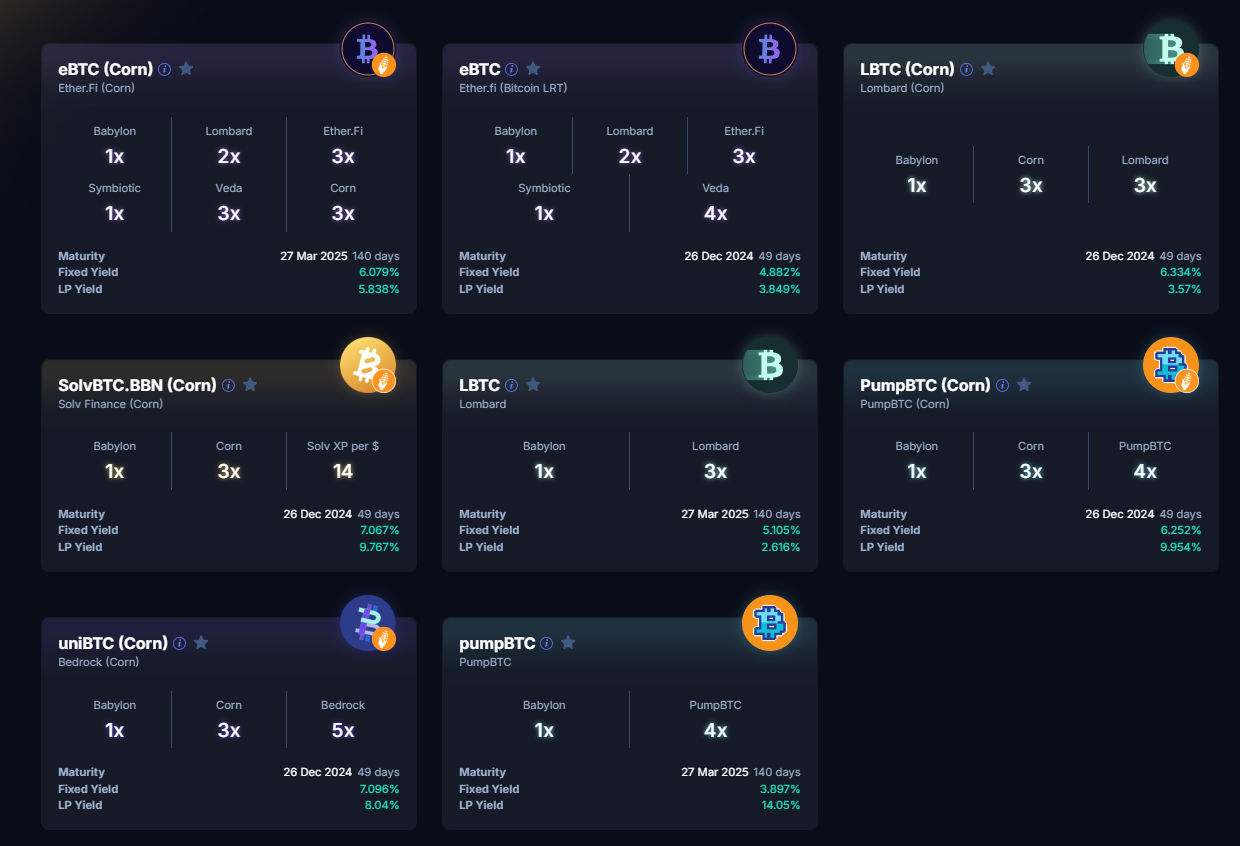

- BTCFi's coin-based Buff yield comes from: Babylon+LRT rewards + BTC scaling chain rewards + ETH chain LRT bundled yields (similar to Pendle and Swell);

- ETHFi's coin-based Buff yield comes from: POS interest + re-staking rewards + LRT rewards + ETH scaling chain rewards.

Source: Pendle / BTC Bonanza

2.1 State Channels

State channels are a scaling solution that allows users to conduct multiple transactions off the mainnet, only submitting to the mainnet when the channel is opened or closed. Currently, in Bitcoin, there are the Lightning Network and Ark, where users deposit BTC into a multi-signature address and conduct daily transactions through state channels, ultimately verifying the transaction results through mainnet consensus to ensure security.

2.2 Sidechains and Rollups

From the perspective of developing the Bitcoin ecosystem for fast transactions, Turing completeness, and interoperability, sidechains and Rollups are more suitable for the development of Bitcoin's ecosystem. Bitcoin's sidechains and Rollups have strong independence, with Rollups aiming to move complex operations to Layer 2, while the mainnet is only responsible for verifying the proofs submitted periodically by Layer 2, thereby increasing throughput. This mechanism ensures that the Layer 2 ledger is secure and consistent with the mainnet. However, for sidechains, the mainnet cannot directly verify whether cross-chain behavior on the sidechain is legitimate; cross-chain bridges will lock mainnet assets and map assets on the sidechain, often increasing the degree of decentralization of the chain through additional verification methods to ensure asset security, while currently, the solutions of sidechains and Rollups still show good market performance in releasing liquidity.

2.3 UTXO+ Client Validation

In terms of native characteristics and security, the UTXO solution stands out, aligning more closely with the definition of "orthodoxy." UTXO + client validation is an off-chain solution based on Bitcoin's characteristics, aimed at improving transaction efficiency and privacy while inheriting Bitcoin's security. Since Bitcoin natively uses the UTXO (Unspent Transaction Output) model rather than an account model, the core idea of client validation is to shift transaction validation from the consensus layer of the blockchain to off-chain, with the client related to the transaction responsible for validation. Specifically, users need to validate the validity of transfer declarations on their own clients to ensure transaction security and efficiency. This off-chain validation reduces the burden on the blockchain and ensures user privacy by having each client store only data relevant to itself.

The RGB protocol is a concrete implementation of this concept, first proposed in 2016 by Peter Todd with the concepts of "one-time seals" and "client validation." RGB uses Bitcoin's UTXO as "seal strips," binding the state changes of off-chain assets to Bitcoin's UTXO, thereby ensuring secure off-chain state changes without double spending. In this way, RGB retains the strong security of the Bitcoin network.

Although this solution brings significant efficiency and privacy advantages, it still has some drawbacks. Users' clients only store transaction data relevant to themselves, leading to data silos that hinder the development of applications like DeFi. UTXO + client validation achieves efficient and privacy-friendly off-chain transaction validation by inheriting Bitcoin's security, but there is still considerable room for improvement in data transparency, operational convenience, and the completeness of development tools.

2.4 Large Blocks Changing Existing Consensus

Changing the existing consensus also means changing today's Bitcoin, and there are hard issues such as consensus and ecological development in realizing the vision of BTCFi, which will only be elaborated here.

BCH (Bitcoin Cash) is a hard fork of Bitcoin due to Bitcoin's scalability issues at Block 478558 (August 1, 2017), with Bitcoin Cash's block size being 8MB, while Bitcoin's block size was decided to increase from 1MB to 2MB within six months on the same day. The plan for Bitcoin Cash was first proposed by Bitmain, a Chinese Bitcoin mining machine company, and related hard fork tokens include BSV.

3. The Fi in BTCFi Needs to Better Release Liquidity

Source: pixabay.com

As mentioned at the beginning, Bitcoin's trillion-dollar market value cannot remain in a long-term dormant state like Ethereum, where it can earn interest through borrowing. The storage options are limited to secure hardware wallets or trusted centralized exchanges. How can BTCFi gradually circulate such a massive market value through on-chain financialization?

3.1 Prerequisites for Development

1. Cross-Chain Interoperability

Unlike other smart contract platforms like Ethereum, the Bitcoin blockchain does not have native smart contract functionality. The primary task of BTCFi is to develop trusted cross-chain bridges so that Bitcoin can participate in DeFi applications on other blockchains with smart contract capabilities. These bridges would allow Bitcoin to be "mapped" onto other chains, retaining its value while enabling more functionalities.

2. Layer 2 Scaling Solutions

Bitcoin's Layer 2 scaling is more challenging to balance among the triangular issues compared to Ethereum's Layer 2, often sacrificing decentralization to some extent. However, for the market, a more centralized development often generates new wealth effects more easily. How project teams can provide the market with more wealth effects to compensate for the lack of decentralization may be a primary consideration.

3. Smart Contract Functionality

To support DeFi applications, Bitcoin needs some form of smart contract functionality. Currently, the Bitcoin network does not have native smart contracts, and developers are exploring ways to provide smart contract support for Bitcoin through Layer 2 solutions (such as RSK, AVM, Bitvm) or sidechains. This would enable Bitcoin to directly support lending, liquidity provision, derivatives, and other DeFi functions.

4. Strong Developer Tools and Infrastructure

Developers need comprehensive tools and infrastructure to create and deploy BTCFi applications, but the Bitcoin ecosystem seems to not require one-click, chain-like repetitive construction.

3.2 Major Challenges Faced

1. Limitations of the Bitcoin Protocol

Bitcoin is designed to be a secure and reliable means of value storage and lacks the flexibility of Ethereum or other blockchains specifically designed for DeFi. Due to the absence of built-in smart contract functionality, developing BTCFi applications must overcome the limitations of the protocol itself, which may involve complex technical innovations.

2. Liquidity Issues

Even if Bitcoin is brought into Ethereum and other smart contract-supporting blockchains through cross-chain bridges, its liquidity in DeFi remains far lower than that of tokens like Ethereum. The current lack of liquidity may limit the adoption of BTCFi.

3. Security and Trust Issues of Cross-Chain Bridges

Cross-chain bridge technology is key to the development of BTCFi, but these bridges themselves pose security risks. In recent years, cross-chain bridge attacks have been frequent, leading to significant financial losses. Ensuring the security of cross-chain bridges and preventing risks from centralization or technical failures remains an important challenge for BTCFi.

4. Difficulty in Accurately Capturing Prices with Oracles

The architectural limitations of the Bitcoin blockchain make it difficult to deploy oracle services on Bitcoin as easily as projects like Chainlink on Ethereum. This limitation complicates the deployment of oracle systems within the BTCFi ecosystem, potentially requiring reliance on Layer 2 or sidechain solutions. In terms of reliance on cross-chain bridges and price synchronization challenges, BTCFi may primarily depend on cross-chain bridges to map Bitcoin onto other chains for cross-chain price synchronization. Overall, it faces greater technical and security challenges regarding oracle accuracy compared to Ethereum.

5. Finding Its Own Development Path, Not Just Imitating Ethereum

The core goal of Bitcoin's design from the beginning was to prioritize security over functionality. In the design of BTCFi, market acceptance and security will always take precedence over functionality. Bitcoin's adoption globally is mainly focused on value storage and payments, so BTCFi may concentrate on financial products related to payments and value storage. The concept of PayFi is not only applicable to Solana but is also more suitable for Bitcoin.

Reference Article:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。