Chainlink co-founder Sergey Nazarov has consistently emphasized that the development of blockchain technology is not merely a technical iteration, but a profound transformation involving finance, economics, and even social structures. He envisions that as blockchain technology evolves, we will witness a more open, transparent, and decentralized world. This is already beginning to manifest in some of the industries that have the most significant impact on the real world, such as finance and trade.

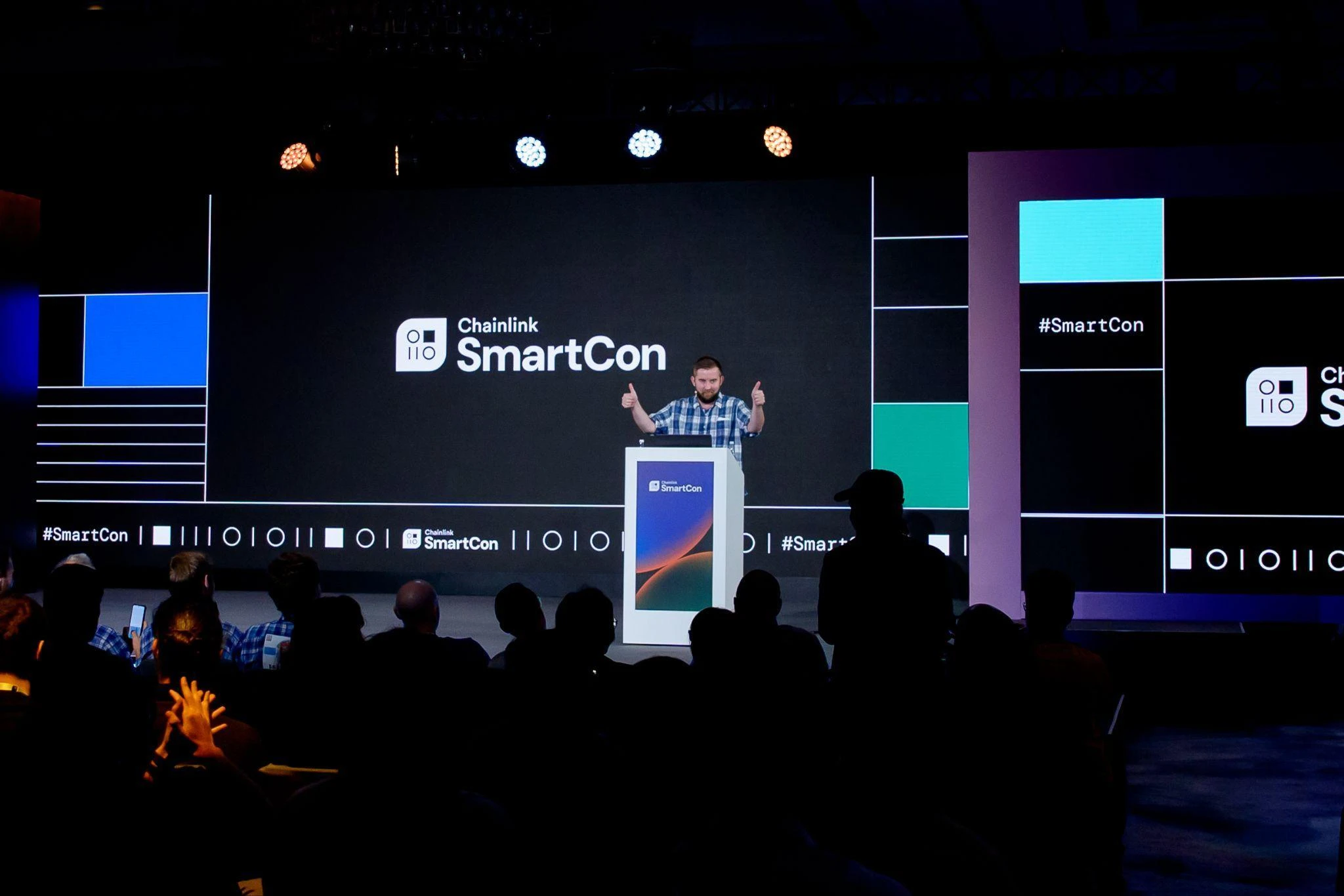

A few years ago, Chainlink began collaborating with over a dozen financial market infrastructure and institutions, including Swift, to explore how these institutions can efficiently transfer tokenized assets between public and private chains using existing Swift infrastructure. Following a series of proofs of concept and pilot projects over the past two years, Chainlink has further positioned itself to empower the digitalization and tokenization processes of capital markets through blockchain technology, facilitating the development of on-chain finance. At the end of October, Chainlink, at the invitation of Hong Kong's Deputy Secretary for Financial Services and the Treasury, Chan Ho-lam, presented a grand show in Hong Kong—bringing its annual flagship conference SmartCon to Asia for the first time. Themed "Integrating Blockchain with Traditional Finance," Chainlink co-founder Sergey Nazarov and the global Chainlink team, along with over a hundred core leaders from government agencies, Web3, and capital markets, delivered an exciting agenda for more than 2,000 attendees from the global Web3 community and capital market participants, including Euroclear, Citibank, Fidelity International, HSBC, Franklin Templeton, ANZ, Standard Chartered Ventures, Aptos Labs, Sonieum, Matrixport, CELO, and more. (For conference replays, please click https://smartcon.chain.link/video-on-demand)

Chan Ho-lam attended the 2023 SmartCon event held in Barcelona, Spain, last October, where he engaged in an in-depth conversation with Chainlink founder Sergey Nazarov, discussing the latest trends in Web3, virtual assets, and fintech in Hong Kong, as well as the thriving fintech ecosystem in the region.

At this Hong Kong SmartCon, Chan Ho-lam stated: "Last year in Barcelona, I personally felt the enthusiasm and innovative spirit of the Chainlink community developers. I deeply realized the immense potential of this technology in driving the transformation of decentralized finance and the digital economy. Chainlink plays a crucial role in the global blockchain ecosystem, with its technology applications covering key areas such as decentralized oracle networks. Therefore, I hope to deepen the understanding of its development trends in Asia, especially Hong Kong, and explore how to apply its technology to local fintech and Web3 innovation waves. As an international financial center, Hong Kong possesses strong Web3 development potential and a sound regulatory framework. In the future, I look forward to Chainlink achieving greater breakthroughs in Asia, particularly in Hong Kong, promoting the widespread application of decentralized technology in the region, and helping Hong Kong become an important engine for global Web3 development."

As discussed in several sessions at the conference, the next era will be decentralized, and blockchain has already transcended the Web3 industry, playing an important role on the real-world stage. This week at Singapore FinTech Week, Chainlink, in collaboration with several institutions in the Monetary Authority of Singapore's Project Guardian, launched a series of tokenization use cases:

To facilitate cross-chain communication with tokenized fund contracts, SBI Digital Markets created a digital transfer agent smart contract, supported by Chainlink's industry-standard Cross-Chain Interoperability Protocol (CCIP). This pilot demonstrated the feasibility of using smart contracts and the Chainlink platform to streamline fund operations between different blockchain networks and financial systems, fundamentally transforming operational efficiency and transparency for the $63 trillion mutual fund industry.

A pilot project jointly conducted by Swift, UBS Asset Management, and Chainlink was also successfully completed this week, utilizing the Swift network for the settlement of subscription and redemption operations for tokenized funds. This pilot project covered over 11,500 financial institutions across more than 200 countries and regions, using fiat payment systems for digital asset transaction settlements. This pilot showcased how financial institutions can leverage blockchain technology, the Chainlink platform, and the Swift network for the settlement of subscription and redemption operations for tokenized investment funds, achieving a seamless payment experience without needing to put the entire payment process on-chain. Thus, the entire process of fund subscription and redemption can be automated.

ADDX, in collaboration with ANZ and Chainlink, announced a new use case in the Monetary Authority of Singapore's Project Guardian, focusing on the full asset lifecycle of tokenized commercial paper in cross-border transactions. This use case utilizes ADDX's investment platform, ANZ's digital asset services, and Chainlink's Cross-Chain Interoperability Protocol (CCIP), which includes the recently announced Private Transactions feature.

This series of collaborations with leading financial institutions demonstrates that through standardization, blockchain technology can better integrate into the existing financial system, bringing more value to the global economy. Chainlink co-founders stated at Singapore FinTech Week that these are exciting achievements, and the Chainlink team looks forward to continuing to work with partners to expand the adoption of these use cases, facilitating the scaling of on-chain finance.

From Sibos held in Beijing in October, to Hong Kong FinTech Week and SmartCon 2024, and then to Singapore FinTech Week, it is evident that the integration of blockchain technology and traditional finance is gradually deepening. Chainlink has long been positioned not just as a bridge connecting TradFi and DeFi, but also aims to build a new economic model through technological evolution, allowing various industries to integrate and thrive together, jointly promoting the development of the global economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。