DeFi companies are concerned about the regulation from the U.S. Securities and Exchange Commission, but with Donald Trump being elected president, the market expects the regulatory environment to become more favorable, leading to a rise in DeFi token prices.

Written by: Brayden Lindrea

Translated by: Koala, Mars Finance

DeFi companies are worried about implementing a "value accumulation mechanism" for their tokens under the supervision of the U.S. Securities and Exchange Commission — but this situation may change with the inauguration of President Donald Trump.

An industry analyst stated that as traders anticipate the Trump administration will enhance the "investment appeal" of holding "utility" tokens, decentralized finance tokens have risen over 30%.

UNI was the biggest winner from November 6 to 7, rising over 35% to a local high of $9.58.

Charlie Sherry, CFO of BTC Markets and cryptocurrency analyst, explained in a comment to Cointelegraph: "Until recently, DeFi tokens were widely labeled as 'useless governance tokens,' which had no value other than voting on protocol changes through governance voting rights."

"However, investors and token holders have been buying in because they believe that one day, the fees earned by these protocols will be able to return value to the tokens."

Sherry pointed out that this "value accumulation mechanism" has not yet been implemented because many DeFi protocols are concerned about enforcement actions from the U.S. Securities and Exchange Commission, with Sherry explaining that the SEC's investigation into Uniswap Labs is a typical example.

On November 6, Donald Trump won the presidency of the United States by a landslide against Vice President Kamala Harris. According to 10x Research, SEC Chairman Gary Gensler may resign as early as December or January.

Sherry stated that these two points could jointly trigger a wave of "regulatory optimism." "The market is now digesting the expected regulatory shift, anticipating that DeFi projects and their tokens will face a more favorable environment."

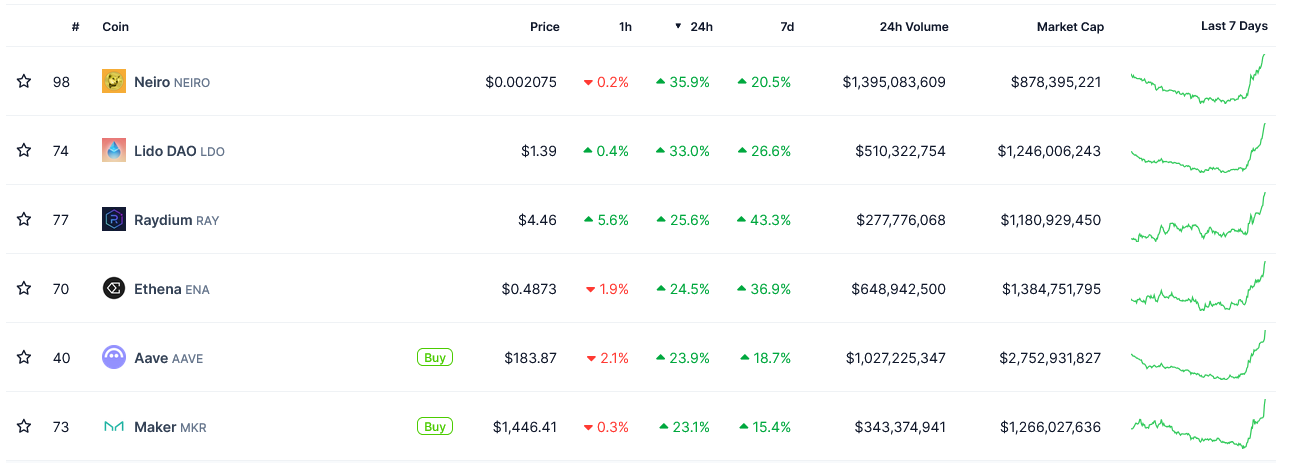

The best-performing tokens in the past 24 hours. Source: CoinGecko

Sherry further explained the value accumulation mechanism, stating that the "fee conversion" proposal from the lending protocol Aave would be "an important step in creating intrinsic value for AAVE token holders."

Similarly, Sherry noted that a portion of the fees from Uniswap's new Layer 2 Unichain will also flow to UNI token holders — "transforming UNI from a governance token into a utility asset and expanding its investment appeal."

Sherry pointed out that DeFi protocols behind LIDO, ENA, MKR, and Frax (FXS) may also see similar "value accumulation" changes.

Meanwhile, Markus Thielen, research director at 10x Research, stated that the rise in DeFi tokens may be due to some traders adopting a "buying the laggards" strategy — that is, purchasing assets that performed poorly in the previous year, which may become leaders in the following year.

Thielen told Cointelegraph that there is also speculation that BlackRock may promote its spot Ethereum ETH ETF "more aggressively" in 2025.

Thielen stated that if Ethereum successfully breaks through the $2,700 level, it could reach $3,000.

As of the time of this writing, Ethereum is currently trading at $2,845, having risen 8.5% in the past 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。