Bitcoin spot ETF data and stablecoin market capitalization have both seen a rebound.

Written by: 1912212.eth, Foresight News

After Trump's victory, the cryptocurrency market has recently experienced a massive surge. Bitcoin, Ethereum, Meme coins, re-staking, DeFi, RWA, L2, AI—almost all major sectors have seen a general rise, with the only difference being the extent of the increase.

So, how is the overall data performance of the cryptocurrency market today? Let's take a closer look.

Bitcoin Spot ETF Daily Net Inflow Exceeds $600 Million

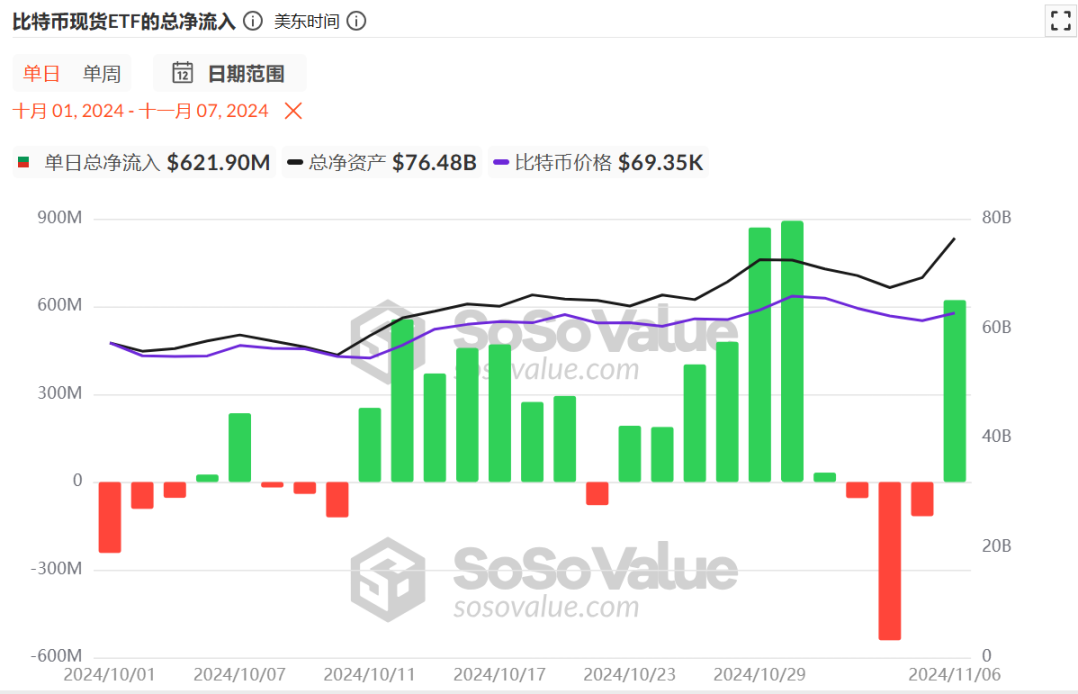

Since October, Bitcoin spot ETF data has shown significant net inflows, with the net inflow in both amount and duration far exceeding net outflows.

At the beginning of November, due to uncertainties surrounding the U.S. elections, there was a three-day net outflow totaling about $700 million. However, after the election results were confirmed on November 6, the single-day net inflow reached an astonishing $621.9 million, almost completely offsetting the net outflow.

On that day, the total trading volume reached $6.07 billion, a new high since March 15 of this year. Among them, BlackRock's ETF IBIT had a single-day trading volume of $4.14 billion, setting a new historical high.

After the election results were confirmed, off-exchange funds, which had previously been hesitant, surged back into the market. Currently, the cumulative total net inflow of Bitcoin spot ETFs has risen to $24.12 billion.

Stablecoin Market Capitalization Approaches Historical High

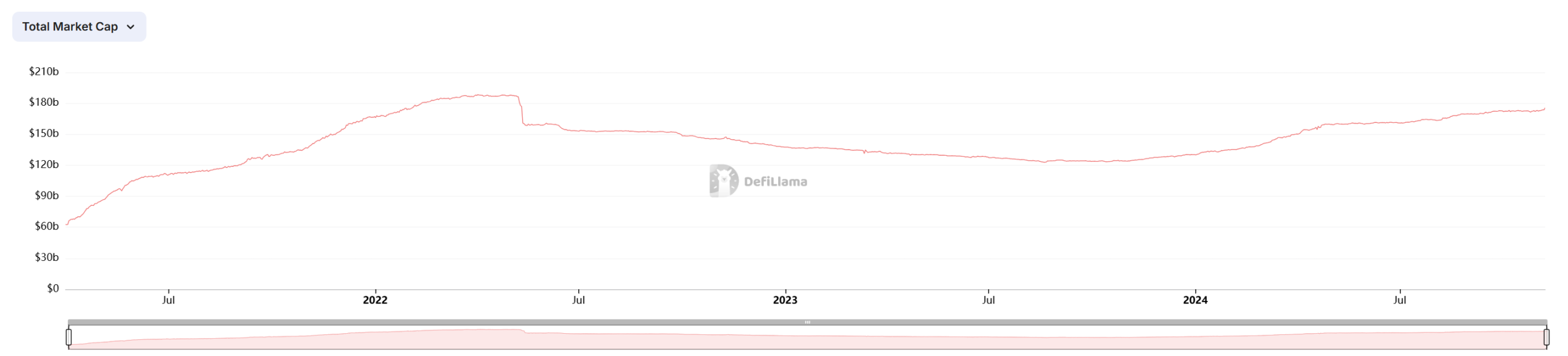

Stablecoins, which measure market liquidity, have also performed well. The total market capitalization has risen above $175.06 billion, nearing the historical high of $187 billion. Over the past seven days, its market capitalization has increased by 1.47%, indicating a continuous inflow of funds.

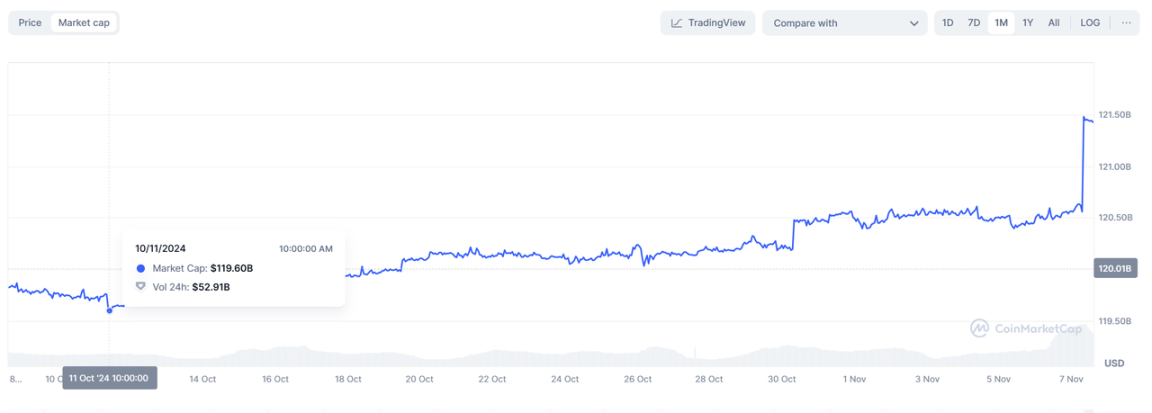

Among them, USDT's market capitalization rose from $120 billion to $121.5 billion over the past month. Notably, on November 7, its market capitalization surged from $120.6 billion to $121.4 billion in a single day, an increase of over $800 million.

USDC data also performed well, rising from a low of $34.38 billion to $36.7 billion over the past month, an increase of over $2 billion. The inflow of U.S. funds remains strong.

Total Market Capitalization of Cryptocurrency Rises to $2.5 Trillion, Approaching Historical High

The peak total market capitalization of the last cryptocurrency cycle was $2.86 trillion. In April of this year, the total market capitalization briefly reached $2.7 trillion, and it has now risen above $2.5 trillion, not far from the historical high.

Institutional and Trader Perspectives

Bitfinex Analyst: Expecting a Large Release of Capital into the Crypto Space in the Short Term After Trump's Election

As the industry anticipates a less hostile attitude from federal agencies towards cryptocurrencies, this trend is expected to facilitate more capital inflow into the Web3 space. Analysts state: "We expect a large amount of capital to be released for the crypto space in the short term. Additionally, this may influence the approach taken by the U.S. SEC, which is generally perceived as hostile towards the crypto industry."

Matrixport: Election Volatility Eases, Bitcoin Expected to Rise Further by Year-End

Matrixport released a daily chart report indicating that Bitcoin experienced a slight sell-off during the critical moments of the election, with the greed and fear index retreating from the overbought "greed" zone to a more balanced level, creating conditions for subsequent increases. As the results of the U.S. presidential election become clearer, the market is expected to see a rise in risk appetite towards the end of the year. With the election situation remaining tense and volatility continuing to rise, once volatility decreases, traders will be better positioned to increase their holdings. Against the backdrop of strengthening upward momentum for Bitcoin, the greed and fear index is also expected to rise further.

10x Research: Market Narrative Shifts, Bitcoin Aiming for $100,000

10x Research states that as ETF demand grows parabolically, Bitcoin is expected to follow suit, potentially reaching $101,694 by the end of January 2025. A strong bullish window is expected to continue into the first quarter of 2025. The narrative is shifting from positioning DeFi as an external alternative to the future and traditional financial systems to viewing Bitcoin as digital gold. This framework positions Bitcoin as a permanent, long-term asset in institutional portfolios.

CryptoQuant CEO: Advises Bitcoin Holders to Gradually Sell, Warns of Full-Position Buying Risks

Ki Young Ju, CEO of crypto analytics platform CryptoQuant, tweeted that new investors often hold Bitcoin during bear markets and tend to sell after experiencing losses, typically around two years later when the market stabilizes. He believes that now is the time for this transition, suggesting that Bitcoin could rise another 30-40% from current levels, but will not replicate the 368% increase from $16,000. He advises investors to consider gradually selling rather than continuing to "buy the dip" with full positions.

Meme Coin KOL Murad: Bitcoin Will Exceed $100,000

Meme coin KOL Murad tweeted that Bitcoin will exceed $100,000, and top meme coins will rise over 100 times. This tweet received over 6,000 likes.

Trader Ansem: An Unprecedented Altcoin Bull Market Awaits if Regulations Favorable

Ansem tweeted that if the U.S. implements favorable regulations for DeFi in the coming years, we will see an unprecedented altcoin bull market.

Trader Eugene: Don't Underestimate Breaking Historical Highs

Trader Eugene tweeted yesterday that during the most uncertain times in the market, one must follow the oldest rule of the market. Don't underestimate Bitcoin breaking historical highs.

Trader Nachi: The Real Super Cycle Begins

Trader Nachi tweeted that Trump's overwhelming victory marks the beginning of a real super cycle, expected to last at least four years.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。