Market predictions suggest that Powell will avoid political topics at the upcoming press conference, primarily discussing the economic situation and cautiously analyzing the new government's economic policies while maintaining neutrality.

Written by: Revc, Golden Finance

Introduction

After Donald Trump won the U.S. presidential election again, global financial markets gradually shifted their focus from the election results to Federal Reserve Chairman Jerome Powell and the direction of his monetary policy. In the upcoming interest rate decision meeting (3 AM Beijing time on the 7th), the market generally expects the Federal Reserve to further ease monetary policy, with a predicted rate cut of 25 basis points to address the pressures of slowing U.S. economic growth and a weak labor market. However, Trump's policy proposals have raised concerns among investors, particularly regarding how his fiscal policies might affect the Federal Reserve's future decision-making path.

Trump's Policy Expectations and Federal Reserve Challenges

During his campaign, Trump proposed a series of economic policies, including imposing tariffs on trade partners, deporting illegal immigrants, and corporate tax cuts. If these measures are implemented, they could increase inflationary pressures and raise the federal deficit, thereby posing greater challenges to the Federal Reserve's inflation targets and employment stability. Economists believe that the Federal Reserve may continue to cut rates to support the economy, but Powell may be cautious about the pace of rate cuts to avoid exacerbating economic uncertainty. Against this backdrop, the market predicts that Powell will avoid political topics at the upcoming press conference, primarily discussing the economic situation and cautiously analyzing the new government's economic policies while maintaining neutrality.

Disputes Over Rate Path Adjustments and Rate Cut Endpoints

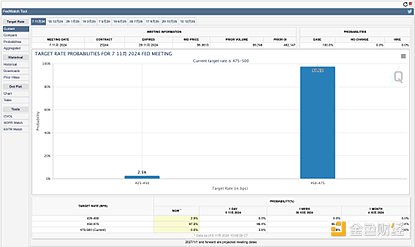

Trump's victory has changed market expectations for the future rate path. According to CME's "FedWatch Tool" data, investors expect the Federal Reserve may continue to cut rates in the coming months, with the federal funds rate potentially dropping to 3.75%-4.0% by the end of 2025. Some analysts believe that Trump's fiscal policies will increase inflationary pressures, possibly forcing the Federal Reserve to accelerate rate cuts. However, experts like economists at Nomura predict that the Federal Reserve may only cut rates once in 2025, keeping the terminal rate at 3.625%. Professor Bill English from Yale School of Management believes that the Federal Reserve may pause rate cuts mid-cycle to assess the response of economic data, providing a buffer against market uncertainty.

Market Impact of Powell's Speech and Global Attention

As the interest rate decision approaches, global investors are looking forward to Powell's assessment of the economic situation and hints about the frequency of rate cuts. Whether Powell will indicate that inflation is gradually under control and whether the pace of rate cuts will slow down in the future has become a market focus. CME data shows that some traders believe rate cuts may pause next year, and any statements from Powell could directly influence market expectations. In the political environment following Trump's victory, the Federal Reserve's future monetary policy is seen as a crucial factor affecting economic recovery and global asset prices.

Trump's Policies and Potential Volatility in Global Capital Markets

If Trump's economic policies, including tax cuts, increased government spending, and high tariffs, are fully implemented, they will impact the Federal Reserve's policy path. Economists believe that if inflation rises rapidly due to fiscal expansion, Powell may have to adjust the pace of current monetary policy and adopt more cautious easing measures to stabilize market expectations. This will not only affect domestic bank rates, housing loans, and savings rates in the U.S. but will also have far-reaching effects on global capital markets through fluctuations in the dollar and interest rates. The market expects Powell to gradually slow down rate cuts to address this challenge, which global investors will closely monitor.

Short-term Reactions and Outlook of the Cryptocurrency Market

Changes in Federal Reserve policy also have an indirect impact on the cryptocurrency market. Whenever the Federal Reserve announces rate cuts or eases policy, the relative returns on traditional assets decline, and some funds may flow into cryptocurrencies like Bitcoin to hedge against risks. If Trump's policies lead to rising inflation, cryptocurrencies may further attract safe-haven funds.

Conclusion

As the U.S. election concludes, the Federal Reserve's monetary policy will become a barometer for global markets. In the current political and economic context, Powell and the Federal Reserve's policy decisions, especially the dynamic adjustments regarding inflation, rate paths, and their impact on global capital markets, will continue to lead investors' focus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。