Preface: Investment carries risks, and operations should be cautious.

Article review takes time, and there may be delays in publication. The article is for reference only, welcome to read!

Article writing time: November 7, 14:19 Beijing time

Market Information

- Ripple CEO calls for Trump to quickly reshape U.S. cryptocurrency regulation after taking office;

- Barclays: Trump may pressure the Japanese government and central bank through exchange rates;

- Xi Jinping congratulates U.S. President-elect Trump;

- Fortune magazine: Musk strongly supports Trump, possibly seeking relaxed regulation and government subsidies;

- Expectations of Trump's victory have driven up Bitcoin prices, thereby stimulating voter support;

- JPMorgan predicts the Federal Reserve will cut interest rates quarterly starting in March 2025;

Market Review

The U.S. election concluded yesterday afternoon, with Trump elected. Bitcoin also surged in price due to the election, reaching a new historical high of 76,420. After a long silence, Ethereum also broke out, with two consecutive large bullish candles on the daily chart breaking the bottom consolidation trend. Tonight, at 3 AM tomorrow, is the Federal Reserve's interest rate meeting. Based on the previous non-farm payroll data, poor employment figures have increased the likelihood of a more significant rate hike in the Fed's decision. The interest rate swap market is heavily betting that the Fed may cut rates by 50 basis points in November, rather than the previously stated 25 basis points. For tonight's interest rate meeting, everyone needs to be mentally prepared, as continuous data has led to a persistent rise in the market. In trading, everyone should pay attention to controlling risks;

In terms of market conditions, we previously expected a rebound, which has occurred. Due to the impact of the election, this rebound has been quite strong. We won't elaborate much on the news impact; those who caught this rebound should have made a significant profit. Tonight, focus on the decision from the interest rate meeting;

Market Analysis

BTC:

On the daily chart, Bitcoin's price has been pushed higher due to the election, but it is still not outrageous. From a technical perspective, after breaking through, the resistance level for Bitcoin will be around 77,000. After breaking the previous high, the path above will be clear, but the market will not always move in one direction. Currently, there are no strong short signals on the daily chart. With Trump's election and the Fed's rate cut, in future trading, it is advisable to focus on low long positions. During the day, you can plan around 74,100, aiming for new highs. After reaching around 77,000, watch for any long upper shadows to provide short opportunities; manage your entry accordingly. For short-term trading, control risks and manage profits and losses independently;

ETH:

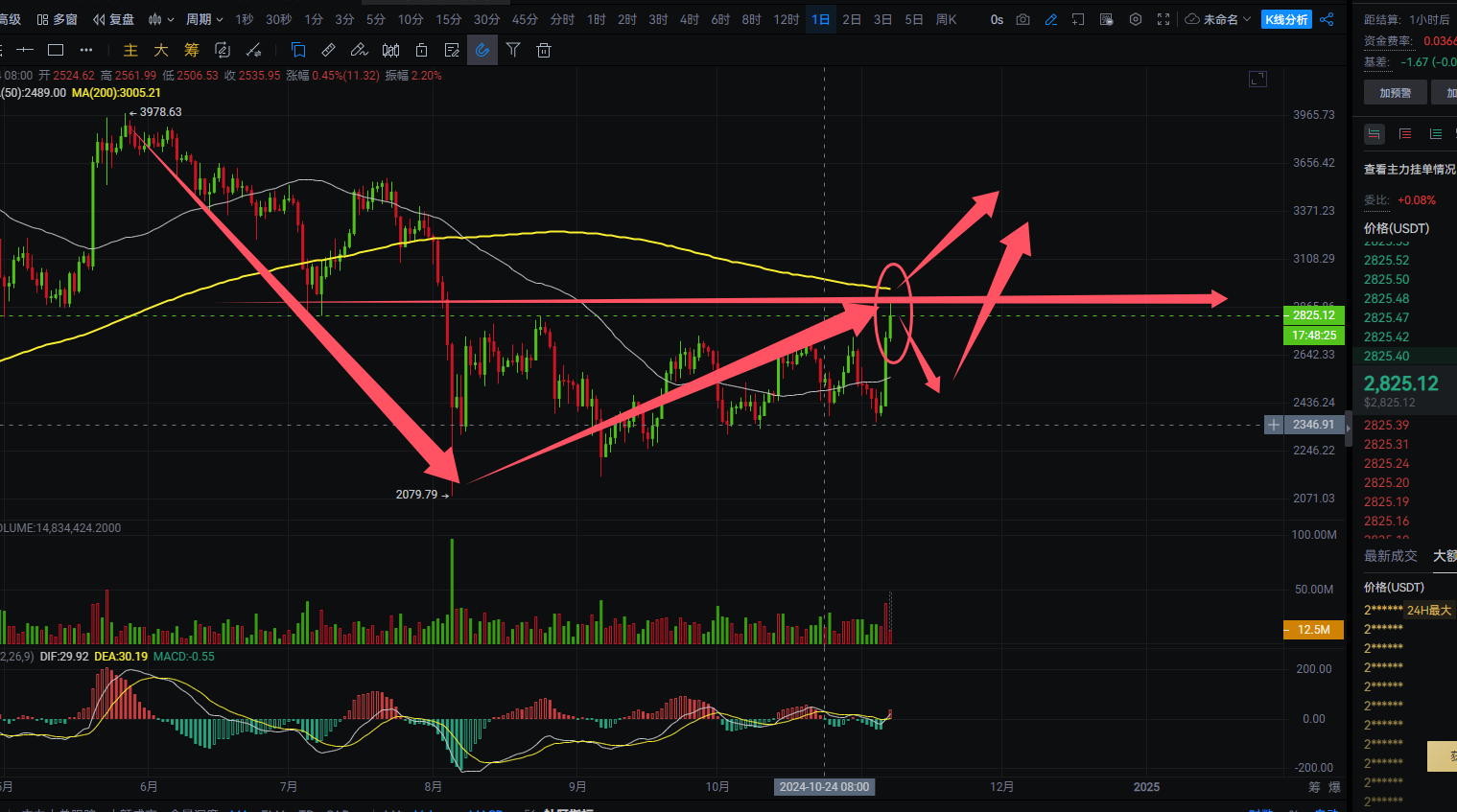

On the daily chart, Ethereum has finally broken out after a long period of consolidation due to the U.S. election, but this breakout only reached previous resistance. After the top of the range consolidation, it did not continue to rise. In trading, focus on the stability around 2,860 to plan your positions. If the daily chart fails to effectively break the 2,860 level, the market will likely see a pullback, approximately around 2,550 before starting to rally again. In trading, plan based on the daily close; if it does not break 2,860, short to around 2,550. If it breaks through, you can chase up to around 3,000; manage your entry accordingly. For short-term trading, control risks and manage profits and losses independently;

In summary:

Bitcoin bulls are strong; in trading, you can go long on pullbacks. For Ethereum, pay attention to breaking the upper resistance before planning positions;

The article is time-sensitive; pay attention to risks. The above is only personal advice and for reference!

Follow the WeChat public account Crypto Lao Zhao to discuss the market together;

Everything, the root of suffering is the pursuit of certainty. Impermanence is the norm and the way life should be. Always wanting to grasp the market, not trading at 50% certainty, not trading at 70% certainty, must wait for 100% certainty—where is there 100% certainty in the market? Trading is about trading risks, trying to let the odds stand on your side. Those who give love will receive love in return; those who bring blessings will receive blessings. Sometimes, learn to take a little loss, be a bit foolish, a bit clumsy. For example, if the market is bullish, once this is confirmed, don’t get too stuck on the position, lower your position a bit, and then get in first; at worst, it will reverse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。