The second season of the Wavedrops event is still ongoing, with 7% of the tokens being allocated as airdrop rewards.

Written by: Asher, Odaily Planet Daily

Yesterday, the Ethereum restaking protocol Swell Network announced on the X platform that its token SWELL will be available for claiming starting at 17:00 Beijing time on November 7 (claim link: https://app.swellnetwork.io/dao/voyage). Once the claiming opens, it can be claimed within a maximum of 6 months; any unclaimed tokens will be returned to the DAO for future plans. Additionally, the SWELL token will be listed on major centralized exchanges at 18:00. According to official information, SWELL will be listed on centralized exchanges such as Kucoin, Huobi HTX, Bitget, Bybit, and MEXC.

Below, Odaily Planet Daily provides a quick overview of the Ethereum restaking protocol Swell Network, its token economic model, and how to participate in the second season airdrop event.

Project Introduction

Source: Official Twitter

Swell is a non-custodial liquid staking protocol dedicated to providing the best liquid staking experience in the world, simplifying access to DeFi while ensuring the future security of Ethereum. It utilizes diversified AVS and a rich ecosystem of innovative applications (including Ion, Brahma, Ambient, etc.) to achieve restaking upgrades. Through Swell, users can earn passive income by staking ETH, earn blockchain rewards, and obtain a liquid staking token (LST) that generates yield, allowing them to hold or participate in a broader DeFi ecosystem for additional earnings.

It is worth mentioning that Swell L2 is migrating to the Optimism Superchain. This move will allow Swell L2 to join the superchain as an Optimistic Rollup built on the OP Stack.

According to ROOTDATA, in March 2022, Swell Network announced the completion of a $3.75 million seed round financing, led by Framework Ventures, with participation from IOSG Ventures, Apollo Capital, Maven 11, angel investor Mark Cuban, Synthetix co-founder Kain Warwick, Jordan Momtazi, Balancer founder Fernando Martinelli, Ryan Sean Adams, Bankless co-founder David Hoffman, Ren Protocol co-founder Loong Wang, and Mask Network founder Suji Yan.

Token Economic Model

According to official documents, the Swell Network token SWELL has a total supply of 10,000,000,000 tokens, with 13% of the total supply (1,300,000,000 tokens) available at TGE. The specific allocation ratios are as follows:

- Community: 3,500,000,000 SWELL, accounting for 35% of the total supply, mainly including three parts. First, Voyage (first season airdrop event), accounting for 8% of the total supply; second, Wavedrops (second season airdrop event), accounting for 7% of the total supply; third, the launch pool, which will have 135,530,000 SWELL allocated for the launch fund pool and marketing to support SWELL's listing and issuance on exchanges, with the remaining tokens used for strategic purposes related to the community, ecosystem, and strategic incentives;

- Team: 2,500,000,000 SWELL, accounting for 25% of the total supply, allocated to current and future core contributors and advisors of Swell DAO. This portion of tokens will be locked for 12 months after TGE, followed by a linear unlock over 36 months;

- Early fundraising: 2,500,000,000 SWELL, accounting for 25% of the total supply, allocated to private investors who provided funding, expertise, and other support during the early stages of the Swell protocol development. This portion of tokens will be locked for 12 months after TGE, followed by a linear unlock over 30 months;

- Foundation: 1,500,000,000 SWELL, accounting for 15% of the total supply, reserved for strategic plans that align with Swell's overall vision and mission, including L2 expansion, product development, ecosystem growth, resource allocation, network expansion, and Swell's long-term growth and sustainability positioning.

Among the supply, 8.5% is allocated to the Voyage airdrop, with 7% of the total supply distributed linearly based on the white pearls accumulated by each Voyager, and an additional 1.5% allocated to the most loyal stakeholders based on their loyalty bonus method.

The rSWELL contract is: 0x358d94b5b2F147D741088803d932Acb566acB7B6;

The SWELL contract is: 0x0a6E7Ba5042B38349e437ec6Db6214AEC7B35676.

Second Season Wavedrops Event

The first season token airdrop event Voyage of Swell Network was completed with a snapshot on July 30, but immediately followed by the launch of the second season token airdrop event Wavedrops (project official website: https://www.swellnetwork.io/).

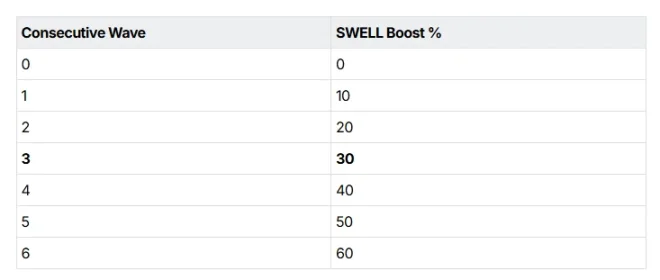

In the Wavedrops event, each cycle lasts 10 weeks, where users earn "black pearls" through staking, which can be exchanged for SWELL tokens at the end of each cycle based on the amount of black pearls earned. According to official information, to reward early users, the first "wave" cycle will allocate 2% of the total supply, while the second and third "wave" cycles will each allocate 1.5% of the total supply. Subsequent "wave" cycles will only allocate 1% of the total supply. Additionally, continuous participation in multiple "wave" cycles will provide bonuses, with the specific bonus coefficients as follows:

Relationship between the number of "wave" cycles participated and the bonus

Off-market Trading Trends

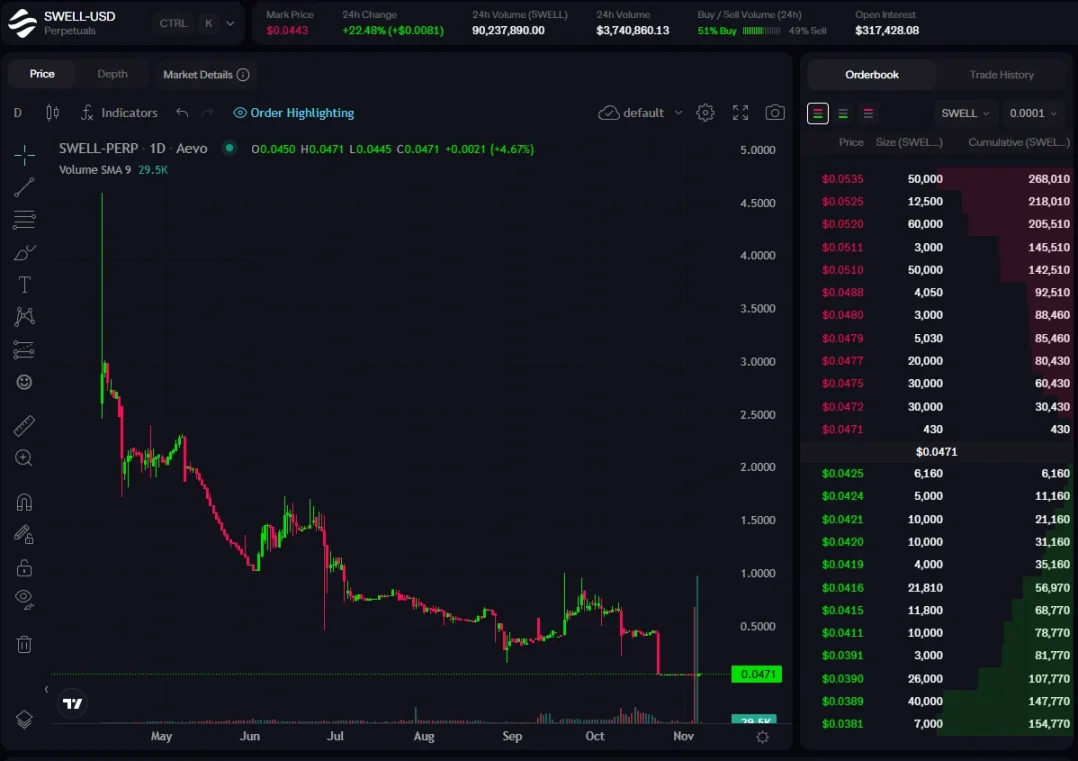

According to AEVO pre-market trading data, the SWELL price has been continuously declining since the opening, currently reported at $0.0443. Due to the upcoming token airdrop, the price has increased by 22.48% in the last 24 hours, with trading volume around $3.7 million in the last 24 hours.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。