Conveying the Way of Trading, Enjoying a Wise Life.

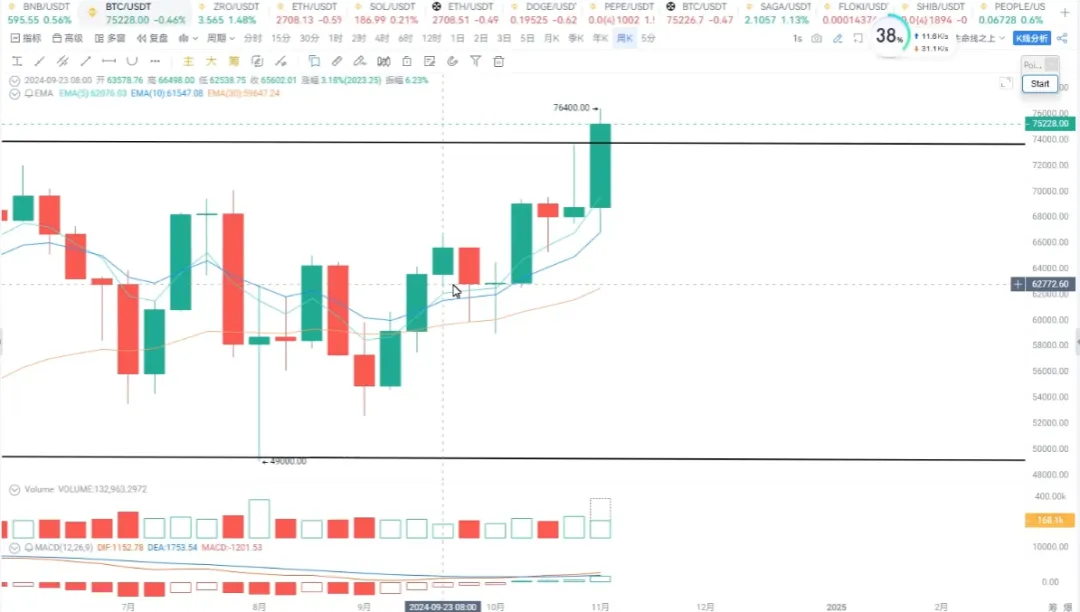

The market in this wave is actually quite enticing. The price of Bitcoin surged to $66,000 on the 14th of last month. This week, there was a long bullish candle during the upward movement, causing the MACD to form a golden cross at this point, so after forming the golden cross resonance, the view at that time was that the price of Bitcoin would strengthen upwards.

During the process, in the second week, a small bearish candle with a long lower shadow was formed, which can be understood as a hammer star. At this point, during the upward movement, there was some loosening of positions, so at this time, some people were escaping. The price touched the five-week moving average.

Looking at last week's situation from the daily chart level, when this wave broke through $66,000, it began to pull back. During the pullback, the price made a new high accompanied by divergence, which was quite tempting, so when it retraced to the 30 moving average, it pulled up again. This wave corresponds to the weekly inverted hammer line, which is the inverted hammer line after last week's close.

We can see that when it reached the position above $73,000 - $74,000, a high-level inverted hammer line appeared, indicating that the selling pressure below was quite large. The large selling pressure can also be considered a bearish signal. Correspondingly, the MACD indicator at this point shows that the energy bars are gradually starting to shrink, so compared to the previous period, there is no significant advantage in height.

From the performance of the daily chart level, this wave of market movement shows that the MACD energy bars have gradually decreased compared to the last time and the time before that. This indicates that the bullish momentum is actually exhausted, and the price is making new highs. After retracing to the 30 moving average, it began to stop falling, and yesterday's close formed a golden bar, which was either a massive volume or a very large volume.

We all know that due to the impact of the election, the fanatics won, which is a long-term positive dynamic influence on the future cryptocurrency market. In terms of this performance, the energy bars of Bitcoin are also not particularly good. Therefore, I believe that this sharp pullback will definitely happen. As for how much it will pull back, you can refer to the horizontal position; the weekly chart level has not closed yet, and after the daily chart closes, you can refer to the position of $73,777.

To summarize, the entire wave of this market over the past month has been extremely tempting, which is the allure of the industry, continuously pushing higher and continuously diverging. This indicates one thing: for retail investors to make money during the entire bull market, it is actually quite difficult. This is what I want to emphasize today.

In other words, after a major trend is established, there is not much to say; it won't be like the last round where many things were discussed. In fact, I have nothing to say because saying too much is just nonsense, and saying too much will only add to your troubles, making it harder for you to hold onto your positions. So, one piece of advice I can give you is: Hold onto the tokens you have, and don't fidget with them.

As for those who ask if they can get a 10x coin, that depends on your fortune. If your fortune isn't enough, even if you get a 10x coin, what good is it? You won't be able to take profits. If your fortune is in place, then whether it's 10x or 5x, it could happen at any time. This is the second point I want to emphasize. The third point is that in the future market process, there will be greater washout efforts, so whether you can hold onto the coins in your hand is the key.

For more information, you can contact our assistant and join the VIP group.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。