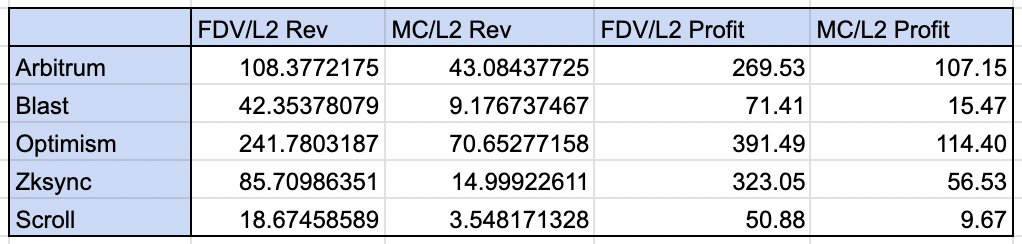

The trading multiples of Optimism are significantly higher than those of other comparison projects.

Author: taetaehoho

Translation: ShenChao TechFlow

Do concepts like L1 premium, monetary value, xREV/TEV really exist?

Special thanks to @smyyguy and @purplepill3m for reviewing and providing feedback on this article.

If you are not very familiar with REV, you can read @jon_charb's this article.

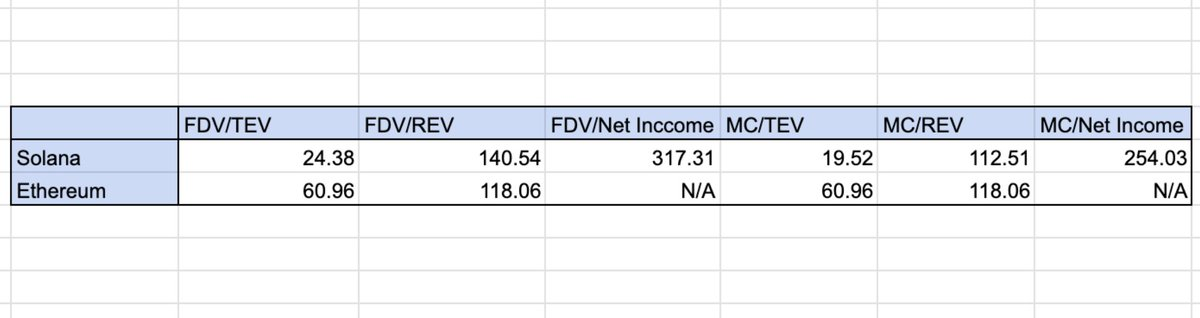

The following multiples are based on valuation data as of 12 PM (Eastern Time) on October 30, 2024.

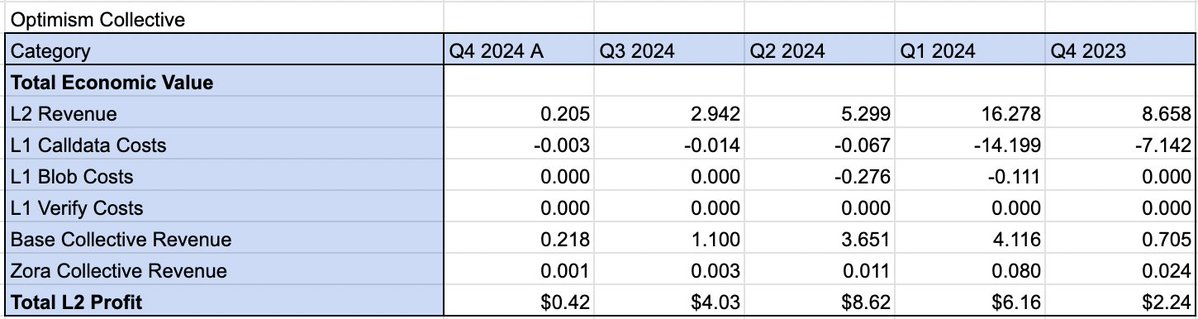

L2 profit is its revenue (including base fees and priority fees) minus on-chain operating costs (such as L1 data calls, Blob, and validation costs). The data for Arbitrum, Optimism, Zksync, and Scroll is from the past twelve months, while Blast only has data for three quarters (which inflates its multiples compared to other projects). The data for ETH and Solana is also from the past twelve months.

Some notes:

REV and L2 revenue are comparable metrics. L2 revenue is the income before deducting operator costs (sequencer costs), which is similar to REV.

L2 DAOs allocated a large number of tokens during the token generation event (TGE). A portion of L2's fully diluted valuation (FDV) can be attributed to governance value, which does not exist in L1 tokens. Therefore, we mentally adjust L2's multiples upward, but we do not make this adjustment when discussing the observations.

Some direct observations:

In terms of fully diluted valuation (FDV), there is no obvious "L1 premium," but most L2s have not fully circulated. However, there is indeed an "L1 premium" in market cap comparisons. (The FDV/L2 revenue for Arbitrum and OP is about 100-250, while the FDV/REV for Ethereum and Solana is about 118-140).

The trading multiple of Optimism is significantly higher than that of other comparison projects. Investors seem optimistic about its collective expansion.

Through collective profit sharing (i.e., 15% of sequencer revenue and 2% of profits), the DAO has achieved net profits exceeding OP's L2 revenue so far in the fourth quarter. From the total value accumulated to the treasury, the collective strategy is successful. Considering that Base alone contributed about $9 million to the collective treasury, it would be a good choice to conduct large-scale revenue-sharing grants in the future.

Restricting block space is unrelated to increasing revenue. Arbitrum's median fee during liquidation peaks is about $10, but its L2 profit is lower than Base.

Token buyers have not priced in Scroll's growth (its market cap is three times its L2 revenue).

The L1 verification costs of ZKP have temporarily reduced the profit margins of Zk rollups. Currently, we have not seen the cost savings from state differences passed on to users.

Please check the spreadsheet for details.

This raises a few questions for me:

Does a monetary premium really exist? Or, do L2s have the same valuation when on-chain activities are the same?

Does ETH really have a sovereign premium (SOV) compared to Solana? (Ethereum's REV is mainly concentrated in the first and second quarters of 2024; if only comparing the most recent quarters, is this premium significant?)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。