The rise in crypto assets reflects the market's expectations for the loose policies brought about by Trump's election.

Written by: Pzai, Foresight News

With the confirmation of votes across the United States, Trump's election has become a certainty. As a president with a strong connection to cryptocurrency, his friendly attitude towards digital currencies has injected a strong boost into the market's further growth, with Bitcoin, an important part of Trump's future crypto strategy, officially breaking its historical high. Thus, we will review the changes in related assets before and after the election in this article.

Cryptocurrency

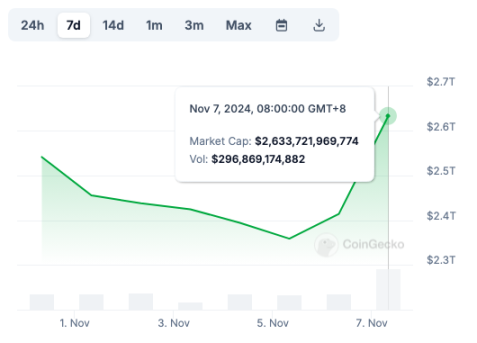

In just two days, Trump's election has driven the total market value of cryptocurrencies from $2.3 trillion, increasing by 12% to $2.63 trillion, reflecting his influence as the most politically impactful figure on the crypto industry.

For cryptocurrencies, the impact of the "Trump trade" has also been reflected in real-time market conditions. Bitcoin, as the core of the strategy and the leader of the crypto market, has shown significant growth before and after the election. Yesterday morning at 8 AM, Bitcoin started a surge from the $69,000 position, briefly breaking the previous high, and later reaching a maximum of $76,200.

Ethereum slowly rose from the $2,620 point yesterday and jumped to the $2,800 point today. The ETH/BTC exchange rate also recovered from its historical position of 0.034 to 0.0377. As the second-largest asset in the crypto market, Ethereum's performance has shown a certain gap compared to Bitcoin.

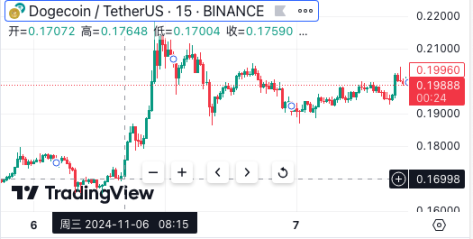

In terms of MEME assets, DOGE, one of Musk's favorites, started at $0.17 and reached a high of around $0.022 yesterday. Another mainstream MEME coin, PEPE, peaked at $0.00001.

Solana jumped from $166 to a high of $189, reaching a new peak.

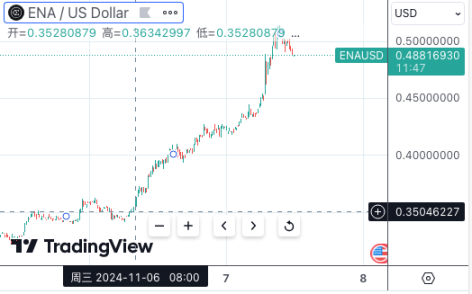

In the DeFi sector, AAVE rose from $135 to a high of $190, while ENA also briefly broke the $0.5 mark from $0.35.

Crypto-related Stocks

The influence of Trump's policies has already begun to manifest in the market, as evidenced by the significant response of related crypto stocks and ETFs in the U.S. stock market to the potential growth of the crypto market.

In terms of exchanges, major compliant exchanges have seen notable increases: Coinbase rose by 31.11%, and Robinhood increased by over 19.6%. In the mining sector, influenced by Trump's advocacy for developing Bitcoin mining domestically, Cipher Mining rose by over 31%, Riot Platforms increased by over 26.1%, and Canaan Creative ADR rose by about 13%. In the ETF sector, the double-leveraged Bitcoin ETF rose by over 19.7%, the Ethereum ETF ETHV increased by over 11.4%, and the Bitcoin ETF BITB rose by about 9.9%. "Bitcoin whale" MicroStrategy (MSTR) rose by about 13.2%.

Market Outlook

Some traders believe that due to Trump's high tariff policies, China's potential loose policies in response to U.S. tariffs may bring related asset volatility, particularly affecting the strength of the dollar and the trend of Treasury yields, which could then transmit to the crypto market.

The market expects the Federal Reserve to cut interest rates by 25 basis points this month, so traders are closely monitoring the Fed's next steps. Due to concerns that potential hawkish policies may dampen market enthusiasm, the outlook for crypto assets remains unclear. Singapore-based crypto asset management firm QCP stated in a report on Wednesday, "Although it is expected that the likelihood of rate cuts will decrease due to Trump's proposed friendlier policies, the market still anticipates 1.8 rate cuts this year and another 3 next year."

Overall, the rise in crypto assets clearly reflects the market's expectations for the loose policies brought about by Trump's election. Capital, driven by the need to hedge against this potential risk, has priced in the expected benefits in market prices. If U.S. policies can balance compliance and innovation, it will further enhance the widespread acceptance and legitimacy of crypto assets, especially the safe-haven attributes and stable growth potential of assets like Bitcoin. In the long run, the price trend of crypto assets will still be closely related to their market acceptance, the level of policy support, and global capital flows. The clarity and sustainability of policies will be key factors for investors to rebuild confidence in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。