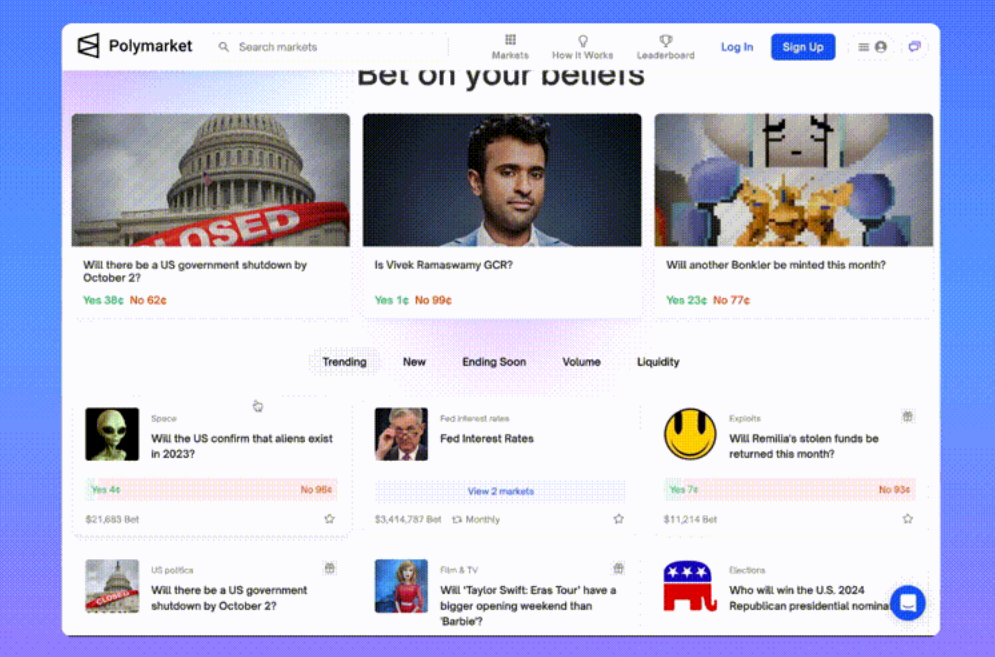

Polymarket is a decentralized prediction market platform where users can bet on the outcomes of real-world events using cryptocurrency. This article will guide you through its features, functions, advantages, risks, and comparisons with other platforms like PredictIt.

Author: kucoin

Translation: Blockchain in Plain Language

Polymarket's innovative operating model and strong support from industry leaders highlight its potential in the prediction market space, providing users with a reliable and engaging platform for speculative activities. **In the current cryptocurrency landscape, prediction markets like Polymarket offer users a novel way to engage with global events, fully leveraging the transparency and immutability of *blockchain technology*. This approach not only democratizes the betting market but also provides new use cases for cryptocurrency, promoting the widespread application and understanding of blockchain technology.

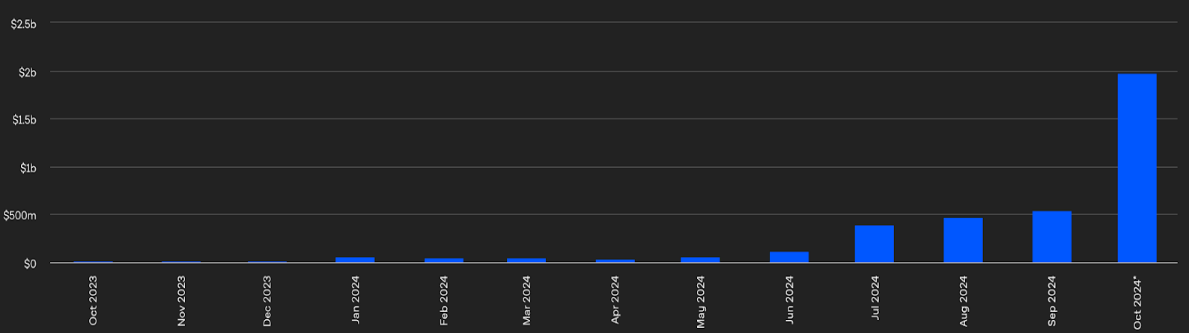

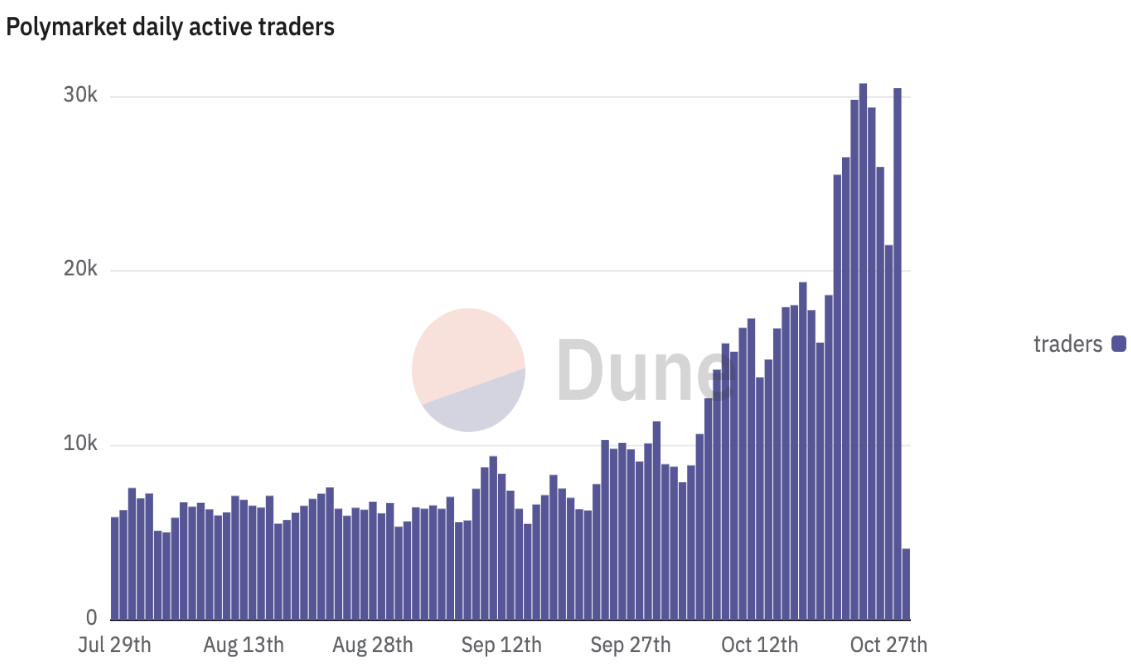

As of October 2024, Polymarket's monthly trading volume approached $2 billion, with over 191,000 active traders, a significant increase from June's trading volume of $110 million and nearly 30,000 users. The daily active trader count on the platform reached a new high in October, exceeding 30,000. These figures make Polymarket the largest decentralized prediction market platform in the world.

Polymarket Monthly Trading Volume | Source: TheBlock

1. What is Polymarket?

Polymarket is a decentralized prediction market platform based on Polygon, where users can bet on the outcomes of various real-world events. With its unique market prediction approach and integration of stablecoins like USDC, the platform is becoming increasingly significant in the crypto space, ensuring liquidity and stability in trading. By October 2024, Polymarket's monthly active user count had surpassed 191,000.

Polymarket Daily Active User Count | Source: Dune Analytics

**With the help of *blockchain technology* and smart contracts, Polymarket provides a transparent and secure way to speculate on a variety of events, from political elections to sports events and economic indicators.** This means that all transactions are conducted on the Ethereum blockchain through smart contracts, ensuring transparency and security, while enhancing scalability and reducing fees through the Layer2 solution Polygon.

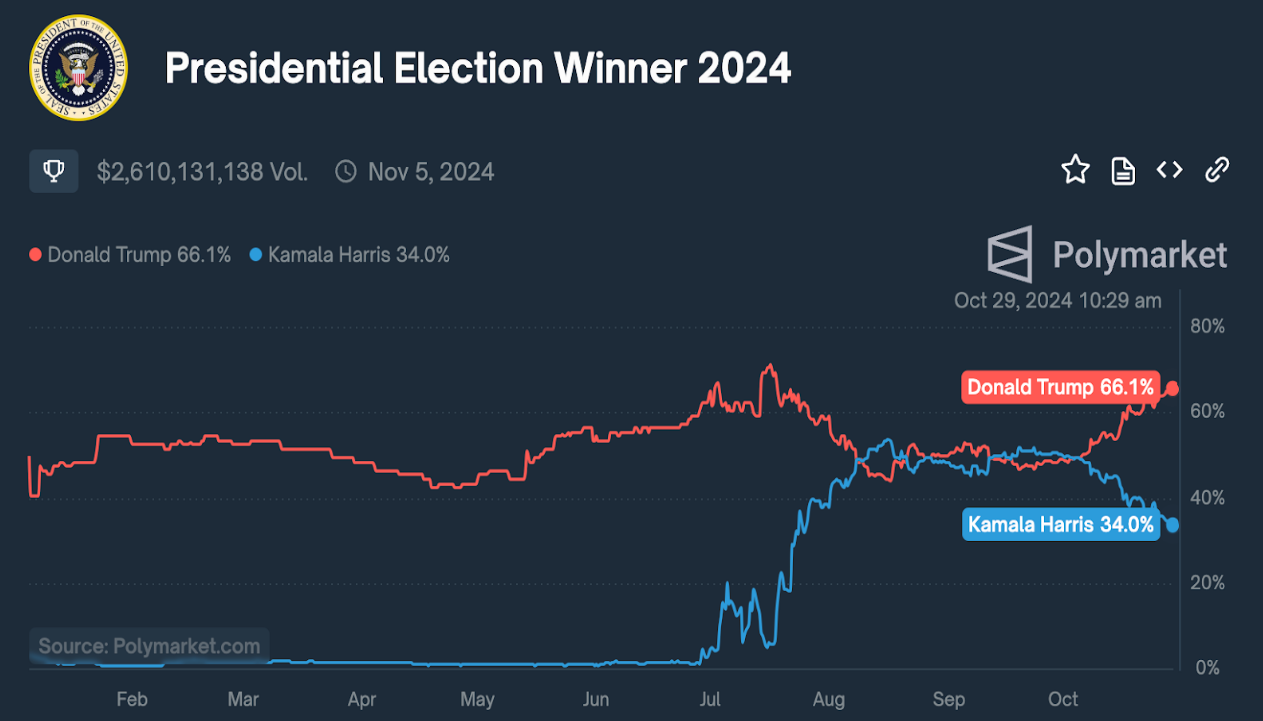

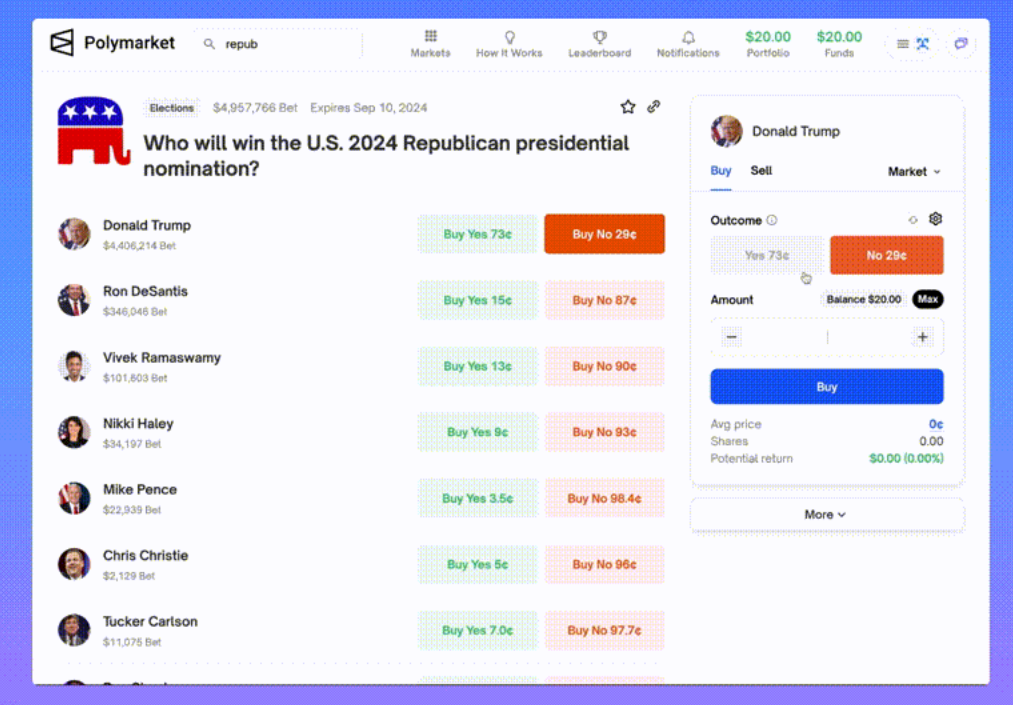

Polymarket's Most Popular 2024 Presidential Election Winner Vote | Source: Polymarket

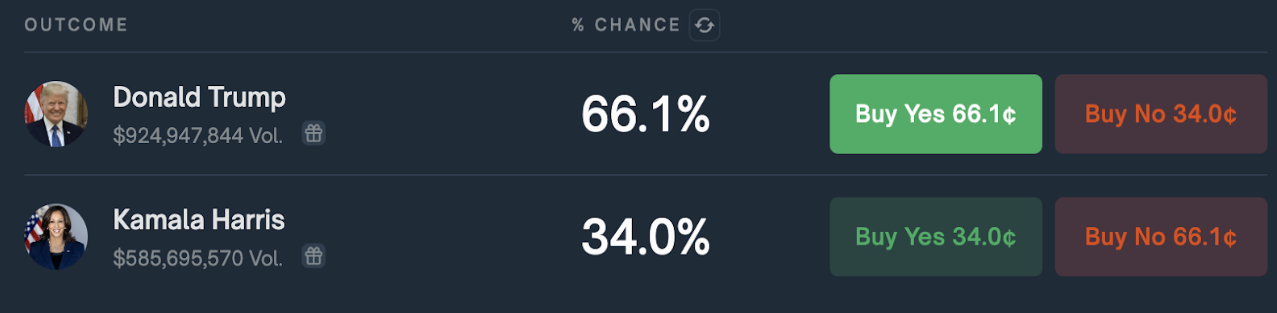

On Polymarket, users purchase shares that represent the probability of a certain event occurring. For example, if you believe a particular candidate will win an election, you can buy a "yes" share at a price reflecting the current market odds. If the event occurs as you predicted, the share will be worth $1; if the event does not occur, the share becomes worthless. This mechanism allows you to profit from your understanding and predictions of various events.

**As of now, the winner of the 2024 U.S. presidential election is the largest *voting* project on the platform, with over $2.6 billion in bets.** According to current trading, Polymarket users foresee a 66% chance of Trump winning the election, while 34% believe Democratic candidate Kamala Harris will win in the U.S. elections in November 2024.

2. Who is the founder of Polymarket?

Polymarket was founded by Shayne Coplan, a young entrepreneur with a vision to disrupt the prediction market industry. Under his leadership, Polymarket quickly gained attention and secured significant investments.

The platform raised a total of $70 million in two funding rounds. The Series A funding round, led by General Catalyst, raised $25 million, with participation from notable investors like Joe Gebbia of Airbnb and Polychain. The recent Series B funding round, led by Peter Thiel's Founders Fund, raised $45 million and received support from high-profile investors including Ethereum co-founder Vitalik Buterin, Dragonfly, and Eventbrite co-founder Kevin Hartz.

**Despite facing regulatory challenges, such as a $1.4 million fine from the *Commodity Futures* Trading Commission (CFTC) for offering event-based contracts, Polymarket continues to grow.** The platform has adapted to the changing regulatory environment by reducing its services in the U.S. while expanding globally. The addition of former CFTC Chairman J. Christopher Giancarlo to its advisory board highlights Polymarket's efforts to effectively navigate regulatory challenges and ensure compliance.

3. How does Polymarket's decentralized prediction market work?

The meaning of prices on Polymarket

As a decentralized Web3 application, Polymarket allows users to place bets by linking their non-custodial Web3 wallets without the need for KYC verification. In the future, Polymarket plans to incorporate DAO elements for user governance. By eliminating traditional financial intermediaries and KYC processes, Polymarket enhances user privacy and accessibility, embodying the core principles of DeFi and Web3.

As mentioned earlier, Polymarket leverages blockchain technology to provide a transparent and secure prediction market platform. Whether you are betting on political events, entertainment activities, or economic indicators, Polymarket ensures an efficient market experience. It primarily operates on the Polygon Layer2 solution to enhance scalability and reduce transaction costs. This integration allows Polymarket to efficiently handle a large volume of transactions without placing excessive strain on the Ethereum network.

Smart Contracts: Polymarket uses smart contracts to automatically manage and execute transactions. These smart contracts ensure that all transactions and market settlements are transparent and immutable. When you place a bet or purchase shares, the smart contract records the transaction on the blockchain, ensuring the security and tamper-proof nature of the entire process.

Security Measures: Polymarket places a high priority on security. With self-custody wallets, your funds are always under your control, as you hold the private keys. This non-custodial approach ensures that Polymarket can never directly access your funds. Additionally, the platform employs robust encryption and authentication methods to protect user data and transactions. These measures make Polymarket a secure prediction market platform.

Polymarket Fees: Detailed Analysis Polymarket charges low fees primarily to cover transaction costs and incentivize liquidity providers. When you trade on Polymarket, you typically pay a small USDC fee to liquidity providers who facilitate these transactions. This fee helps ensure that there is sufficient liquidity in the market, reducing price slippage when buying and selling shares.

Polymarket Liquidity Providers Liquidity providers are crucial to the normal operation of Polymarket. They provide the necessary capital to ensure that there is enough liquidity in the market, allowing users to easily buy and sell shares. Without sufficient liquidity, trading would become difficult, and prices would be unstable due to excessive slippage.

How to Become a Liquidity Provider on Polymarket Becoming a liquidity provider on Polymarket requires several steps. First, you need to deposit funds into the liquidity pool. These funds will be used to facilitate trading in different markets. In return, you will earn a portion of the transaction fees collected from user trades. This is a way to contribute to the platform while earning passive income.

Polymarket does not charge additional fees for trading, but liquidity providers earn rewards from the transaction fees paid by traders. This incentive encourages more participants to provide liquidity, ensuring that the market remains efficient and active.

4. How does Polymarket make money?

Polymarket primarily earns revenue through its trading fees, which are paid in USDC. Each time you place a bet or trade shares on the platform, a small fee is charged. This fee is typically low and is used to incentivize liquidity providers who ensure that there is sufficient liquidity in the market for efficient trading. Additionally, Polymarket benefits from trading volume, as the higher the trading volume, the more transaction fees are collected.

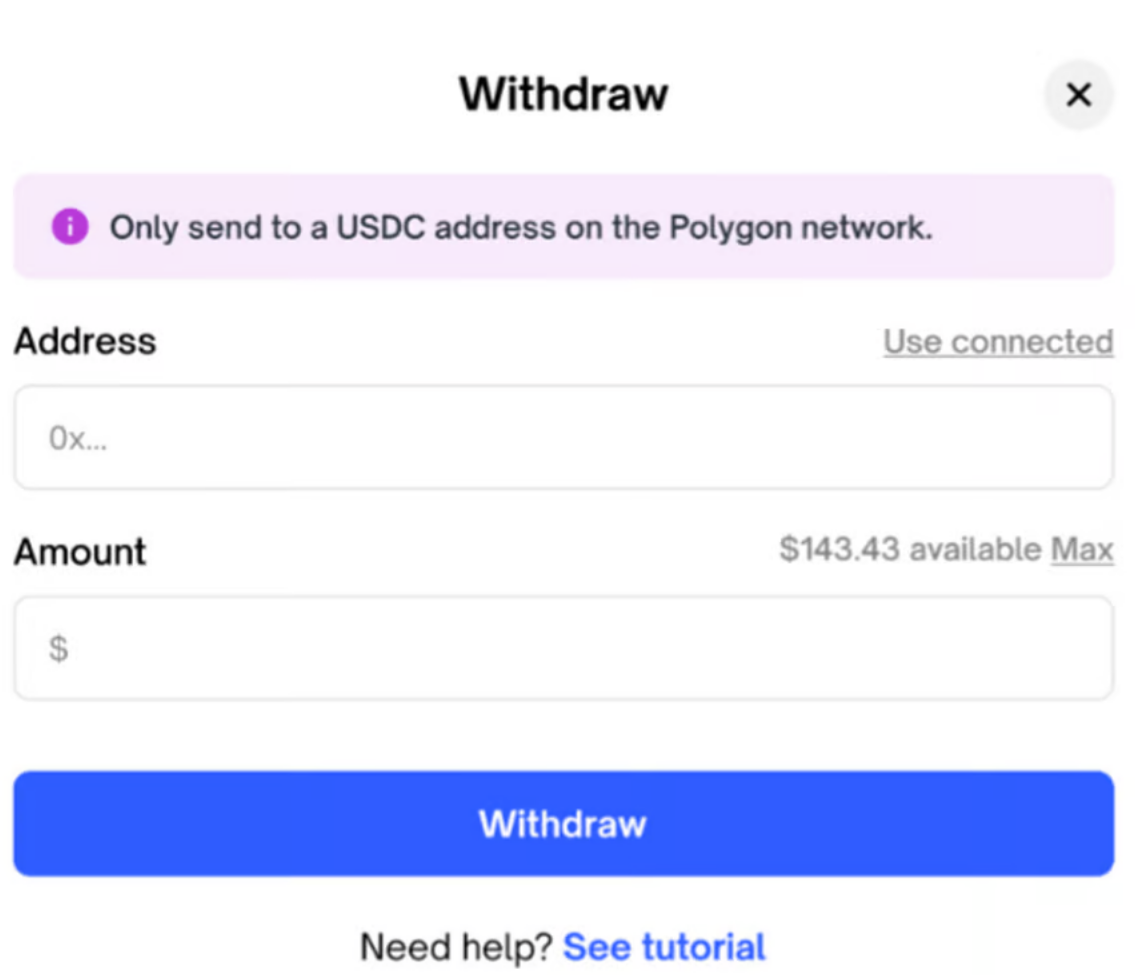

Polymarket does not charge trading fees for buying and selling outcome shares, making it a cost-effective platform for users. However, since transactions are processed on the Ethereum blockchain, depositing and withdrawing USDC incurs network (gas) fees. To reduce these costs, Polymarket utilizes the Polygon Layer2 solution. Additionally, deposits involve a transfer fee of $3 plus the network fee, or 0.3% of the deposit amount, whichever is higher. Gas fees can vary based on network congestion and demand, affecting the costs of deposits and withdrawals. Polymarket does not take a cut from these fees, ensuring that transactions are simple and transparent.

**Trading fees play a crucial role in Polymarket's revenue model. These fees are directly paid to **liquidity providers, who facilitate smooth transactions and reduce price slippage. Unlike traditional platforms, Polymarket does not charge additional market fees, making it a cost-effective choice for users. This structure not only helps maintain market liquidity but also encourages users to participate more actively.

5. How to Get Started on Polymarket

Polymarket allows you to connect an Ethereum-compatible wallet (such as MetaMask) and deposit USDC, a stablecoin pegged to the US dollar. Here are the steps to get started on Polymarket:

1) Register: Visit the Polymarket website and register an account using your email address. Polymarket will create an Ethereum-based wallet for you, where you hold the private keys, ensuring complete control over your funds.

2) Deposit Funds: Deposit USDC into your Polymarket wallet. You can acquire USDC through centralized exchanges (like KuCoin). You can also deposit USDT, and the platform will automatically convert your funds to USDC.

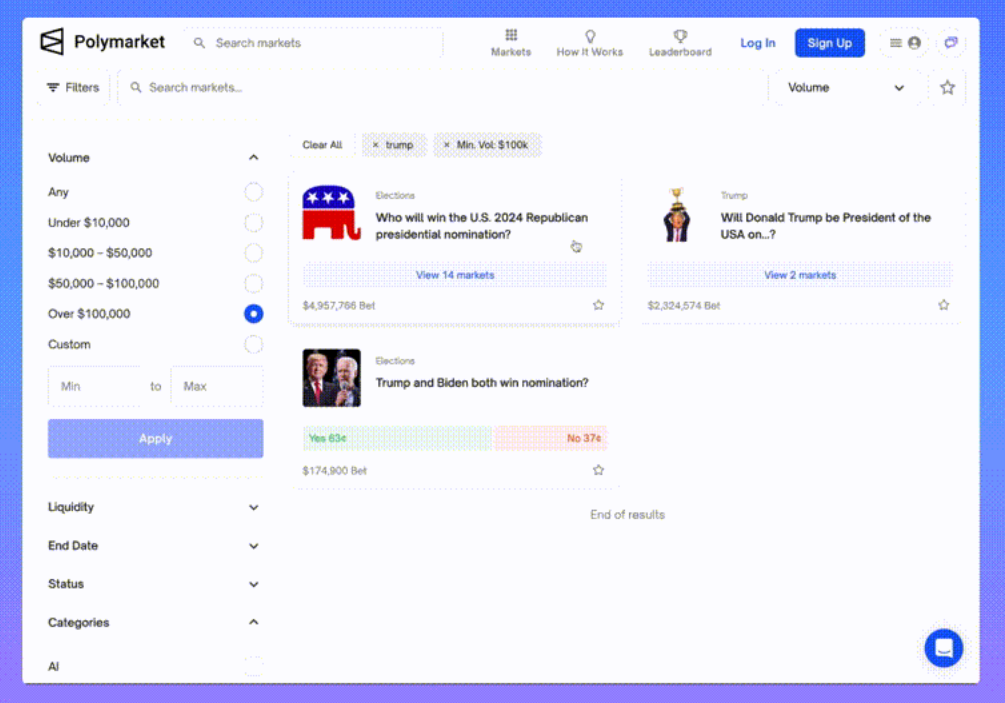

3) Choose a Market: Select from a variety of markets, including binary (yes/no) outcomes, categorical options, and scalar markets. You can use filters to find markets that interest you.

6. How to Bet and Make Predictions on Polymarket

Step 1: Choose an Event Select the event you want to bet on. For example, you might choose a political election or a sports match.

Source: Polymarket Docs

Step 2: Purchase Outcome Shares Buy shares of the outcome you believe will occur. The price per share is determined by the probability of that outcome, ranging from $0.01 to $1.00. For example, if you think a particular candidate will win the election, you can buy a "yes" share at the current market price.

Source: Polymarket Docs

Step 3: Trade Shares You can sell your shares at any time before the market closes. If your prediction is correct, the shares will be worth $1 each when the market closes. If your prediction is wrong, the shares will become worthless.

Source: Polymarket Docs

Step 4: Market Settlement Once the outcome is determined, you can cash out your shares. If the outcome is unclear, Polymarket's Market Integrity Committee (MIC) will decide the final result.

7. How to Withdraw from Polymarket

Go to the funds page on the Polymarket platform and click the "Withdraw" button. Enter the USDC address where you want to receive the funds. Ensure that the address supports USDC on the Polygon network.

Source: Polymarket Docs

Enter the amount you wish to withdraw and click "Withdraw." Your funds will be sent to the specified address immediately.

Polymarket provides a user-friendly dashboard that allows you to view all markets. You can filter markets by category, liquidity, status, and more. The interface displays the current price of shares, the total amount wagered, and other relevant data. This makes it easy for you to track your investments and make informed decisions.

8. Comparison of Polymarket with Competitors

Compared to traditional prediction markets like PredictIt, Polymarket differs in several key aspects. Polymarket is decentralized, operating on the Polygon network, offering higher scalability, lower fees, and stronger privacy protection. In contrast, PredictIt is a centralized platform regulated by U.S. authorities, which imposes restrictions on trading and market creation. While PredictIt is open to U.S. residents, Polymarket provides a broader range of market options and more trading flexibility.

Compared to other decentralized prediction markets like Augur and Gnosis, Polymarket offers competitive fees. For instance, Augur users may encounter higher fees because the platform requires holding and using REP Tokens for various activities. Gnosis, while offering a wider range of services, has a more complex fee structure due to its additional features and governance mechanisms.

1) Comparison of Polymarket and PredictIt Polymarket differs significantly from traditional prediction markets like PredictIt. Polymarket is decentralized, operating on Polygon to enhance scalability, resulting in lower fees and stronger privacy protection. PredictIt, on the other hand, is a centralized platform regulated by U.S. authorities, which sets restrictions on trading and market creation. While PredictIt is user-friendly and open to U.S. residents, it has higher fees and more limited market options compared to Polymarket. Polymarket's advantages lie in its decentralized nature, low trading costs, and diverse market choices, but it also faces notable weaknesses in terms of legal restrictions in the U.S. and potential technical issues.

2) Comparison of Polymarket and Augur Polymarket and Augur are both well-known blockchain-based prediction market platforms, but they differ in several aspects. Polymarket utilizes the Polygon protocol for Ethereum scaling, providing users with a straightforward way to participate without needing to hold the platform's native token. Augur, one of the early platforms in this space, allows users to create their own markets and uses its native REP token for rewards, market creation, and dispute resolution. Augur also features a dedicated sports betting platform. While both support binary, categorical, and scalar markets, Augur's reliance on REP tokens may lead to higher costs for users. Augur recently launched a "Turbo" version on the Polygon network to improve trading efficiency, similar to Polymarket's infrastructure.

3) Comparison of Polymarket and Gnosis Gnosis offers a broader range of services than prediction markets, including decentralized trading, wallet services, and various infrastructure tools. Founded in 2015, it has developed a more complex ecosystem compared to Polymarket. The GNO token plays a central role in Gnosis's governance and staking mechanisms. Gnosis has also built its own Layer-2 solution—Gnosis Chain—to address scalability and efficiency issues, providing smart contract functionality while reducing costs. While Polymarket focuses on simplicity and accessibility, Gnosis aims to provide a comprehensive and multifunctional platform for the Ethereum community, supporting a wider variety of applications.

4) Comparison of Polymarket and Kalshi Polymarket and Kalshi are both major players in the prediction market space, each with unique operating models and regulatory stances. Polymarket offers a decentralized prediction market utilizing Ethereum and Polygon, using cryptocurrencies like USDC and prioritizing user privacy by not requiring KYC procedures. However, it cannot operate in the U.S. due to regulatory issues. In contrast, Kalshi is a CFTC-regulated platform based in the U.S., trading in U.S. dollars and adhering to strict KYC requirements, which enhances trust and security for U.S. traders. Kalshi has launched markets for cryptocurrency price fluctuations and traditional events, targeting U.S. traders who prefer a regulated environment. Polymarket's popular markets include political events and cryptocurrency price fluctuations, while Kalshi offers a wide range of market options, including financial and weather events.

9. Why Polymarket is Gaining Popularity in the Crypto Community

Here are some advantages of using the Polymarket platform for betting on key event predictions:

Potential Profit Opportunities: Polymarket provides you with the opportunity to profit from predictions and knowledge. By purchasing shares of real-world event outcomes, if your prediction is correct, you can earn profits. For example, if you believe a political candidate will win an election and buy a "yes" share at 0.70 USDC, if they win, the value of each share will become 1 USDC. This can lead to significant profits, especially if you purchased a large number of shares at a lower price.

Community-Driven Platform: Polymarket is not just a betting platform; it is a decentralized community where users can interact and share insights on various topics. You can join discussions, follow trends, and see what other participants are betting on. This social aspect enhances the experience of the Polymarket dApp, making it more interactive and informative.

Market Efficiency and Real-Time Data: Polymarket provides real-time probabilities for events, reflecting the collective knowledge and opinions of users. This data is often more accurate than traditional polls or expert predictions, as it aggregates the wisdom of the crowd. As more users participate and trade, market prices adjust based on the most current and accurate information.

10. Risks and Key Considerations of Polymarket

Before starting to use Polymarket, here are some potential risks and key factors to consider:

Market Volatility: Prediction markets like Polymarket can be highly volatile. The prices of outcome shares can fluctuate based on new information and user sentiment. This means the value of your investment can change rapidly. It is crucial to understand this volatility and only invest funds you can afford to lose. For example, during significant political events or announcements, market prices may experience substantial fluctuations due to the impact of new data.

Legal and Regulatory Issues: Like many other crypto-based platforms, the regulatory environment in which Polymarket operates is quite complex. The platform was fined $1.4 million by the U.S. CFTC for offering event-based contracts without proper registration. As a result, Polymarket cannot be used by U.S. residents, and regulatory developments may affect its operations in other regions. Always stay informed about the legal status of the platform in your jurisdiction to avoid potential legal issues.

Risks of Prediction Markets: Participating in prediction markets involves several risks beyond volatility and legal issues. These include the risk of misinformation, where incorrect or misleading information may distort market outcomes, and the risk of technical issues, such as smart contract vulnerabilities or network congestion. Additionally, while Polymarket uses non-custodial wallets, it is essential to securely manage your private keys to prevent loss of funds due to hacking or personal error.

11. Potential Impact of Polymarket Whales

In any market, large stakeholders or "whales" can significantly influence outcomes. In Polymarket, whales can affect market prices by placing large bets, which may change the probabilities of events occurring. For smaller investors, if they believe the market is overreacting, they can look for profit opportunities by betting against the trends set by whales.

For example, during the U.S. presidential election, large bets from Polymarket whales influenced share prices, indicating a higher probability of certain candidates winning. This activity can lead to greater volatility but also provides a dynamic trading environment for quick decision-making and profit. Observing and understanding whale activity can become a strategic advantage for other market participants.

12. Popular Predictive Events on Polymarket

Polymarket hosts numerous prediction markets that have achieved successful predictive outcomes, showcasing the platform's accuracy and the power of collective user wisdom.

2020 U.S. Presidential Election: A notable example is during the 2020 U.S. presidential election when traders successfully predicted Joe Biden's victory. Early buyers of "yes" shares profited significantly as Biden's chances increased, even while the election results were still uncertain.

2024 Election Polls: During the 2024 presidential election, Polymarket provided a real-time map showing market odds for candidates like Donald Trump and Kamala Harris. This allowed users to trade on event outcomes like "Trump vs. Harris" and closely track "presidential odds" and "2024 election polls," further fostering an interactive and data-driven predictive environment. As of the writing of this article, the largest poll on the platform, "2024 Presidential Election Winner," has attracted over $2.6 billion in bets.

Bitcoin Price Predictions: One of the most popular polls in the crypto category is "What will the Bitcoin price be in October 2024?" This poll has seen trading volumes exceeding $4 billion, with over $2.1 billion in bets focused on Bitcoin breaking the $70,000 mark, especially amid the U.S. presidential election hype.

2024 Paris Olympics: Polymarket's polls on the 2024 Paris Olympics have also garnered significant attention. Popular polls include which country will win the most medals at the 2024 Olympics and separate polls predicting champions in specific sports.

2024 UEFA Euro Championship Winner: Polymarket hosted markets predicting the winner of the 2024 UEFA European Championship. These markets attracted sports enthusiasts who made informed bets based on their understanding of team performance and player data. As of July 2024, the betting volume for the 2024 Euro Championship winner has reached $2.8 million.

Polymarket's markets typically exhibit high accuracy due to the financial incentives involved, encouraging users to conduct thorough research and make informed bets. This collective wisdom often reflects real-world outcomes more accurately than traditional polling methods.

13. Future Development of Polymarket's Decentralized Platform

Polymarket gained widespread attention during the 2024 U.S. presidential election. With increasing user adoption, the Polymarket Web3 decentralized application (dApp) plans to launch several new features to enhance user experience and expand market options. These new features include more advanced analytical tools for better market predictions, support for more cryptocurrencies to expand payment options, and an optimized user interface for greater intuitiveness. Additionally, there are plans to introduce decentralized governance mechanisms that allow users to participate in platform decision-making.

Experts predict that Polymarket will expand its market coverage and become a leading global prediction market platform, leveraging its efficient and transparent system. The development of similar platforms and ongoing technological advancements may also drive further growth for Polymarket.

However, participating in prediction markets also involves risks. Market volatility, regulatory changes, and potential misinformation can all impact predictive outcomes. It is essential to consider these risks and invest responsibly before participating.

Article link: https://www.hellobtc.com/kp/du/11/5517.html

Source: https://www.kucoin.com/learn/crypto/what-is-polymarket-and-how-does-it-work

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。