Original Title: 2024 U.S. Election For Crypto: A Potential Turning Point from Tight Regulation and Ban to Support and Innovation

Author: HTX Ventures

Translation: zhouzhou, BlockBeats

Editor's Note: This article focuses on the impact of the U.S. election on the cryptocurrency market, particularly the potential boost to prediction markets and BTCFi. By interpreting prediction platforms like Polymarket and innovations in the DeFi and BTCFi sectors, it explores the possible opportunities for crypto projects in terms of policy, regulation, and technology. The article also discusses the incentives for developer innovation stemming from Bitcoin technology upgrades (such as OP_CAT) and their significance for the entire crypto market.

Below is the original content (reorganized for readability):

Full Summary:

Singapore / November 4, 2024—Since the advent of Bitcoin, it has gone through three election cycles and has become a key issue in the 2024 U.S. presidential campaign. As the ideas of Bitcoin proposed by Satoshi Nakamoto have gained traction, supporters have formed a significant voting bloc, becoming an important force in U.S. politics.

This article analyzes various factors contributing to the increasing importance of Bitcoin and cryptocurrency in elections, including the decline in real wages due to inflation, challenges to the dollar's global dominance, the growing interest of U.S. voters in cryptocurrency, and the current government's regulatory strategies towards the crypto industry.

The article further explores the differing positions of presidential candidates on cryptocurrency and how their attitudes shape future policies and market expectations. Additionally, it discusses the role of prediction markets, particularly the role of Polymarket in elections, potential innovation paths for prediction markets, and how elections can influence the crypto market through macroeconomic liquidity.

Finally, the article predicts the potential impact of election outcomes on crypto companies. If Trump wins, a clearer and more lenient regulatory environment is expected, which would support the incubation and growth of crypto startups. This environment would also provide IPO pathways for crypto companies, ensuring exits for traditional investment institutions, enhancing wealth effects, and improving the financing environment. Meanwhile, DeFi is expected to enter mainstream financial markets more rapidly, and the innovation and development of BTCFi will also accelerate.

The Background of Cryptocurrency as a Key Election Issue

The Significance of Bitcoin to the U.S.

1. Growing Demand to Combat Inflation

A Forbes survey shows that real wages in the U.S. (adjusted for inflation) have changed little since the mid-1980s. Adjusted for inflation, the purchasing power of the average hourly wage in the U.S. today is nearly the same as in 1978. This exacerbates wealth inequality: the upper class becomes richer by holding substantial assets, while the working class sees their wealth shrink.

Since the 2008 financial crisis, more people have viewed Bitcoin as a potential tool to combat inflation and economic uncertainty, particularly as it offers the hope of financial independence for the middle class. The decentralization and limited supply of Bitcoin make it an alternative asset under government and central bank intervention. Although the dollar remains the global reserve currency, the appeal of Bitcoin continues to grow as investors increasingly seek hedging assets. For the increasingly burdened working class, Bitcoin is seen as an effective tool against inflation.

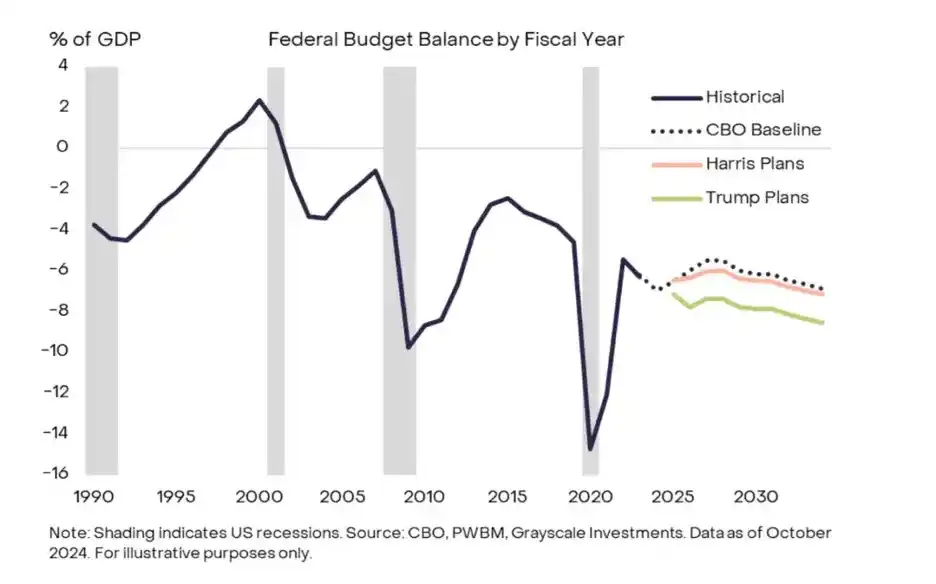

Whether Trump or Harris wins the presidential election, U.S. fiscal policy is likely to lead to larger budget deficits. The Congressional Budget Office predicts that the federal budget deficit will account for 6.2% of GDP over the next decade. If Trump reinstates the tax cuts from 2017 and further lowers tax rates, the deficit could rise to 7.8% of GDP. In contrast, Harris plans to raise the corporate tax rate to 28%, but her other reform proposals could still push the deficit up to 6.5% of GDP.

Over the past 25 years, U.S. federal debt has surged from 40% of GDP to 100%, and this ratio could climb to between 124% and 200% over the next 10 to 30 years. The upcoming presidential election could trigger a "sensitive moment" when the bond market realizes the severity of the debt issue and may demand higher returns to offset financing risks. This moment could lead to a bond market collapse, triggering a financial crisis.

Both Trump's tax cuts and Harris's tax increases could further exacerbate the U.S. fiscal deficit and debt burden, increasing the risk of turmoil in financial markets. Faced with such high debt, solutions are limited, and diluting debt through inflation may be the only way out for the U.S. government. However, the adverse effects of inflation will erode the purchasing power of the working class and exacerbate wealth inequality.

Notably, the pending "Bitcoin Bill" awaiting Congressional approval could provide a new avenue for addressing the U.S. debt issue. This bill aims to integrate Bitcoin into a broader financial system, potentially attracting significant private and institutional capital, helping to stabilize the U.S. debt structure, and possibly bringing some stability to the global financial system.

As a decentralized and scarce asset, Bitcoin can serve as an effective tool for governments and investors to combat inflation and risk, especially in the face of debt and inflation pressures, giving it potential strategic significance.

2. Strengthening the Dollar's Global Influence

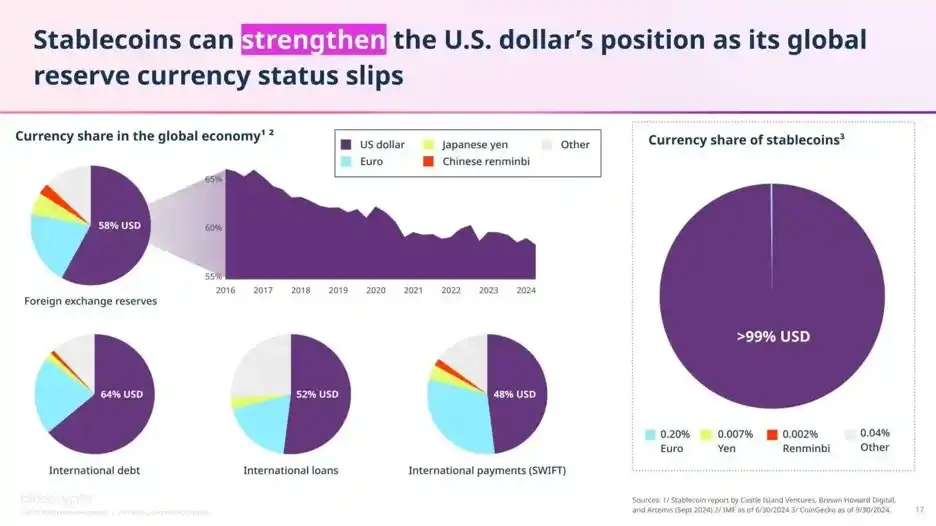

As one of the most popular cryptocurrency products today, stablecoins have become the center of policy discussions, with the U.S. Congress reviewing several related bills. A key factor driving these discussions is that stablecoins are seen as a means to help expand the international influence of the dollar, especially against the backdrop of the dollar's declining status as the global reserve currency.

Currently, over 99% of stablecoins are denominated in dollars, far exceeding the second-ranked euro, which accounts for only 0.20%. The exponential growth of stablecoins further solidifies the dollar's dominance in the digital asset market and provides the U.S. with a new way to maintain its advantage in the global financial system.

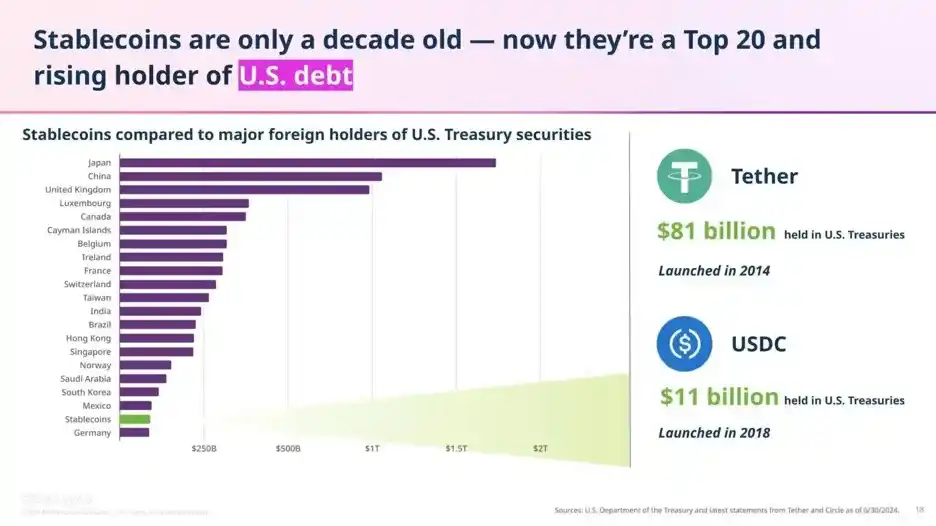

In addition to enhancing the dollar's international influence, stablecoins may also strengthen the domestic financial foundation of the U.S. Although stablecoins were only introduced a decade ago, they have already become among the top 20 holders of U.S. Treasury bonds, surpassing countries like Germany. This indicates that stablecoins not only expand the global dominance of the dollar but also, by absorbing a large amount of Treasury bonds, become an important part of the U.S. financial system, providing additional liquidity support for the economy.

Rising Voter Interest in Cryptocurrency

According to a national survey commissioned by Grayscale and conducted by Harris Poll, more than half of voters indicated that they are more likely to support candidates who "understand cryptocurrency" rather than those who do not.

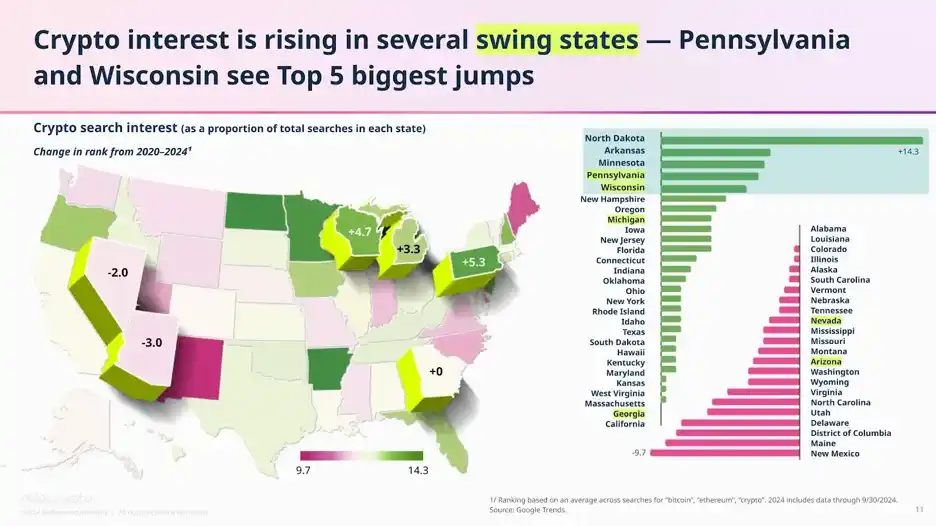

At the same time, interest in cryptocurrency among swing state voters has also significantly increased. Since the 2020 election, two key battleground states—Pennsylvania and Wisconsin—expected to be highly competitive, have seen their Google search interest rankings for cryptocurrency rise to fourth and fifth place, respectively. Michigan ranks eighth in this metric.

Increased Regulation of Crypto Companies by the Biden Administration

Since taking office, the Biden administration has been committed to strengthening regulation of cryptocurrencies and has promised to establish a stricter regulatory framework. Related measures include filing a lawsuit against Ripple for unregistered securities issuance, imposing additional tax reporting requirements on crypto companies and Bitcoin miners, and levying capital gains taxes.

Following the collapse of FTX, the government has intensified its crackdown on major crypto companies and has achieved several significant legal advancements. For example, the former CEO of Binance, the world's largest crypto exchange, Changpeng Zhao, was sentenced to four months in prison due to U.S. and international lawsuits. Subsequently, the U.S. Securities and Exchange Commission filed a lawsuit against Coinbase, accusing it of operating a crypto asset trading platform without registering as a securities exchange. If this case succeeds, it could pose a significant threat to Coinbase's business model, with other sued companies including the crypto exchange KuCoin.

The Core Role of Donations from Crypto Companies

In 2024, crypto companies have become major contributors to political donations in the U.S. Coinbase and Ripple are the largest corporate political donors this year, contributing nearly 48% of the total corporate donation amount. Fairshake, a super PAC founded in 2023 by former New York Governor's aide Josh Vlasto, has raised over $200 million to support pro-crypto candidates, making it the highest-spending PAC in this election cycle.

Fairshake aims to elect pro-crypto candidates and combat skeptical opponents, receiving support from companies like Coinbase, Ripple, and Andreessen Horowitz. This funding not only influences the policies of presidential candidates but also drives congressional election strategies that support cryptocurrency. As a result, the crypto industry has stepped into the spotlight, becoming an important force in U.S. politics.

A typical example occurred in March of this year when progressive Democratic star Katie Porter raised over $30 million in the California Senate election and was expected to win. However, due to her adoption of Elizabeth Warren's political stance and her alignment with Harris on banking regulation issues, Fairshake viewed her as an "ally of the anti-crypto movement."

During the California primary, Fairshake spent over $10 million opposing Porter, undermining her support among young voters. Through Hollywood billboards and targeted statements against her, Fairshake claimed that Porter misled voters into supporting pro-corporate legislation. As a result, her campaign funding was affected, and she ultimately failed to advance to the fall election.

Therefore, many Democratic candidates have added sections supporting cryptocurrency on their campaign pages, seeking funding from crypto PACs, which now have a significant influence on candidates' positions.

Impact of the Election

Candidates' Policy Proposals

Harris

Harris has made limited statements regarding cryptocurrency policy, only indicating that her administration will "encourage innovative technologies like AI and digital assets while protecting our consumers and investors." Recently, in response to lower-than-expected support among Black voters, she proposed a series of economic security plans, including a commitment to establish a regulatory framework for cryptocurrency aimed at protecting Black male investors.

However, this framework is only targeted at Black voters and lacks clear regulatory details or specific policy positions, leading to criticism from the cryptocurrency community as hypocritical, viewing it as merely a tactic to win votes. The current Biden-Harris administration has taken a more confrontational regulatory approach towards the crypto industry, involving multiple lawsuits, restrictions on traditional banking services, and vetoing bipartisan legislation.

The government is also considering imposing capital gains taxes on cryptocurrencies. While Harris's crypto policy may be friendlier than Biden's and could improve the regulatory environment for the industry, she remains cautious on key issues such as taxation, Bitcoin mining, and self-custody, far less supportive than Trump.

Trump

The Republican Party has consistently emphasized individual freedom, aligning its values with the decentralized principles of cryptocurrency. The Republican National Committee has pledged that Trump will defend Bitcoin mining rights and "ensure that every American has the right to self-custody digital assets and can trade freely without government surveillance." In contrast, the Democratic Party typically advocates for increased government power and regulation, which may create ideological friction with the cryptocurrency community.

Trump has shown a strong interest in the digital asset industry, claiming his goal is to make the U.S. a "global crypto hub and Bitcoin superpower." He supports Bitcoin mining and promises to protect self-custody rights. Additionally, during his campaign, Trump used Bitcoin to buy burgers for restaurant patrons and criticized the Securities and Exchange Commission (SEC) for its tough stance on cryptocurrencies, vowing to appoint a pro-crypto chair if re-elected. Trump even launched his own DeFi project—World Liberty Financial.

Trump has proposed a series of crypto policies, including:

· Establishing a Strategic Bitcoin Reserve:

Trump stated that the government will "retain all Bitcoin currently held or acquired by the U.S. government" as the "core of a strategic national Bitcoin reserve." As of October 2023, the U.S. government holds Bitcoin worth over $5 billion, primarily seized through criminal investigations. However, it remains unclear how these Bitcoin reserves will be utilized, their feasibility, and whether the crypto industry will widely accept this initiative.

· Establishing a Presidential Advisory Council on Cryptocurrency:

Trump promised to establish a "Bitcoin and Cryptocurrency Presidential Advisory Council" in Nashville, stating that the council will be composed of "industry supporters" rather than "crypto skeptics" to formulate rules.

· Prohibiting the Federal Reserve from Issuing Digital Currency:

Despite many countries advancing central bank digital currencies (CBDCs), this trend has faced resistance within the U.S. cryptocurrency community. Although the Federal Reserve has not yet decided whether to issue a digital dollar, a report released in January 2022 detailed the potential costs and benefits of a CBDC.

Trump has publicly opposed this proposal multiple times, calling it "a dangerous threat to freedom." In May 2024, the House passed a bill prohibiting the Federal Reserve from issuing a CBDC, although the bill still needs further advancement to become law. It is worth noting that while Trump supports cryptocurrencies, his tariff policies may create economic uncertainty. The long-term impact of his policies on the market and the crypto industry remains to be seen.

Possible "Divided Government"

Currently, unless one party can control both houses of Congress and the presidency, a period of political instability seems almost inevitable.

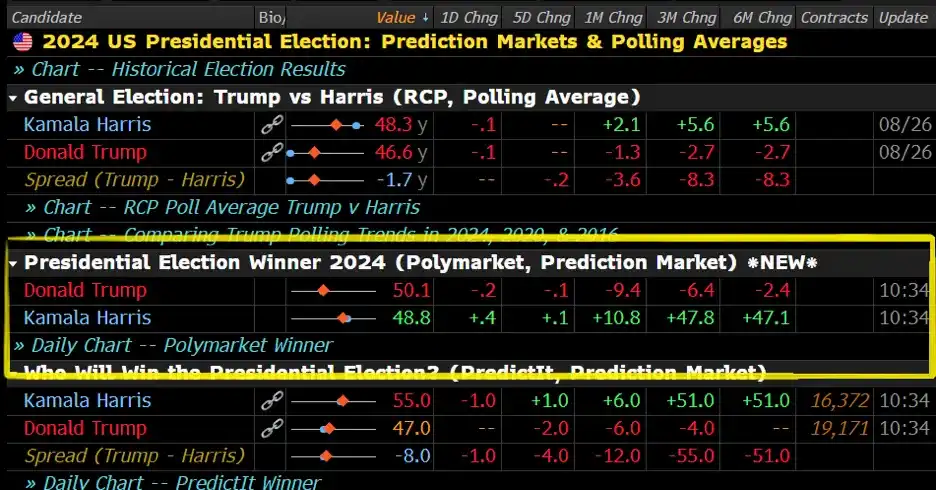

As of October 25, Polymarket data shows significant differences in the odds of victory among parties in the presidential, Senate, and House elections. The only relatively likely outcome at this point is that the Republicans will control the Senate. At the same time, the possibility of a "divided government" is also high—meaning the presidency and the Senate will be controlled by different parties. The last occurrence of a divided government was during the Obama administration, while both Biden and Trump have governed without a divided government.

This political landscape typically leads to policy gridlock, as the president and the Senate must compromise on significant legislation and appointments. If the Republicans achieve a sweeping victory, they may enact new laws within three to six months, which would be a favorable outcome for the cryptocurrency market, as the Republicans generally advocate for a more lenient regulatory framework for cryptocurrencies.

On Wednesday, September 25, 2024, the U.S. Congress passed a temporary government spending bill to ensure funding for government agencies continues until December, avoiding a government shutdown. This bill postpones final spending decisions until after the November 5 presidential election. In other words, from December until the new Congress is sworn in on January 3, the government's fiscal budget will be somewhat constrained. This means that during this transition period, the president's influence on fiscal policy may be limited, and a formal budget can only be passed after the new House of Representatives takes office.

Possible Changes in SEC Leadership

Since Gary Gensler took office as SEC Chair, his tough regulatory stance has sparked opposition from the cryptocurrency community. While he has achieved some success in combating illegal securities offerings, his strict enforcement has faced protests from many crypto companies.

Trump has publicly stated that if re-elected, he would "fire" Gensler and push the SEC to adopt a more pro-cryptocurrency stance. Traditionally, SEC chairs tend to resign when a new president takes office. If a Harris administration were to take office, adopting a stance similar to the opposing camp to gain industry support would not be surprising. Therefore, whether Harris or Trump is elected, the SEC leadership is likely to undergo significant changes.

Macroeconomic Liquidity: Inevitable Volatility and the Determinative Role of Quantitative Easing Levels

When the Federal Reserve lowers interest rates and global capital liquidity significantly increases, the price of Bitcoin tends to rise, indicating that macroeconomic liquidity still has a decisive impact on the cryptocurrency market.

In 2020, in response to the COVID-19 pandemic, the Trump administration initiated an unlimited quantitative easing policy, injecting vast amounts of capital into the cryptocurrency market. On March 15, 2020, the Federal Reserve lowered the federal funds rate by 1 percentage point to between 0% and 0.25% and launched a $700 billion quantitative easing program. Subsequently, the Federal Reserve further announced the removal of QE limits and committed to asset purchases as needed, thus initiating unlimited quantitative easing. This move brought significant liquidity to the crypto market.

On October 21, 2024, at a town hall meeting in Lancaster, Pennsylvania, Trump reiterated that if he is re-elected on November 5, he will significantly lower U.S. interest rates. This promise could once again drive up the prices of cryptocurrencies like Bitcoin, especially with further increases in liquidity.

How Elections Affect Cryptocurrency Startups

Web3 Prediction Markets Surpassing Web2 Competitors

Since its launch in 2020, Polymarket has rapidly emerged as a leader in the field. It accounts for 80% of the trading volume generated by betting on the U.S. presidential election. As an application developed in an on-chain environment, Polymarket competes with traditional markets and holds the largest market share, which is rare in the industry. Polymarket allows users to speculate and bet on the outcomes of future events related to sports, politics, business, science, and more. The platform gained significant attention during the 2021 U.S. presidential election, handling 91% of the total betting volume, equivalent to $3.5 million in bets.

Polymarket has faced many challenges, including a $1.4 million civil monetary penalty and settlement with the U.S. Commodity Futures Trading Commission (CFTC), after which it ceased official operations in the U.S. and geo-fenced access to the site for U.S. users. CFTC Chair Rostin Behnam warned that if its "footprint" in the U.S. is large enough, it must register its derivative contracts or face enforcement actions.

Prediction markets have gradually evolved into a broader financial tool, surpassing mere speculation. As Polymarket expands, the influence of prediction markets has extended into various areas, including public opinion, financial hedging, and business decision-making.

How Prediction Markets Work

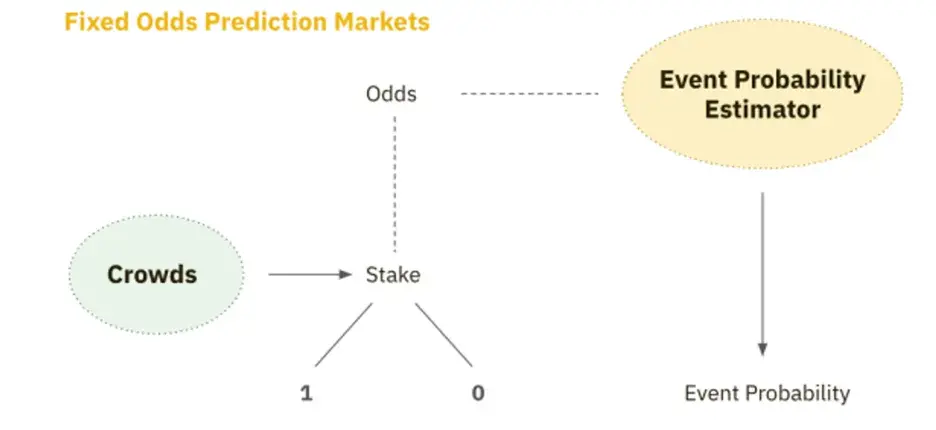

Prediction markets are a type of derivatives market where participants bet on the outcomes of events. These markets typically use binary options. For example, in a binary market, a question like "Will the Bitcoin spot ETF be approved?" can be answered with "yes" or "no." The price distribution of "yes" or "no" is determined by the predictions and bets of market participants, with the total price summing to one dollar or slightly above.

On the expiration date, when the event outcome is revealed, the stock price converges to either $0 or $1. Participants who predicted correctly will receive a $1 payout, while those who predicted incorrectly will receive $0. This is how profits and losses are determined.

In addition to cryptocurrencies, offshore centralized providers often limit the amount that can be bet on specific outcomes, similar to sports betting. This restricts individuals from fully leveraging their insights, while the final outcomes are typically controlled by centralized operators. On-chain prediction markets eliminate these barriers, as smart contracts and decentralized ledgers create a transparent global market, ensuring that these platforms are fair and tamper-proof.

Polymarket's order book adopts a hybrid decentralized model. User-submitted orders are sent to Polymarket's operators, who match and execute orders off-chain. The foundation of this trading system is a customized trading contract that facilitates atomic swaps (settlements) between binary outcome tokens and collateral assets (ERC20) based on signed limit orders.

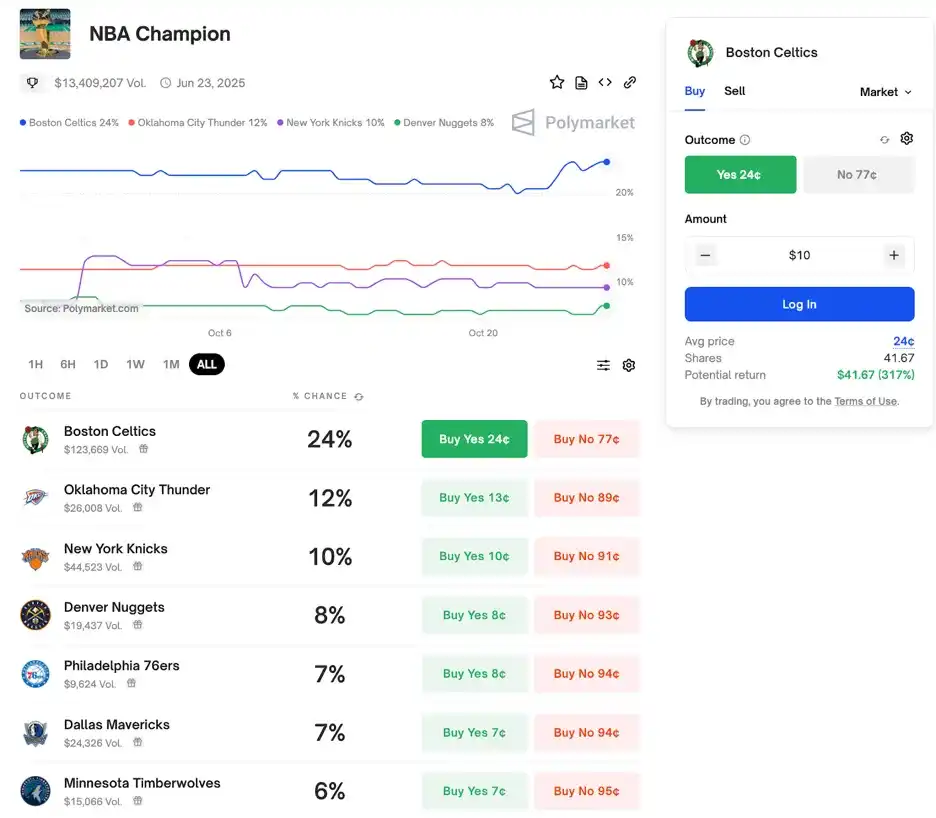

In addition to the aforementioned binary markets, Polymarket also offers categorical markets and scalar markets. Categorical markets allow betting on multiple options, with each option being determined as $1 or $0 based on the outcome. For example, a market predicting the 2025 NBA champion might include options like the Celtics, Thunder, Knicks, and Nuggets.

As the regular season has just begun, everything is uncertain, and users can choose to bet on multiple teams. Scalar markets differ from the previous two types, with profits and settlements based on the final result's position within a predefined range.

Product Iteration of Prediction Markets

Augur is one of the earliest blockchain prediction markets. By 2018, it had achieved a trading volume of $400,000, which was quite significant given the on-chain activity at the time, demonstrating the market's demand for on-chain prediction markets. However, Augur failed to maintain a stable user base, primarily due to its complex mechanisms and vulnerability to malicious attacks.

Unlike Polymarket, Augur allows anyone to create markets by staking its governance token, REP. Augur's system is designed to invalidate a market if errors are detected in its fundamental components (market definition, expiration time, or decision conditions) during the market creation process.

As a result, attackers could intentionally create flawed markets with the intent of forcing the market to become invalid and profiting from it. Additionally, Augur's permissionless market creation led to several controversial events, such as markets predicting "when a certain singer will die."

To attract users during the early application development phase, Polymarket internalized the market creation process and selectively centralized operations. By providing a user-friendly market and avoiding ethical controversies, Polymarket established a stable initial user base. This selective centralization strategy aims to successfully attract early users while ensuring transparency and traceability of core trading activities.

Prediction Markets Break Boundaries and Enter the Mainstream

According to the efficient market hypothesis, asset prices in capital markets quickly and fully reflect all information available to market participants. Therefore, prediction markets are always efficient, with the potential to address the issue of inaccurate predictions, which indicates market inefficiency, and achieve accurate forecasts.

The founders of Polymarket noted that the platform was launched to address the widespread misinformation and errors during the pandemic. In fact, Polymarket effectively transformed the speculative demands of market participants into a tool for collecting public sentiment data. For example, it predicted Kamala Harris would become the Democratic nominee and J.D. Vance would be Trump's vice-presidential candidate before their official announcements.

As a result, Polymarket has been widely adopted by several mainstream media outlets (even among cryptocurrency skeptics in mainland China) as an alternative news source. The widely used Bloomberg Terminal even began incorporating Polymarket's data into its dashboard starting in August 2024.

Polymarket is also integrating with content platforms. On July 30, 2023, the renowned content subscription platform Substack announced the embedding of Polymarket's prediction markets, launching the new "Substack The Oracle by Polymarket."

On "The Oracle," readers can find insights and analyses from thousands of active markets on the Polymarket trading platform. Polymarket's "The Oracle" regularly aggregates significant markets and key statistics, providing in-depth analysis of some of today's hottest topics.

Future Development Directions of Prediction Markets

Currently, Backpack Exchange has launched prediction tokens for the U.S. presidential election. SynFutures and dYdX have introduced leveraged trading products related to the election and implemented advanced order features (such as limit orders and stop-loss orders) to help users manage risk. This leveraged trading allows users to operate larger positions with a smaller initial investment, thereby amplifying potential returns.

dYdX particularly focuses on permanent contracts for Trump prediction markets, allowing traders to participate in the market with 20x leverage and engage in long or short trades. This flexible trading structure enables users to capitalize on every market fluctuation and potentially achieve substantial returns in the short term. Overall, the combination of leveraged trading and prediction markets remains relatively complex for ordinary users and is more suited for professional traders.

Trump's Victory Could Encourage Crypto Companies to Go Public in the U.S.

Under a Trump administration, there would be a clearer regulatory framework and a more lenient regulatory environment, reversing the current trend of crypto companies fleeing the U.S. and blocking U.S. IP addresses. Meanwhile, according to Bloomberg, several crypto-related companies, such as Circle Internet Financial, Kraken, Fireblocks, Chainalysis, and eToro, may go public in the coming years, with other eligible crypto companies also expected to adopt standard IPO procedures.

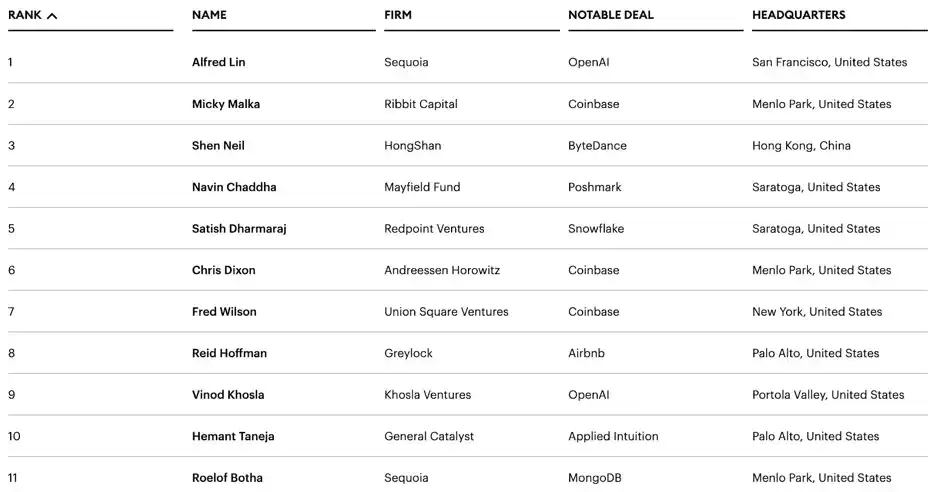

In contrast, under the Biden administration, only a few crypto companies have completed IPOs in recent years due to the tough regulatory stance taken by current SEC Chair Gary Gensler. As a result, it has become more challenging for crypto companies to secure mainstream institutional funding. Although Coinbase's IPO in 2021 attracted many traditional funds to establish crypto divisions, Coinbase remains the only crypto project to appear on Forbes' 2024 Midas List.

DeFi and BTCFi Will Benefit First

Although Trump's own DeFi project—World Liberty Financial (WLFI)—has only sold 4.3% of its tokens and has been criticized for its lack of utility, it reflects his attention to DeFi.

In DeFi, BTCFi stands out for its ease of building consensus and gaining legitimacy, providing a stronger foundation that ensures its continued development.

Bitcoin remains the largest common ground among the crypto industry, Wall Street, and the U.S. Securities and Exchange Commission. The core of BTCFi is to leverage BTC through various businesses (such as staking, lending, trading, and derivatives). Over time, the value of BTCFi is expected to grow to multiple times that of BTC, reflecting trends in other major asset classes. However, this development requires a favorable external environment over a relatively long period. If Trump wins the election, this process may accelerate.

Crypto companies developing BTC financial tools will be incentivized and able to obtain a more lenient regulatory environment, thereby solidifying BTC's position as a foundational asset. On the other hand, the innovations of BTCFi will be driven by developers, promoting various groundbreaking applications based on Bitcoin's programmability. For example, the upgrade of Bitcoin in 2025, following the Taproot upgrade in 2021, is expected to implement OP_CAT.

Once OP_CAT is enabled, developers will be able to use advanced Bitcoin-native programming languages, such as sCrypt, to directly develop decentralized and transparent smart contracts on the Bitcoin mainnet. sCrypt is a TypeScript framework for writing smart contracts on Bitcoin, allowing developers to write smart contracts directly in TypeScript, one of the most popular high-level programming languages.

Additionally, Bitcoin's current second-layer solutions may also transition to zk-rollups, with the total market potential of BTCFi expected to exceed ten times the current market value of BTC.

Many projects are already exploring how to leverage sCrypt around OPCAT for development. For instance, Bitcoin's parallel chain Fractal Bitcoin has already supported OPCAT and launched the CAT protocol.

Currently, re-staking projects developed using Bitcoin scripts, such as Babylon, and stablecoin lending platform Shell Finance are also considering related development after the release of OP_CAT to achieve complete decentralization and more complex on-chain functionalities, relying on Bitcoin's consensus mechanism to ensure security fully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。