Before 2034, there will be about 10 trillion in U.S. debt interest. Considering that Trump's term is only 4 years, if Bitcoin can truly serve as a reserve for the U.S. dollar, then it only needs to address about 5 trillion in interest issues. Therefore, the price of a single Bitcoin only needs to reach $261,780, which is about 3 times the current price.

Written by: Zuo Ye

I have been focusing on the election recently and haven't had the heart to update. Now that the outcome is clear, I will immediately present a lengthy piece.

From today onwards, Trump will become the most powerful president since Franklin D. Roosevelt. It was during Roosevelt's presidency that Fort Knox became the U.S. gold strategic reserve base, and Trump has also declared that he wants to make Bitcoin the federal reserve currency of the United States.

In this U.S. election, Trump defeated Harris in the popular vote. As long as the electors remain loyal to the will of the voters, Trump has already secured more than half of the 538 electoral votes. If all goes well, on January 6, 2025, Trump can return to his loyal White House.

Moreover, the Republican Party has already secured 51 seats in the Senate, and the two parties in the House of Representatives are expected to form a balance of power. Even if the Republicans cannot gain control, the gap between the two parties is within single digits. Thanks to Trump's multiple nominations of Supreme Court justices during his first term, the current ratio of conservative to liberal justices in the Supreme Court is stable at 6:3, which even surpasses President Roosevelt, as he did not fully control the Supreme Court.

The last time there was a miracle of two non-consecutive elections was 132 years ago during the Cleveland era. After November 5, Wikipedia's page will need to be updated; Trump has achieved the historical status of being the second person in history.

Looking back at the history of Rome, the Republican Party has become Trump's party, and the first unification of the three powers has given him a power base that previous U.S. presidents did not have. The last time Roosevelt established the dollar-gold alliance was until the Bretton Woods system collapsed. Will Bitcoin also open this historical process?

Web3 Institutionalization Process Begins

In Eastern powers, institutions mean stability, while in Western powers, figures like Trump and Musk see the System and Deep State as representing decayed interest groups that need to be eliminated. This is why Musk has personally entered the fray, hoping to become the captain of the Department of Government Efficiency (D.O.G.E), adding new catalysts and vitality outside the existing political correction mechanisms.

This is not a new idea. The birth of the FBI, the emergence of the IRS, and the establishment of the CIA are all new variables that could not be maintained by existing routes. Therefore, it is unnecessary to believe that cryptocurrencies and Bitcoin will truly change America; what we need to focus on is how the dollar and gold are being "Americanized," which is the so-called institutionalization, where the new resistance forces are absorbed as part of the existing ruling order.

The End of Free Dollars

The issuance of the dollar has roughly gone through three stages: from the Continental currency during the Revolutionary War to the establishment of the Federal Reserve in 1913, the gold standard from 1879 to 1944, and the era of fiat currency after the 1970s.

As early as the American Revolutionary War, the Continental Army began issuing dollars, but at that time, the dollar was more of a war bond. If you bet that the Continental Army would win, you just needed to hoard dollars. Later, during the Civil War, the federal government issued a large number of "greenback dollars," which also had a strong war bond character, while the Southern government issued cotton bonds. Ultimately, the industrialized dollar triumphed over the plantation owners' cotton.

Then came the Bretton Woods system associated with World War II, where the dollar was pegged to gold, and other countries' currencies were pegged to the dollar. This dual peg mechanism was essentially a gold standard mechanism, but after Nixon announced that gold would no longer be redeemable for dollars, this system officially collapsed.

The above is the dollar history we are familiar with, and today's dollar is essentially a voucher for U.S. Treasury bonds. The U.S. Treasury issues bonds, which the Federal Reserve buys and uses as reserves for dollar issuance. Mechanisms like Luna-UST are merely poor imitations.

The era of free banking with greenback dollars between the 1820s and the Civil War is not much different from the current prosperity of cryptocurrencies. A large number of banks could issue banknotes independently, which were essentially promissory notes redeemable on demand. Even if the face value of the banknotes issued by different banks was the same, there were situations where they could not be exchanged. At the height of this era, there were over 70,000 different types of "dollars" in circulation.

To a considerable extent, the chaos of the dollar system was also one of the causes of the Civil War.

This confusion of issuing entities could not last, just like today's regulatory approach to cryptocurrencies. If not managed, even gold could be sold at prices ranging from the moon to the underworld, with the economic system long remaining under the Brown system.

In response, the U.S. enacted the National Bank Act in 1863, establishing a number of national banks and the Office of the Comptroller of the Currency (OCC). However, it is important to note that the U.S. government did not deny the qualification of other banks to issue banknotes but rather conducted targeted "reviews" and supervision, similar to how the SEC reviews the "securities issuance" qualifications of various cryptocurrencies, without denying your qualification to issue cryptocurrencies. The characteristics of U.S. management are hidden in history.

Thus, the U.S. government began to intervene massively in the dollar until the economic crisis of 1907, where J.P. Morgan played the role of savior. This led to the hard power of collaborating with the U.S. government, and in 1913, the Federal Reserve Act was enacted, marking the complete end of free dollars.

After Bitcoin Lands

Zhang Hua was admitted to Peking University, Li Ping entered a technical school, and I worked as a sales clerk in a department store. We all have bright futures.

There are only two types of cryptocurrencies in the world: Bitcoin and others. In Trump's view, the dollar needs a new anchor, and Bitcoin could be a better anchor than U.S. debt, at least serving as one of the supports like gold. The only problem is that Bitcoin's price cannot accommodate tens of trillions in liquidity. If each Bitcoin is worth one million dollars, it is more likely that the dollar will depreciate.

Let's do a simple math problem. The current scale of U.S. debt is $35 trillion, and the current circulation of Bitcoin is about 19.1 million. A simple division shows that to resolve the U.S. debt crisis, the price of a single Bitcoin needs to reach $1,832,460. The current $75,000 is just an appetizer, with a 24-fold increase still needed.

A more rational choice is that Bitcoin does not need to become the reserve currency of the dollar like gold; it only needs to address the interest on U.S. debt. According to estimates, the current annual interest on U.S. debt is about $1 trillion, which is roughly half of the cryptocurrency market value or approximately equal to Bitcoin's market value. However, this still requires the U.S. government to control all or most of the Bitcoin. Regardless of whether the U.S. government can achieve this, an illiquid asset has no value.

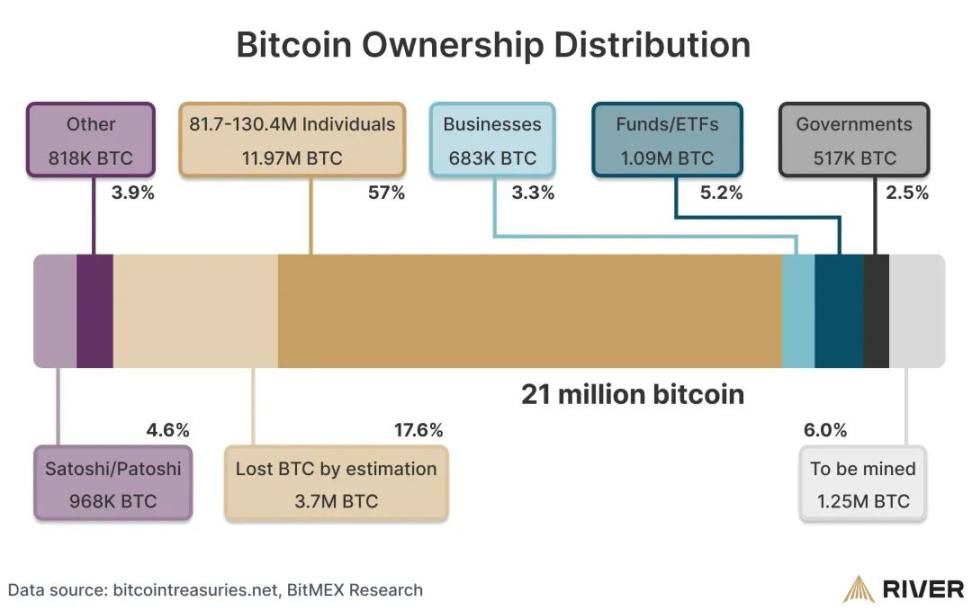

Image description: Bitcoin distribution map

Image source: River Capital

Currently, the U.S. government's Bitcoin holdings are around 1%. However, like J.P. Morgan's relationship with the Federal Reserve, most BTC ETFs have a U.S. background. If we include their 5.2% share and Satoshi Nakamoto's passive locked-up 4.6%, then theoretically, the U.S. government has the ability to control or influence about 10% of Bitcoin's price, which already counts as a super whale.

Before 2034, there will be about 10 trillion in U.S. debt interest. Considering that Trump's term is only 4 years, if Bitcoin can truly serve as a reserve for the U.S. dollar, then it only needs to address about 5 trillion in interest issues. Therefore, the price of a single Bitcoin only needs to reach $261,780, which is about 3 times the current price. This is achievable, as long as one adopts the attitude of "after I die, let the flood come."

And the entire Web3 will also enter the American era. The last internet dividend bore the fruits of Silicon Valley; this time, it remains to be seen how it will unfold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。