How should traders predict market trends and potential price movements? This beginner's guide teaches you how to interpret various patterns and shapes of "cryptocurrency candlestick charts."

Written by: Siddhant Kejriwal, CoinBureau

Translated by: Glendon, Techub News

Cryptocurrency trading primarily operates through two main mechanisms: liquidity pools on decentralized exchanges (DEX) and order books on centralized exchanges (CEX). On decentralized exchanges, liquidity pools aggregate funds in smart contracts, enabling peer-to-peer trading without traditional intermediaries. In contrast, centralized exchanges use order books to list buy and sell orders, facilitating trades by matching these orders. Compared to DEX, the order book model is more common, providing traders access to detailed candlestick charts that depict the historical movements of asset prices.

Candlestick charts are an indispensable tool in trading, with each candlestick summarizing price movements over a specific time period, offering insights into market sentiment and potential future price trends. By mastering the interpretation of candlestick charts, traders can identify market trends and effectively understand the collective behavior of market participants over time.

This guide is designed specifically for cryptocurrency beginners, aiming to delve into how to read cryptocurrency candlestick charts. Although the basic principles are similar to traditional asset markets (such as the stock market), the unique characteristics of the cryptocurrency market, including high volatility, 24/7 trading, and varying liquidity levels, add a distinct perspective to candlestick analysis in the cryptocurrency space. This guide will explore these differences in depth, providing readers with practical knowledge to navigate the complexities of cryptocurrency trading.

Basics of Candlestick Charts

Candlestick charts are fundamental tools in financial analysis, visually displaying the changes in asset prices over time. In cryptocurrency trading, these charts are crucial for understanding market behavior and making informed decisions.

Key Features of Candlestick Charts:

- Price Movements Over Time: Candlestick charts show the fluctuations of asset prices over a specific time period, providing insights into market trends and volatility.

- Multiple Time Frames: These charts can be drawn for different time periods, ranging from seconds to months, allowing traders to analyze short-term fluctuations or long-term trends.

- Visual Cues: Candlestick charts dynamically represent trading data using shapes and colors, making it easy for traders to interpret market sentiment at a glance.

- Pattern Recognition: By observing recurring patterns and identifying potential entry and exit points, traders can speculate on future price movements.

- Technical Indicators: Charting platforms often provide various indicators to present data from different perspectives, enhancing the depth of price analysis.

Structure of Candlestick Charts

Candlestick Structure | Image from Pocketful

Understanding the components of a candlestick chart is crucial for effective chart interpretation:

1. Body: The rectangular area between the opening and closing prices. A red body indicates a bearish period (closing price < opening price), while a green body indicates a bullish period (closing price > opening price).

2. Wicks (Upper and Lower Shadows): Thin lines extending from the body represent the highest and lowest prices during that period. The upper wick shows the highest price, while the lower wick indicates the lowest price.

3. Open, High, Low, Close (OHLC) — Each candlestick contains these four data points:

- Opening Price: The price at the beginning of the period.

- Highest Price: The highest price reached.

- Lowest Price: The lowest price reached.

- Closing Price: The price at the end of the period.

4. Bullish and Bearish Candlesticks: A green (or white) candlestick indicates a bullish period, where the closing price is higher than the opening price. Conversely, a red (or black) candlestick indicates a bearish period, where the closing price is lower than the opening price.

Time Frames and Their Significance

Candlestick charts can be constructed using different time frames, each serving different trading strategies:

- Short-Term Time Frames (1 minute to daily): These charts capture price fluctuations every minute, providing opportunities for quick trades, ideal for day traders looking to profit from intraday price movements.

- Medium-Term Time Frames (daily to weekly): Suitable for swing traders who expect to profit from price movements over several days. These charts filter out some noise from short-term time frames, providing a clearer view of emerging trends.

- Long-Term Time Frames (weekly to monthly): Long-term investors prefer this framework as they focus on overall market trends. For example, hourly data may be irrelevant, so they rely on daily or weekly candlestick charts to make informed decisions.

Choosing the appropriate time frame that aligns with your trading goals helps filter out unnecessary data, allowing for more targeted analysis. Candlestick charts visually display the changing sentiment of the market towards an asset over time.

How to Interpret Cryptocurrency Candlestick Patterns

Candlestick charts are not just a visual representation of price movements; they also form unique patterns that can reveal the market's perception of a particular asset. Identifying these shapes can help traders predict potential price movements and make informed decisions.

Candlestick Shapes and Sizes

The shape and size of each candlestick convey specific information about trading activity during a particular period:

Body Length:

Long Body: Indicates strong buying or selling pressure. A long green (bullish) body means buyers dominated the trading period, pushing prices up. Conversely, a long red (bearish) body indicates sellers controlled the situation, leading to a price drop.

Short Body: Reflects indecision or balance between buyers and sellers. This often results in a Doji pattern, where the opening and closing prices are nearly the same.

Wick Length:

Long Upper Wick: Shows that buyers pushed prices up during the trading period, but sellers brought them down before closing, indicating potential resistance.

Long Lower Wick: Indicates that sellers pushed prices down, but buyers subsequently pushed them up, showing potential support.

Short Wicks: Suggest that the opening and closing prices are close to the high and low of the trading period, indicating a decisive trend with little resistance.

By analyzing these shapes, traders can assess market sentiment and speculate on future price movements. For example, a candlestick with a long lower wick and a small body near the top (Hammer) may indicate a potential bullish reversal after a downtrend.

Basic Chart Patterns

Understanding basic candlestick patterns is crucial for interpreting market behavior. These patterns can be bullish or bearish depending on how they form and the current market trend.

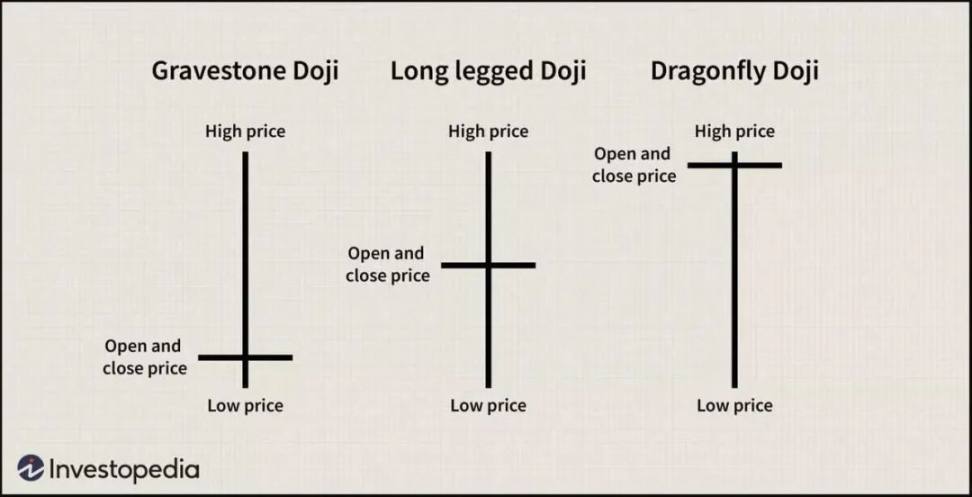

Doji

- A Doji is a candlestick where the opening and closing prices are nearly the same, resulting in a very short or nonexistent body.

- This pattern indicates market indecision. The length of the wicks can provide additional context; long wicks indicate significant volatility during the trading period.

- A Doji appearing at the bottom of a downtrend may signal a potential bullish reversal, while a Doji at the top of an uptrend may indicate a bearish reversal.

Doji Pattern | Image from Investopedia

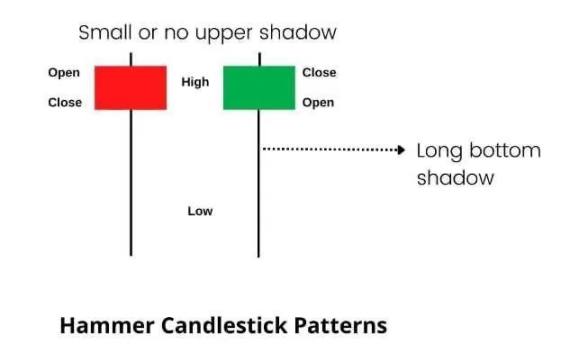

Hammer

- A candlestick with a small body at the upper end of the trading range and a long lower wick, resembling a hammer.

- This indicates that sellers pushed prices down, but buyers subsequently regained control, pushing prices up. Typically seen as a bullish reversal signal after a downtrend.

- Generally a bullish signal, especially when it appears after a decline.

Hammer Pattern | Image from Intradayscreener

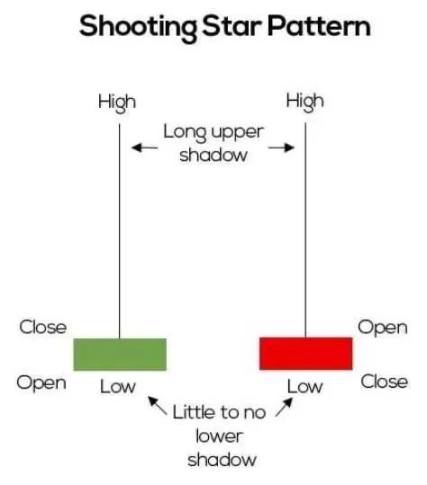

Shooting Star

- A candlestick with a small body at the lower end of the trading range and a long upper wick, resembling a shooting star.

- This indicates that buyers pushed prices up, but sellers subsequently took control, causing prices to fall. Typically seen as a bearish reversal signal after an uptrend.

- Generally a bearish signal, especially when it appears after a rise.

Shooting Star Pattern | Image from ThinkMarkets

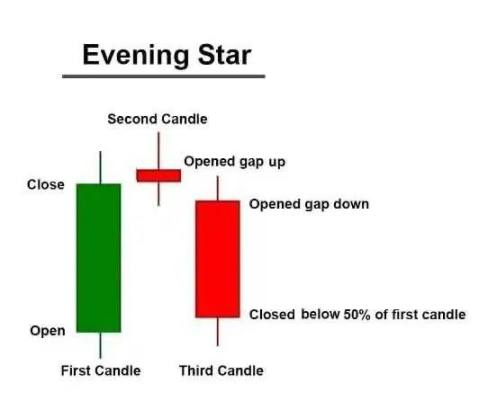

Evening Star

- A three-candle pattern consisting of a large bullish candle (bullish body), followed by a small body candle (which can be bullish or bearish), and then a large bearish candle (bearish body) that closes below the midpoint of the first candle.

- This indicates a potential bearish reversal after an uptrend. The small body candle represents indecision, while the subsequent bearish candle confirms the reversal.

- A bearish signal, especially when the closing price of the third candle is below the midpoint of the first candle.

Evening Star Pattern | Image from StockDaddy

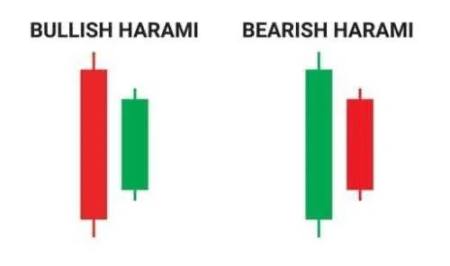

Harami Pattern

- A candlestick pattern where a large candlestick is followed by a small candlestick, with the body of the small candlestick completely within the range of the previous candlestick's body.

- The Harami indicates a potential reversal. A "Bullish Harami" appears in a downtrend, suggesting a possible upward reversal, while a "Bearish Harami" appears in an uptrend, indicating a possible downward reversal.

- The position and color of the candles determine the meaning of the pattern. A "Bullish Harami" consists of a red large candlestick (bearish) followed by a green small candlestick (bullish); while a "Bearish Harami" consists of a green large candlestick (bullish) followed by a red small candlestick (bearish).

Harami Pattern | Image from asiaforexmentor

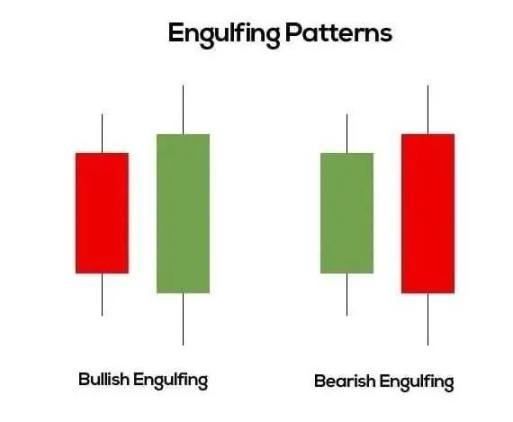

Engulfing Pattern

- A pattern consisting of two candlesticks, where a small candlestick is followed by a large candlestick that completely engulfs the body of the previous candlestick.

- A "Bullish Engulfing Pattern" that appears in a downtrend indicates a potential upward reversal, while a "Bearish Engulfing Pattern" that appears in an uptrend suggests a potential downward reversal.

- In a "Bullish Engulfing Pattern," a small bearish candlestick is followed by a large bullish candlestick. In a "Bearish Engulfing Pattern," a small bullish candlestick is followed by a large bearish candlestick.

Engulfing Pattern | Image from Medium

Indicators, Not Oracles

It is important to note that while these patterns can provide valuable insights, they are not foolproof indicators. They represent probabilities rather than certainties. The actual market movements depend on various factors, including market sentiment, economic indicators, and geopolitical events.

As traders gain experience and practice, they will discover subtle and context-specific patterns that can significantly enhance their trading accuracy. Developing a keen insight into these nuances is a skill that requires long-term honing and is essential for successful trading.

Technical Indicators and Tools

In cryptocurrency trading, technical indicators are important tools that help traders analyze price movements and make informed decisions. Understanding how to use these indicators can enhance your trading strategy and improve your ability to predict market trends.

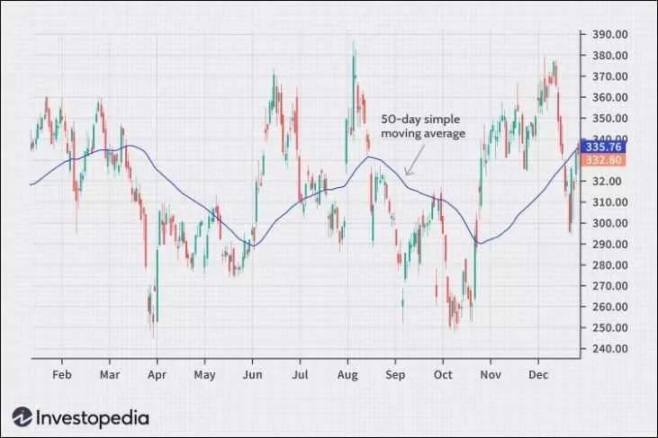

Moving Averages (MA)

Moving averages are used to smooth price data, creating a single flowing line that makes it easier to identify the trend direction over a specific time period.

Construction Method:

1. Simple Moving Average (SMA): Calculated by adding the closing prices of an asset over a specific number of periods and then dividing by that number. For example, a 10-day SMA is the sum of the closing prices over the past 10 days divided by 10.

2. Exponential Moving Average (EMA): This gives more weight to recent prices, making it more responsive to new information. It uses a more complex formula that applies a multiplier to the latest price data.

Moving Average Indicator | Image from Investopedia

Moving averages help determine the overall trend direction. When the price is above the moving average, it indicates an uptrend; when the price is below, it indicates a downtrend. They also act as dynamic support and resistance levels. For example, in an uptrend, the moving average may serve as a support level where prices often bounce.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements, helping to identify "overbought" or "oversold" conditions. (Note from Techub News: Overbought refers to a situation where the asset's price rises to a level that cannot be supported by fundamental factors, usually occurring after a rapid price increase, indicating that a downward correction is likely; oversold refers to a situation where the asset's price has significantly dropped, suggesting a potential upward movement in the short term.)

1. Construction Method: The RSI is calculated using the following formula: RSI = 100 - [100 / (1 + RS)], where RS (Relative Strength) is the average of "n" days' closing prices that have increased divided by the average of "n" days' closing prices that have decreased. The default period for the RSI is 14 days.

2. Interpretation: The RSI value ranges from 0 to 100. A value above 70 typically indicates that the asset is overbought, potentially signaling a downward correction. Conversely, a value below 30 indicates that the asset is oversold, suggesting a potential upward correction. Traders use the RSI to identify potential turning points and confirm the strength of trends.

RSI Indicator | Image from Investopedia

Bollinger Bands

Bollinger Bands are used to measure market volatility and provide a relative definition of an asset's high and low prices.

1. Construction Method: Bollinger Bands consist of three lines: the middle line is a simple moving average (usually 20 periods), while the upper and lower bands are two standard deviations above and below the middle line, respectively.

2. Interpretation: When the Bollinger Bands widen, it indicates increased volatility; when they narrow, it indicates decreased volatility. Prices touching the upper band may indicate overbought conditions, while touching the lower band may indicate oversold conditions. Traders use Bollinger Bands to identify potential breakout points and assess the strength of trends.

Bollinger Bands Indicator | Image from Investopedia

Volume Analysis

Volume analysis examines the number of shares or contracts traded in a particular asset, providing insights into the strength of price movements.

1. Construction Method: Volume is typically displayed as a histogram at the bottom of the price chart, showing the number of units traded over a specific period.

2. Interpretation: High volume during price increases indicates strong buying interest and a strong trend, while high volume during price decreases indicates strong selling pressure. Conversely, low volume may indicate a lack of interest and a weak trend. A surge in volume often precedes significant price fluctuations and serves as a leading indicator of potential market shifts.

Combining Indicators for Deeper Insights

While each indicator provides valuable information, relying on multiple indicators simultaneously can sometimes lead to conflicting signals. It is crucial to test different combinations to find which ones complement your trading strategy.

For example, using volume indicators as a constant measure of price movement strength, then switching between moving averages and Bollinger Bands to identify trends and assess volatility.

By thoughtfully combining indicators, you can gain a more nuanced understanding of market dynamics and improve your ability to predict price movements.

Advanced Charting Techniques

Let’s discuss advanced indicators that are essential tools for cryptocurrency traders. Understanding these indicators can provide deeper insights into market dynamics, helping you predict potential price movements. However, it is important to note that these patterns are complex and do not provide direct signals. Their subjective nature means that skill and experience are required for effective interpretation, but once mastered, they can offer early and profitable trading opportunities.

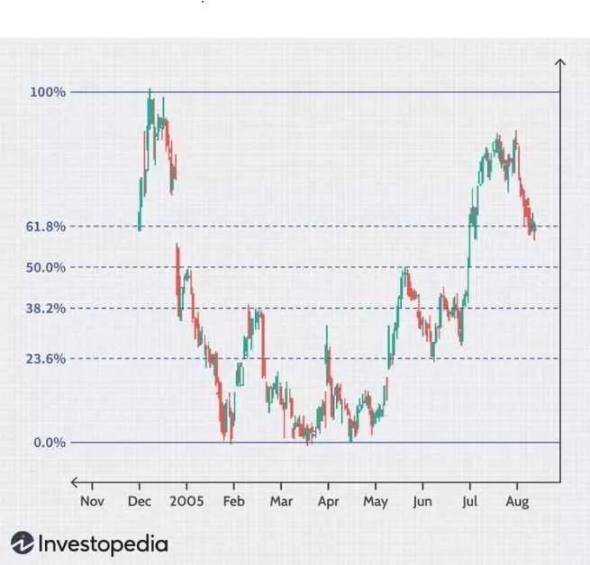

Fibonacci Retracement Levels

Fibonacci Retracement Levels are used to identify potential support and resistance areas on cryptocurrency price charts. Traders use these levels to predict where price pullbacks may stall or reverse within the existing trend. These levels help traders make decisions about entry and exit points.

Fibonacci Retracement Levels | Image from Investopedia

How are Fibonacci Retracement Levels Constructed?

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones (e.g., 0, 1, 1, 2, 3, 5, 8, 13, 21, etc.). In trading, specific ratios derived from this sequence (such as 23.6%, 38.2%, 50%, 61.8%, and 78.6%) are used for analysis.

Steps to Construct Fibonacci Retracement Levels on Cryptocurrency Charts:

- Identify Key Points: Locate significant peaks (high points) and troughs (low points) on the chart.

- Apply the Fibonacci Tool: Use charting software to draw retracement levels between these two points. The tool will automatically create horizontal lines at key Fibonacci ratios.

- Interpretation: These lines represent potential support levels (where prices may stop falling and reverse upward) and resistance levels (where prices may stop rising and reverse downward).

So, what do Fibonacci Retracement Levels tell us?

This indicator highlights areas where cryptocurrency prices may experience pauses or reversals within the current trend. Specifically:

- Support Levels in an Uptrend: During price pullbacks, retracement levels indicate where buying interest may resume, thus supporting prices.

- Resistance Levels in a Downtrend: During price increases, these levels indicate where selling pressure may increase, potentially preventing further price rises.

Practical Applications and Considerations in the Cryptocurrency Context

In the cryptocurrency market, prices often experience extreme volatility, making Fibonacci levels an important tool for predicting potential reversal points. However, their effectiveness may be limited by the following factors:

- Subjectivity: Choosing the correct high and low points can be subjective. Different traders may select different points, leading to varying retracement levels.

- Market Volatility: Due to high volatility, cryptocurrencies may quickly surpass standard retracement levels, reducing the reliability of these indicators.

Combining with Other Indicators:

To improve accuracy, traders often combine Fibonacci levels with other technical indicators:

- Moving Averages: Used to confirm trend direction.

- Candlestick Patterns: Used to identify potential reversal signals.

- Volume Indicators: Used to assess the strength of price movements.

While Fibonacci Retracement Levels require careful analysis, they can provide early signals of potential market reversals. Traders who skillfully apply these indicators in the cryptocurrency context may gain a competitive edge in capturing profitable opportunities ahead of others.

Ichimoku Cloud

The Ichimoku Cloud, or Ichimoku Kinko Hyo, is a comprehensive indicator that provides a clear insight into an asset's trend, momentum, and potential support and resistance levels. In cryptocurrency trading, it is used to determine the overall trend direction and identify potential buy or sell signals.

Ichimoku Cloud | Image from Investopedia

How is the Ichimoku Cloud Constructed?

The Ichimoku Cloud consists of five lines and a cloud area, each line calculated differently:

- Tenkan-sen (Conversion Line):

- Calculation: (Highest price over 9 periods + Lowest price over 9 periods) / 2

- Represents the short-term moving average.

- Kijun-sen (Base Line):

- Calculation: (Highest price over 26 periods + Lowest price over 26 periods) / 2

- Acts as a medium-term indicator of market trends.

- Senkou Span A (Leading Span A):

- Calculation: (Conversion Line + Base Line) / 2, plotted 26 periods ahead.

- Senkou Span B (Leading Span B):

- Calculation: (Highest price over 52 periods + Lowest price over 52 periods) / 2, plotted 26 periods ahead.

- Kumo (Cloud Area):

- The area between Leading Span A and Leading Span B.

- The cloud moves forward, providing future support and resistance levels.

- Chikou Span (Lagging Span):

- The current closing price plotted 26 periods back.

- Helps visually understand the relationship between current and past prices.

What can the Ichimoku Cloud tell us? It provides a multi-dimensional perspective:

Trend Identification:

Price above the cloud: indicates an uptrend.

Price below the cloud: indicates a downtrend.

Price within the cloud: indicates market consolidation or sideways movement.

Support and Resistance:

The cloud itself acts as dynamic support in an uptrend and dynamic resistance in a downtrend.

Momentum and Signals:

Conversion line crosses below the base line.

Both lines are below the cloud.

The cloud ahead appears red (Leading Span A is below Leading Span B).

Conversion line crosses above the base line.

Price is above the cloud.

The cloud ahead appears green (Leading Span A is above Leading Span B).

Bullish Signal

Bearish Signal

Practical Applications and Considerations in the Cryptocurrency Context

In the cryptocurrency market:

- Impact of Volatility: Rapid price changes may lead to frequent line crossings, resulting in potential false signals.

- Subjectivity: Interpreting cloud signals requires experience; novice traders may find conflicting indications.

- Time Frame: The effectiveness of this indicator may vary across different time frames. Longer time frames may provide more reliable signals.

Combining with other indicators to mitigate subjectivity:

- Volume Analysis: Confirm the strength of signals.

- RSI or MACD: Validate momentum indicated by the Ichimoku Cloud.

- Support and Resistance Levels: Combine cloud signals with traditional levels to enhance reliability.

The Ichimoku Cloud is a powerful tool that, despite its complexity, can provide early insights into market trends. For cryptocurrency traders willing to invest time in mastering it, this indicator can become an indispensable part of a comprehensive trading strategy.

Wyckoff Accumulation and Distribution Pattern

The Wyckoff Accumulation and Distribution Pattern helps traders understand the structural phases of the market, particularly focusing on the actions of large institutional participants (often referred to as "whales" in cryptocurrency). By identifying accumulation and distribution phases, traders can anticipate significant market movements and adjust their strategies accordingly.

Wyckoff Accumulation Pattern | Image from trendspider

How is the Wyckoff Pattern Constructed?

The Wyckoff method divides market cycles into four phases:

- Accumulation Phase: Institutions accumulate large positions without significantly impacting prices.

- Markup Phase: After accumulation, prices begin to rise as demand exceeds supply.

- Distribution Phase: Institutions sell their holdings to retail investors at higher prices.

- Markdown Phase: After distribution, prices decline due to increased supply.

Key Elements of the Accumulation Phase:

- Phase A: Initial support and selling climax prevent a downtrend.

- Phase B: Institutions quietly accumulate; prices consolidate.

- Phase C: "Spring" or shakeout tests supply levels, often triggering retail stop-loss orders.

- Phase D: Price breaks through resistance levels; uptrend begins.

- Phase E: Demand dominates; a strong uptrend continues.

Key Elements of the Distribution Phase:

- Phase A: Initial supply and buying climax prevent an uptrend.

- Phase B: Institutions distribute their holdings; prices fluctuate within a range.

- Phase C: Upward thrust serves as a final test; prices briefly exceed resistance before reversing.

- Phase D: Price breaks below support levels; downtrend begins.

- Phase E: Supply dominates; a strong downtrend continues.

What insights does the Wyckoff pattern provide about asset markets? It reveals the intentions of significant market participants:

- Accumulation: Indicates a potential uptrend as large participants build positions.

- Distribution: Indicates a potential downtrend as large participants exit positions.

Practical Applications and Considerations in the Cryptocurrency Context

In the cryptocurrency market:

- Market Manipulation: The presence of whales means that the emphasis on institutional behavior in the Wyckoff method is highly relevant.

- Volatility: Rapid price changes may distort traditional Wyckoff phases, making them harder to identify.

- Subjectivity: Determining exact phases requires careful analysis; misunderstandings can lead to losses.

Combining with other indicators to enhance effectiveness:

- Volume Analysis: High volume at specific phases confirms institutional activity.

- Price Action: Candlestick patterns can provide additional clues.

- Market Sentiment: News and social media trends may support interpretations of the Wyckoff method.

While mastering the Wyckoff method can be challenging, it can provide profound insights into the cyclicality of the cryptocurrency market. Traders skilled at identifying accumulation and distribution patterns can position themselves advantageously ahead of significant market movements.

Understanding Complexity and Subjectivity

It is important to emphasize that these advanced indicators and patterns are not foolproof:

- No black-and-white signals: They often provide trends rather than clear buy or sell signals.

- Subjectivity: Personal interpretation plays a significant role; two traders may draw different conclusions from the same chart.

- Market Conditions: In the fast-paced cryptocurrency environment, external factors such as regulatory news, technological developments, or market manipulation may overshadow technical signals.

Maximizing Benefits

To effectively use these indicators:

- Develop Skills: Invest time in learning and practicing to master these tools.

- Combine Approaches: Use multiple indicators and analytical techniques to confirm potential signals.

- Stay Informed: Keep up to date with market dynamics and developments that may affect technical analysis.

- Risk Management: Always employ sound risk management strategies to protect capital.

By recognizing complexity and adopting a rigorous, informed approach, you can leverage these advanced charting techniques to gain a competitive edge in cryptocurrency trading.

Unique Characteristics of the Cryptocurrency Market

The cryptocurrency market has characteristics that are distinctly different from traditional financial markets. Understanding these unique factors is crucial for traders to effectively navigate the cryptocurrency market.

High Volatility

Reasons for Volatility in the Cryptocurrency Market

- Market Speculation and Hype: The cryptocurrency market is highly speculative, with prices often driven by investor sentiment rather than intrinsic value. Positive news or rumors can lead to rapid price increases, while negative information can cause sharp declines.

- Regulatory News and Events: Announcements regarding cryptocurrency regulations can significantly impact prices. For example, news about potential government bans or approvals can lead to widespread market fluctuations.

- Market Manipulation: Compared to traditional assets, the relatively low market capitalization of cryptocurrencies makes them susceptible to manipulation by large holders (referred to as "whales"), who can influence prices through large trades.

To cope with this volatility:

- Diversify your portfolio.

- Use stop-loss and limit orders.

- Stay informed about market developments.

24/7 Market Trading

Impact of Continuous Markets on Trading Habits

Unlike traditional financial markets, the cryptocurrency market operates continuously without closing hours. This constant activity can lead to:

- Increased Pressure: The continuity of the market may require traders to constantly monitor prices, leading to fatigue.

- Missed Opportunities: Significant price movements can occur at any time, potentially resulting in missed trading opportunities during non-trading hours.

To address the demands of a 24/7 market:

- Use automated alerts.

- Implement automated orders.

Low Liquidity

Impact of Low Liquidity on Price Slippage and Order Execution

Liquidity refers to the ease of buying and selling an asset without affecting its price. In a low liquidity environment:

- Price Slippage: Large orders may cause significant price changes, resulting in buying at higher than expected prices or selling at lower than expected prices.

- Order Execution Delays: Due to a lack of counterparties, trades (especially large ones) may take longer to execute.

To minimize issues related to low liquidity:

- Choose reputable exchanges.

- Monitor the order book.

Impact of Whales and Institutions

Large Market Participants and Their Influence

"Whales" refer to individuals or entities that hold large amounts of cryptocurrency. Their activities can significantly impact market prices:

- Market Manipulation: Whales can cause price fluctuations by executing large trades, leading to sudden market movements.

- Psychological Impact: Observing whale movements can influence trader sentiment, potentially leading to "herd behavior" and amplifying price changes.

Identifying Potential Whale Activity:

- Monitor large trades.

- Use online whale alerts.

By understanding the unique characteristics of the cryptocurrency market, traders can develop strategies to navigate its complexities and improve trading efficiency.

Common Chart Analysis Traps and How to Avoid Them

Navigating the cryptocurrency market can be challenging, especially for novice traders. Understanding common traps can help formulate a more balanced and informed trading strategy.

Overreliance on Technical Analysis

While technical indicators are valuable tools, having too many indicators on a chart can lead to analysis paralysis and conflicting signals. It is essential to select a few key indicators that align with your trading strategy and thoroughly understand them. This focused approach can provide clearer insights and enable more decisive actions.

Balancing Technical Analysis with Fundamental Insights

Relying solely on technical analysis may overlook critical factors that affect asset value. Combining fundamental analysis (such as evaluating project teams, technology, market demand, and regulatory environment) can provide a more comprehensive perspective. This balance helps make informed decisions based on market patterns and the underlying asset's value.

Recognizing the Limitations of Charts in an Unpredictable Market

Technical analysis is based on historical price data and patterns, which may not always predict future trends, especially in volatile or news-driven markets. It is important to acknowledge the limitations of charts, as unforeseen events can disrupt predictive patterns. Staying adaptable and preparing for various scenarios can enhance trading resilience.

Ignoring Macroeconomic Factors

Global economic events can impact the cryptocurrency market, such as changes in interest rates, geopolitical tensions, and economic policies. For example, regulatory announcements can lead to significant price fluctuations. Understanding global events helps anticipate market reactions and adjust strategies accordingly.

Additionally, traders should consider fundamental factors such as hard forks, tokenomics, and developments in blockchain technology. Internal dynamics within cryptocurrency projects, such as hard forks, changes in tokenomics, or technological upgrades, can significantly affect their value. Understanding these factors provides insights into a project's future prospects and potential risks. For instance, a hard fork may create new tokens, thereby affecting supply and demand dynamics.

Understanding the Interconnectivity of Markets

Cryptocurrencies do not exist in isolation; they are part of a broader financial ecosystem. Fluctuations in traditional markets (such as stocks or commodities) can influence cryptocurrency prices. Recognizing these interconnections helps understand market sentiment and potential spillover effects.

Avoiding FOMO (Fear of Missing Out) Trading

The fear of missing out can lead to impulsive decisions, such as buying rapidly rising assets without proper analysis. This behavior often results in buying at price peaks and suffering losses when the hype subsides. Maintaining discipline and adhering to a clear trading plan can help avoid mistakes caused by FOMO.

Assessing the Validity of Market Trends Before Acting

Not all market trends are sustainable or based on solid fundamentals. It is crucial to conduct thorough research to assess the validity of a trend before taking action. Due diligence includes analyzing the reasons behind the trend, evaluating the project's fundamentals, and considering broader market conditions. Such due diligence helps distinguish genuine opportunities from fleeting hype.

By understanding these common traps and adopting a balanced approach that combines technical analysis with fundamental insights, traders can improve their decision-making process and navigate the cryptocurrency market more effectively.

How to Interpret Cryptocurrency Candlestick Charts: Final Thoughts

The cryptocurrency market faces unique challenges that require a deeper understanding than just technical chart interpretation. External factors, including market manipulation, news and social media influence, and the lack of extensive historical data, can affect the accuracy of chart interpretations. Technical events and changes in exchanges add further layers of complexity to technical analysis. As cryptocurrencies evolve, closely monitoring regulatory changes and global market participation becomes crucial for understanding long-term price behavior.

Ultimately, mastering cryptocurrency candlestick analysis is a gradual and ongoing process. While the tools and indicators mentioned in this article are powerful, they are just the starting point. Continuous practice, staying informed, and adapting to the ever-changing market dynamics are essential processes for achieving long-term success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。