Original Author: BitMEX

Welcome back to our periodic options alpha series. That's right — Bitcoin has officially broken through its historical high, and many of you may be planning your next trades to ride this massive pump.

In this article, we will share how options can help you better manage risk and provide you with tools to excel in a bull market. Specifically, we will share three scenarios illustrating how to strategically use options to capitalize on Bitcoin's ongoing momentum. We will delve into specific setups that allow you to:

Buy the dip,

Bet on a big surge, and

Profit from range trading.

Whether you want to enter the market with lower risk, target explosive gains, or trade within a price range, don't miss these options strategies that will help you trade smarter and more flexibly in a bull market.

Scenario 1: Using Put Options to Buy the Dip

If you are bullish on Bitcoin in the long term, you might want to buy on every dip, but it's easier said than done — setting limit orders is not perfect. Imagine your buy order fails to execute by just $0.01, and then Bitcoin starts to rise — we believe many of you have experienced this.

Strategy 1: Sell Put Options to Optimize Entry Strategy

One way to improve the above issue is to sell put options at a specific strike price below the current market price. This approach is wiser than simply waiting for the price to drop for the following reasons:

1. Earn Premiums: When you sell put options, you receive a premium, which is guaranteed income if the Bitcoin price does not reach the strike price before expiration.

2. Set Target Price: If the Bitcoin price drops to or below your chosen strike price, you are obligated to buy the asset at that price, effectively executing a "buy the dip" strategy while also earning additional income from the premium.

3. Downside Protection through Premiums: The premium received provides some buffer against potential losses, making this strategy less risky than directly buying spot.

For example:

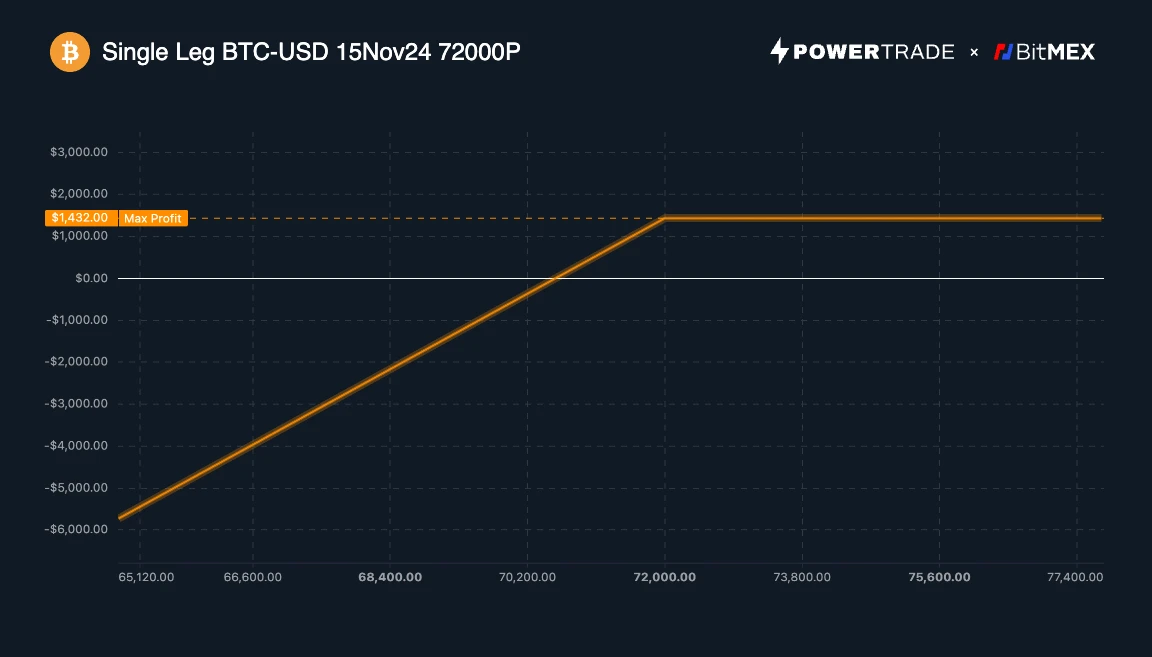

Suppose Bitcoin is currently trading at $75,000. You sell a put option with a strike price of $72,000, expiring on November 15.

If Bitcoin drops below $72,000 before expiration, your put option will be exercised, and you are obligated to buy Bitcoin at the strike price of $72,000. If Bitcoin does not drop below $72,000 at expiration, although you did not buy any Bitcoin, you collected a substantial premium of $1,432.

Alternative Strategy: Use a Risk Reversal Strategy

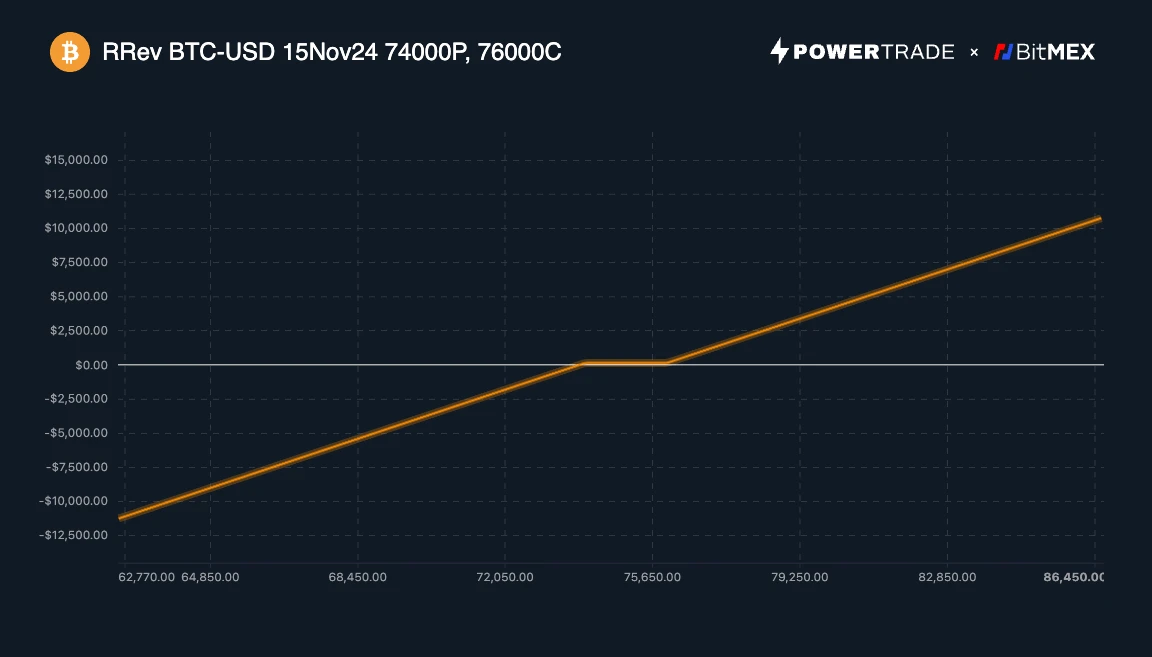

If you are willing to take on more risk for potential rewards, consider adopting a risk reversal strategy, which involves simultaneously selling put options and buying call options with a higher strike price. Here's how this strategy works:

Downside Buffer: Selling put options generates premium income, helping to buffer against slight price declines.

Upside Participation: The premium received from selling put options can offset the cost of buying call options, allowing you to participate in upward movements without additional costs.

Risk-Reward Balance: This method provides you with an ideal entry price while giving you the opportunity to profit from price increases, especially suitable for situations where a slight pullback is expected before a rebound.

Through the risk reversal strategy, traders can profit from both slight pullbacks and bullish momentum, making it a wise choice in a volatile bull market.

Scenario 2: Betting on a Big Surge - Using Out-of-the-Money (OTM) Call Options to Bet on Bitcoin Reaching $100,000

Are you confident that Bitcoin can reach the milestone of $100,000 by the end of the year? While buying spot directly at the current price is risky and requires significant capital, out-of-the-money (OTM) call options provide an attractive alternative for betting on a substantial rise.

Solution: Use Out-of-the-Money Call Options to Bet on a Surge

1. Low-Cost Entry: The strike price of out-of-the-money call options is above the current market price, making them cheaper than at-the-money (ATM) call options or spot purchases. This means you can gain potential upside with less capital.

2. Controlled Risk: The maximum loss of this strategy is limited to the premium paid for the options, making it suitable for traders who want to limit downside risk.

3. Asymmetric Returns: The more Bitcoin's price exceeds the strike price, the more profitable the option becomes, giving OTM call options a high leverage effect in a rising market.

For example:

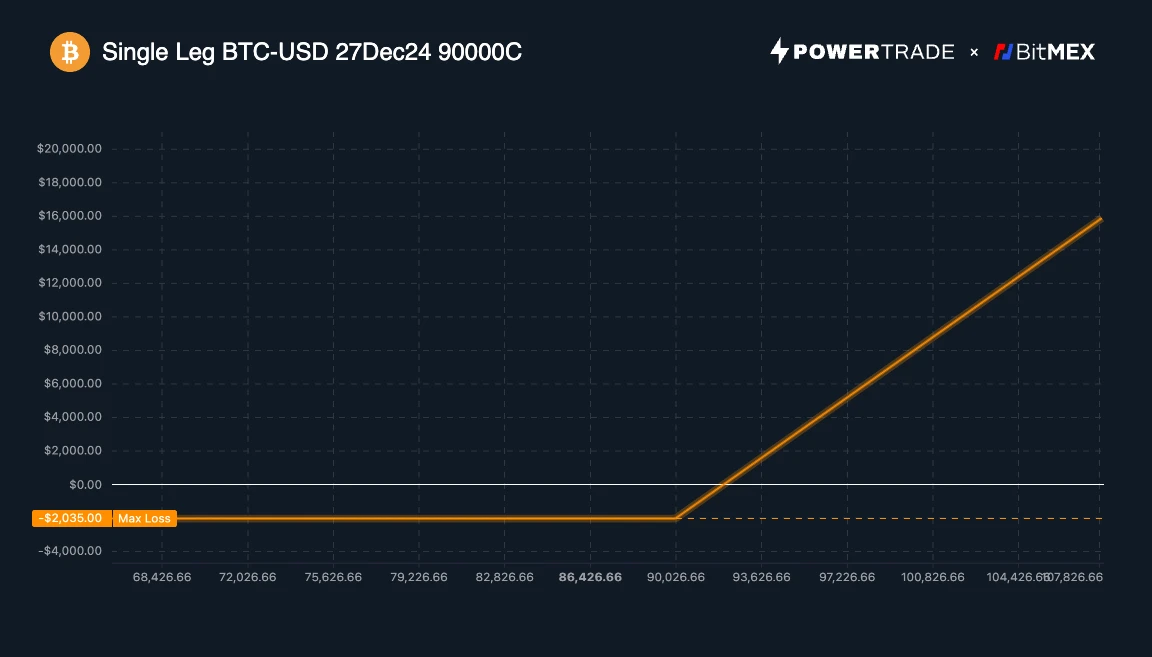

Suppose Bitcoin is currently trading at $75,000. You purchase an OTM call option with a strike price of $90,000, expiring in December.

If Bitcoin reaches $100,000 before expiration, this call option will yield substantial profits. If Bitcoin fails to reach the target price, your loss is limited to the premium paid for the option.

In a bull market, OTM call options are a popular strategy for capturing significant upward movements, especially when probability assessments indicate a reasonable chance of reaching high prices. Additionally, this method leverages the unique asymmetric return structure of options.

Scenario 3: Using Vertical Spreads for Swing Trading

Bitcoin's bull market does not always rise straight up; it often experiences pullbacks and consolidations. During these periods, swing trading is a wise choice, and vertical spreads can be a powerful options strategy.

Solution: Use Vertical Spreads for Swing Trading

Vertical spreads involve buying and selling call or put options with different strike prices but the same expiration date. This strategy is particularly useful when you expect Bitcoin to rise slowly. Here are its benefits for swing traders:

1. Lower Cost and Risk: The capital required for vertical spreads is less than that for directly buying a single option. For example, a bull call spread (buying a call option with a lower strike price while selling a call option with a higher strike price) provides bullish exposure with limited risk and lower premiums.

2. Profit from Volatility: In a range-bound market, when Bitcoin is expected to fluctuate within a specific price range, vertical spreads can help you capture profits without needing to time the market precisely or take on excessive risk.

3. Predictable Risk-Reward Ratio: Since the maximum profit and loss are determined at the start of the trade, traders can make precisely calculated bets based on expected price ranges.

For example:

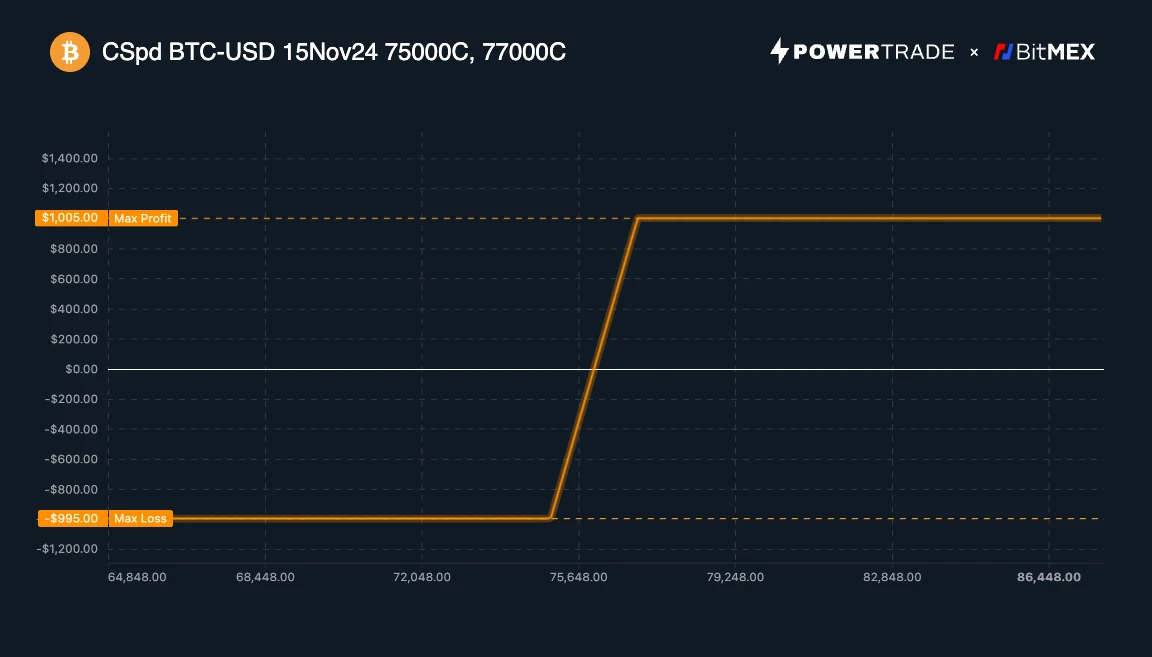

Suppose Bitcoin is currently trading at $75,000, and you expect it to rise between $77,000 and $78,000.

A bull call spread strategy might involve buying a call option with a strike price of $76,000 while selling a call option with a strike price of $78,000.

If Bitcoin does rise, this spread strategy allows you to profit from the difference in strike prices, while the risk is much lower than a full position.

Vertical spreads are particularly well-suited for slow-rising bull markets, as they enable traders to precisely manage risk and reward ratios, making them an ideal choice for range trading.

Conclusion: Strategic Advantages of Options in a Bull Market

In summary, options provide traders with a complex set of tools to effectively navigate a cryptocurrency bull market:

Buy the Dip: Selling put options or using risk reversal strategies allows traders to profit from pullbacks or secure ideal entry points.

Capture Big Moves: OTM call options are perfect for traders with strong convictions about significant price increases, offering substantial upside potential while limiting downside risk.

Swing Trading: Vertical spreads provide a cost-effective way to trade within expected price ranges, reducing risk in range-bound markets.

These strategies can help traders refine their approach in a bull market, maximizing returns while managing risk. As you consider your next steps in the cryptocurrency market, options trading may be the advantage you need to navigate market volatility with confidence.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。