On November 3, the Hong Kong Securities and Futures Commission (SFC) released the "Report on the Application of Compliance Technology in Combating Money Laundering and Terrorist Financing," aimed at exploring the application of compliance technology ("Regtech") by Hong Kong financial institutions in the AML/CFT compliance process.

Written by: Beosin

I. Background and Purpose of the Report

On November 3, the Hong Kong Securities and Futures Commission (SFC) released the "Report on the Application of Compliance Technology in Combating Money Laundering and Terrorist Financing," aimed at exploring the application of compliance technology ("Regtech") by Hong Kong financial institutions in the AML/CFT compliance process.

As financial crime methods continue to evolve, traditional manual monitoring methods struggle to meet increasingly complex compliance demands. Regtech is becoming an important tool for financial institutions to enhance AML/CFT compliance and efficiency. The SFC analyzed the application status, advantages, and challenges of various Regtech solutions in AML/CFT through a survey of 50 licensed companies.

II. Main Application Areas and Current Status of Regtech

1. Name Screening (AML screening, 92%)

As the most widely used AML/CFT process, name screening significantly reduces false positives and enhances efficiency through automation technology. Regtech solutions commonly apply technologies such as fuzzy logic and AI, effectively identifying potential risks even when there are slight variations in name spelling or format. These tools improve the accuracy of screening, making the identification of high-risk customers or related parties more reliable.

2. Customer Due Diligence (CDD, 71%)

The application of Regtech optimizes the customer onboarding and risk assessment processes, particularly in areas such as identity verification, data collection, and risk rating. Through automated customer risk scoring, financial institutions can complete onboarding reviews more quickly and accurately, dynamically updating customer risk data to timely identify potential AML/CFT risks.

3. Transaction Monitoring (KYT/TM, 69%)

Transaction monitoring is a crucial part of the AML/CFT process, involving the detection of large transactions or unusual activities. Traditional monitoring is rule-based, leading to a high volume of false positives, while Regtech solutions can dynamically analyze transaction behavior patterns and risk scores using AI and machine learning, significantly reducing false positives and prioritizing high-risk transactions.

4. Management Information Reporting (Reporting, 43%)

In reporting and information management, Regtech provides senior management with a comprehensive overview of compliance status through data visualization and real-time monitoring tools, helping decision-makers quickly identify compliance risk points and resource allocation needs based on dynamic data.

5. Third-Party Deposit Identification and Due Diligence (34%)

This step requires identifying the source of third-party funds for clients to prevent illegal fund inflows. Some companies use API integration technology to obtain real-time deposit information from banks and utilize automated comparison tools for rapid verification of fund sources, ensuring fund compliance.

III. Main Advantages of Regtech Application

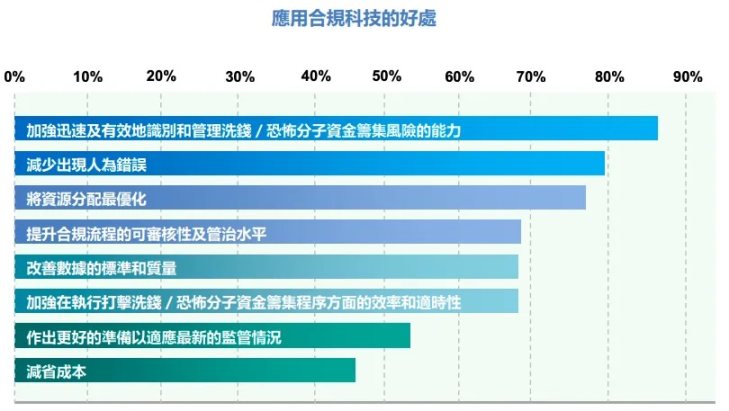

Image source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

The report indicates that over 85% of licensed companies believe that Regtech significantly improves the efficiency of AML/CFT risk identification and management. The main advantages include:

1. Enhanced Efficiency and Resource Optimization

Automated AML/CFT processes reduce the time and operational errors associated with manual reviews, allowing human resources to focus more on high-risk customers and transactions, further optimizing resource allocation.

2. Improved Data Consistency and Quality Enhancement

The application of data standardization and digitization enhances data quality, making the review process more reliable. Through Regtech, financial institutions can establish data review processes more efficiently, meeting regulatory requirements.

3. Stronger Adaptability and Update Capability

The report shows that over half of the companies believe Regtech helps them quickly adapt to new regulatory changes. Some Regtech solution providers can offer corresponding software updates based on policy adjustments, allowing businesses to flexibly meet the latest compliance requirements.

4. Improved Customer Experience

By simplifying customer onboarding and ongoing monitoring processes, Regtech helps reduce unnecessary verification steps, enhancing customer experience. For example, the system automatically screens suspicious transactions, reducing customer inconvenience by lowering false positive rates.

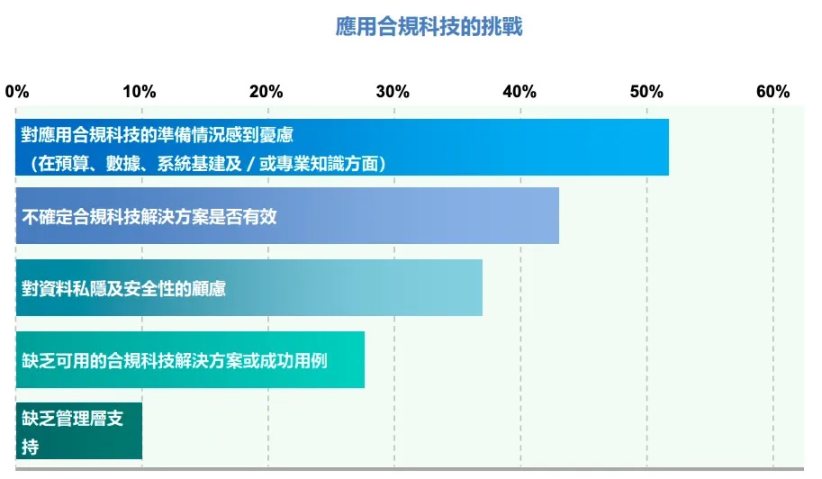

Image source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

IV. Main Challenges of Regtech Application

Despite the many advantages of Regtech, the report also mentions some current challenges:

1. High Implementation Costs and Stricter Infrastructure Requirements

Some financial institutions, especially small and medium-sized companies, still face shortcomings in budget, data management, and system infrastructure. Additionally, initial implementation costs are high, and actual long-term savings often only become apparent after the system is operating stably.

2. Concerns About Data Privacy and Security

For solutions involving cloud storage, some institutions express concerns about data privacy and security, particularly regarding compliance issues related to cross-border data transfer. To address this, the report recommends that financial institutions rigorously review vendors' security measures and ensure data safety.

3. Higher Requirements for Technical and Operational Expertise

In terms of technology application, financial institutions need to ensure they have sufficient technical support to manage and maintain Regtech systems. Additionally, some licensed companies mention difficulties in adapting to new technologies and automated operations, especially due to a lack of mature cases and industry experience.

4. Need for Greater Involvement and Support from Decision-Makers

Although most companies have received support from management, some institutions still lack effective promotion from senior management, leading to slower implementation of Regtech. The report emphasizes that a "top-down" compliance culture is crucial for the effective application of Regtech.

Image source: SFC: Report on the Adoption of Regtech for Anti-Money Laundering and Counter-Financing of Terrorism

V. Future Outlook and Application Recommendations

The report also proposes a roadmap for the gradual implementation of Regtech. For financial institutions considering adopting Regtech, the report recommends:

- Gradually advancing implementation: The implementation of Regtech is not an overnight process; it can start with a specific process and gradually expand to broader AML/CFT processes to reduce initial costs and accumulate experience.

- Introducing management and supervisory human resources: In technology applications, institutions need to ensure the appropriateness of data and system settings, especially when using AI models, requiring sufficient human oversight to prevent false positives or missed reports.

- Selecting suitable service providers: If relying on solutions provided by external vendors, institutions should ensure they have compliance experience and technical capabilities, and establish contingency plans to address unexpected situations such as technical disruptions.

Conclusion

For the industry and regulators, the recent heated discussions in Hong Kong regarding RWA and stablecoin-related regulations also reflect the importance of AML compliance.

The Hong Kong Securities and Futures Commission is keeping pace with the times by releasing this report, providing practical views and guidelines on the application of Regtech in AML/CFT compliance. With the rapid development of financial technology, the application of Regtech will become an important means for financial institutions to enhance compliance capabilities and optimize resource allocation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。