Author: Weilin, PANews

On the afternoon of November 6, U.S. Republican presidential candidate Trump was successfully elected as the 47th President of the United States. The election results showed that Trump won the key swing state of Pennsylvania, ultimately securing 270 electoral votes and defeating Democratic candidate Harris.

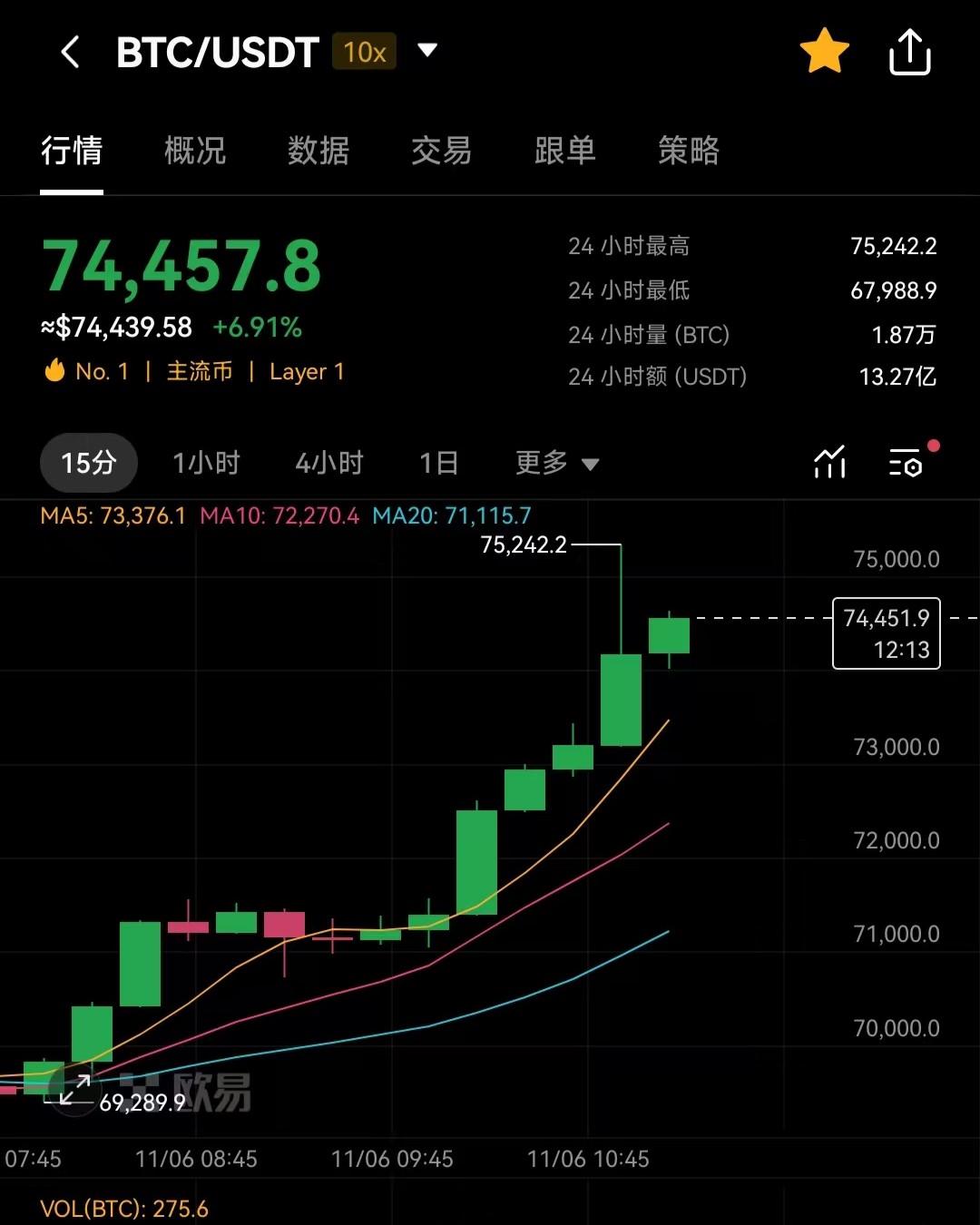

As news of Trump's election spread, the crypto market reacted strongly, with Bitcoin's price breaking historical highs around $75,000 shortly before 11:20 on November 6. At this moment, all eyes were on the cryptocurrency market, and crypto users and investors couldn't help but ask: How will Trump's election affect the future trends of the crypto market?

Securing the Key Swing State of Pennsylvania, Bitcoin Rises to Historical Highs

The prices of Bitcoin and other cryptocurrencies reacted swiftly during the election counting period, especially after Trump had a clear advantage and won Pennsylvania. This change not only reflects the market's positive response to Trump's crypto policies but also shows the market's optimistic expectations for the future of crypto assets.

After the election results were announced, Trump delivered a victory speech, stating, "This is the greatest political movement in history. We will help our country regain its health," and "This will indeed be America's golden age." He thanked voters, the winning states, his family, and supporters from his campaign team. Trump also mentioned Musk and his Starlink project, saying, "We must protect our geniuses," and thanked them for their assistance during the hurricane in North Carolina. Additionally, Trump revealed that over 900 campaign rallies had been held during the campaign.

Before the election, investors generally believed that regardless of whether Trump or Harris was elected, the regulatory environment for the cryptocurrency market would undergo significant changes, with the market's support for Trump being more pronounced. Compared to Harris's ambiguous stance, Trump has been more clear and aggressive in his cryptocurrency policies. He not only proposed a "strategic reserve" plan for Bitcoin but also stated that he would promote more open policies for the crypto market. According to multiple analyses, Trump's election could further drive up Bitcoin prices.

Can Trump's Crypto Policies and Promises Be Fulfilled?

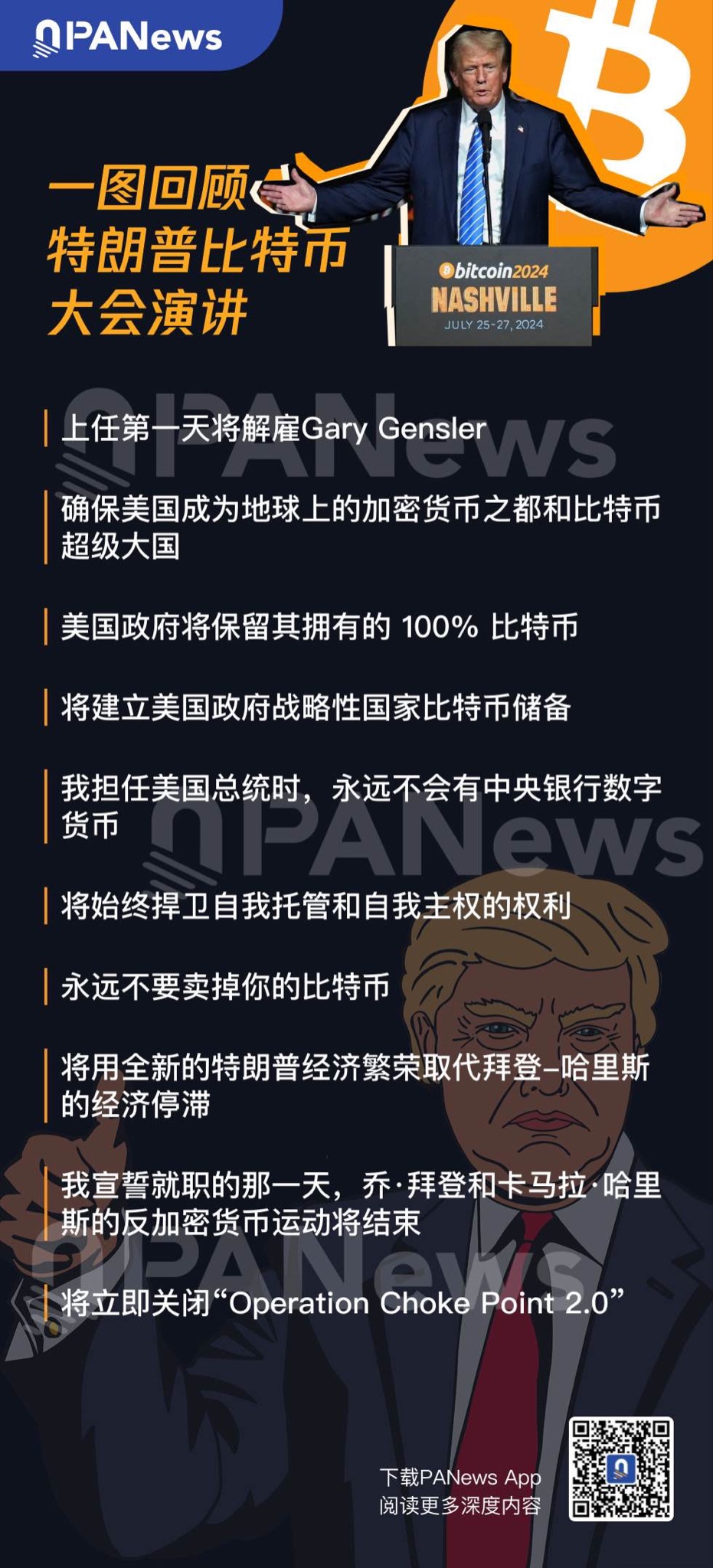

Trump's stance on cryptocurrency policy was clearly articulated as early as July this year. At the Bitcoin conference held in Nashville, he publicly promised to stop the creation of a digital dollar (CBDC). He also committed to establishing a U.S. Bitcoin strategic reserve. Furthermore, Trump proposed the establishment of a dedicated cryptocurrency policy working group called the "Bitcoin and Cryptocurrency Presidential Advisory Committee."

Trump's crypto policy is not limited to the concept of a Bitcoin strategic reserve; he also emphasized protecting Americans' freedom to control their crypto assets. The Republican platform specifically states: "We will defend the right to mine Bitcoin, ensuring that every American has the right to self-custody their digital assets and trade freely without government surveillance and control."

In contrast to Trump's proactive stance, Democratic candidate Harris's crypto policy appears more ambiguous and conservative. Although she mentioned policies related to digital assets, she did not clearly articulate how to handle Bitcoin and other crypto assets, nor did she propose actionable plans like Trump. This has led the market to generally believe that Trump's victory could bring about more lenient and favorable regulatory policies for cryptocurrencies.

With Trump's election, what changes will the regulatory environment for the crypto market undergo? At least two key pieces of legislation will be closely watched during Trump's term: the "Financial Innovation and Technology Act of the 21st Century" (FIT21) and the "Stablecoin Payment Act." FIT21 is one of the core pieces of legislation in the U.S. regarding cryptocurrencies and is expected to gain further traction after the election. The FIT21 bill has already been approved by the House of Representatives and has received broad support from both Republican and Democratic lawmakers. The passage of this bill will make the regulation of cryptocurrencies in the U.S. clearer and more standardized.

Currently, the regulatory environment for cryptocurrencies in the U.S. is relatively fragmented, with different regulatory agencies having different policy stances, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Crimes Enforcement Network (FINCEN), and the Internal Revenue Service (IRS).

The goal of the FIT21 bill is to clearly define the regulatory framework for cryptocurrencies, eliminating existing regulatory confusion and uncertainty. Many lawmakers believe that the SEC's regulation in the crypto space is overly stringent and hinders the development of the crypto industry.

The "Stablecoin Payment Act," proposed by Republican Congresswoman Cynthia Lummis and Democratic Congresswoman Kirsten Gillibrand, aims to provide a clear regulatory framework for stablecoins. This bill requires large stablecoin issuers to register with the Office of the Comptroller of the Currency (OCC) in the U.S. and mandates a 1:1 asset reserve. Additionally, the bill grants the Federal Reserve regulatory authority over stablecoins and prohibits the issuance of algorithmic stablecoins. For Trump, how he views this bill and its implementation will also be an important aspect of future policies.

Market Prediction: Bitcoin May Rise to $80,000 to $90,000 in the Next Two Months

Before the election results were announced, analysts from Bernstein, led by Gautam Chhugani, stated on November 4 that the election would have a "short-term impact" on cryptocurrency sentiment and affect Bitcoin's price. Bitcoin is currently around $68,000, below last week's seven-month high of over $73,000. Chhugani predicts that if the pro-crypto candidate Trump wins the election, Bitcoin could rise to $80,000 to $90,000 in the next two months, breaking the historical high of nearly $73,800 set in March.

The Bernstein analysis team maintains a price target of $200,000 for Bitcoin by the end of 2025, unaffected by the election results. They explained that for a digital asset with a market capitalization of $1.4 trillion, "the genie is out of the bottle," with the spot Bitcoin ETF serving as the latest driving force, further enhancing the value of this decentralized currency.

Standard Chartered analyst Geoff Kendrick wrote in October that he expects Bitcoin to reach $125,000 after Trump's victory.

PlanB, the creator of the Bitcoin Stock-to-Flow (S2F) model, predicts that after Trump wins the election, Bitcoin's price will reach $100,000 in November. In December, with a large influx of ETF funds, Bitcoin will soar to $150,000. By January 2025, as the crypto industry returns to the U.S., Bitcoin will climb to $200,000. In February 2025, Bitcoin's price will drop back to $150,000. PlanB believes that profit-taking by investors will lead to a brief pullback in Bitcoin after reaching high levels. From March to May 2025, Bitcoin will show a globalization trend, with prices breaking through $500,000. In 2026-2027, the market will adjust and enter a bear market.

The predictions of anonymous senior investor The Giver are relatively conservative, believing that the election-driven rise in Bitcoin is more of a temporary phenomenon rather than a long-term trend. The Giver thinks that Bitcoin's price will surge in the short term but is unlikely to sustain into the next year due to limited market capacity in the fourth quarter of 2024.

Argentinian economist, trader, and consultant Alex Krüger believes that with Trump's victory, Bitcoin's target price by the end of the year will be $90,000.

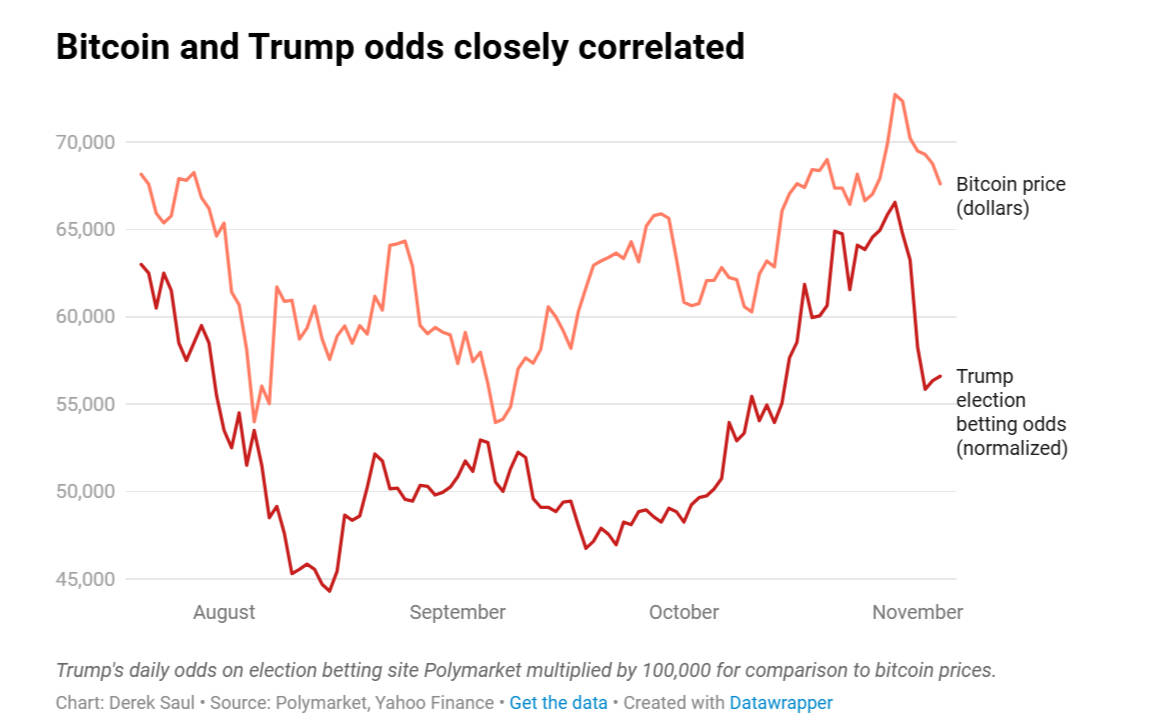

Previous data has shown that elections are one of the factors influencing Bitcoin prices, with Bitcoin's trends showing consistency with Trump's winning probability in prediction markets.

At the same time, according to analysis from BloFin Academy, although there may be a phenomenon of "selling the truth" for some meme stocks and meme coins after the election, the best trading strategy for assets like Bitcoin (BTC) and gold (GLD) seems to be "selling volatility." Typically, "selling the truth" is a common phenomenon after major events, driven by various reasons: as uncertainty dissipates, investors and institutional traders often choose to take profits or stop losses, while statistical arbitrage strategies can also prompt price corrections for well-performing assets.

With the development of the derivatives market, the adjustment of market makers' positions and hedging has become an important factor in "selling the truth," especially for assets with high volatility or low liquidity. For some meme stocks (like DJT) and meme coins, a return to normal prices after the event is almost a "foregone conclusion." This return is usually driven by two main factors: significant deviations in return distribution from normal levels provide opportunities for statistical arbitrage, and the rapid decline in implied volatility after the event also accelerates this process.

For Bitcoin (BTC) and gold (GLD), although the decline in volatility may lead to selling pressure, their price declines will be relatively limited compared to meme assets. More importantly, the returns of Bitcoin and gold have not significantly deviated from normal distribution, so after a short-term adjustment, their potential for continued upward movement remains greater than that of meme assets.

Unlike gold, Bitcoin has stronger price momentum, stemming from its higher negative Gamma. Negative Gamma means that market makers' hedging behavior will exacerbate market volatility, accelerating price changes during upward or downward movements. In contrast, gold's higher positive Gamma means that during price increases, market makers' hedging behavior actually adds more resistance to price increases, making the upward trend more gradual.

BloFin Academy believes that Ethereum (ETH) is similar to gold in this regard. Due to the Gamma peak located around the $2,500-$2,600 strike price range, when ETH prices continue to rise, market makers' selling behavior will create resistance to its upward movement. Considering that the Gamma peak comes from each cycle option, market makers' hedging behavior will continue to limit ETH's upward space in the coming days.

BloFin Academy concludes that for most traders, selling volatility is the best strategy at present.

Overall, how the future crypto market will develop still requires continuous attention to the specific policies and legislative progress of the Trump administration in the crypto space. For investors, maintaining a flexible strategy will be key to gaining an advantage in this uncertain market game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。