Original | Odaily Planet Daily

Author | jk

In the recently held 2024 U.S. presidential election, Republican candidate Donald Trump successfully won the presidency. This news, as a major highlight of the second half of this year, will undoubtedly have a profound impact on the international situation and the cryptocurrency market.

In this article, we will delve into the potential effects of Trump's victory on the crypto industry, including the overall background and market reactions to his re-election, presenting the Meme coins related to him and their short-term fluctuations, reviewing his previous campaign promises, and predicting the impact of possible future policy measures on the crypto market.

Trump's Return to Power: Market Reacts Strongly in the Short Term

In the early hours of November 6, U.S. local time, Republican candidate Donald Trump was essentially confirmed as the new President of the United States. (Extended reading: Why is it said to be "essentially confirmed"? Please see the previous summary by Odaily Planet Daily on the election mechanism “Must-Read Before the U.S. Election: Everything You Need to Know”**) In the voting, the Republican Party successfully secured key swing states such as *North Carolina, Georgia, and Pennsylvania*, and as of the time of writing, had obtained a total of 277 electoral votes, approximately 51.94% of the popular vote, defeating opponent Kamala Harris and successfully being elected as President of the United States.

In fact, from the moment Trump secured key swing states, his presidency was already a foregone conclusion. However, from the start of vote counting on November 5, to Trump showing a clear advantage, and then the release of swing state vote counts, there were several hours in between, during which Bitcoin's performance was nothing short of wild: on the evening of November 5, Beijing time, which was the time when polling stations opened in the U.S., Bitcoin's price was fluctuating around $68,000; by the morning of November 6, it surged past the $70,000 mark, and by noon, it broke through $75,000 to achieve a new high, subsequently fluctuating above $74,000.

Bitcoin's performance today. Source: Coingecko

Ethereum's performance was also impressive, rising from around $2,400 before election day to over $2,600, and then fluctuating above $2,500. Meanwhile, Solana saw a 24-hour increase of 15%, rising to around $185, while the Meme coin Doge, closely associated with Trump's staunch supporter Elon Musk, experienced a daily increase of about 25%, with a 7-day increase also reaching 15%, standing out among high market cap coins. It can be seen that the market has high expectations for Trump's election in the U.S. election and anticipates positive developments for crypto during his term.

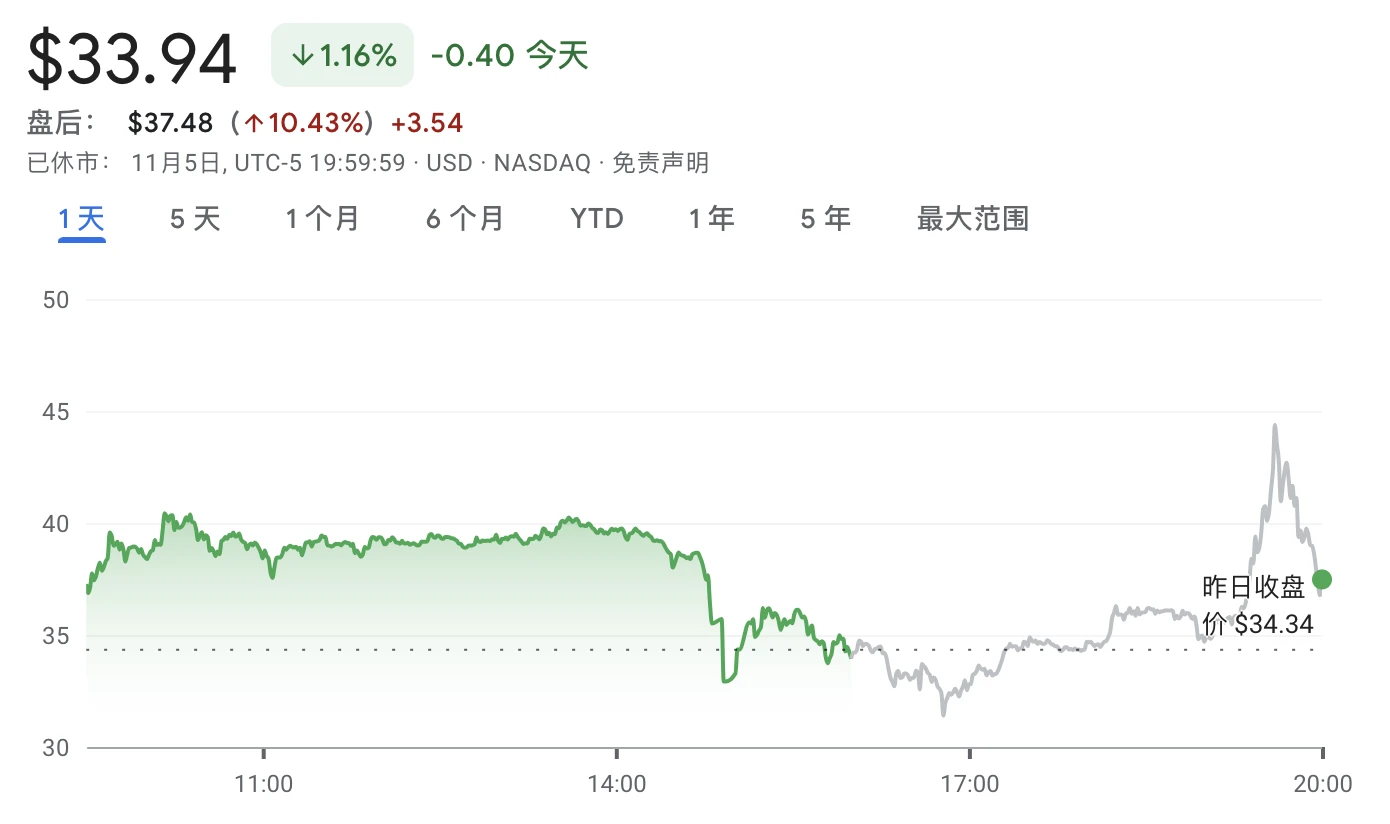

Due to market timing, we have not yet been able to observe the impact of Trump's victory on the three major U.S. stock indices. However, stocks related to Trump, such as Trump Media & Technology Group, also surged in after-hours trading, with prices rising 10.43% as of the time of writing.

DJT stock price also surged. Source: Google

Another "MAGA"

With the news of Trump's victory, Meme coins related to him also experienced significant fluctuations.

The MAGA token saw a 24-hour increase of 20%, currently priced at $3.95, and the anticipated large address sell-off did not occur, instead, there was a significant increase;

MAGA token performance, Source: Coingecko

TREMP saw a 24-hour increase of 25.2%, currently priced at $0.3793; in contrast, STRUMP experienced the anticipated sell-off, with a 24-hour decrease of over 16%, currently priced at $0.005369; FIGHT rose 4.7%, while TRUMPCOIN fell 3.2% in 24 hours.

In contrast, Harris's Meme performance has already plummeted: HORRIS saw a 24-hour decrease of 91.6%, and other Meme-related concepts have basically disappeared. It can be seen that the choices in the Meme market are more honest than anyone else: Trump's Meme has some expectations for future support, while Harris's Meme expectations have completely vanished.

However, it must be said that the current upward trend may lead to a short-term pullback, as previous whale addresses may choose to sell after the victory, especially after the market fully digests the victory news the following day in the U.S. Meanwhile, some current declines in Meme coins do not represent long-term lows, as the concept of Meme will continue to persist and fluctuate with each of Trump's crypto-related policies, which brings us to our next question: what policies will he implement?

Trump's Campaign Promises: Is Gary Gensler Really Leaving This Time?

Trump's victory has profound implications for U.S. policy direction, economic development, and the crypto market. His attitude towards cryptocurrencies has changed significantly over the past few years, from criticizing Bitcoin and other cryptocurrencies to showing some interest in blockchain technology, and finally to accepting cryptocurrency donations, being enthusiastic about the crypto industry, and speaking at Bitcoin conferences. This shift makes it difficult to gauge his true stance. Arthur Hayes believes that “Catering to the young, politically active, and newly wealthy crypto community may help Trump win the election… Trump is a shrewd politician. He will say anything to anyone who wants to be re-elected. Once in office, anything related to cryptocurrency will become a distant memory.”

In a previous article published by Odaily Planet Daily “Guess How Many of Trump's Previous Campaign Promises Were Fulfilled?”, we summarized that during his last term as president, Trump successfully fulfilled about 23% of his promises, conceded and partially fulfilled 22% of his promises, but broke about 53% of his promises. This means that the crypto-related goals, which are not a major part of Trump's political agenda, may indeed be broken or thrown in the trash.

Regardless of the final outcome, Trump has indeed made several promises that are favorable to the promotion of the crypto industry as a candidate more pro-crypto than Harris:

Promised to end the regulatory hostility towards the crypto industry;

Promised to protect the right to mine Bitcoin and the rights of U.S. citizens to self-custody digital assets;

Promised to release Ross Ulbricht, who was convicted for creating the dark web marketplace "Silk Road";

Promised to keep Senator Elizabeth Warren (who proposed strict regulatory legislation for the crypto industry) and "her henchmen" away from Bitcoin holders;

Promised to replace Gary Gensler on his first day in office (Odaily has summarized potential candidates for the future SEC chair, see “Who Will Be the New SEC Chair After Gary Gensler?”);

Promised to establish a national strategic reserve for Bitcoin and not sell the held Bitcoin;

Promised to establish a Bitcoin advisory committee;

Does not support CBDCs.

At the same time, Odaily Planet Daily has summarized all the potential crypto bills that could be passed after Trump takes office, see “If Trump Is Elected President, What Crypto Bills Will Be Passed?”

The above promises do not have a comprehensive record but are made by Trump in different settings: at campaign rallies, in private meetings with industry leaders, or speeches at Bitcoin conferences, with only a small part of the official policy draft concerning the protection of U.S. citizens' rights. Among these promises, there are indeed several that could immediately trigger positive developments and support for the crypto industry, **so the core question returns to what we initially said: *Yes, now you are president, can you fulfill the promises you made before?* The answer to this question may determine the trajectory of the industry this year and at least for the next four years.

Extended reading: “Besides the Presidency, This Position's Election Will Also Deeply Impact the Future of Crypto”

Related topics: The U.S. Election Battle: A 'Life or Death' Moment for the Crypto Industry

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。