The impact of this election is merely a small episode and will not hinder the development of cryptocurrency.

Author: Matt Hougan

Translated by: Deep Tide TechFlow

I am reflecting on the development of cryptocurrency in an election year.

There is nothing new to discuss regarding Tuesday's election.

If you haven't seen my comments before, here is my summary:

In the short term, Trump's victory is more favorable for cryptocurrency than Harris's victory.

In the long term, regardless of who is elected, Bitcoin, Ethereum, and stablecoins will continue to thrive.

During Harris's administration, the regulatory risks faced by alternative coins will be higher than during Trump's administration.

The only "bad" outcome for cryptocurrency would be a complete victory for the Democrats, as this could empower the extreme factions within the party that are hostile to cryptocurrency. But even so, I would still choose to buy in during the lows.

The past four years have taught me one thing: Washington cannot stop the development of cryptocurrency. It can change the trajectory of development, accelerate or slow down the process, and may even bring more chaos or new clarity.

But it cannot stop the advance of cryptocurrency.

Current State of Cryptocurrency: November 2020 vs. November 2024

One reason I enjoy presidential elections is that they give us a chance to reflect on the changes over the past four years.

Is the situation better or worse compared to the last election?

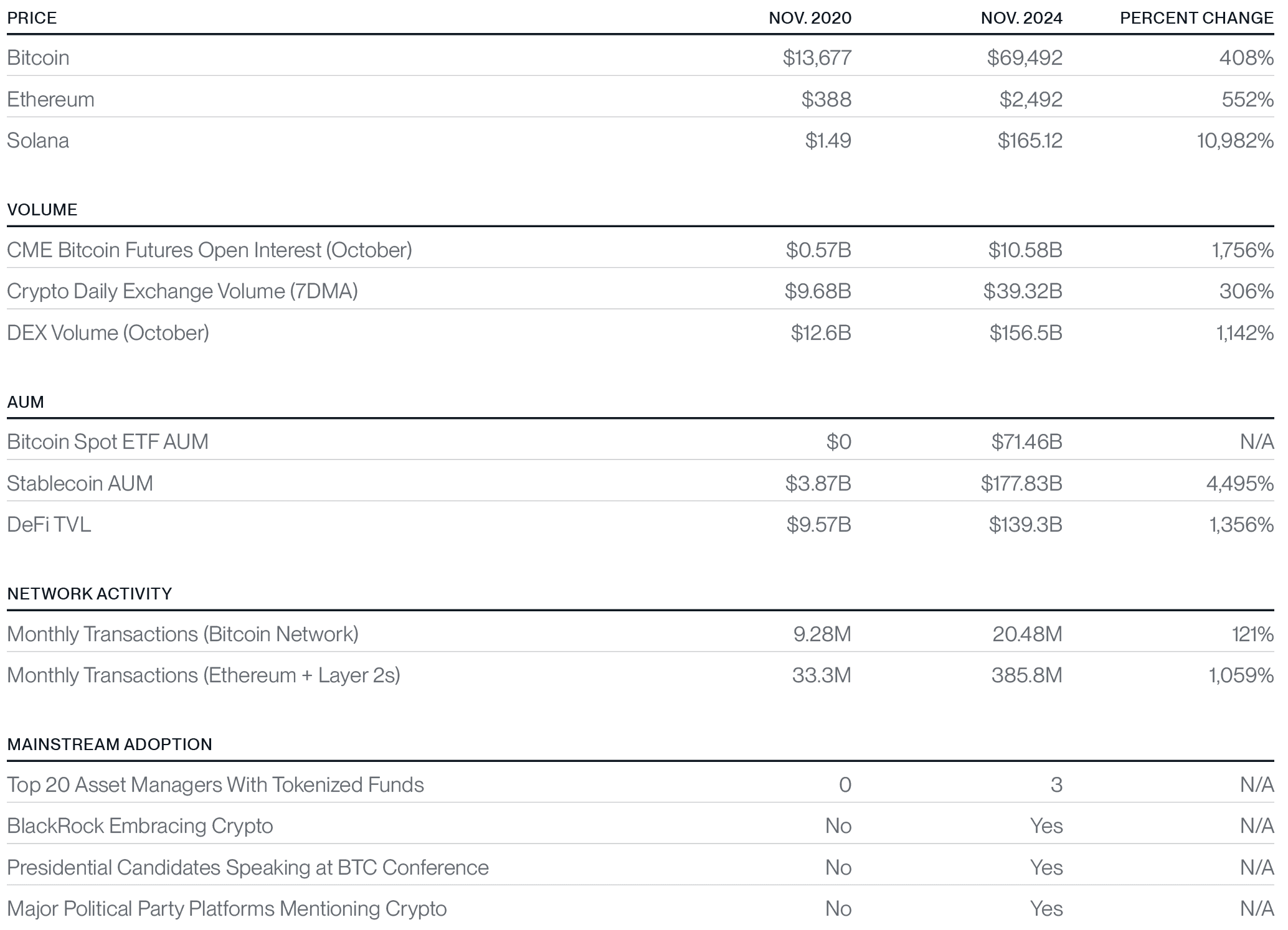

When reviewing the cryptocurrency space, the results are obvious. Despite facing a fierce regulatory environment, such as “Operation Choke Point 2.0”, numerous SEC lawsuits, and many contradictory or ambiguous statements, the progress we have made is still astonishing.

You can choose any statistic to verify this.

Progress in Cryptocurrency: 2020 vs. 2024

Source: Price data for Bitcoin, Ethereum, and Solana is from Bitwise Asset Management, as of November 2, 2020, and November 2, 2024. CME Bitcoin futures open interest, decentralized exchange trading volume, and monthly Bitcoin network transaction volume are from The Block, using full month data from October 2020 and October 2024. Daily average trading volume of cryptocurrency (7-day moving average) is from The Block, as of November 6, 2020, and November 3, 2024. Assets under management for Bitcoin spot ETFs and stablecoins are from The Block, as of November 2, 2020, and November 2, 2024. Total value locked in decentralized finance is from The Block, as of November 4, 2020, and November 2, 2024. Monthly transaction volume for Ethereum and its second-layer networks is from The Block and GrowThePie, as of October 2020 and October 2024. Data on tokenized funds from the top 20 asset managers is from RWA.XYZ, as of November 2, 2024. Other data is from Bitwise Asset Management, as of November 4, 2024.

We often focus too much on the short-term fluctuations in cryptocurrency prices and overlook the long-term trends. Presidential elections provide us with a great opportunity to review past developments.

Will these trends continue?

When examining these statistics, you need to consider whether these trends will persist. From my perspective, the answer is yes.

Our view is that regardless of who is elected on Tuesday:

Inflows into spot cryptocurrency ETFs will continue to increase

Stablecoins will continue to grow rapidly

Major institutions will continue to increase their investment in cryptocurrency

Wall Street will continue to embrace tokenization and real-world assets

Blockchain technology will continue to become faster and more cost-effective

Real-world applications like Polymarket will continue to make breakthroughs and gain mainstream acceptance

There is no doubt that the election results on Tuesday are significant in the short term. But I believe that in the long run, the impact of this election is merely a small episode and will not hinder the development of cryptocurrency.

Risks and Important Information

This does not constitute investment advice; there is a risk of loss: Before making any investment decisions, investors must conduct their own independent review and research, assess the pros and cons and risks of the investment, and make investment decisions based on these reviews and research, including determining whether the investment is suitable for themselves.

Cryptographic assets are a digital representation of value that can be used as a medium of exchange, unit of account, or store of value, but they do not have legal tender status. While cryptographic assets can sometimes be exchanged for US dollars or other national currencies, no government or central bank currently supports or guarantees them. Their value is entirely determined by the supply and demand in the market, making them more volatile than traditional currencies, stocks, or bonds.

Trading in cryptographic assets carries significant risks, including severe price volatility or flash crashes, market manipulation, cybersecurity risks, and the potential loss of principal or all investments. Additionally, the regulatory and customer protection measures for the cryptocurrency market and exchanges differ from those for stocks, options, futures, or foreign exchange markets, lacking corresponding controls and protections.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。