Bitcoin welcomes new market expectations with ATH.

Written by: Chandler, Foresight News

With Trump securing 19 electoral votes from Pennsylvania, the 2024 U.S. election has essentially come to a close.

On November 6, FoxBusiness reporter Eleanor Terrett stated that, in fact, the first "crypto president" will now be Trump.

The crypto market responded to this outcome promptly. On November 6, Bitcoin reached an intraday high of 75,656 USDT, breaking the previous high of 73,775.9 USDT set in March this year, continuing to set a new all-time high. The capital markets mirrored this trend, with the dollar index increasing by nearly 1.5%, and S&P 500 and Nasdaq 100 index futures rising over 1.1%.

As the election nears its end, investors' focus has shifted to the impact of the new president's inauguration on the market.

July's "Bitcoin" Declaration

Let’s first revisit Trump's commitments to crypto during the Bitcoin conference he attended in the U.S. this July:

- "On the first day, I will fire Gary Gensler and appoint a new SEC chairman. If elected, I will establish a strategic national Bitcoin reserve for the U.S. government. The U.S. government will hold 100% of its Bitcoin, and Bitcoin will fly to the moon. Never sell your Bitcoin."

- "Bitcoin may one day surpass gold in market value. I reiterate my commitment to easing Ross Ulbricht's sentence."

- "During my presidency, there will never be a CBDC."

- "If elected president, Bitcoin and cryptocurrencies will soar in unprecedented ways."

- "Bitcoin does not threaten the dollar; the current U.S. government threatens the dollar. The U.S. will become the global capital of cryptocurrency and the world's Bitcoin superpower."

- "Bitcoin represents freedom, sovereignty, and independence from government coercion and control. I assure the Bitcoin community that on the day I take office, Joe Biden and Kamala Harris's anti-crypto campaign will end."

How the U.S. Election Results Will Affect the Crypto Market

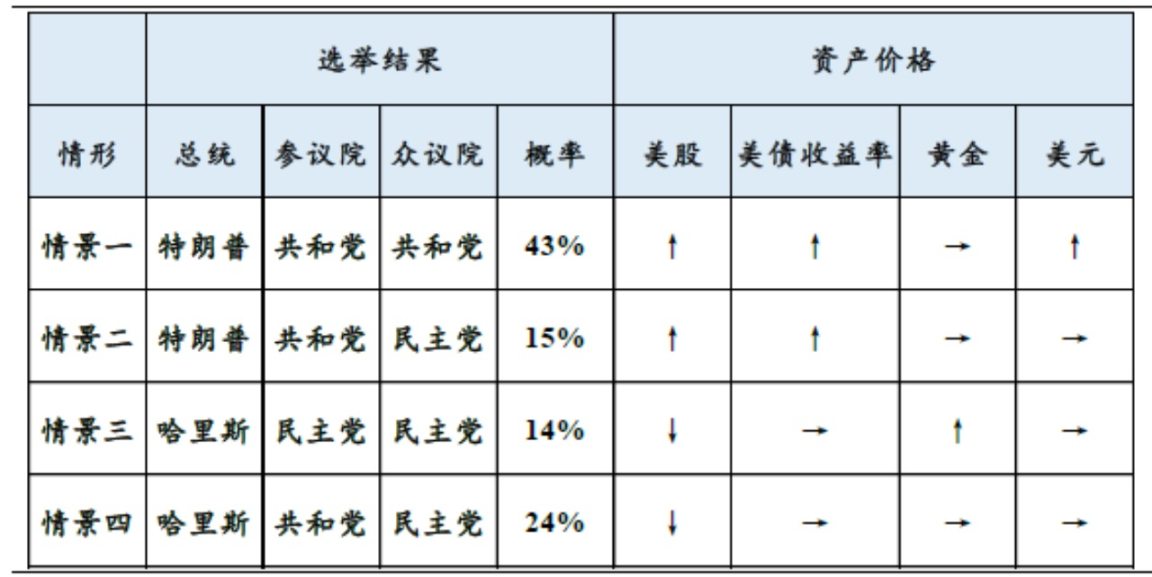

Dongwu Securities previously analyzed four scenarios based on betting odds (which are more sensitive and directional) according to presidential party affiliation, and interpreted their impact on asset prices. In the scenario where the Republican Party sweeps (43%), U.S. stocks > dollar > gold > U.S. bonds. They pointed out that whether the U.S. president's policies can be smoothly promoted, implemented, and supported by Congress is particularly important.

On one hand, in this scenario, Trump would more smoothly implement his policy proposals, significantly reduce taxes for domestic companies, and relax regulations, providing a strong boost to U.S. stocks; on the other hand, policy resonance (increased tariffs + tightened immigration) would increase re-inflation pressure in the U.S., potentially benefiting the dollar, which would lead to selling pressure on long-term U.S. bonds.

If Trump's tax cuts and relaxed regulatory policies are implemented, they will have a strong appeal to the capital markets, and the crypto market may see a wave of short-term capital inflow as a result. Tax cuts reduce the tax burden on businesses and individuals, increasing the funds available for investment, and crypto assets may become one of the important channels for this capital inflow. Relaxed regulations would reduce the compliance burden on crypto companies, encourage innovation, and enhance capital confidence in the crypto market. For mainstream assets like Bitcoin and some strong meme-based altcoins (like DOGE), the increase in market funds could drive up their prices and, to some extent, increase the market activity of these assets.

From a long-term perspective, if Trump's policies are further advanced, in a low-interest, expansive fiscal economic environment, the market often prefers high-yield, high-liquidity investments, and crypto assets gradually align with this preference. Additionally, if the regulatory costs in the crypto market are low, institutional investors' willingness to participate will also increase, helping to gradually expand the scale and application of the crypto market.

Moreover, regardless of the election results, changes in control of the White House and Congress could significantly impact the regulatory environment and future development of crypto assets. Control of the Senate is particularly crucial for the crypto industry, as it plays a decisive role in confirming the leaders of key regulatory agencies (such as the SEC and CFTC).

Furthermore, if Trump returns to the White House, the effectiveness of his proposed crypto policies will also significantly impact the future development of the crypto asset industry.

Implementation of Crypto Policies

Trump has clearly stated during his campaign that he supports innovation in crypto assets and plans to promote industry growth through relaxed regulations. He also intends to propose a plan to designate Bitcoin as a strategic reserve asset for the U.S.

Republican Senator Cynthia Lummis has also introduced the "Bitcoin Strategic Reserve Act," which has been submitted to Congress and is under review by the Senate Banking Committee. This bill aims to establish a strategic Bitcoin reserve and other projects to ensure transparent management of the federal government's Bitcoin holdings, utilizing certain resources from the Federal Reserve System to offset costs, among other purposes. The bill will subsequently undergo review by the Senate, House of Representatives, and the president to determine whether it will be passed into law.

If Bitcoin is indeed designated as a strategic reserve asset for the U.S., it would have significant symbolic and practical implications. On one hand, this would mark Bitcoin's transition from a niche asset to a nationally recognized reserve asset, greatly enhancing its legitimacy and recognition. Such a policy shift would grant Bitcoin a new status, significantly boosting market confidence in its long-term value.

On the other hand, as a strategic reserve asset, Bitcoin would provide economic stability and financial security for the nation alongside traditional reserve assets like gold and foreign exchange reserves. This recognition could further solidify Bitcoin's position in the global financial system, prompting more global central banks and governments to reassess their stance on Bitcoin and digital assets. Especially in the context of seeking to hedge against dollar volatility and economic uncertainty, this policy shift would serve as a demonstration effect, encouraging more countries to follow suit in incorporating Bitcoin into their reserve assets to achieve diversification and risk management, thereby further expanding Bitcoin's global market demand and adoption rate.

However, it is important to note that in the formulation and execution of U.S. presidential policies, traditional processes and the complex political environment are inextricably linked. The president's policy commitments often require a meticulous policy operation process to transition from campaign blueprints to actual governance. Overall, the U.S. presidential governance process is closely related to the interactions among Congress, the judiciary, and various executive agencies. After the new president takes office, whether their policies can be fulfilled ultimately depends on several key factors: party distribution, the application of executive orders, legislative support from Congress, and a broader social opinion base.

Gary Gensler's Future

After the 2024 U.S. election, Gary Gensler's days as chairman of the SEC will be numbered. Gensler's term is set to expire in January 2026, but traditionally, when a new president comes from an opposing party, the SEC chairman often resigns. Therefore, when Trump is elected, the pressure on Gensler will increase significantly, especially as the opposition between him and the crypto asset industry becomes more pronounced. Trump has stated on multiple occasions that if elected, he will fire Gensler, which means his departure is almost a foregone conclusion.

Since taking office as SEC chairman in 2021, Gensler has taken a tough stance on the crypto asset industry, emphasizing that existing securities laws are sufficient to regulate crypto assets and enforcing regulations through legal means.

According to data from the Blockchain Association, since Gary Gensler became SEC chairman, the U.S. crypto industry has spent over $400 million to respond to the agency's enforcement actions. During this period, the SEC has filed lawsuits against several large crypto companies, including Coinbase and Kraken. The Blockchain Association stated that the $400 million is just "a small part of the industry," as it is based on a sample survey of its association members.

With Trump's confirmation of election, Gensler's future will become a focal point. While he may continue to stay at the SEC, according to tradition and the current political atmosphere, his resignation is almost certain.

Overall, today's rise in Bitcoin's price clearly reflects, to some extent, the market's expectations of the easing policies that would come with Trump's election. Capital, driven by the need to hedge against this potential risk, has preemptively factored the anticipated benefits into market prices. If U.S. policies can balance compliance and innovation, it will further enhance the widespread adoption and legitimacy of crypto assets, especially the safe-haven attributes and stable growth potential of assets like Bitcoin.

In the long run, the price trend of crypto assets remains closely related to their market acceptance, the level of policy support, and global capital flows. The clarity and sustainability of policies will be key factors for investors to rebuild confidence in the near future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。