According to Kaiko's analysis, observing key cryptocurrency metrics on major platforms can provide insights into the movements of "smart money" during the U.S. election. Analysts predict that as the presidential campaign nears its end, cryptocurrency prices may experience significant volatility depending on the results.

Written by: James Hunt

Translation: Plain Language Blockchain

The day of the U.S. election has arrived, and the 24/7 trading nature of the cryptocurrency market has an advantage over traditional market trading hours. Kaiko's analysts outline three key metrics to watch as election results are announced.

1. Order Book Data

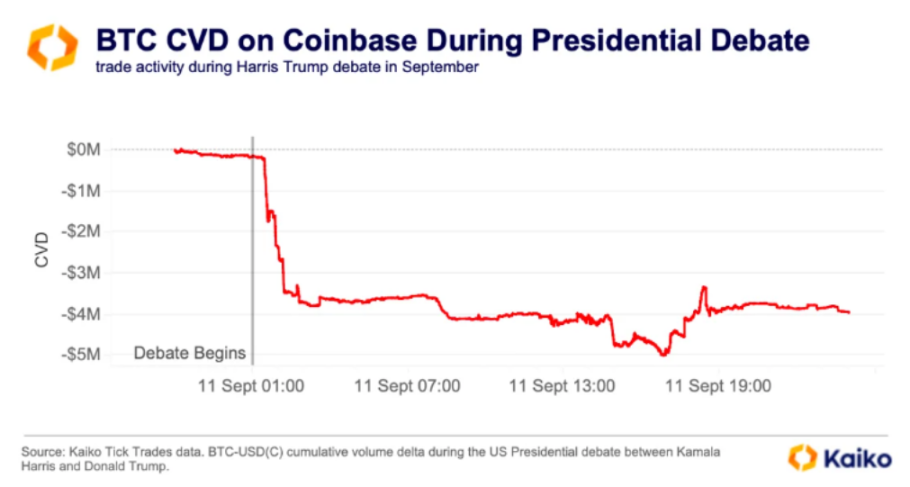

First, observing order book data on major platforms can provide insights into the movements of "smart money." By calculating the cumulative volume delta (CVD) from order book data, one can measure net buying and selling activity across global cryptocurrency exchanges. Kaiko analyst Adam Morgan McCarthy stated that this metric provided valuable insights during the presidential debate between Trump and Kamala Harris and is expected to play a role again during the election. During the debate in September, the CVD turned negative, indicating a bearish market reaction to Trump's performance, as Harris was perceived as less friendly to the crypto industry, while Trump showed a clear supportive stance towards crypto.

CVD on Coinbase during the presidential debate. Image source: Kaiko.

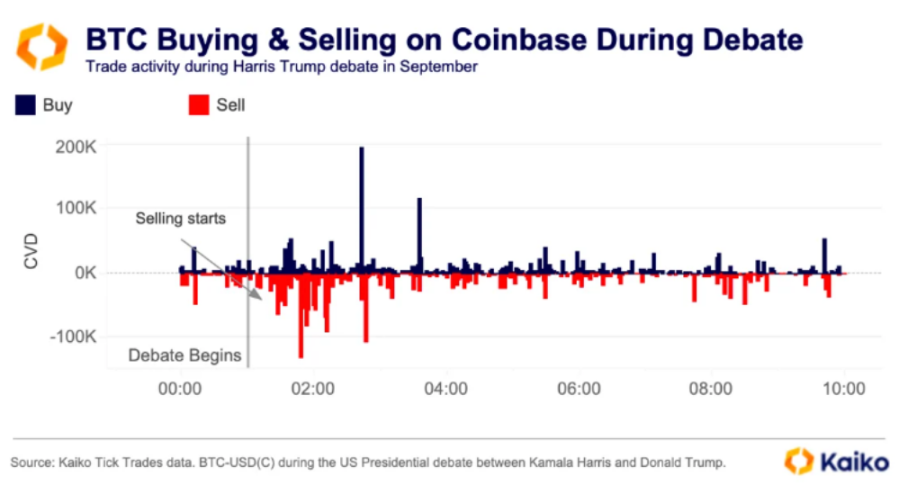

Analysts explained that by separating order book data into buys and sells, one can observe the strong selling pressure resulting from the market's real-time reaction to Trump's performance. This helps in timing the market, showing when buying and selling pressures weaken, and providing clues to participants' expectations.

BTC buys and sells on Coinbase during the presidential debate. Image source: Kaiko.

2. Funding Rates

According to Kaiko's analysis, the second metric to watch is the funding rate, as leveraged traders are very sensitive to sudden changes, which can lead to market squeezes or cascading liquidations, whether up or down.

Higher funding rates typically indicate increased speculative activity in Bitcoin perpetual contracts. In March, when Bitcoin broke through $73,000 to set a new all-time high, the funding rate soared above 0.05%. However, McCarthy noted that last week, when Bitcoin approached the same level, the funding rates on the two largest perpetual contract platforms, BN and Bybit, remained around 0.01%, indicating a decline in traders' confidence ahead of the election.

BN adjusts its funding rate every eight hours, with the first adjustment at 12 PM Eastern Time, followed by an adjustment at 8 PM after voting ends on the East Coast. The next adjustment will occur at 4 AM Eastern Time on Wednesday, by which time the election results may be clearer.

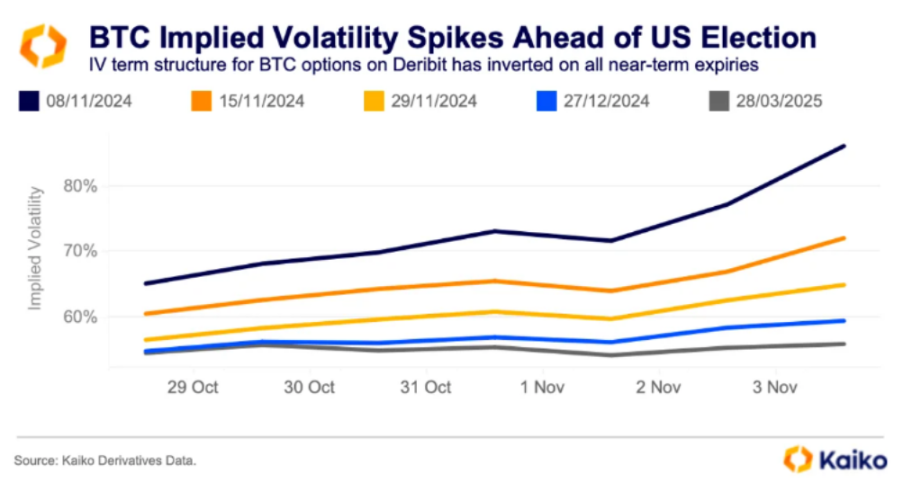

3. Implied Volatility

Finally, implied volatility (IV) is also a key metric in the derivatives market, showing how participants price risk. IV is a forward-looking indicator that predicts the expected volatility of an asset over a given time frame, aggregating multiple data points into a single number, allowing traders to assess whether options are relatively cheap or expensive.

Monitoring the IV term structure helps traders anticipate potential market risks. An inverted IV term structure, where short-term IV is higher than long-term IV, typically signals an impending risk event, such as the U.S. election, as explained by Kaiko analysts.

Recently, Bitcoin's rally nearing historical highs led to a surge in short-term IV, catching traders off guard and prompting them to adjust their positions. This change affected the IV smile—a pattern showing higher implied volatility for options that are slightly above or below the current price. A right-tilted IV smile indicates market expectations of rising price volatility, while a left-tilted smile suggests concerns about potential price declines. Recent changes highlight how traders hedge against expected price volatility, he added.

Implied volatility of Bitcoin before the U.S. election. Image source: Kaiko.

Ultimately, the market is driven by supply and demand and influenced by participant behavior, but McCarthy noted that the accuracy of these trend predictions remains uncertain, as traders are not infallible.

4. Discrepancies Between Prediction Markets and Polls Amid Uncertainty

Currently, Trump's probability of winning on the decentralized platform Polymarket is 62%, while Harris stands at 38%. This platform has seen a trading volume of $3.25 billion on presidential election outcomes, making it the largest prediction market to date. On the regulated Kalshi platform, Trump's odds are 57%, and Harris's are 43%. However, Bernstein analysts noted on Monday that national poll averages remain close, with Harris leading by 1%, within the margin of error.

Kaiko previously pointed out that the level of open contracts on Polymarket indicates a lack of sufficient liquidity for betting on the U.S. election, and its predictive ability is also under scrutiny. Analysts from crypto trading firm and market maker GSR mentioned this week that others pointed out the inconsistent performance of prediction markets in elections, where large players might distort the market, or there could be potential biases due to the dominance of male, crypto-native users and non-U.S. traders on the platform.

However, after the odds of the two candidates briefly converged over the weekend, Gautam Chughani, head of Bernstein's digital asset division, stated: "For those who believe Polymarket data is manipulated by Trump bias, we believe the weekend trading data is sufficient to prove it operates like any public market, and traders can easily be spooked by gradually increasing polling data."

Additionally, supporters of prediction market accuracy argue that the focus on voter polling rather than Electoral College voting, as well as the use of retrospective polling in election models, are key factors. They also emphasize that the odds in most betting markets are similar to those on Polymarket, indicating a low likelihood of market manipulation. GSR also added that academic research shows prediction markets are often more accurate than surveys or expert opinions, with transparency, collective wisdom, and market dynamics driving odds toward accuracy.

Kaiko noted that Pennsylvania, North Carolina, Georgia, Michigan, Wisconsin, Arizona, and Nevada are key states to watch on election night, especially Pennsylvania. If Harris loses her 19 electoral votes, the path to the White House will become exceptionally difficult, if not nearly impossible, according to some polls.

Currently, on Polymarket, Trump is leading in Arizona, Georgia, Nevada, North Carolina, and Pennsylvania, while Harris is leading in Wisconsin and Michigan.

5. Expected Impact on Bitcoin Prices

Greg Magadini, head of derivatives at Amberdata, stated in an interview with The Block that he expects Bitcoin's price to fluctuate between $6,000 and $8,000 after the election, potentially dropping to the $60,000 level if Harris wins; if Trump wins, it could break through $75,000 to set a new all-time high.

BRN analyst Valentin Fournier also agreed, predicting a price fluctuation of about 10% for Bitcoin after the election, with a positive impact expected if Trump wins; if Harris wins, a price correction may occur. "However, regardless of the election outcome, the medium to long-term outlook for Bitcoin remains positive," Fournier noted.

On Monday, Bernstein analysts stated that they expect Bitcoin to reach $80,000 to $90,000 before Trump's inauguration on January 20, but also warned that if Harris wins, Bitcoin could drop to $50,000 during the same period before recovering.

According to The Block's Bitcoin price page, Bitcoin is currently trading at $68,828. Over the past week, Bitcoin has fallen about 4%, but it has risen 63% year-to-date.

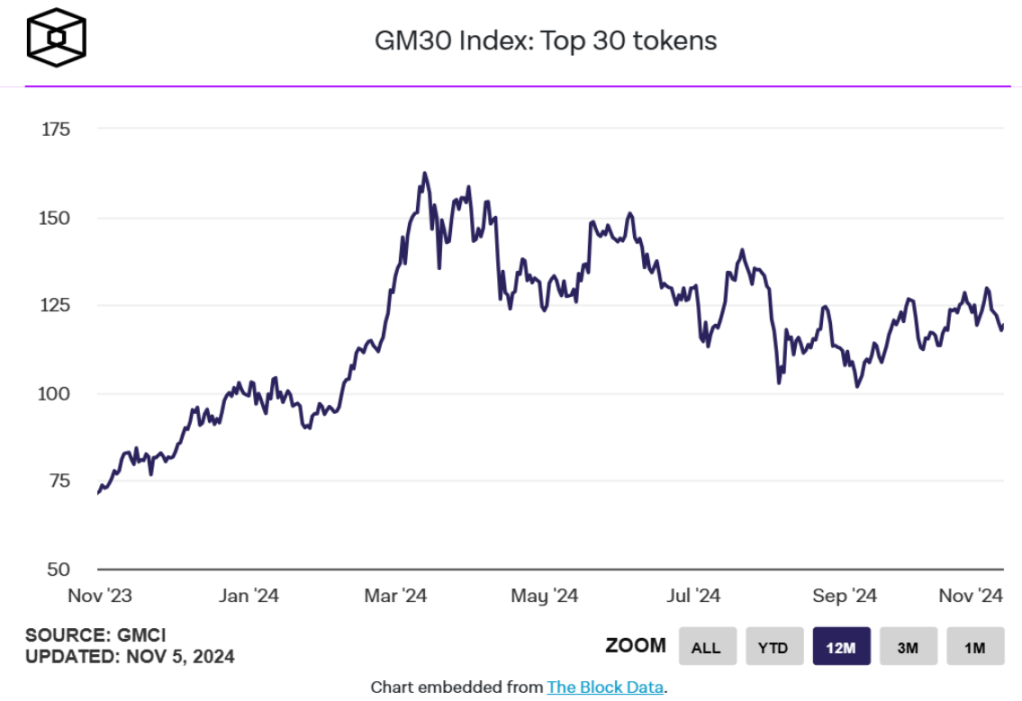

Meanwhile, the GMCI 30 index, representing the top 30 cryptocurrencies, has dropped about 7% over the past seven days, currently at 120.08, but has risen about 21% in 2024.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。