The core significance of standardizing Bitcoin staking lies in establishing a unified technical framework and standards, which brings broader applicability, liquidity, and scalability to the Bitcoin staking market, promoting the financialization process of staking assets.

Written by: Chandler, Foresight News

Staking, as a mechanism for appreciating crypto assets, was first widely applied in PoS networks like Ethereum. With the continuous expansion of the Bitcoin ecosystem, staking protocols have gradually been introduced to the Bitcoin network, driving innovation in this field. However, due to Bitcoin's unique PoW consensus mechanism, its staking model significantly differs from that of PoS networks. Early Bitcoin staking products mainly focused on liquidity mining and basic staking, helping users earn rewards by locking assets.

As the staking mechanism continues to evolve, protocol developers have gradually introduced more diverse asset appreciation methods, making the Bitcoin staking ecosystem more complex. In addition to basic asset locking returns, the staking mechanism has also introduced cross-chain integration and node operation rewards, allowing users to participate in multiple networks and earn rewards simultaneously. Furthermore, some protocols have adopted complex trading strategies to enhance overall yield by flexibly managing staking assets amid market fluctuations.

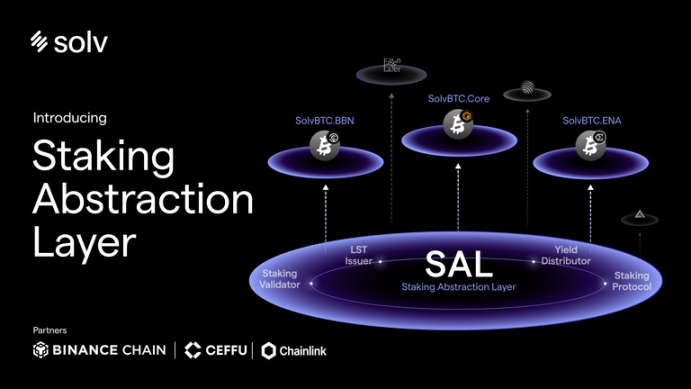

In this continuously evolving staking ecosystem, Solv Protocol demonstrates its unique competitive advantage by successfully addressing the liquidity fragmentation issue in Bitcoin staking. On October 8, 2024, Solv Protocol launched the Staking Abstraction Layer (SAL), aiming to achieve unified staking standards and cross-chain compatibility through this mechanism, effectively solving the long-standing issues of decentralization and complexity in the Bitcoin staking ecosystem. More importantly, SAL introduces new yield strategies and models, broadening the application boundaries of Bitcoin staking and enhancing its flexibility and sustainability.

The author hopes to delve into how Bitcoin staking can achieve innovative breakthroughs within the traditional PoW network by analyzing the Staking Abstraction Layer (SAL) launched by Solv Protocol and the challenges in the development of the Bitcoin staking ecosystem, further exploring its application potential in the DeFi ecosystem. With the continuous introduction of cross-chain technology, liquidity management, and complex yield strategies, Solv Protocol's SAL will become a key force driving innovation in this field, leading Bitcoin staking towards a more mature and diversified direction.

The Necessity of Standardizing BTC Staking

Liquidity of capital is a crucial resource in financial markets, and excessive fragmentation of liquidity can lead to inefficient capital circulation, weakening the overall effectiveness of the financial ecosystem, especially in DeFi. As mentioned earlier, the Bitcoin staking ecosystem currently faces serious issues of liquidity fragmentation, lack of standardized operations, and poor cross-chain collaboration, which greatly limits Bitcoin's application potential in the DeFi space.

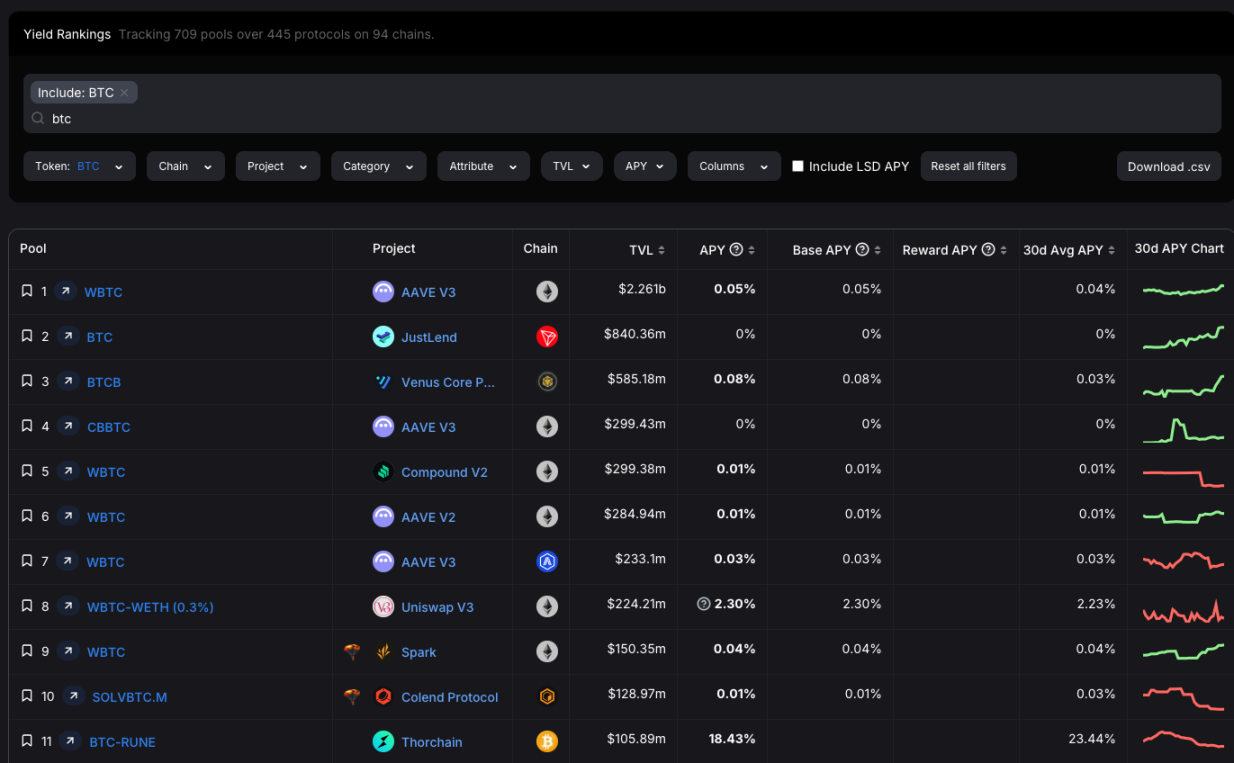

According to data from Defillama, the currently yield-generating Bitcoin has been dispersed across 94 chains, 445 protocols, and 709 liquidity pools. Notably, these yield-bearing Bitcoins have all been transferred from the Bitcoin main chain, operating through some form of wrapping or cross-chain bridging mechanism (e.g., Wrapped BTC). However, the use of these assets involves trust assumptions, whether it is WBTC relying on the trust of a single entity or sidechains or Layer 2 Bitcoin managed through multi-signature mechanisms, which introduces a certain degree of trust risk. More importantly, although these Bitcoin assets can technically be wrapped and migrated to other chains, the lack of unified standards and liquidity management mechanisms results in these fragmented liquidity being inefficiently integrated and utilized.

The decentralization of Bitcoin staking also brings complexity in practical operations. Whether native Bitcoin is stored in cold wallets or wrapped BTC is used for staking or liquidity mining in DeFi protocols, users often face differences in operational rules, staking models, and yield distribution mechanisms across different platforms. This creates a high barrier for users participating in staking, resulting in friction in the liquidity conversion process and consequently lowering overall capital efficiency. Additionally, since Bitcoin liquidity on different blockchains cannot flow freely between multiple financial platforms, this fragmentation further exacerbates the difficulty of liquidity management, affecting the overall user experience of Bitcoin in DeFi.

Currently, the main players in the Bitcoin staking space are gradually taking shape, competing in the market through differentiated technical paths and product designs. Protocols like Solv Protocol and Babylon each have their focus, forming a multi-layered competitive and cooperative landscape. Babylon has expanded the market application of staking with its self-custody mechanism and cross-chain liquidity design, enriching the yield options for Bitcoin holders and thus gaining a certain competitive advantage in the market. Solv Protocol has emerged prominently in the staking space with its flexibility and high Total Value Locked (TVL), especially with its launch of the SolvBTC series products, such as SolvBTC.BBN, SolvBTC.ENA, and SolvBTC.Core. These products cover different market needs through collaboration with protocols like Babylon, Ethena, and CoreDAO, further promoting the diversified development of the Bitcoin staking ecosystem.

However, to further unleash the potential of Bitcoin staking, standardized operations and cross-chain collaboration must be achieved. Standardization can provide a more consistent user experience for Bitcoin staking, lower participation barriers, and enhance capital utilization efficiency through a unified liquidity management mechanism. Cross-chain collaboration can address the current liquidity fragmentation issue, allowing Bitcoin assets to flow freely between different chains, thereby laying the foundation for various financial innovations within the DeFi ecosystem.

Projects like Babylon, while making significant contributions to the security and locking mechanisms of Bitcoin, primarily rely on the support of liquidity platforms like Solv Protocol for their liquidity. The introduction of SAL allows users to participate in Bitcoin staking and earn rewards without needing to understand the technical details of each underlying protocol. This standardized staking framework not only enhances the convenience of staking but also achieves liquidity integration through cross-chain collaboration, promoting the widespread application of Bitcoin in DeFi.

Strategic Positioning of SAL: Integration and Standardization

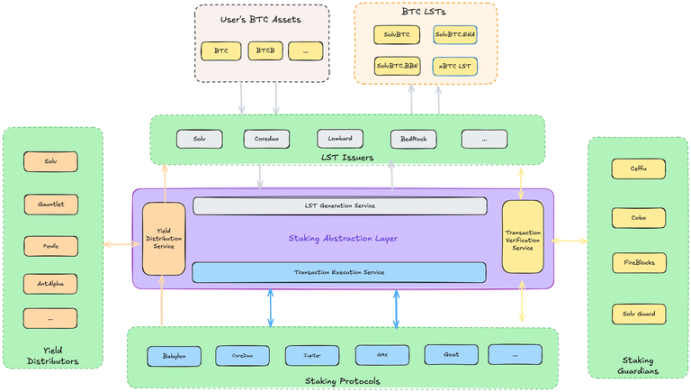

The launch of SAL serves as a technical tool for Bitcoin staking and represents a systematic reconstruction of the entire Bitcoin staking ecosystem. This solution aims to abstract the technical differences and operational methods of various Bitcoin staking protocols through smart contract technology, providing a unified and standardized staking solution. Its core advantage lies in integrating Bitcoin-related liquidity assets from multiple chains (such as Ethereum, BNB Chain, CeDeFi, etc.), managing and scheduling these assets uniformly through SAL's smart contracts.

From a technical perspective, SAL's greatest innovation is its ability to abstract the technical implementation differences of different staking protocols through smart contract technology, constructing a unified operational framework. Through the Staking Parameter Matrix (SPM), SAL standardizes the technical operations in Bitcoin staking, allowing operations between different protocols to be conducted under the same logic. The significance of this technological innovation is that it transforms complex cross-chain operations into a simple user experience, making Bitcoin staking no longer limited to the domain of technical experts but accessible to a broader range of ordinary users and institutional investors. This highly abstracted design can greatly enhance the efficiency and transparency of the entire Bitcoin staking ecosystem, reducing unnecessary friction caused by technical differences.

More importantly, SAL integrates four key roles in the staking ecosystem—LST issuers, staking protocols, staking validators, and yield distributors—forming an efficient collaborative system. The role of LST issuers is to convert users' Bitcoin staking assets into liquid tokens, allowing stakers to maintain liquidity control over their assets while earning rewards. The staking protocol serves as the core operational entity in the ecosystem, responsible for generating yields through staking activities. Staking validators bear the responsibility for the system's security, ensuring the transparency and integrity of the staking and transaction processes, preventing fraud and erroneous behavior. Finally, yield distributors are responsible for fairly and efficiently distributing the yields generated from staking to users.

From a broader financial perspective, SAL not only addresses the technical issues of staking but also brings about a liquidity reconstruction of staking assets. Currently, a large amount of assets on the Bitcoin network are in a "dormant" state; despite their market value reaching trillions of dollars, the proportion actually used for staking and financial activities is relatively low. The launch of SAL promotes the standardization and transparency of staking, enabling Bitcoin assets to be more widely applied in financial activities.

Additionally, SAL's contribution to security is also one of the important factors that can drive the Bitcoin staking ecosystem towards maturity. The greatest risk in traditional staking models lies in the complexity and transparency issues of cross-chain operations, while SAL ensures the transparency and security of staking transactions through standardized staking validation mechanisms and smart contracts. Staking validators play a crucial role in the SAL ecosystem, responsible for ensuring the correctness and compliance of each staking transaction, thereby enhancing the security of staking operations and increasing user trust in staking protocols.

From Standardization of Staking to Transition to Sustainable Business Models

The standardization of staking is a key step in maximizing capital efficiency and liquidity integration within the Bitcoin ecosystem. Solv Protocol can leverage SAL to establish a brand new Bitcoin staking framework, making the diversity of LSTs possible and providing DeFi users with more choices, thus meeting the diverse needs of users in capital management. For example, the issuance of LSTs can be designed based on different locking periods, yield distribution mechanisms, and liquidity characteristics, enhancing the flexibility of staking products and expanding the application scenarios of Bitcoin as a financial tool, no longer limited to a single locking reward mechanism.

From a market application perspective, SAL can broaden the boundaries of Bitcoin staking by introducing complex financial trading strategies into the staking ecosystem. Traditional Bitcoin staking primarily focuses on fixed income models, where users lock assets to obtain simple staking returns. SAL transforms staking from merely a static asset locking mechanism into a dynamic process that can integrate with complex DeFi financial strategies, enhancing capital utilization efficiency. Staking users can employ LSTs for leveraged staking, arbitrage trading, yield optimization, and other strategies, achieving synergistic applications across multiple financial products.

Furthermore, the introduction of SAL lays the foundation for a sustainable business model in Bitcoin staking. Traditional staking models often lack long-term appeal due to limited liquidity and insufficient market adaptability. SAL provides standardization and flexibility, allowing Bitcoin staking to dynamically adjust to changes in market demand, ensuring that staking assets can continuously maintain efficient liquidity and yield capabilities under different market conditions. As the market evolves, staking protocols can adjust staking rules according to demand, ensuring that the staking process always aligns with the latest needs of the capital market. This flexibility and scalability provide sustainability for the long-term development of Bitcoin staking and create a stable inflow of capital and profit models.

As of now, several protocols and service providers have joined the SAL protocol ecosystem, including Babylon, Ethena, CoreDAO, and Jupiter, marking further maturation of the Bitcoin staking market. Additionally, Chainlink has utilized its CCIP technology to achieve cross-chain operations and underlying asset transparency verification for LST assets generated based on SAL. These collaborations not only demonstrate the broad applicability of SAL but also bring richer application scenarios to Bitcoin staking, further promoting the sustainable development of staking business models.

Looking at the Future Development and Challenges of the Bitcoin Staking Ecosystem from Solv's Perspective

Before discussing the future of the Bitcoin staking ecosystem, it is essential to clarify Solv Protocol's strategic positioning in this field. Through the standardized technology of SAL, Solv Protocol introduces a new operational logic to the Bitcoin staking ecosystem, addressing issues such as fragmentation of staking protocols, lack of interoperability, and operational complexity. Compared to traditional staking protocols, Solv has fundamentally reshaped the structure of the staking market, becoming a provider of industry infrastructure rather than merely a subordinate tool serving other staking platforms like Babylon.

In contrast to existing staking protocols like Babylon, Solv positions itself as a more upstream infrastructure provider. While protocols like Babylon play important roles in specific scenarios, their functions are more focused on integrating Bitcoin into the staking mechanisms of other blockchain networks. Solv's innovation lies in its standardized framework, which is not limited to serving a specific protocol but provides a reliable infrastructure for all staking protocols. As more protocols and service providers join, Solv Protocol's standardized framework will become an indispensable part of the Bitcoin staking ecosystem. This role as infrastructure makes Solv Protocol the core of the staking market, rather than a supporting tool reliant on other staking protocols.

However, in this rapidly developing market, the Bitcoin staking ecosystem and Solv will still face numerous challenges, particularly in advancing industry standardization, balancing liquidity and security, and addressing market acceptance and innovation capabilities.

The diversification and complexity of the Bitcoin staking market make industry standardization an inevitable demand. Although Solv Protocol has established a unified staking framework through SAL, allowing staking activities to run seamlessly across different protocols and chains, the promotion and further refinement of this standard will still require time. The ultimate formation of standardization depends on the coordination of major market participants, which is a technical challenge and a reflection of industry collaboration. Whether Solv's standards can become the universal norm in the industry depends on its ability to attract a sufficient number of staking protocols to adopt this framework and continuously drive the efficient operation of the staking market.

At the same time, balancing liquidity and security will also be one of the core issues for future development. Bitcoin staking inherently involves the long-term locking of assets, and the main challenge for stakers is how to maintain responsiveness to market changes while their assets are locked. The introduction of liquid staking tokens alleviates this issue to some extent, allowing stakers to earn staking rewards while still maintaining a degree of asset liquidity. However, as the scale expands, the risks in cross-chain operations and asset custody gradually increase. The inherent complexity of cross-chain bridge technology makes the cross-chain transfer of assets a potential risk point, especially when handling large amounts of assets, where this risk becomes more pronounced.

The further expansion of the market also depends on user education and the improvement of market acceptance. While Bitcoin staking provides users with a way to earn rewards, the process remains relatively complex, particularly for ordinary users who are not technically savvy; cross-chain staking and the choice of different protocols may increase their participation barriers. Solv Protocol's standardized framework has made significant progress in simplifying operational processes, but to truly achieve large-scale application in the staking market, a more intuitive and user-friendly experience design is needed. Reducing the technical understanding difficulty for users and increasing user education efforts will be key to driving the scaling of the staking market. Only when ordinary users can easily participate in staking activities can the staking market truly expand into the mainstream.

In the long run, innovation capability will determine the leadership position of various protocols in the staking ecosystem. Although industry standards have been established through SAL, the competitive landscape of the staking market continues to evolve. The future staking ecosystem will not be limited to the current staking mechanisms; more innovative products such as staking options, staking derivatives, and cross-chain staking will emerge, providing new growth opportunities and development space for staking protocols. By promoting the continuous expansion and innovation of the Bitcoin staking ecosystem, Solv is becoming a core force in this market. The future challenge lies in how to continue leading technological innovation in the market while ensuring security and liquidity, and making its standardized framework a widely accepted infrastructure in the industry.

Conclusion

In summary, Solv Protocol has already shown a certain leading quality in the Bitcoin staking ecosystem. Compared to traditional staking protocols, Solv's SAL technology not only brings qualitative improvements to the industry but also sets a new technical benchmark for the staking market, endowing the Bitcoin staking market with broader applicability and stronger scalability.

More importantly, Solv does not rely solely on its current market advantages but further consolidates its dominant position in the staking market through continuous technological expansion and industry collaboration. According to Defillama data, the Bitcoin locked amount in the Solv protocol has exceeded 25,000 BTC, and with Bitcoin prices reaching new highs, its total locked amount on the platform has officially surpassed $2 billion. This data highlights Solv Protocol's achievements in the staking market and further establishes its position in the Bitcoin ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。