Instead of directly participating in PVP, consider whether there are other operational opportunities in the current meme trend.

Written by: WOO

Background: The myth of getting rich quickly is only visible on social platforms; losing money is the norm.

In recent months, Solana has been closely tied to Pump Fun and meme coins. In terms of trading volume, 36.8% of the entire chain is related to Pump Fun, indicating that the meme sector holds a crucial position in Solana.

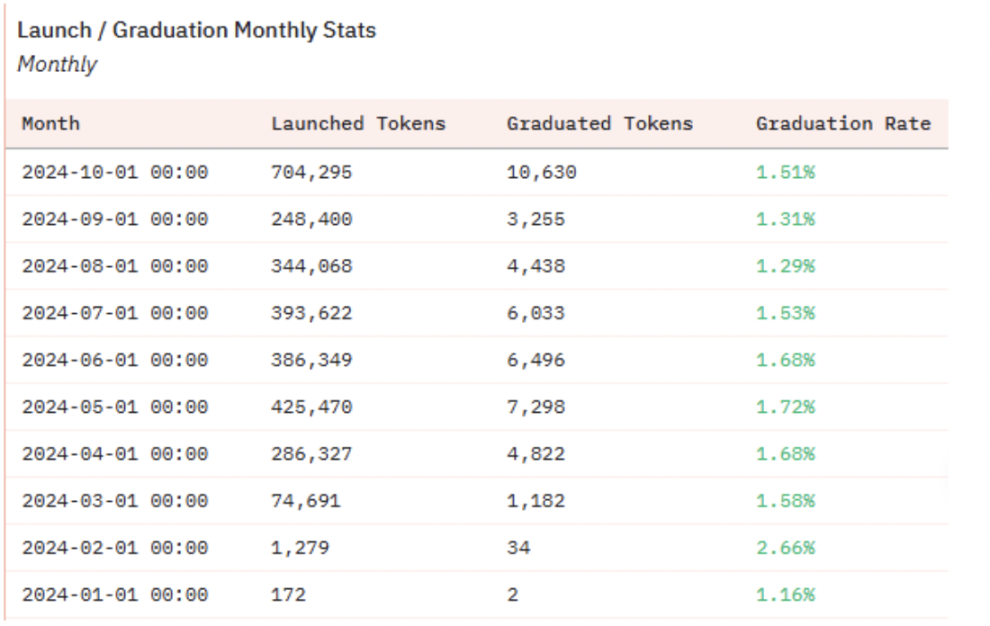

Meme coins have brought about a wealth effect, but more importantly, they are a game of existing players battling against each other. According to a Dune dashboard created by @adam_tehc, tokens in Pump Fun have only a 1-2% chance of being listed on Raydium; another more disheartening statistic is that only 3% of addresses related to Pump Fun tokens have made profits exceeding $1,000. This means that if you made $1,000 playing Pump Fun memes, you are better than 96% of the players.

The data above reflects the true nature of the wealth effect of meme coins: the myth of getting rich quickly often only appears on social platforms, while losses are the reality for most people.

How can one find certain opportunities in the turbulent meme market? One can think differently, not directly participating in PVP, but considering whether there are other operational opportunities in the current meme trend.

Potential Winners of the Meme Craze: Jito

To conclude: The longer the meme craze on Solana continues, the higher the jitoSOL interest rate will be.

Currently, memes have become part of Solana's DNA, with meme coins issued by Pump Fun continuously rising every day. Tokens related to Pump Fun account for over 40% of the total trading volume on the chain, and this trend is on the rise.

What impact does this have on the Solana ecosystem? For low liquidity and low market cap meme coins, trading speed is crucial. If you buy slower than others, you may end up buying at a high price.

In the context of FOMO sentiment and surging trading volume, Solana MEV attacks become profitable, and the value captured also increases.

MEV refers to the ability to increase, delete, and change the order of transactions in a block. Unlike Ethereum, Solana does not have a public memory pool. Due to the characteristics of its consensus mechanism, the cost of participating in MEV activities is relatively low. MEV bots cannot manipulate transaction order based on fees; they can only compete on latency and speed. Only by reading the state first can they successfully execute transactions.

Because of the low transaction costs and the first-in-first-out transaction processing mechanism, there are many spam transactions on Solana, which occupy a large amount of Solana block space and can cause Solana to crash.

Jito is a provider of Solana MEV infrastructure. They have launched a client that runs an off-protocol memory pool, where seekers submit transaction packages they wish to include for profit, along with bids for these packages, which are then submitted to validators running the client. The highest bidder wins, and their transaction packages are submitted to the chain, creating an additional revenue source for validators and their stakers. 100% of the fees paid go to the validators and their stakers.

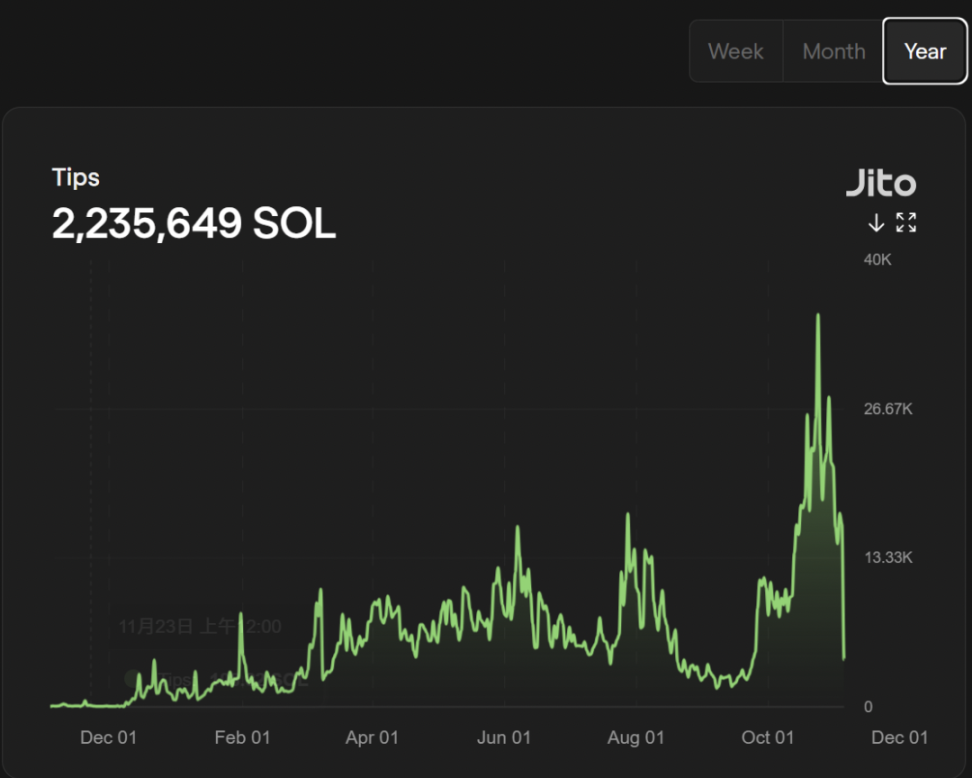

Therefore, for Jito, the higher the trading volume on Solana, the more MEV revenue Jito can capture, and ultimately, the more revenue is distributed to stakers.

The interest rate of jitoSOL comes from staking + MEV rewards. Thanks to the surge in MEV revenue, the current annualized interest rate of jitoSOL is about 8%, far exceeding stETH's 3%, thus providing users with arbitrage opportunities. So how should one operate?

(This year, Jito MEV tips have reached 2,235,649 SOL, valued at approximately $357 million, and the chart shows a continuous upward trend.)

Self-made Solana version of Ethena, revenue sources = staking + funding rate

How to execute?

Buy three-quarters of the funds in SOL, then stake the SOL through Jito to obtain jitoSOL, earning 8% APY. Additionally, deposit one-quarter of the funds into a centralized exchange, open a three-times leverage short position on the same amount of SOL, and earn funding rate interest.

- Assuming the SOL funding rate is 0.01%

Assuming you have 120,000 USDT and want to earn stable interest, the profit formula is as follows:

90,000 * 8% (jitoSOL APY) + 30,000 * 3 (three-times leverage short) * 0.01% * 3 * 365 = 7,200 + 9,855 = 17,055

17,055 / 120,000 = 14.2%

The annualized interest rate is approximately 14%.

If the Solana meme trend continues, the market will first focus on SOL, which can push the funding rate upward, breaking through the 0.01% neutral sentiment, while Jito's MEV value capture can also increase the APY of jitoSOL. Using this Delta Neutral strategy, the annualized interest rate is expected to exceed 20%.

Conclusion: Keep an eye on meme popularity and look for certain returns.

The above only introduces the most basic Delta Neutral strategy. Advanced strategies can be combined with the lending protocol Kamino on SOL or use Jito's recently added Restaking features to enhance yield.

The advantages of this strategy lie in its safety and high capacity:

- jitoSOL is the largest LST on SOL, with good security and not easily de-pegged.

- SOL is a mainstream currency, with good depth in most centralized exchanges, allowing for high strategy capacity.

Conversely, if the cryptocurrency market does not perform as expected and the funding rate turns negative, it will erode the strategy's returns. Therefore, this strategy is not a mindless way to earn money; it still requires close attention to market conditions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。