Original | Odaily Planet Daily (@OdailyChina)

Author | Nan Zhi (@Assassin_Malvo)

This morning, Trump's vote count and winning probability in the presidential election continued to rise. As of 11:17 (UTC+8), Polymarket predicts that Trump has over a 90% chance of winning the U.S. presidential election, leading Bitcoin and the entire crypto market to surge.

At 11:00, Bitcoin quickly broke through its historical high, setting a new record of 75,000 USDT, with a 24-hour increase of nearly 10% (thus, BTC has not disappointed any Hodler).

Meanwhile, Ethereum surpassed 2,600 USDT, with a 24-hour increase of 6.8%; SOL broke through 180 USDT, with a 24-hour increase of 13.8%.

The total market capitalization of cryptocurrencies has significantly risen. According to CoinGecko, the total market cap of cryptocurrencies has now risen to 2.6 trillion USD, with a 24-hour increase of 6.72%.

In terms of derivatives trading, Coinglass data shows that in the past 24 hours, the total liquidation across the network reached 452 million USD, with the vast majority being short liquidations, amounting to 346 million USD. In terms of cryptocurrencies, BTC saw liquidations of 244 million USD, DOGE 39.7 million USD, and ETH 37.66 million USD.

Just a New High

Why is there such a close relationship between Trump's winning probability in the U.S. election and the crypto market's performance? The core reason lies in Trump's and his team's promise to adopt a more liberal attitude towards cryptocurrencies compared to the Democrats. For example, he would not allow the creation of a CBDC (digital dollar) to avoid restricting Americans' financial freedom; he plans to establish a Bitcoin strategic reserve, and under his leadership, the U.S. government will no longer sell Bitcoin but will hold it long-term; he also pointed out that the U.S. will establish a special task force responsible for cryptocurrency policy—the Bitcoin and Crypto Presidential Advisory Council.

(Odaily Planet Daily Note: See more in “What Crypto Bills Would Trump Pass If Elected President?”)

On the other hand, Trump will also have a significant impact on the macroeconomic trends in the U.S. According to Jinshi, the next U.S. president will fill several vacant positions, and Powell's term as Federal Reserve Chairman will end in May 2026, meaning Trump or Harris will be able to choose the next leader of the Federal Reserve.

Mark Spindel, Chief Investment Officer of Potomac River Capital and a historian studying the Federal Reserve and politics, pointed out in a recent interview that this is “a significant crossroads for the Federal Reserve.” He added that if Trump's team wins, they will clearly be “very proactive.” During his presidency, Trump frequently attacked Powell and publicly pushed the central bank to act according to his ideas, even suggesting negative interest rates, and Trump has hinted that if he wins a second term, he might do even more.

Options Data: $80,000 Becomes a Key Price Level, Call Selling Dominates

Options data shows that traders are concentrating their bets around the $80,000 Bitcoin strike price, with strong short-term bullish call sales as traders prepare for potential price movements using options premiums.

Forster stated: “The dominance of sold call options indicates that traders are strategically collecting premiums, and the focus on the $80,000 target highlights a potential turning point for Bitcoin.”

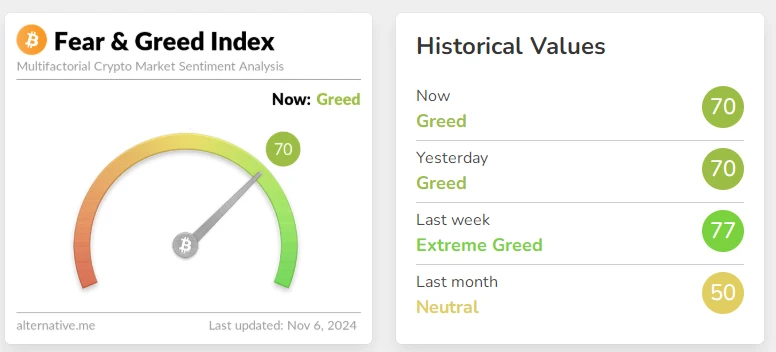

Public Sentiment is Frenzied, Fear Index Hovering at High Levels

Alternative data shows that today the Fear and Greed Index has risen to 70, remaining in the greed category, while last week's level was extreme greed.

Odaily Planet Daily Note: The fear index threshold is 0-100, including indicators: volatility (25%) + market trading volume (25%) + social media heat (15%) + market surveys (15%) + Bitcoin's proportion in the overall market (10%) + Google Trends analysis (10%).

What to Watch After the Election?

After the election, the most critical event this week will be the Federal Reserve's interest rate decision announcement, along with a monetary policy press conference by Fed Chair Powell.

In terms of timing, due to the U.S. election and daylight saving time, the Federal Reserve will announce its interest rate decision at 03:00 Beijing time on November 8 (Friday).

As per usual, the Federal Reserve holds its policy meetings on Tuesday and Wednesday, announcing the decision results in the early hours of Thursday Beijing time. However, this time it coincides with the U.S. election voting, so the Fed's meeting has been postponed by one day. The 2024 U.S. election voting will start at 13:00 Beijing time on November 5 (Tuesday).

How Much Will Rates Be Cut?

Goldman Sachs Chief Economist Jan Hatzius stated that the Federal Reserve will fulfill its earlier indication of two rate cuts by the end of the year, especially after last week's weaker-than-expected employment report. He expects this situation to continue into the first half of 2025.

In a report released last Sunday, Hatzius stated, “We expect the Federal Reserve to cut rates four times consecutively in the first half of 2025, with the final rate dropping to 3.25%-3.5%, but we have greater uncertainty regarding the pace and final target of the Fed's rate cuts next year,” he added that his forecast is about 50 basis points higher than the market consensus.

According to Jinshi, investors are anticipating that Fed Chair Powell will lower rates by 25 basis points this week to keep the rate cut plan on track, despite some stubborn inflation signs and mixed signals regarding the job market. JPMorgan Chief Economist Michael Feroli stated in a report: “This week's FOMC meeting is a refreshingly simple decision, and the reasons for a rate cut remain valid.” Fed watchers expect Powell to reach a consensus around a modest rate cut after a significant cut in September.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。