Bond market traders increased their bullish bets on U.S. Treasuries at the last moment, with options, futures, and cash positions all turning bullish; meanwhile, Bitcoin continued to support Trump, rising over 2% on Wednesday and surpassing the $71,000 mark.

Written by: Zhao Ying

Source: Wall Street Insight

The U.S. presidential election remains tense, marking one of the most evenly matched elections in history, with the market betting on different outcomes. U.S. Treasuries shifted to "betting on Harris" at the last moment, while Bitcoin continued to "bet on Trump."

On Wednesday, as the U.S. election entered the vote-counting phase, bond market traders increased their bullish bets on U.S. Treasuries at the last moment, with options, futures, and cash positions all turning bullish, raising the stakes on Harris potentially winning the election.

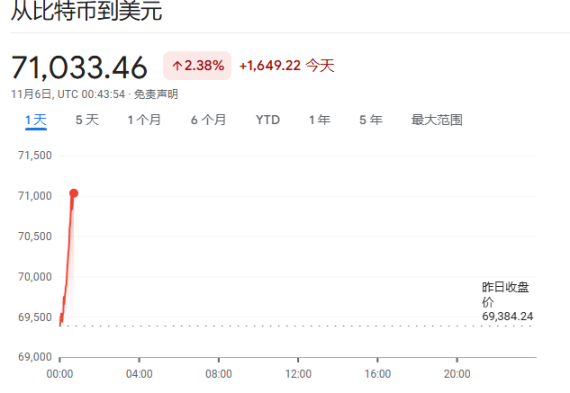

Bitcoin, on the other hand, continued to support Trump, with its price rising over 2% on Wednesday to $71,033, maintaining its largest gain in a week.

Analysts believe that the bond market fears a Republican sweep, as Trump would push for tax cuts and tariff plans, expanding the fiscal deficit and reigniting an era of inflation, which would drive up the yield on 10-year U.S. Treasuries. Conversely, cryptocurrencies could benefit in a dual manner; Trump is undoubtedly a supporter of cryptocurrencies, but Harris has also indicated that she would not continue the severe crackdown on the industry as Biden did.

U.S. Treasuries Shift to "Betting on Harris"

U.S. Treasury investors are making significant moves into trades that could profit from rising Treasury prices, believing that such a scenario is more likely if Harris wins the election, while reducing bets on Trump's victory.

Since Monday, U.S. options activity has been dominated by short-term bullish bets, with weekend polls showing Harris gaining an advantage over Trump, prompting traders to prepare for a potential Harris victory.

This shift has also been observed in the futures market, where new long positions emerged on Monday, including a significant increase in demand for longer-term bonds. As of the week ending October 29, asset management firms' net long positions increased by approximately 182,000 contracts of 10-year Treasury futures.

Additionally, JPMorgan's latest client survey indicates that net long positions in U.S. Treasuries are at their highest level in about three months, marking another sign of a shift in market sentiment.

These actions signify a turn among traders, who had previously established bearish positions based on expectations of a Trump victory. However, as polls indicate a deadlock in the campaign, investors are now preparing for the possibility of an opposite outcome and bracing for market volatility.

Bitcoin Continues to "Support Trump"

On Wednesday, Bitcoin's price rose over 2% to $71,033, maintaining its largest gain in a week and remaining less than 5% off the record low set in March.

Due to Trump's support for digital assets, Bitcoin's rise is seen as part of the so-called "Trump trade."

Trump has vowed that if he returns to the White House, he will make the U.S. the global capital of cryptocurrency, establish a strategic Bitcoin reserve, and appoint regulators who are enthusiastic about digital assets, positioning himself as the most pro-industry candidate. Harris, on the other hand, has taken a more cautious approach, promising to support a regulatory framework for the industry.

Bonds Fear a Sweep, Cryptocurrencies Win Either Way?

Overall, the bond market fears a Republican sweep, while cryptocurrencies are expected to perform well regardless of the outcome.

Analysts believe that a significant Republican victory is viewed as a "clear threat" to bond buyers. In the case of a unified Republican government and Congress, Trump would push for tax cuts and tariff plans, expanding the fiscal deficit and reigniting an era of inflation. This would drive up the yield on 10-year U.S. Treasuries, potentially leading to further declines in the bond market.

On the other hand, if Harris wins in a divided Congress, it could trigger a relief rally, increasing the likelihood of a deadlock that could control government spending.

What happens in other scenarios is almost contentious. JPMorgan's strategists expect that a unified Democratic government and Congress would lead to increased government spending, thereby pushing up bond yields. Conversely, RBC Capital suggests that this scenario would be most favorable for bonds, leading to corporate tax hikes, exacerbating an "unfavorable for business" environment, and weakening risk appetite.

Regarding cryptocurrencies, analysts believe that Bitcoin is likely to benefit from a Trump victory, as Trump is an active supporter of cryptocurrencies, claiming to establish a strategic reserve of original cryptocurrencies and appointing regulators friendly to the industry. However, a Harris victory may not necessarily be detrimental to the industry, as she has indicated she would not impose the same severe restrictions as Biden.

In the short term, the optimism among cryptocurrency investors may have already been partially absorbed by the market. Bitcoin's price has once again surpassed the $70,000 mark, and Bitcoin exchange-traded funds have seen their largest inflow of funds to date. Additionally, with competition still too close to call, demand for hedging in the cryptocurrency options market has surged.

According to Bloomberg statistics, on Monday, net outflows from 12 Bitcoin ETFs managed by companies like BlackRock and Fidelity reached an astonishing $579.5 million, setting a historical high. Options pricing suggests that the expected market volatility for Bitcoin on the day after the election will reach 8%.

Furthermore, options traders are preparing for significant profits in the future. According to data from the largest cryptocurrency options exchange, Deribit, the largest open contracts for March expiration are concentrated around strike prices of $100,000 and $110,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。