Author: Huo Huo

According to a report released by CEX Bybit in June, institutional investors increased their holdings in spot Memecoins from $62.5 million to $204.8 million between February and March this year, peaking at $293.7 million in April. The most popular Memecoins include DOGE, SHIB, PEPE, and BONK. Subsequently, after a deterioration in market sentiment led to a sell-off of Memecoins, total holdings dropped to $139 million, but this increase still represents a 125% growth compared to the beginning of the year.

It can be said that since the beginning of this year, Memecoins have increasingly become a significant focus for institutional investors. Unlike previous fleeting Memecoin fads, Memecoins have become an important narrative and hotspot in this market cycle.

Starting in the second half of 2024, some VCs have announced plans to invest in Memecoin infrastructure, marking a shift from previous VC opposition to Memecoins to a gradual acceptance. How are these venture capital firms getting involved in Memecoins?

a16z

A16z, short for Andreessen Horowitz, is a well-known American venture capital firm founded by Marc Andreessen and Ben Horowitz in 2009, headquartered in Silicon Valley. It made early investments in Facebook, Twitter, Instagram, and Airbnb, and has continued to focus on Web3 and blockchain, having invested in Coinbase with significant returns and establishing multiple crypto funds, becoming one of the important investors in the crypto industry.

However, as a mainstream venture capital institution, a16z's initial attitude towards the Memecoin market was not very friendly. Between February and April this year, the Memecoin market surged, with the average weekly increase of 20 popular Memecoins like PEPE reaching six times, and projects like WIF and BOME quickly launching on CEX, capturing market share from VC Tokens.

Eddy Lazzarin, the Chief Technology Officer of a16z Crypto, harshly criticized Memecoins in a tweet on April 25, 2024, stating that they undermine the "long-term vision" of cryptocurrencies and tarnish the views of "the public, regulators, and entrepreneurs" towards the industry, acting as a "casino for a relatively small group of people."

Chris Dixon, a managing partner and Chief Technology Officer at A16Z, also publicly disparaged Memecoins, bluntly stating that they are essentially a casino.

However, recently a16z has changed its critical stance on Memecoins from earlier this year and has been actively participating in MemeCoin.

First, a16z co-founder Andreessen Horowitz tipped $50,000 in BTC to the bot account Truth Terminal on X, which led to the recent popularity of the goat coin GOAT, pushing it from an obscure project to a shocking historical market cap of $850 million, making Truth Terminal the first AI millionaire and simultaneously promoting the AI+Meme development trend.

Source: Marc Andreessen

Then, on the morning of October 28, Marc posted two pieces of content related to AI16Z, quickly drawing attention to AI16Z. This "AI16Z Fund" was created by the Twitter account "Marc 'AI' ndreessen," which launched the fund on daos.fun. The fund manages approximately 420 SOL in raised funds through AI dialogue, specifically investing in Memecoins and simulating Marc Andreessen's personality.

Before October 27, the fund's market cap was around $4 million. However, after Marc retweeted a comic image featuring an ai16z-themed T-shirt, the market cap of AI16Z skyrocketed over 20 times in just 12 hours, reaching nearly $100 million.

Although some sources have linked it to the famous venture capital firm a16z, suggesting that the fund may have received support from the company, Andreessen Horowitz has not officially confirmed any relationship with this project. Therefore, it remains unclear whether the token has truly received a16z's backing or if it is merely using a similar name to attract attention. However, it is clear that a16z no longer disparages Memecoins as it did before.

DWF Labs

DWF Labs was established in 2022 and is a new generation Web3 investor and market maker, having invested in several well-known projects, including dYdX, SushiSwap, Injective Protocol, Astar Network, and Morpheus Network.

Currently, according to relevant news, DWF Labs has invested in multiple Memecoins and has been involved for some time, having invested multiple times in the pet Shiba Inu "Floki" (FLOKI) in 2023, and further investing $12 million in 2024. These funds supported several development projects for FLOKI, such as FlokiFi (decentralized finance), the educational platform Floki University within the Floki Inu ecosystem, and its metaverse game Valhalla. This series of investments not only boosted FLOKI's price but also helped it successfully list on several major trading platforms.

Additionally, on June 3, 2024, DWF Labs invested $5 million in Milady Meme Coin (LADYS). This funding aims to support the growth of Milady Meme Coin in the memecoin market, enhance its development capabilities, and promote community participation.

In August 2024, DWF Labs collaborated with Floki and the BNB Chain to exclusively launch the Memecoin Simon’s Cat on the BNB Chain. Simon’s Cat is a world-renowned cat animation series and a very popular cat meme.

In September 2024, DWF Labs announced a partnership with GraFun to support the launch of Tokens on the GraFun platform, aiming to enhance liquidity for Memecoin projects released on the GraFun platform.

DWF Labs managing partner Andrey Grachev expressed great enthusiasm for this collaboration: "Working with GraFun is an exciting opportunity to support the next generation of Memecoin projects on the BNB Chain."

GraFun's BigGra agreed, stating: "The collaboration with DWF Labs is a significant milestone for both GraFun and the Memecoin ecosystem. We believe this partnership will bring tremendous value to our community and the broader market."

Moreover, Andrei Grachev posted on the X platform: "The Memecoin market has become a mature and solid part of the industry. It leverages extreme fear and greed, allowing savvy investors and traders to amass significant wealth. DWF Labs institutionalized its investment in Memecoins years ago, and it remains one of our priorities."

Binance Labs

Binance Labs is a leading global blockchain and crypto investment institution, affiliated with the crypto CEX Binance, established in 2018. It has invested in several well-known crypto projects, including Coinbase, Polygon, Injective Protocol, Elrond, Terra, and 1inch.

As early as 2023, Binance Labs invested in multiple Memecoins and continued to show enthusiasm for the MemeCoin sector in 2024. In January 2024, Binance Labs invested in the native ecological Token MEME of Memeland. Memeland primarily focuses on NFT and social features, and the project was included in the Binance Launchpool in October 2023.

Subsequently, Binance Labs supported the development of its Whyanelephant project, which features a dancing elephant characterized by absurdity, nonchalance, and extreme emotional fluctuations, representing you and me in the crypto market.

Coinbase Ventures

Coinbase Ventures was established in 2018 and is headquartered in San Francisco, California. As the investment arm of Coinbase, Inc., it primarily invests in early-stage companies in the cryptocurrency and blockchain technology sectors. It has invested in projects including Compound, Chainlink, Dapper Labs, Etherscan, and Ripple.

Coinbase Ventures has also been involved with Memecoins for a long time, having supported Dogecoin as early as 2018, although the specific investment amount was not disclosed. However, the project has garnered significant community support. In 2021, Coinbase Ventures invested in Shiba Inu, and its parent company Coinbase announced at the end of 2023 that it would add Bonk to its list of tradable assets.

The latest news is that after the success of GOAT, Coinbase CEO Brian Armstrong proposed setting up a crypto wallet for Truth Terminal.

Subsequently, Coinbase Ventures released a proposal outlining how the combination of artificial intelligence and blockchain technology will shape the future. Coinbase stated in its post: "The future of AI can be built on blockchain technology, as crypto assets can help enhance the accessibility, transparency, and use cases of emerging technologies. The efficiency, borderlessness, and programmability of cryptocurrencies, when combined with AI, have the potential to change the way humans and machines interact with the digital economy."

It is evident that as Coinbase plays an important institutional role in the cryptocurrency market, in addition to launching the highly popular Layer 2 base chain and becoming the custodian for all Bitcoin spot ETFs, it has also been involved early in the Memecoin sector.

Crypto Labs

Crypto Labs is a venture capital firm established in 2018 and headquartered in Singapore, having invested in several well-known crypto projects, including Ripple, Filecoin, Dapper Labs, SushiSwap, Aave, and Chainlink.

On October 9, 2024, it was reported that PPKING, a fair launch platform for Memecoins on the TON public chain, announced the completion of a $2 million seed round financing, led by Crypto Labs. The project aims to create an efficient, secure, and entertaining decentralized financial platform through innovative DeFi mechanisms and a deep integration with MEME culture. The new funds will support its Memecoin trading and liquidity provision.

Pantera Capital

Pantera Capital is a venture capital firm founded in 2013 and headquartered in California, with founder Dan Morehead being a former Goldman Sachs trader with extensive financial experience. It has invested in several well-known crypto projects, including Bitcoin, Ethereum, Chainlink, Dapper Labs, and Polkadot.

Pantera Capital has long shown a strong interest in the memecoin space, having invested in Shiba Inu in 2021.

Pantera partner Paul Veradittakit emphasized that Memecoins play an important role in attracting young users to Web3. He views Memecoins as the "Trojan horse" for cryptocurrency adoption, leveraging viral popularity to interact with DeFi, NFTs, and other decentralized services. By making crypto and blockchain applications more accessible to mainstream audiences, Pantera believes that Memecoins hold significant value in overcoming the distribution limitations faced by NFTs, potentially achieving fractional ownership of NFTs through the ERC-404 standard.

In recent months, Pantera executives have mentioned that Memecoins are helping platforms like Solana build a more active user base. Pantera also maintains a positive and embracing attitude towards the MemeCoin sector.

OKX Ventures

OKX Ventures is the venture capital arm of the OKX platform, having invested in several well-known crypto projects, including Solana, Polygon, Tether, and SushiSwap.

OKX Ventures has also been involved early in Memecoin investment activities, participating in the investment in SHIB during the wave of popularity in May 2021. It has also invested in Floki Inu, BabyDogeCoin, and others.

Additionally, OKX began supporting the listing of various leading Memecoins early this year, indicating that OKX Ventures is particularly sensitive to Memecoins, leveraging its trading platform.

Others

In general, because it is not possible to directly issue Memecoins for profit, most venture capital institutions collaborate with projects through investments, focusing on hot Memes that have backgrounds and stories. Some investment institutions initially experienced a sense of opposition due to their inability to participate directly or indirectly. Additionally, some investment institutions are actively laying out launchpads on various public chains to further support the dissemination and vitality of Memecoins.

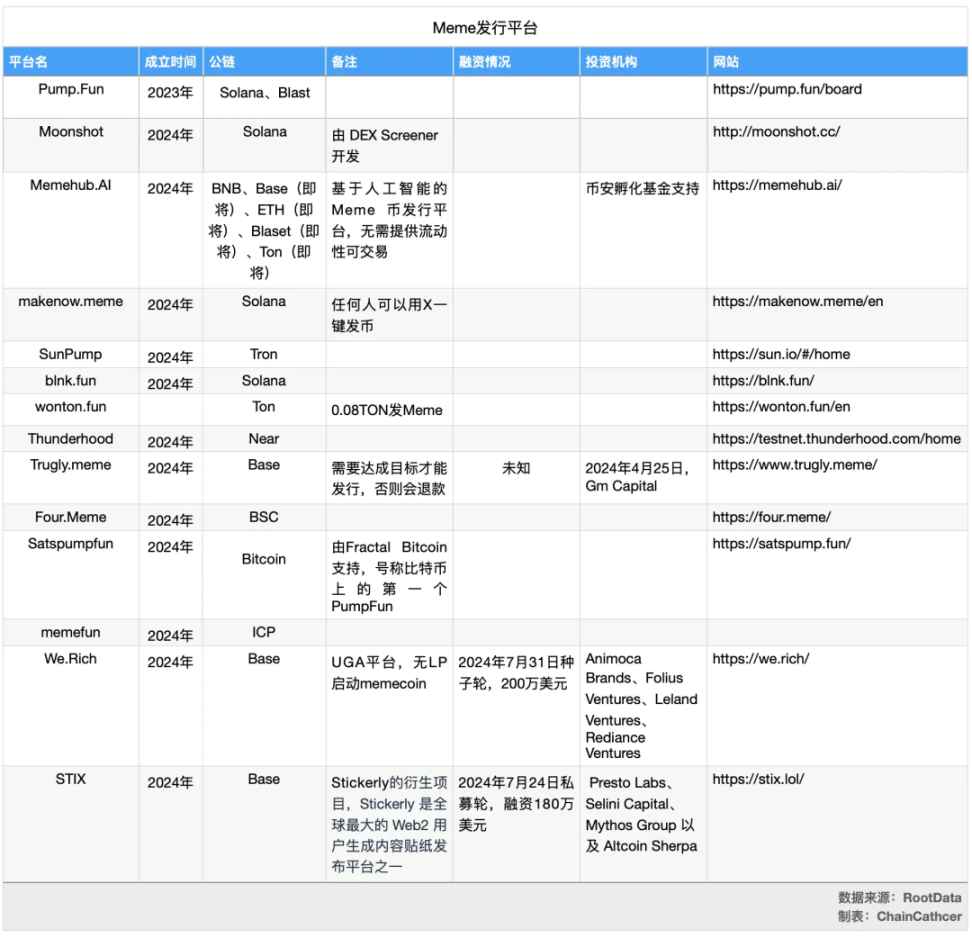

According to RootData, an incomplete count shows that since 2024, more than 10 new Meme Launchpad projects or projects with Meme Launchpad features have emerged, supporting different public chains, with the most support for Meme Launchpad projects on Base and Solana, and some venture capital firms can be seen behind these initiatives.

Summary

Looking back at the competition between VC Tokens and Memecoins, it is evident that most governance Tokens supported by venture capital have high valuations and low circulation, making it difficult for retail investors to find profit opportunities. In this context, retail dissatisfaction with VC market manipulation has been rising, expressing that "these VC coins are a feast for capital and a nightmare for retail investors; they would rather engage with meme coins than VC coins." In response to this, Memecoins, which are highly viral, have low barriers to entry, are user-friendly, and have a rapid wealth creation effect, have emerged.

Although this phenomenon once led to a confrontation between venture capital and retail investors in the first half of the year, with some VCs accusing Memecoins of disrupting the market, retail investors countered by accusing VCs of wrongdoing. However, due to the current development trend of Memecoins, VCs have had to reassess the market and adjust their layouts and investment directions.

While some VCs still look down on Memes, it is undeniable that Memecoins have become a crucial element in activating public chain ecosystems. Following the launch of Memecoins on several leading CEXs, a large number of users have been attracted, making chains like Base, Blast, and Solana more active. As of November 5, 2024, the market cap of Memecoins is approximately $61 billion. In the future, with the power of AI combined, Memecoins may exhibit even greater potential and become true game changers in the market.

Finally, according to statistics released by some KOLs on social networks, most Meme participants have experienced some degree of loss, as extreme market conditions often lead to high risks. It remains uncertain whether the next step in the Meme craze will be to push prices higher or follow in the footsteps of NFTs. This serves as a reminder to everyone to conduct thorough research (DYOR) before making any important decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。