If Sui and Aptos want to survive longer in this market, they need to promote the Move language.

On October 14, the closing price of the SUI token broke $2.3, setting a new historical high, with its market cap entering the top 20, and the upward trend continuing, with a two-day increase of over 30%.

While the entire cryptocurrency market was fluctuating alongside Bitcoin, SUI surged nearly 300% from $0.75 to its historical peak, making it the best-performing public chain token from the beginning of 2024 to now.

People can't help but wonder if Sui will surpass the performance chains big brother Solana and Ton?

However, such comparisons are not very meaningful. In the previous issue of Crypto-Value, I mentioned that when comparing public chain projects, in addition to whether they pursue performance or stability, another aspect is their "age."

Whether it's Ethereum, Cardano, Solana, or Ton, they have all experienced at least one round of bull and bear market transitions, but Sui only launched its mainnet in 2023, making it truly a "youth."

However, Aptos launched around the same time, and they can be said to have been born from the same team, which makes the comparison more valuable.

The plan for the Crypto-Value column is to evaluate projects from the perspective of an angel investor or VC, strictly assessing investment projects' strategies based on due diligence, fundamentals, competitors, valuation, technical aspects, and founders.

Due Diligence: Same Origin, Different Paths

Sui and Aptos are referred to as "born from the same team" because their core team members all come from Meta's (formerly Facebook) cryptocurrency project Diem.

Due to regulatory reasons, Meta ultimately abandoned the Diem project, but some core developers from the project chose to leave Meta, establish their own paths, and create Sui and Aptos, aiming to realize the original technical concepts of Diem.

In addition, both Sui and Aptos use the programming language Move, originally developed by Meta for the Diem project. The white paper describes it as: "Resources can never be copied or implicitly discarded; they can only be moved between program storage locations," hence the name "Move."

The difference between Move and other programming languages like Solidity used in Ethereum lies in its resource usage, which is derived from the mathematical concept of linear logic.

In linear logic, formulas are treated as basic resources that can only be used once. This mechanism aims to maximize security without increasing the complexity of transactions, thereby reducing gas fees.

In short, the Move language can provide a safer and more flexible smart contract development environment, especially excelling in asset management and high-frequency trading.

Most importantly, Sui and Aptos share extremely similar design philosophies with Solana in terms of parallel processing, consensus optimization, proof of stake (POS), and storage efficiency, all dedicated to solving the performance bottlenecks of traditional blockchains (which I define as "stable chains").

This is why the market often compares these two "youths" with a "middle-aged" counterpart. However, the advantage is that the youth can reference the paths taken by the middle-aged as they grow, potentially capturing the explosive growth path of Solana again.

In fact, Sui has already begun to do this. After Solana experienced terrifying growth through the memecoin sector during the bear market, meme coins in the Sui ecosystem have also started to flourish.

If you are a meme coin speculator or investment enthusiast, I highly recommend you to position yourself early in leading dog coins, frog coins, etc., within the Sui and Aptos ecosystems (see below).

Now, looking back, while Sui and Aptos seem to converge in most technical designs, they actually have significant differences in their technical implementation paths and version scales, allowing investors to achieve a diversified effect when investing in both.

Specifically, Aptos generally follows the textbook design of the Diem white paper, while Sui's object model differs slightly from Aptos because its storage system is object-centric, meaning you can see most things on the blockchain, including addresses and transactions.

Sui clarifies whether objects are owned, shared, mutable, or immutable, while Aptos does not. Additionally, Sui's ownership API is more concise than Aptos's, as it more clearly presents the blockchain design.

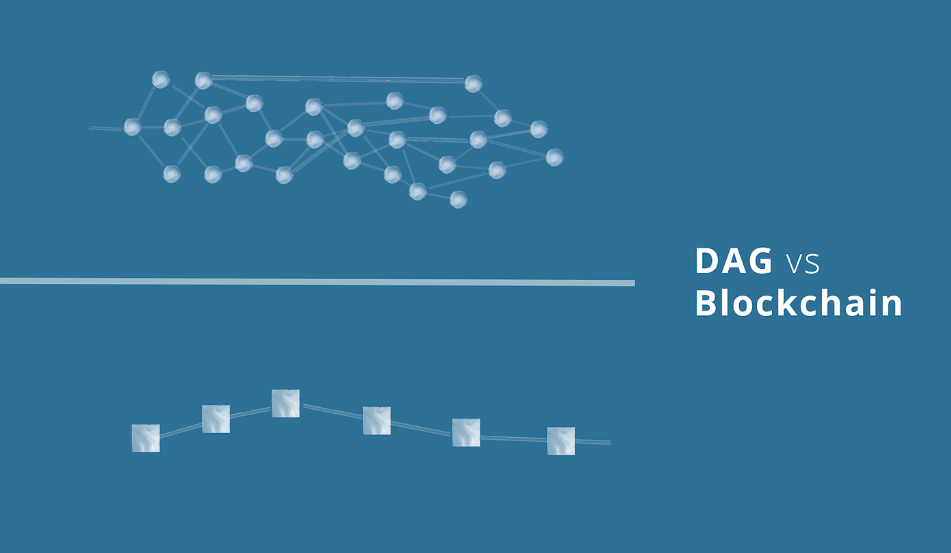

Furthermore, Aptos achieves parallelization by dynamically detecting dependencies and using BlockSTM (a derivative protocol of the HotStuff consensus protocol) to schedule execution tasks (see above).

Sui further innovates by implementing Narwhal and Tusk as its consensus algorithm, which is a DAG (Directed Acyclic Graph)-based memory pool for parallelization at the execution layer (see below).

This protocol is asynchronous, meaning it can resist DoS (Denial of Service) attacks. So on the surface, Sui has a slight advantage over Aptos in terms of security.

However, I believe that the security innovations of performance chains can even be disregarded, as their decentralized attributes begin to blur when the number of nodes decreases.

The so-called security is also at a centralized level and is not revolutionary, which is why they have a high probability of chain breaks; just look at the history of Solana and Ton.

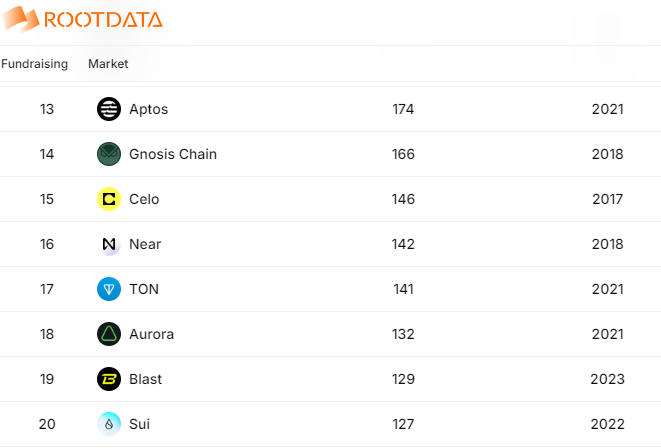

Finally, regarding version scale, Aptos has a first-mover advantage, having launched slightly earlier than Sui, so its ecosystem scale and participant scale are naturally larger and have already been validated.

Specifically, Aptos has higher activity on GitHub, with more code commits and contributors, indicating a larger development community.

Additionally, the number of projects in the Aptos ecosystem is richer, with over 170 active projects, while Sui has around 120 projects (see above). A more mature ecosystem typically means an advantageous market position and more collaboration opportunities.

Having compared the background, technology, and current status, let's now look at how the "youthful potential" of both has impacted the prices of their native tokens.

First, let's look at SUI (see above). Like most VC tokens, there was a significant pullback after the token was issued, but with this year's "pseudo-bull market" (driven by Bitcoin and Ethereum through ETFs), the price quickly rose above market cap and TVL, before pulling back again below the market cap curve.

Soon after, a suspected "whale" pumped the price, or it could be that the price was already undervalued, leading to a synchronous explosion in token price, market cap, and TVL. Now, the three curves are intertwined, with the price curve still slightly below the other two.

Overall, this wave of increase is reasonable, as it is not just the price that is rising. Furthermore, historically, when the three lines intertwine, it is very likely to welcome another explosive growth.

Next, let's look at APT (see above). In contrast, APT had a wave of explosive growth before the "pseudo-bull market," and then the price closely followed the market cap curve, with the TVL curve only showing a significant upward trend until now.

Currently, the price curve is far below the other two, and more positively, the highest is actually the TVL curve, indicating that APT's price may be severely undervalued.

Fundamentals: Stable Supply of Tokens

In terms of token economics, compared to the already mature ADA mentioned in the previous issue, SUI and APT are both very complex, but I will try to simplify it for you.

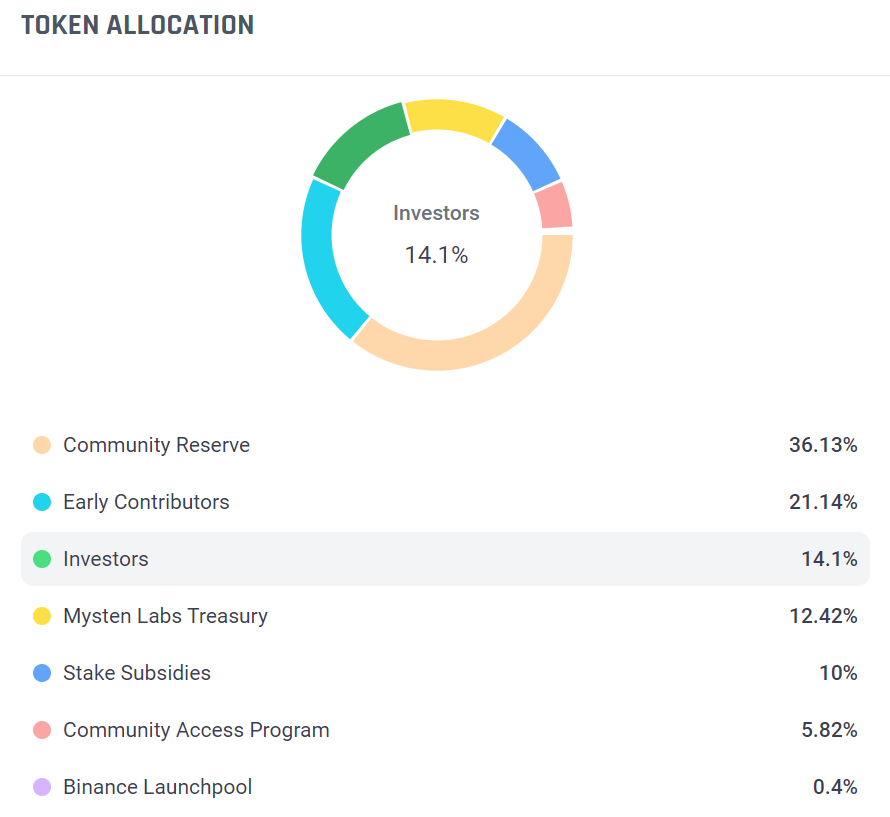

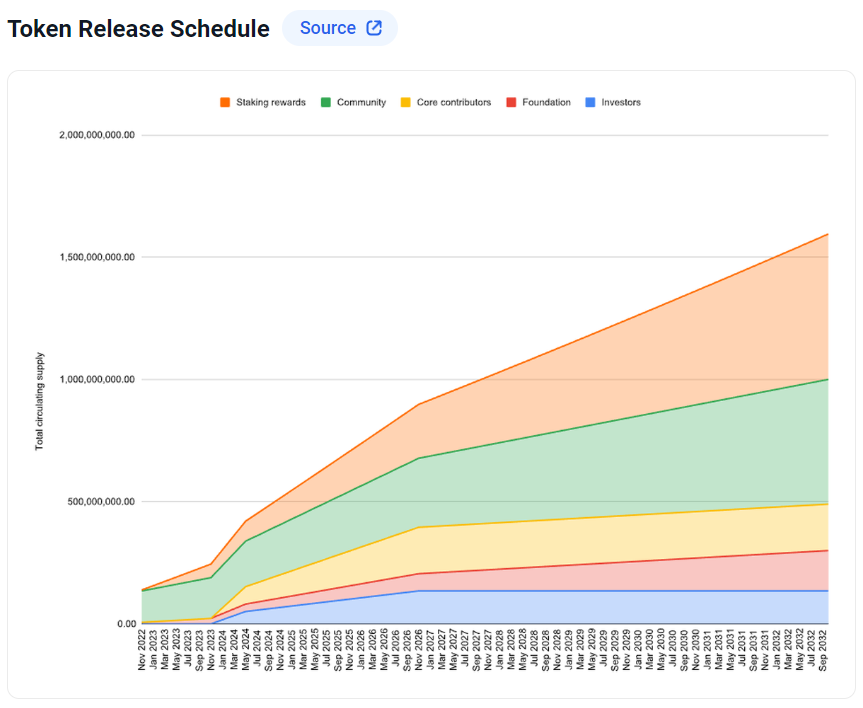

First, the token distribution of SUI is incredibly complex, with various roles participating (see below). This is not a good thing, as the more types of roles involved in token distribution, the higher the uncertainty in the future.

Since SUI is a VC token, early investors and team members holding the tokens have not yet been able to exit with profits, and they will certainly try to pump the price, so we should pay more attention to the proportion of early investors in the token distribution.

Investors account for 14.1%, early contributors 21.14%, and the lab's self-holding is 12.42%. These proportions, which could potentially be sold off to "cut leeks," add up to 47.66%, nearly half.

This is a good thing for us to invest before the bull market, as we can already determine that SUI will definitely experience a crazy surge during this round of the bull market. However, we also need to exit when the project is overvalued, just like these early participants.

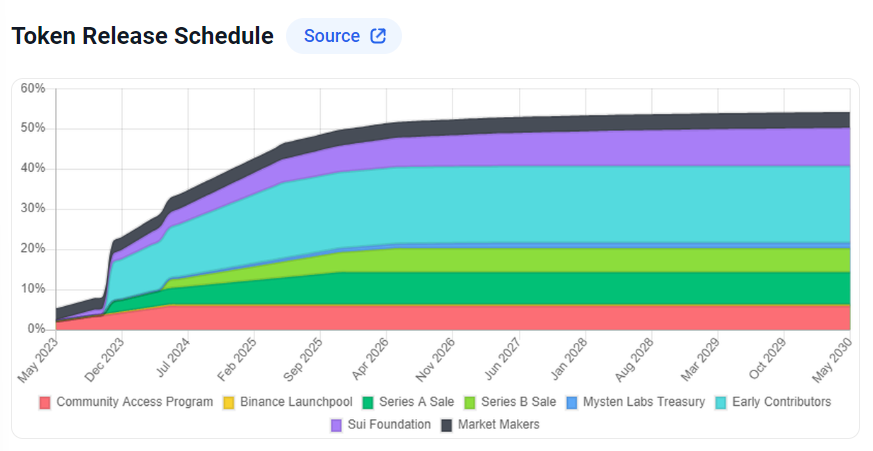

Another predictable factor is the impact of the token unlock cycle. Regardless of which role is involved in the token distribution, it will be a linear unlock in 2025, so the supply is relatively stable.

The total supply of SUI tokens is fixed at 10,000,000,000, with a current circulation of 2,845,750,695, accounting for 28.46%, which is slightly less than the planned 35% shown in the chart below.

The reason may be that even if the tokens are unlocked, it does not mean that all unlocked tokens can immediately enter the market for circulation. Many projects have additional lock-up rules for tokens allocated to teams, early investors, or community funds.

However, we can conclude that this gap is approximately at a ratio of 0.813, which can be used for the token circulation forecast in 2025.

Continuing with the chart below, the planned circulation of SUI in 2025 should be around 45%, multiplied by 0.813 gives us 36.585%. When multiplied by the total supply, the circulation in 2025 is approximately 3,700,000,000.

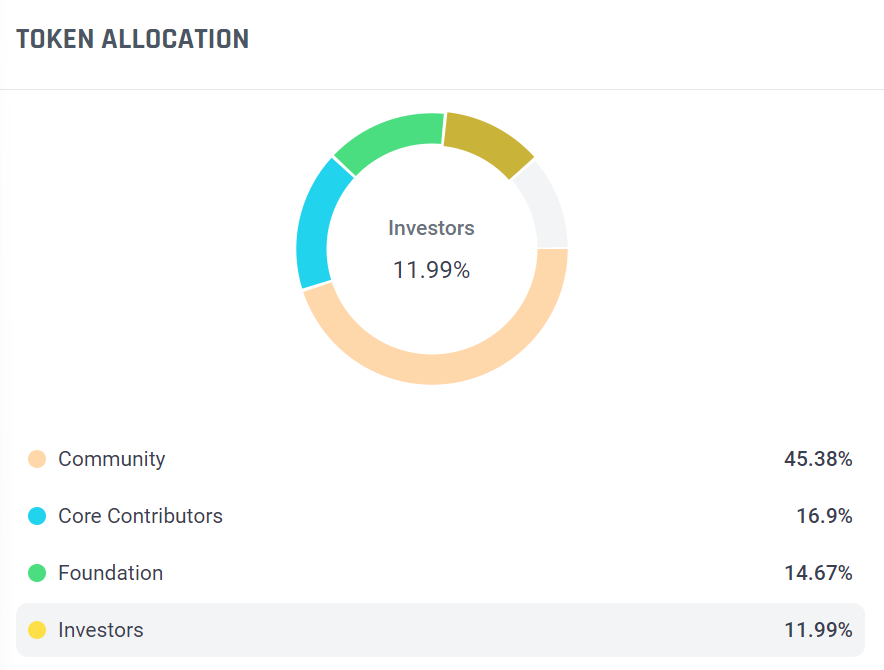

Moving to APT, we find that both the token distribution and the token unlock cycle are much simpler and easier to understand. The only thing worth mentioning is that APT has an unlimited issuance, unlike SUI, which has a fixed supply.

If you are an investor who will exit for arbitrage during this bull market, then this difference does not affect you at all, as both will be in the issuance phase in 2025.

However, if you plan to hold for the long term, then SUI's fixed supply may be more attractive, as it ensures scarcity.

In APT's token distribution, investors account for 11.99%, the team accounts for 14.67%, and core contributors account for 16.9%, totaling 43.56%, which is also close to half.

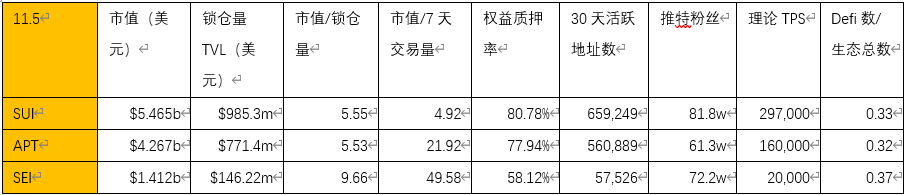

Next, we calculate the token circulation of APT in 2025. According to the unlock cycle shown in the chart below, the circulation of APT at the beginning of 2025 should be 550,000,000, while the current circulation is 519,059,281, which is basically in line.

The planned circulation at the end of 2025 is 750,000,000, so taking the average, it should be 650,000,000. Therefore, the average unlock amount for Aptos in 2025 is expected to be 650,000,000.

Competitors: Supplementing Due Diligence Data

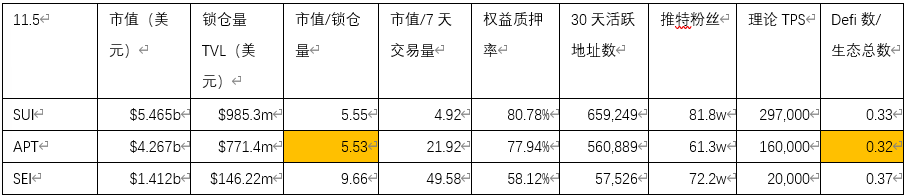

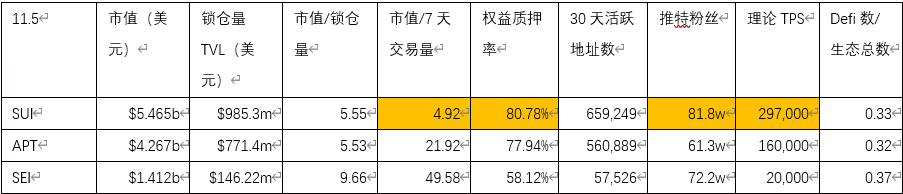

To make a fair comparison, I have brought in another comparison item, which is also a public chain project released in 2023, currently still a "youth," Sei.

But to be honest, apart from having more Twitter followers than Aptos, there is no other aspect where it can compete with the first two.

Aptos slightly outperforms Sui in terms of market cap/locked amount and the number of DeFi projects/total ecosystem, as shown in the two indices (above). This indicates good user activity, stickiness, and a diversified ecosystem.

On the other hand, Sui seems to have entered its "adolescence," with almost all data and indices far ahead (below).

Valuation: Comparing to SOL's History

Since SUI and APT are both projects preparing to experience their first bull market, their growth during the bull market will be very rapid. The top-down valuation method may lead to underestimation, so this time we will directly use a bottom-up approach for valuation.

The top-down valuation method can refer to the previous issue's research analysis on ADA. If you are interested, you can use that method to value the two.

As usual, each valuation strategy will have conservative, fair, and aggressive assessment scales, and readers can choose or combine them based on their risk preferences.

First, let's look at what level Solana reached during its first bull market. In the 2021 bull market, SOL rose from $25 to around $250, roughly a tenfold increase (below).

However, if you were an early holder, you would have seen a rise from the $1 level, increasing by about 250 times.

If SUI can be compared to SOL's explosive growth cycle, then conservatively, SUI's market cap could increase tenfold during this bull market (the price is already at the $2 level, and the market cap has surged), leading to a conservative estimate of SUI's market cap at around $5.5 billion.

For a fair prediction, that would be a 50-fold increase, corresponding to a market cap of $22 billion. Aggressively, the market cap could increase 200 times to reach $110 billion.

Based on the fundamentals, the expected circulation of SUI in 2025 is around 3,700,000,000, leading to price estimates under the three scales of $1.49, $5.95, and $29.73 (below).

We can see that under conservative estimates, SUI's current price ($2) is already higher than the predicted price, so whether now is a good time to buy needs careful consideration.

Similarly for APT, conservatively, the market cap could increase tenfold to $4.3 billion, fairly, it could increase fiftyfold to $21.5 billion, and aggressively, it could increase to 200 times to $86 billion.

Based on the fundamentals, the expected circulation of APT in 2025 is around 650,000,000, leading to price estimates under the three scales of $6.62, $33.08, and $132.31 (below).

Again, under conservative estimates, APT's current price is already overvalued, so both tokens have potential for growth only during the bull market.

Technical Analysis: What Price to Enter Recently?

Now, as angel investors, we have determined to invest in these two projects! So we should discuss a "good price," right?

Therefore, we need to conduct a more micro technical analysis to see what price offers the best value recently.

For SUI, even though the recent upward momentum has weakened, it has not deviated from a reasonable upward channel, and the price has been consistently touching the support level, so $1.82 is a good entry point (below).

However, since the results of the U.S. elections will be announced tomorrow, there is also a possibility of a sudden drop, with a more aggressive support level at $1.03.

But if you judge that after the U.S. elections, we will directly enter a bull market, then hurry up and buy now.

APT's recent situation is not as strong as SUI; it has already broken below the stable upward channel (below). I previously entered a portion at the lower edge of the channel at $9.36, which seems to have been too early.

Fortunately, the next support level has rebounded, and I also managed to catch some limit orders, so now buying around $8.3 offers really high value.

The Founders

Finally, let's take a look at the founders of the two projects. Evan Cheng (in the above image) is the co-founder and CEO of Mysten Labs, the creator of Sui, while Mo Shaikh (left in the below image) is the co-founder and CEO of Aptos Labs.

Evan Cheng and Mo Shaikh both worked on Meta's Diem and Novi projects, focusing on different functional areas. Evan was mainly responsible for technical architecture and the development of the Move language, while Mo focused on strategy and market development.

They are both committed to making Diem a globally usable digital payment system. However, due to regulatory pressure, Meta ultimately chose to terminate the Diem project, which also presented an opportunity for both to independently promote their blockchain visions.

Although they now lead different companies and projects, they share a similar vision for advancing blockchain infrastructure development. Their blockchain projects are dedicated to achieving high throughput and low latency performance, supporting the scalable implementation of decentralized applications.

In the cryptocurrency industry, Sui and Aptos are often compared due to their common origins and similar technical backgrounds, and the "co-opetition" relationship between the two has become a hot topic in the crypto space.

Where there is a topic, there is a narrative, and where there is a narrative, there is an increase, right?

In summary, Sui and Aptos will definitely benefit in this bull market, and Sui has already started to gain traction. So if you are a value investor for the next bull market, you can confidently invest in these two projects.

However, beyond the projects and tokens, those who understand technology can delve into the advantages and sustainable development potential of the Move language.

Because if Sui and Aptos are to survive longer in this market, they need to promote and expand the Move language.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。