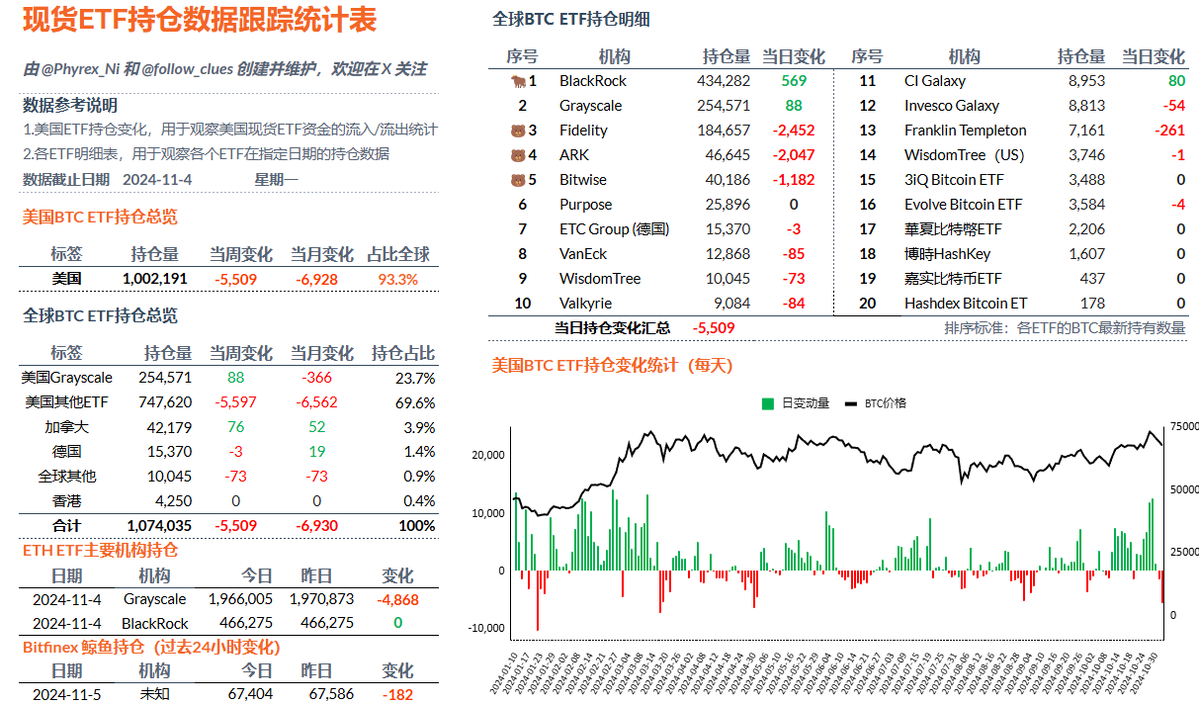

Earlier, when discussing ETH data, it was mentioned that the reduction in BTC spot ETF holdings would be greater, and this has indeed been the case. In the past 24 hours, twelve ETFs in the United States have collectively reduced their holdings by 5,509 #BTC, marking the largest reduction since early September. This reflects the previous FOMO among investors regarding BTC. When the expectation of Trump's election was high, many investors bought in, but now that the expectation has decreased, we see this segment of speculative investors exiting.

Similar to #ETH, BlackRock's investors are still continuously buying BTC and ETH. Although the buying volume is not large, there is still a net increase observed, while the majority remains focused on selling. Yesterday, aside from the 763 BTC increase in BlackRock and Grayscale's Mini ETF, nine other institutions collectively saw an outflow of 6,272 BTC, with only one institution showing no change.

This situation clearly reflects the election period's speculation and aligns with the current price movement trends. Essentially, it is a game between users regarding Trump and Harris. A victory for Trump would lead to a noticeable increase in BTC holdings, while an increase in Harris's winning probability would result in significant selling.

Voting with money seems to be more reliable.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1N8YIm1ZzDN197hMAlkuvH3BgFb8es0x1y4AJLCbDPbc/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。