Although the intensity of the election can be clearly seen in the current struggles of investors, this is reflected in the spot ETF with a significant amount of risk-averse sentiment among investors. In the last trading day, both #BTC and #ETH showed a considerable trend of reduction, with ETH experiencing a slightly smaller reduction. However, due to the previous FOMO surrounding BTC, the reduction is now more aggressive.

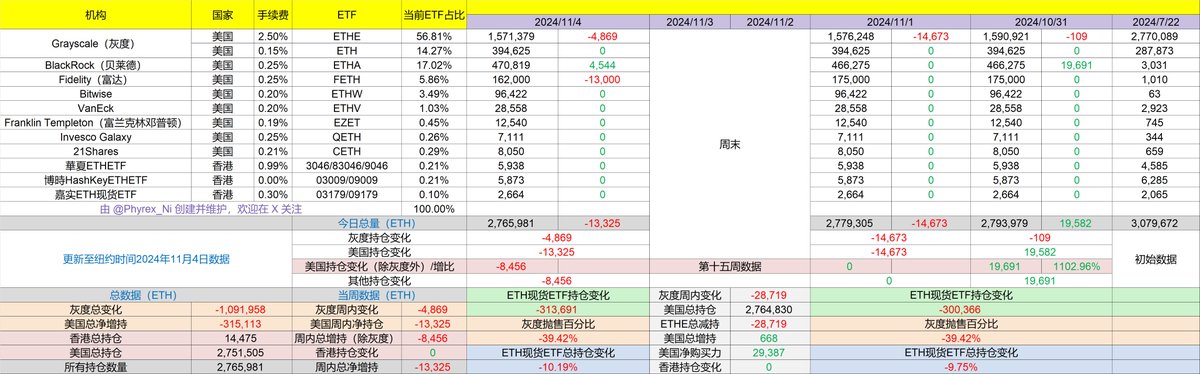

In the ETH spot ETF, yesterday marked another day of net outflow, and the outflow amount was substantial. On one hand, Grayscale's $ETHE continues to see significant selling, with a reduction of 4,869 coins in the past 24 hours. On the other hand, Fidelity experienced its largest sell-off ever, amounting to 13,000 ETH. Although these two sell-offs are notable, they represent a rare intensity of selling.

In terms of net inflow, although BlackRock's investors are still buying, the buying strength is still far less compared to the selling. In the last trading day, there were only 4,544 ETH bought, resulting in a net outflow of 13,325 ETH yesterday. Overall, the market sentiment is not very friendly.

The data has been updated, address: https://docs.google.com/spreadsheets/d/1W7JJ8lMQiUUlBb9U-BvFoq2H-2o5CpUuPO4D_KK3Ubw/edit?usp=sharing

This tweet is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。