In the most active regions of cryptocurrency around the world, the underlying logic for Stripe's acquisition of Bridge is the free exchange and circulation of fiat and stablecoins, even in daily consumption scenarios.

Written by: Sima Cong AI Channel

What truly connects the general public with cryptocurrency is not computer technology, but financial institutions, and the essence is regulation.

Causes of the Event and Personal Conclusions

- Both Stripe and Bridge are currently entering a red ocean;

- The technology itself is not the core moat; the consideration for mergers and acquisitions is "reconstruction cost";

- The core stablecoin itself needs to be "stable"; for example, the recent investigation of Tether has caused uncertainty, which essentially means stablecoins need regulatory certification;

- Bridge has not yet obtained regulatory approval across the United States, let alone worldwide;

- One point we cannot ignore is that even national fiat currencies may not be universally accepted, such as the current Russian ruble;

- Another point is the regulatory policies for financial exchange and circulation in various countries, such as China's annual total volume control (50,000 USD);

- The key is which segment to enter: currently, the most common solution is the issuance of crypto debit cards; centralized exchanges or wallet companies usually collaborate with card organizations like Visa and Mastercard to issue crypto debit/credit cards, allowing users to use their crypto holdings for online or offline purchases, while the issuing company converts the cryptocurrency into local fiat currency through withdrawal payment channels before paying the merchant.

- Especially in the fields of daily consumption and inter-business settlements and cross-border settlements, the legal recognition and use of stablecoins is the most core incremental market;

- Therefore, the core logic is: in the most active regions of cryptocurrency around the world, due to the free exchange and circulation of fiat and stablecoins, as well as the settlement in daily consumption scenarios, this incremental scale is the underlying logic for Stripe's acquisition of Bridge;

Stripe splurged 1.1 billion dollars to acquire Bridge.

As one of the three major payment giants in the United States, Stripe has finally placed a big bet after its crazy attempts with Pay with Crypto this year. It acquired the stablecoin API company Bridge.xyz, which was only established two years ago, for 1.1 billion dollars, creating the largest acquisition deal in the crypto industry.

Bridge was founded by entrepreneurs Sean Yu and Zach Abrams and is a stablecoin API engine that provides software tools to help companies accept stablecoin payments. The two founders previously sold their Venmo competitor Evenly to Block in 2013; Abrams is also a former senior employee of Coinbase.

Bridge's Orchestration API integrates stablecoin payments into existing Web2 businesses, handling all compliance, regulatory, and technical complexities.

Bridge's Issuance API helps users issue their own stablecoins and offers a 5% investment option in U.S. Treasury bonds to improve capital utilization.

This set of APIs, combined with Bridge's own development of 1) cross-chain stablecoin trading, 2) fiat/crypto deposit and withdrawal acceptance, and 3) virtual bank accounts provided through Leed Bank, enables Web2 users to use stablecoins for payments more conveniently, providing a smoother and seamless user experience.

Bridge states that using its API allows for global fund transfers in minutes, seamlessly sending stablecoin payments, converting local fiat currency into stablecoins, and providing global consumers and businesses with dollar and euro accounts, allowing users to save and spend in dollars and euros.

According to Fortune magazine, SpaceX uses Bridge to collect payments in different currencies across different jurisdictions and transfers them to its global treasury via stablecoins.

Bridge has also established partnerships with crypto companies such as the Stellar blockchain network and the Bitcoin payment app Strike, providing infrastructure for their own stablecoin payment functions. Additionally, Coinbase has adopted Bridge's services to support transfers between Tether on Tron and USDC on Base. According to statistics, the annual payment volume processed by Bridge has exceeded 5 billion dollars.

Currently, Stripe is just a payment gateway, relying on networks like Visa/Mastercard: –– charging an additional 1-3% –– relying on banks/local partners –– low authorization rates for stablecoins can eliminate all intermediaries, thus owning the stack.

"If there were only one stablecoin on a single blockchain, then Bridge would have no reason to exist. The value of Bridge lies in allowing developers to seamlessly convert between fiat and stablecoins and flow between different blockchains."

However, this technology itself is not the core moat and the threshold is not high.

Bridge has also obtained licenses in 48 states and holds a VASP license from Poland, and is currently applying for further licenses in New York and Europe.

Competitors are veterans in the red ocean

PayPal launched the PYUSD stablecoin on August 7, 2023, as the only supported stablecoin in the PayPal ecosystem, which will connect PayPal's existing 431 million users, providing a bridge for Web2 consumers, merchants, and developers to seamlessly connect fiat and cryptocurrency.

By opening up payment channels between fiat and cryptocurrency, issuing stablecoins as a medium of exchange, and building a PayPal account wallet system, PayPal has completed its framework layout for Web3 payments, forming a logical closed loop within its ecosystem.

MetaMask launched its latest feature "Sell" on September 5, allowing users to exchange cryptocurrency for fiat through MetaMask Portfolio and send funds to bank accounts. For compliance reasons, this feature is currently limited to the United States, the United Kingdom, and parts of Europe, supporting exchanges only in dollars, euros, and pounds.

MoonPay is currently the leading project for cryptocurrency deposits and withdrawals, with over 5 million registered users. In terms of coverage, MoonPay supports crypto payments in over 160 countries and regions, supporting exchanges for over 80 cryptocurrencies and more than 30 fiat currencies. In terms of payment methods, MoonPay currently supports credit and debit cards, mobile payments, and account-to-account payments. Uniswap has also previously used Moonpay as one of its deposit channels.

Preface: Originating from the Surge in Transaction Volume

In the second quarter of 2024, ending June 30, the transaction volume reached 8.5 trillion dollars from 1.1 billion transactions. During the same period, the transaction volume of stablecoins was more than double that of Visa's 3.9 trillion dollars.

Stablecoins account for nearly one-third of daily cryptocurrency usage, at 32%, second only to decentralized finance or DeFi, measured by the share of daily active addresses, which is 34%.

On June 20, 2024, the total transaction volume of the entire cryptocurrency market was 74.391 billion dollars, with stablecoins accounting for 60.13% of that, approximately 44.71 billion dollars. Among them, USDT (Tether) was the most used, with a market capitalization of 112.24 billion dollars, accounting for 69.5% of the total value of all stablecoins. On June 20, the trading volume of USDT reached 34.84 billion dollars, accounting for 46.85% of the total trading volume that day.

As Congressman Richie Torres (D-N.Y.) wrote in a September column for the New York Daily News, the surge of dollar stablecoins—made possible by the ubiquity of smartphones and blockchain encryption technology—could become one of the greatest financial empowerment experiments in human history.

The average cost of sending USDC on Coinbase's popular L2 network Base is less than one cent.

Background: An Overview of the Emergence and Evolution of Human Currency and Financial Institutions

Sequence: First came currency, then banks and other financial institutions, followed by various payment methods and tools.

The money changers of ancient Babylon, Greece, and Rome can be seen as today's various U businesses, and the popularization of technologies such as online banking and mobile payments in the cryptocurrency world, especially the free, fast, and low-cost exchange and transfer between fiat and cryptocurrency, is key to building the "circulation" of cryptocurrency infrastructure.

I. The Emergence of Currency

The origin of currency is closely related to human economic activities. As the complexity of commodity exchange increased, the earliest barter system exposed some flaws, such as mismatched demands between the exchanging parties and difficulty in measuring items. To solve these problems, people gradually sought a medium of exchange, leading to the emergence of currency.

1. Early Forms of Currency

- Commodity Money: The earliest form of currency used items with intrinsic value as a medium of exchange, such as shells, livestock, and grain.

- Metal Money: With the development of the social economy, precious metals (such as gold, silver, and copper) gradually became the main form of currency due to their scarcity, durability, and portability. Ancient civilizations such as China, ancient Greece, and Rome all used metal money.

2. The Emergence of Paper Money

- Chinese Paper Money: The world's earliest paper money appeared in China during the Tang Dynasty as "flying money," while the "jiaozi" during the Song Dynasty was the first official paper currency. This marked the transition of human currency from physical forms to credit currency.

- Modern Paper Money: With the development of the banking system, countries began to issue paper money backed by national credit, gradually replacing the circulation of metal money.

II. The Emergence and Evolution of Financial Institutions

The emergence and development of financial institutions are closely related to the complexity of human economic activities and the demand for fund management and circulation.

1. Early Financial Institutions

- Early Forms of Banks: The early forms of financial institutions can be traced back to the money changers of ancient Babylon, Greece, and Rome. They helped people exchange currency and safeguard wealth, forming the basis of the earliest banking services.

- Medieval Banks in Italy: The true origin of modern banks can be traced back to the private banks established in Florence, Venice, and Genoa in medieval Italy. These cities established the earliest private banks, providing deposit, loan, and remittance services.

2. The Birth of Central Banks

- The Swedish Central Bank: The world's first central bank is the "Sveriges Riksbank" in Sweden, established in 1668. It is a government-controlled institution responsible for regulating the money supply and stabilizing the economy.

- The Bank of England: In 1694, England established the Bank of England, becoming the world's first modern central bank. It undertook functions such as issuing currency and government borrowing, gradually developing into the core of the national financial system.

3. Development of the Modern Financial System

- The Rise of Financial Markets: With the advancement of the Industrial Revolution, capital markets rapidly developed, especially in the 19th century, when stock and bond markets began to become the core of the economy. Financial centers such as London, Paris, and New York became hubs for global capital flow.

- Separation of Commercial Banks and Investment Banks: In the early 20th century, with the specialization of economic activities, commercial banks (primarily providing deposits and loans) gradually separated from investment banks (primarily providing capital market services).

- Globalization and the Modern Financial System: With the development of globalization, multinational financial institutions and international financial markets rapidly emerged. New financial instruments and technologies, such as financial derivatives, electronic payments, and cryptocurrencies, continuously emerged, changing the structure of the traditional financial system.

III. Future Development of Currency and Financial Institutions

Entering the 21st century, with the advancement of technology, currency and financial institutions are undergoing rapid transformation:

- Digital Currency and Cryptocurrency: Decentralized digital currencies like Bitcoin have emerged, challenging the traditional currency system. Meanwhile, central banks around the world have begun to develop Central Bank Digital Currencies (CBDCs), attempting to digitize the functions of paper money.

- Financial Technology (FinTech): The rise of financial technology has made financial services more convenient, with innovative models such as online banking, mobile payments, and P2P lending changing people's financial behaviors.

- Global Financial Governance: With the interconnectedness of international financial markets, international financial institutions (such as the International Monetary Fund and the World Bank) play an increasingly important role in global financial governance.

3.1. Current Status of Fiat and Stablecoin Exchange

The Bank for International Settlements defines digital stablecoins as a type of encrypted digital currency designed to maintain a stable value relative to a specific asset or a basket of assets. Stablecoins are token-based; their validity is verified based on the tokens themselves rather than the identity of the counterparty, meaning they are account-based payments.

Stablecoins are in the same domain as Bitcoin and other cryptocurrencies because they are electronic currencies that can be traded peer-to-peer without the need for central bank clearing. Additionally, it is important to note that digital stablecoins refer to cryptocurrencies with characteristics such as anonymity, decentralization, and immutability that maintain stable value through price mechanisms. Recently, the G7, IMF, and BIS established a working group specifically responsible for stablecoin-related businesses, referring to digital currencies launched by technology or financial institutions, based on existing large and/or cross-border customers, that have the potential for global application as global digital stablecoins. Digital fiat stablecoins refer to digital stablecoins backed by fiat currency collateral.

The price stabilization mechanisms of digital stablecoins can be divided into two types: one is algorithm-based; the other is collateral-backed. The algorithm-based digital stablecoins do not have any assets backing them but rely solely on algorithms to adjust supply and demand balance based on the current price of the stablecoin to maintain the stability of the exchange rate, for example, Basis pegging to 1 dollar to adjust supply and demand. The collateral-backed digital stablecoins use fiat currency, gold, digital assets, and other assets as collateral for their stabilization mechanism, which has a higher degree of certainty compared to the former.

Digital stablecoins first appeared in July 2014 when the globally renowned cryptocurrency exchange Bitfinex established Tether, which issued Tether (USDT) pegged to the US dollar at a 1:1 ratio. Tether promised that the circulating USDT is backed by 100% dollar deposits and has been audited by a third party. Tether was initially designed for individuals who could not directly use dollars for cryptocurrency transactions. After China shut down cryptocurrency exchanges in 2017, Chinese cryptocurrency users became one of the most important user groups for USDT.

The top two are USDT and USDC.

Customers transfer dollars into Tether's bank account, and after Tether confirms receipt of the corresponding funds, USDT equivalent to the dollar amount is transferred from Tether's core wallet to the customer's wallet, which is the issuance of USDT. If a customer wishes to redeem dollars, after transferring their USDT to Tether's core wallet and paying a fee, Tether will transfer an equivalent amount of dollars to the customer's bank account and destroy the corresponding amount of USDT.

Once Tether enters the circulation field, any business or individual can trade freely.

Tether Limited issues all USDT through the Omni Layer protocol. Omni operates on top of the Bitcoin blockchain, so all issuance, redemption, and existing USDT, including transaction history, can be publicly audited using tools provided by Omnichest.info.

3.2. Process of Purchasing Cryptocurrency

The most common and acceptable payment methods for purchasing cryptocurrency include: credit cards, bank transfers, and even cash. Different websites accept different payment methods, so you need to choose a website that accepts the payment method you want to use.

Not all cryptocurrencies can be purchased on every website. You will need to find a website that sells the cryptocurrency you want to buy.

Each website has different fees. Some are cheap, while others are not so cheap. Before setting up an account on any website, make sure you know how much the fees are.

A cryptocurrency wallet is where you store your cryptocurrency after purchasing it. You can compare a cryptocurrency wallet to your bank account. Just as you store traditional currency (dollars, yen, euros, etc.) in a bank account, you will also store cryptocurrency in a crypto wallet.

There are many easy-to-use and secure options available. It is important to choose a highly secure wallet because if the cryptocurrency in your wallet is stolen, you will never be able to recover it.

There are three types of wallets:

- Online Wallets: Set up the fastest (but also the least secure);

- Software Wallets: Applications you download (more secure than online wallets);

- Hardware Wallets: Portable devices that you plug into your computer via USB (the most secure option).

The type of wallet needed will depend on the cryptocurrency you wish to purchase.

Cryptocurrency exchanges are online websites that allow you to exchange local currency for cryptocurrency. Exchanges are the most popular way to purchase cryptocurrency.

Most exchanges accept bank transfers or credit card payments, and some also accept PayPal payments.

Once you set up an account, you can start purchasing cryptocurrency on the exchange. Most exchanges operate like stock trading platforms: you can buy and hold your cryptocurrency or exchange it for another cryptocurrency.

3.3. Complete Process of Deposits and Withdrawals

In the world of cryptocurrency, safely withdrawing funds is a skill that every investor must master. As the cryptocurrency market continues to evolve, the withdrawal processes of major trading platforms are also constantly changing. Understanding how to withdraw funds safely and efficiently is crucial.

Withdrawal Methods

Bank Transfer: This is the most common withdrawal method, where you convert cryptocurrency into fiat currency and then perform a bank transfer. Most trading platforms support this feature.

E-Wallet Withdrawals: Using e-wallets (such as PayPal, Skrill) to withdraw cryptocurrency as fiat currency. This method is usually faster.

P2P Trading: Withdrawing funds through P2P platforms allows you to trade directly with other users, selling cryptocurrency to them and receiving fiat currency.

Withdrawal Fees

Different platforms may charge different fees. Typically, these include fixed fees and fees based on the transaction amount. Understanding the fee standards of each platform and using the following tips to reduce fees is important:

Choose a withdrawal method with lower fees.

Reduce the fee per transaction by making larger withdrawals.

Using External Service Providers

- Introduction to Exchange Services: You can exchange cryptocurrency for various fiat currencies (such as dollars, euros) through external service providers or OTC exchanges. These services often offer better exchange rates.

- Pros and Cons Analysis: The advantages of external service providers are flexibility and diversity, but there may be certain fees and risks involved.

Cross-Border Withdrawal Strategies

- Currency Exchange Path: Choose the optimal currency exchange path to minimize exchange rate losses and fees. For example, convert funds into a major currency before converting to the target currency.

- Use of P2P Platforms: Engaging in multi-currency trading through P2P platforms can enhance flexibility, but it is important to pay attention to the credibility of trading counterparts.

KYC/AML Policies

- Explanation of KYC/AML Policies: KYC (Know Your Customer) and AML (Anti-Money Laundering) policies require users to provide personal information and documentation to ensure compliance and avoid account freezes.

- Avoiding Account Freezes: Comply with the platform's KYC/AML policies to ensure your account information is complete and accurate.

Potential Issues

In the virtual currency market, the process of converting cryptocurrency into fiat currency (i.e., "withdrawal") is often accompanied by various risks, including high fees, complex processes, and potential legal issues.

IV. Current Status of Free Exchange

1. USDT Cards

The core idea is to utilize the price stability of USDT to provide users with a stable and convenient payment method.

The rates for cryptocurrency debit cards are often higher than those of centralized exchanges because users need to pay additional exchange fees to payment network providers. Users pay for goods and services priced in fiat currency using cryptocurrency through a crypto debit card, so the crypto debit card can only serve as a fiat withdrawal channel. It is important to note that using a crypto debit card for payments incurs capital gains tax, and the card must be preloaded with cryptocurrency before use.

USDT cards allow users to make payments globally without the need to exchange currency. Real-world use cases for users include cross-border shopping, travel expenses, and online subscription services. For example, a Chinese user can use a USDT card to purchase goods on an American e-commerce platform, avoiding complex foreign exchange conversions and high fees. Another scenario is using a USDT card to pay hotel and restaurant bills while traveling abroad, without worrying about the impact of exchange rate fluctuations. Additionally, users can use the USDT card to pay for subscriptions to international services like Netflix, avoiding issues with card declines or high fees. All fees in the process, such as foreign exchange conversion fees and service fees, will be clearly displayed before the user makes a payment.

Currently, there are various virtual currency debit cards on the market that offer USDT payment functionality, such as Binance Card, Crypto.com Card, and Wirex Card. These cards typically partner with Visa or MasterCard, allowing users to use them anywhere these payment networks are accepted.

Common issuance models for USDT cards include:

- Direct issuance by banks. Some traditional banks have begun to venture into the cryptocurrency space by directly issuing USDT cards. These banks leverage their own payment networks and compliance frameworks to provide users with stable cryptocurrency payment solutions. For example, Germany's Fidor Bank has entered the cryptocurrency field by directly issuing USDT cards. These banks utilize their own payment networks and compliance frameworks to offer stable cryptocurrency payment solutions.

- Collaboration between banks and third-party companies for issuance. Some banks collaborate with cryptocurrency companies, utilizing the technology and expertise of third-party companies to issue USDT cards. In this model, banks provide traditional financial infrastructure while third-party companies are responsible for the management and conversion of cryptocurrencies. For instance, in the Asia-Pacific region, Mastercard has partnered with Amber Group, Bitkub, and CoinJar to launch cryptocurrency payment cards, allowing users to spend cryptocurrencies globally.

- Issuance by third-party payment companies. Some companies focused on cryptocurrency payments independently issue USDT cards by collaborating with payment networks like Visa or MasterCard. These companies typically offer more flexible services and customized solutions to attract users with different needs. For example, Crypto.com and Wirex independently issue USDT cards through partnerships with Visa or MasterCard. These companies usually provide more flexible services and customized solutions to meet various user needs.

- SaaS model for collaborative issuance. Third-party payment companies provide USDT card issuance platforms for channel partners or other financial service providers through a Software as a Service (SaaS) model. This model allows other companies to quickly enter the cryptocurrency payment market, leveraging existing technology and compliance frameworks to reduce development and operational costs. For example, third-party payment companies like Bitmama provide USDT card issuance platforms through the SaaS model for channel partners or other financial service providers.

2. Cryptocurrency ATMs

As physical machines, the operational and maintenance costs are higher, resulting in high exchange fees, some of which can reach up to 20%. Cryptocurrency ATM operators purchase liquidity from third-party suppliers and transfer it to users' self-custody wallets, thus requiring remittance licenses.

The biggest advantage of cryptocurrency ATMs is anonymity and privacy, as users can purchase cryptocurrencies with cash, often without KYC processes. Sometimes identification documents are required, but proof of residence and facial recognition are typically not needed.

However, the types of cryptocurrencies supported are limited, primarily supporting BTC and ETH, and most ATMs do not provide withdrawal services. Coupled with high fees, they are often referred to as the most cumbersome way to purchase cryptocurrencies.

3. Centralized Exchanges (CEX)

Centralized exchanges are the most commonly used platforms for fiat deposits and withdrawals. Exchanges inherently have licensing advantages, lower fees, and support a variety of cryptocurrencies, making them the largest liquidity providers in the ecosystem. Retail investors can freely deposit and withdraw through custodial wallets, while merchants typically implement transactions and transfers via APIs and SDKs. As liquidity intermediaries, centralized exchanges profit from the spread between buying and selling liquidity and user fees.

When merchants and their customers use wallets hosted by the same exchange, transactions incur no fees, as funds are merely transferred between different accounts within the same custodial wallet. However, transferring using self-custody wallets will incur corresponding blockchain network fees.

4. Deposit and Withdrawal Aggregators

Deposit and withdrawal aggregators, such as MetaMask's fiat deposit service, guide users to purchase by providing multiple independent deposit and withdrawal projects and centralized exchange quotes, earning commissions. This category essentially serves as an information intermediary, facilitating liquidity sharing by aggregating multiple exchanges and independent deposit and withdrawal projects. Deposit and withdrawal aggregators have three main characteristics:

- They act solely as intermediaries providing quotes, with all transactions conducted through third-party suppliers.

- They do not require remittance licenses, as users undergo identity verification through third-party suppliers.

- In addition to fiat deposits and withdrawals, they can also offer DEX aggregators, liquidity staking, and NFT marketplace functionalities. Deposit and withdrawal aggregators primarily target retail investors and do not provide payment solutions for merchants.

5. Over-the-Counter (OTC) Trading

Over-the-counter (OTC) fiat deposit and withdrawal projects allow buyers and sellers to trade directly, eliminating intermediaries, but are also high-risk areas for fraud. There are two main models:

OTC desks, such as Kraken OTC. In the OTC desk model, the trading parties are customers needing trading services and the OTC desk acting as the counterparty. This model has three major advantages for deposits and withdrawals:

- No trading slippage. By providing fixed quotes for large transactions, it avoids losses from slippage, taking on risks for clients in exchange for the possibility of profiting from better-than-quoted transactions.

- More liquidity. OTC desks can execute trades at the best prices across multiple liquidity platforms.

- High privacy. Trading directly with an OTC desk allows clients to protect their privacy and avoid having transaction information appear on public order books.

6. Customer-to-Customer (C2C)

C2C, such as OKX C2C Trading, refers to direct transactions between individuals for fiat deposit and withdrawal without intermediaries or third parties. OKX holds the digital currency assets of both the buyer and seller until payment confirmation is received from the other party. The platform recommends users trade with certified merchants, as all certified merchants have undergone thorough vetting by OKX. The advantages of C2C include:

- Support for multiple payment methods. Buyers and sellers can define any payment method, and as long as the transaction occurs, they can confirm payment to facilitate the trade.

- Low trust costs. Both parties must first pass the platform's identity verification, and even stricter merchant certification checks. The platform also publicly shares users' transaction information to provide credit references, although it cannot eliminate the risk of some counterparties delaying or canceling orders.

- High privacy. In many countries (such as India), banks prohibit users from engaging in cryptocurrency transactions to avoid potential future policy risks. In C2C trading, users can conceal the purpose of their transfers from banks, thus bypassing banking restrictions.

V. The Essence of Regulatory Compliance

The unique innovation of cryptocurrencies makes their attributes difficult to define, and the vast majority of regions lack comprehensive regulatory frameworks. Currently, the legal licenses related to deposits and withdrawals can be divided into two main categories:

Focusing on payment and currency circulation licenses, such as the remittance licenses in the United States and VASP in the European Union; and specialized virtual asset service provider licenses, which will be the trend in the future.

In the United States, the scope of entities eligible to apply for a remittance license (MTL) includes international remittances, foreign exchange transactions, currency trading/transfers, ICO issuance, providing prepaid projects, issuing traveler's checks, etc., covering all institutions related to currency services.

To apply for this license, deposit and withdrawal projects need to register as money service providers with the Financial Crimes Enforcement Network (FinCEN) and then apply for a remittance license in the operating state. The application follows a registration licensing system and requires re-examination every two years. Due to the ambiguous nature of cryptocurrencies, deposit and withdrawal projects are subject to some degree of oversight by the U.S. Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC).

Compared to the United States, the European Union and the United Kingdom have a more complete regulatory system for cryptocurrencies. Deposit and withdrawal projects need to register for a virtual asset service provider license (VASP). Additionally, all exchanges, mining pools, wallet providers, custodial service providers, and decentralized applications require this license. Registering for a virtual asset service provider license in one EU country allows for business operations across the entire EU.

Lithuania, an EU country, has the most lenient cryptocurrency regulatory policies in the EU, with licenses obtainable within a month and no expiration, requiring a minimum authorized capital of only 2,500 euros, with no local personnel structure requirements. Many centralized service providers hold this license, such as Binance, BIT, Huobi, HyperBC, etc.

In Hong Kong, cryptocurrencies are classified as security tokens and non-security tokens, so operating virtual currencies legally in Hong Kong requires dual licensing. Depending on different regulatory authorizations, the Hong Kong Securities and Futures Commission regulates security token transactions conducted by virtual asset exchanges under the Securities and Futures Ordinance (License 1 + License 7); at the same time, it also regulates non-security token transactions conducted by virtual asset exchanges under the Anti-Money Laundering Ordinance (VASP license). On August 3, HashKey and OSL received permission from the Hong Kong Securities and Futures Commission to upgrade to License 1 (securities trading) and License 7 (providing automated trading services), allowing them to engage in retail cryptocurrency business in Hong Kong. This marks the first batch of institutions to obtain licenses since the new regulatory requirements for retail digital asset trading took effect on June 1, 2023.

In countries or regions that have clearly introduced exchange regulatory policies, a license obtained by an institution signifies that it is under the supervision of the local government and can legally operate cryptocurrency businesses. Users can deposit using fiat payment methods, and their assets and information are highly protected. Additionally, the quantity and quality of licenses reflect the confidence and determination of institutional exchanges to invest in the future, playing an important role in enhancing promotional effects and consolidating user confidence.

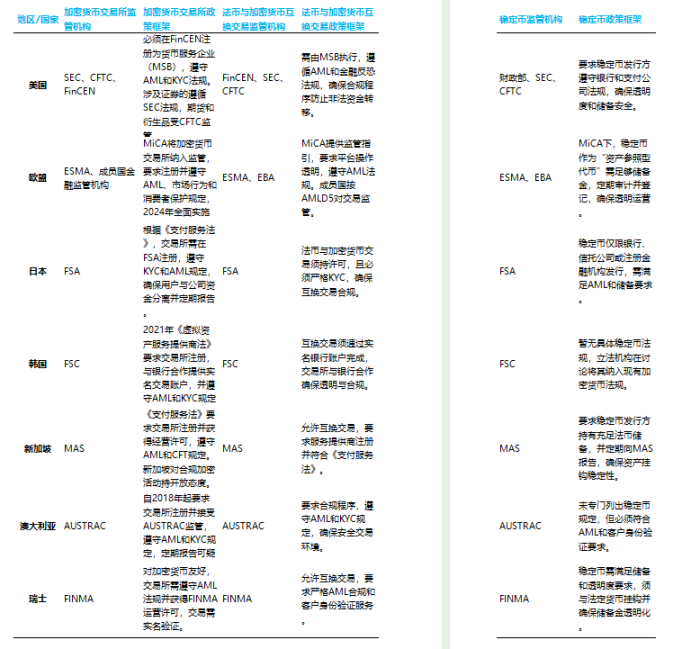

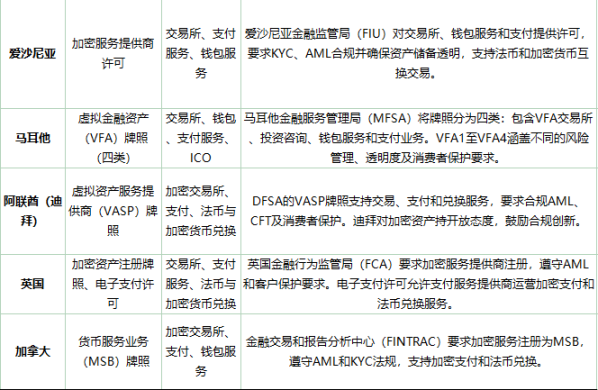

5.1. Detailed Explanation of Countries and Regions That Have Clearly Introduced Regulatory Policies for Cryptocurrency Exchanges, Fiat and Cryptocurrency Swaps and Transactions, Stablecoins, etc.:

Detailed types of licenses for cryptocurrencies and regulatory requirements in various regions, particularly covering financial institutions, payment services, and licenses related to fiat and cryptocurrency trading:

Countries and regions such as the United States, European Union, Singapore, Japan, and Switzerland have provided strict licenses and permits for cryptocurrency exchanges and payment services, covering various aspects such as fiat and cryptocurrency exchange, payment services, and wallet management.

Most countries generally require compliance with AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations, and in most regions, licensing is required, with regular reporting to regulatory authorities.

Some regions (such as Switzerland, Dubai, and Singapore) maintain a relatively open attitude towards cryptocurrency innovation, encouraging emerging financial technologies while providing compliance frameworks.

5.2. Detailed Explanation of Countries and Regions That Have Clearly Introduced Regulatory Policies for Cryptocurrency Licenses:

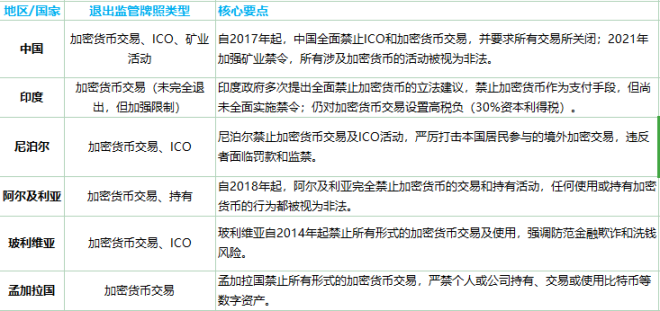

5.3. Summary Table of Some Countries and Regions That Have Clearly Withdrawn from Cryptocurrency "License" Regulation and Their Policy Highlights:

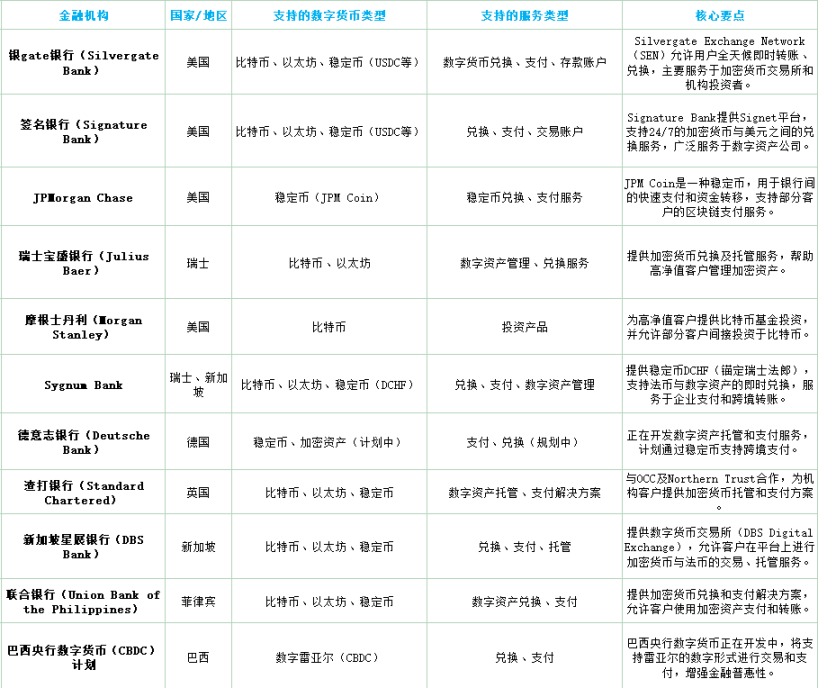

5.4. Summary of the Types of Exchange and Payment Support Provided by Some Banks and Financial Institutions Worldwide for Stablecoins and Other Cryptocurrencies:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。