Original | Odaily Planet Daily (@OdailyChina)

Author | Wenser (@wenser 2010)

In the crypto world, there is no "myth of eternal profit," but there is a "legend of capital absorption."

In October, according to Dune data, pump.fun has accumulated earnings of over $160 million, with a total address count exceeding 2.4 million and a total number of deployed tokens exceeding 2.8 million. Currently, its accumulated earnings have reached $167.3 million, meaning that in just about 4 days, as the "strongest capital absorption machine" of this cycle, pump.fun's earnings increased by approximately $7.3 million, which is quite astonishing.

Combining various protocol income data from the past year, Odaily Planet Daily will categorize and review the top 10 "strongest capital absorption protocols" in this article, revealing the trends and waves of change in the industry cycle for readers' reference.

Capital Absorption Machines Overview: 42 Major Projects with Income Exceeding $30 Million in the Past Year, Mainly Divided into 4 Categories

According to DefiLlama website data, narrowing the timeframe to within one year, there are currently 42 major project protocols with income exceeding $30 million, which can be mainly divided into the following categories:

Blockchain Ecosystem: L1 Networks Remain the "Mainstream Capital Absorption Giants"

Looking closely at the list of "protocols with income exceeding $30 million," we can clearly see that over the past decade of blockchain ecosystem development, L1 public chain networks remain the most mainstream "capital absorption giants," including:

Ethereum leads with nearly $2.57 billion in income over the past year;

Bitcoin ranks second with nearly $1.323 billion in income over the past year;

TRON, positioned as a "stablecoin network," has garnered $515 million in income;

Solana benefits from the booming Meme coin trend this year with $407 million in income;

BSC (BNB Chain) has benefited from its backing by Binance, with income reaching $180 million;

Avalanche has seen explosive growth towards the end of 2023, with monthly protocol income increasing from $2.5 million to $52.25 million.

Overall, despite the rugged and challenging development path of L1 ecosystems, they remain the main "pillar" supporting the crypto world, and Ethereum's staggering $19.367 billion** in protocol income (as of November 3, 2024) is indeed daunting. This also indirectly indicates that, as the largest ecosystem in the crypto world, Ethereum is far from the "desperate situation" often mentioned by many.**

Some Representative Ecosystems

Infrastructure Projects: Stablecoins and DEXs Become "Capital Absorption Experts"

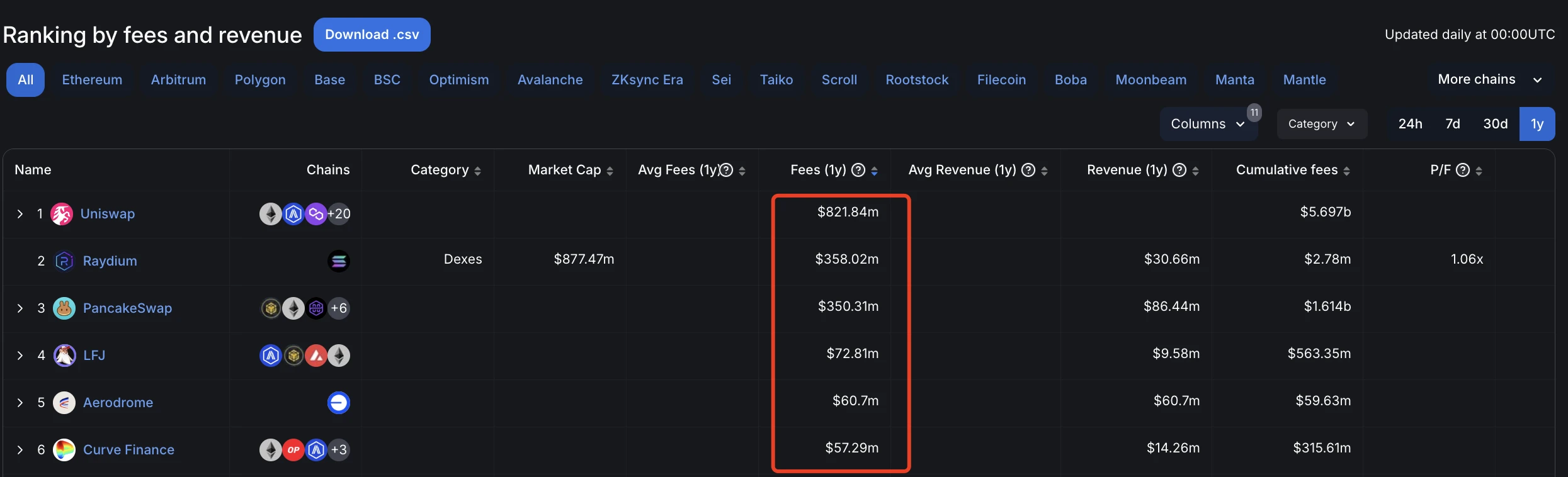

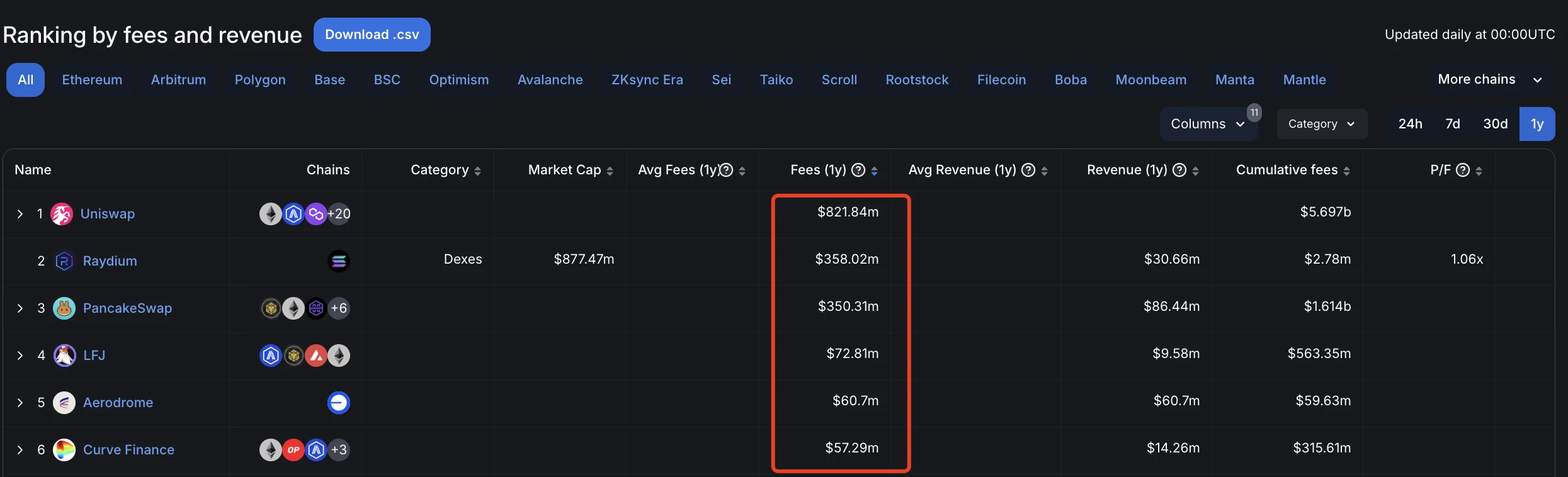

Another category of projects ranking high on the "capital absorption leaderboard" includes various infrastructure projects, including stablecoins, staking protocols, and DEXs, among which—

Tether, the issuer behind USDT, and Circle, the issuer behind USDC, rank high with nearly $16.17 billion and $516 million in protocol income, respectively;

DEXs like Uniswap, Raydium, and PancakeSwap occupy the second tier of this category, with protocol income ranging from $350 million to $820 million over the past year;

In addition, Ethereum ecosystem staking and re-staking protocols like Lido and Ethena also made the list with $986 million and $136 million in protocol income over the past year, becoming part of the "new infrastructure" and gaining high market recognition.

Some Representative Projects

Application Projects: Wallets and Meme Coin Platforms as "Capital Absorption Machines"

As for specific application projects, the previously "popular in the industry" wallet applications and the current thematic track "Meme Coin platforms" have become the most significant "capital absorption machines." Among them—

pump.fun (platform noted as Pump) ranks 16th with nearly $146 million in protocol income over the past year;

pump.fun ranks 16th

MetaMask (commonly known as the little fox wallet) ranks 28th with $70.49 million in protocol income over the past year.

MetaMask ranks 28th

Expansion Projects: L2 and Service Platforms as "New Capital Absorption Novices"

In addition to the main categories mentioned above, there are also many "expansion projects" ranking high in protocol income over the past year—such as Ethereum L2 networks including Base, Arbitrum, ZKsync Era, and Optimism, among which—

- Base ranks 26th with nearly $73.02 million in protocol income over the past year;

- Arbitrum ranks 32nd with nearly $56.19 million in protocol income over the past year;

- ZKsync Era ranks 38th with nearly $36.74 million in protocol income over the past year;

- Optimism ranks 41st with nearly $33.96 million in protocol income over the past year.

Some Representative Ecosystems

Service platforms are more diverse, including the former "NFT market king" OpenSea, aggregation trading platforms like DEX Screener, and various Telegram ecosystem trading bots like Photon, BONKbot, Trojan, Banana Gun, Maestro, etc. Of course, from the image below, we can also see that the Solana ecosystem remains the main focus of these projects.

Some Representative Projects

Overview of the Top 10 "Strongest Capital Absorption" Protocols, A Look at the Most "Profitable" Tracks in Crypto

Based on the above information and DefiLlama website data, we can filter out the following representative "capital absorption projects" based on total protocol income—

- Ethereum, with total protocol income of $19.369 billion;

- Uniswap, with total protocol income of $5.697 billion;

- BTC, with total protocol income of $4.144 billion;

- BSC (BNB Chain), with total protocol income of $2.857 billion;

- OpenSea, with total protocol income of $2.783 billion;

- Lido, with total protocol income of $1.939 billion;

- Tether, with total protocol income of $1.684 billion;

- PancakeSwap, with total protocol income of $1.614 billion;

- TRON, with total protocol income of $1.17 billion;

- AAVE, with total protocol income of $961 million.

Project Ranking Summary

Conclusion: Compared to "Version Answers," Steady Progress is the Key

Honestly, in my personal view, the back-and-forth of "capital absorption protocols" also reflects the changes in the crypto industry:

- Before 2020, the most capital-absorbing protocols were undoubtedly various public chains that started with ICOs, with Ethereum emerging from that time, laying the foundation for today's $300 billion market value;

- From 2020 to 2022, the Ethereum ecosystem became the "center of the cryptocurrency industry," with platforms and projects like Uniswap, Axie Infinity, STEPN, and OpenSea emerging in waves driven by industry trends like DeFi Summer, GameFi Summer, and NFT Summer, shouldering the banner of industry capital absorption;

- In the 2023-2024 phase, which is the current cycle, first appeared the "SocialFi golden product" represented by friend.tech, followed by the "MemeFi MVP" represented by pump.fun, making the crypto industry's "capital absorption black hole" an "asset issuance platform" that simultaneously holds liquidity and attention.

However, looking closely at the protocol income rankings over the past year and even over a longer time frame, version answers are at best "new entrants" in the "capital absorption track." Whether they can navigate through the mid-stage of the product lifecycle and ensure they "stay at the table" in the later stages remains an unknown.

Compared to countless "one-off" protocols and applications, perhaps a steady and sustainable ecosystem is still the best "capital absorption tool."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。