This week is the U.S. election week, and there is a lot of uncertainty surrounding the U.S. elections. Over the past month, Trump's popularity has been high, but Harris's chances of winning are gradually increasing during the election process. The U.S. elections have a significant impact on the entire market, and there is also a monetary policy meeting on Friday, where the market generally expects a 25 basis point rate cut. Currently, the cryptocurrency market is mainly in a wait-and-see mode for risk aversion. The implied volatility (IV) of options at-the-money this week has risen to 80%, and the IV of options this month is significantly higher than that of long-term options. There may be significant market movements in the coming days.

Chu Yuechen: Bitcoin and ETH Market Analysis and Trading Reference for 11.5

History shows that regardless of who wins, Bitcoin may rise after the U.S. elections

Bitcoin, which was born in 2009, is about to face its fourth U.S. election. Data from the previous three elections show that Bitcoin has consistently maintained an upward trend after U.S. elections, never falling back to the price on election day. If this trend occurs again, Bitcoin's price should peak in about a year.

The 2012 U.S. election also took place on November 5, when Bitcoin's price hovered around $11. In November 2013, Bitcoin's price peaked, rising nearly 12,000%, climbing above $1,100. In the first week of November 2016, during the U.S. election, Bitcoin's price was around $700. By December 2017, Bitcoin's price peaked at around $18,000, an increase of about 3,600%. In November 2020, coinciding with the COVID-19 pandemic, Bitcoin rose 478% in the following year, reaching a market high of about $69,000. In March 2024, Bitcoin set a new high of over $73,000. After each Bitcoin halving event, although its price is much higher than four years ago, the rate of increase has narrowed, and the return rate has gradually decreased. The percentage drop between the first and second numbers is 70%, and between the second and third numbers is 87%. If we continue this trend and assume a drop of about 90% this time, it would imply an increase of about 47.8% after the election. This would bring Bitcoin to approximately $103,500 in the fourth quarter of 2025.

As the U.S. presidential election approaches, market traders' anxiety is rising, but Bitcoin's 21-day Relative Strength Index (RSI) is currently at a neutral level of 56%, indicating that it is neither overbought nor oversold. A neutral RSI typically suggests that the risk premium is relatively low during market fluctuations, especially with the potential for implied volatility to decrease after the election.

All of the above are based on experience; whether this time will follow the patterns of previous elections is open to interpretation. Now that we've discussed the broader direction, let's look at how to approach short-term contracts. Yesterday, we provided a long position near 67,500 in the article, and today when the price rose to around 69,000, we also advised everyone to exit, securing a profit of 1,500 points.

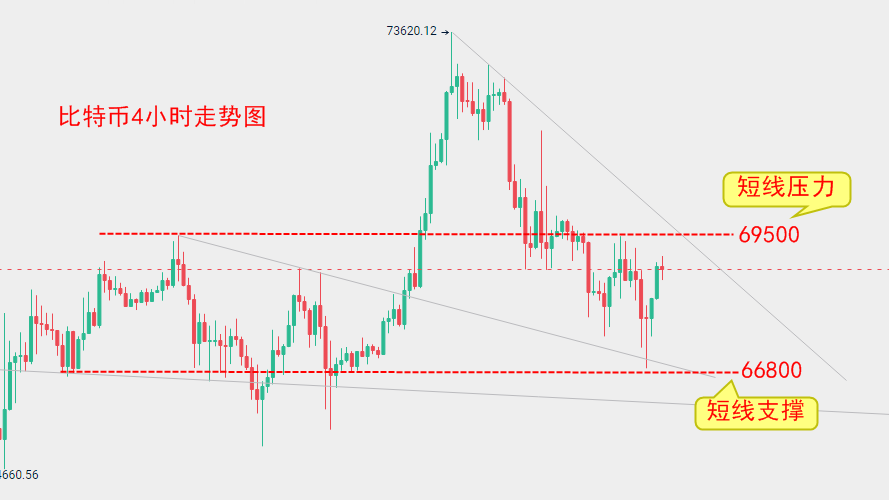

The election results are not yet out; we will have to wait until tomorrow for the results. There is no need to look at the technicals, as they are not reliable. For those trading short-term contracts, please refer to the range orders I provided. For Bitcoin, consider shorting at 69,500—67,000 and going long at lower levels, with a stop loss of 1,000 points and a take profit of 2,500 points. This means that when you enter the trade, set your take profit and stop loss; a 2.5x payout is sufficient.

For ETH, consider 2,350—2,500, with a stop loss of 50 points and a take profit of 150 points.

Specific Operation Suggestions (based on actual market prices)

For Bitcoin, short at 67,000—69,500 and go long at lower levels, with a stop loss of 1,000 points and a take profit of 2,500 points.

For ETH, trade in the range of 2,350—2,500, with a stop loss of 50 points and a take profit of 150 points.

Market conditions change in real-time, and there may be delays in the publication of this article. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are your own responsibility. For daily real-time market analysis, as well as experience sharing groups and practical trading groups, feel free to seek real-time guidance. Live explanations of real-time market conditions will be provided at irregular times in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。