Written by: JiaYi

23,500 BTC, what level is that?

As a long-term investor optimistic about Bitcoin and related sectors, I have invested in several BTC-related projects, such as Babylon, Bouncebit, Yala, Lorenzo, and Solv. Recently, Solv released a significant update, launching the SAL (Staking Abstraction Layer), which has shown robust growth in operations and strong community support.

Currently, there are 23,500 BTC staked on Solv, which, apart from Block.one and the already defunct Mt. Gox, is only surpassed by MicroStrategy (252,220 BTC) and Tesla (252,220 BTC), and is higher than several mining companies like Marathon and Hut 8.

What is the main battlefield of BTCFi? Or, what problems does BTCFi aim to solve? This is a necessary question for the Bitcoin ecosystem, and today I will briefly share my understanding of the BTCFi sector from an investor's perspective.

Bitcoin is on the path of DeFi Summer

Those who have experienced the initial wave of DeFi Summer are certainly familiar with yearn.fi, the "on-chain money market."

In my view, projects like Solv play the role of this "money market" for the Bitcoin ecosystem. It is evident that traditional wrapped Bitcoins like BTCB and WBTC, as well as new types of Bitcoin-like assets such as FBTC and M-BTC, have indeed released Bitcoin's liquidity into on-chain scenarios. However, this duality has also exacerbated the fragmentation of Bitcoin liquidity.

Especially for users with decision-making difficulties, wanting to earn stable higher yields often requires a wallet full of xxBTC. Therefore, Solv's multi-chain, multi-asset strategy for comprehensive yield and liquidity protocols essentially acts as a "yield aggregator" for Bitcoin assets:

Regardless of whether it is BTCB, FBTC, MBTC, or xxBTC… different BTC assets across various chains can be minted into SolvBTC, simplifying everyone's asset management experience.

This also integrates liquidity opportunities from different Bitcoin assets, allowing a SolvBTC to traverse the on-chain landscape, forming a unified asset pool that brings more diverse yield opportunities to holders.

BTCFi will give birth to a vast asset ecosystem

Bitcoin was quite "lonely" in previous years.

In the past few crypto market peaks, whether it was the ICO boom in 2017, the DeFi "summer" of 2020, or the subsequent NFT narrative, the Bitcoin ecosystem seemed to be marginalized, with BTC viewed as a "non-yielding asset."

However, since last year, more and more projects have been attempting to provide stable on-chain yields for BTC, gradually transforming it into a yielding asset. This trend has not only awakened dormant Bitcoin but also opened the door for BTC to enter the on-chain yield market, marking a redefinition and release of BTC's value within the entire ecosystem.

I have never invested in any ETH staking projects because I believe BTC is a more suitable asset for users to stake. BTC holders have the strongest ability to withstand short- to medium-term volatility, and from a comprehensive staking yield perspective, BTC's yielding properties are more conducive to the steady growth of personal assets.

For new Web3 users, or "new retail investors," the mainstream crypto asset they hold is still BTC—valued at $1.35 trillion, the largest and most risk-resistant native crypto asset. As long as the yield opportunities are rich and diverse, most holders will inevitably be tempted by such opportunities.

Moreover, Solv's imagination is not limited to staking yields; it also includes re-staking yields, trading strategy yields, and more. Of course, this brings complex interaction scenarios, which greatly expand the applicability and value of Bitcoin assets, but the risks are also increasing simultaneously.

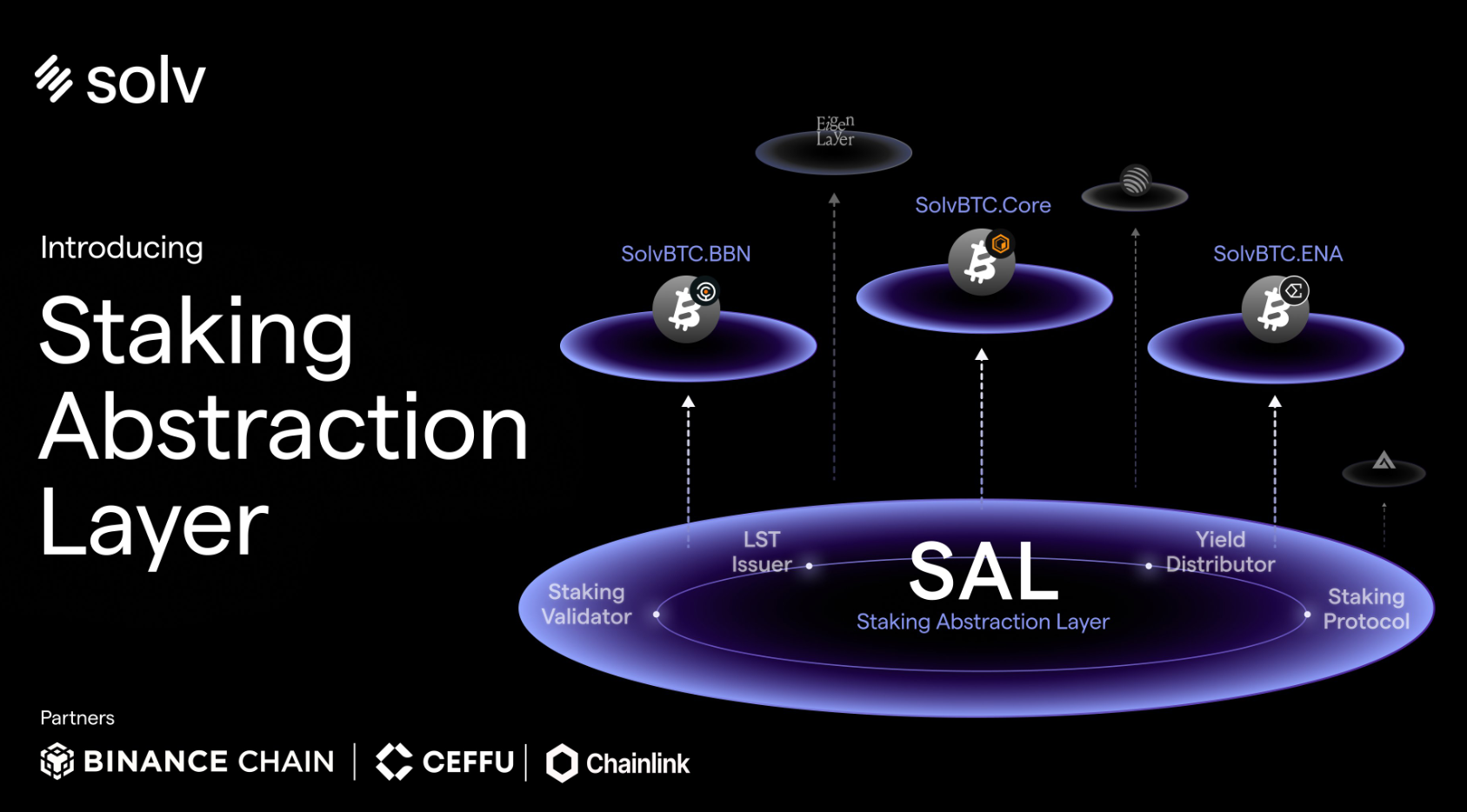

Thus, Solv recently launched the Solv Staking Abstraction Layer (SAL), which is essentially a universal standardized security framework for the Bitcoin staking industry, encapsulating a series of Bitcoin yield and asset management scenarios within a risk-isolated framework. It utilizes smart contract technology and Bitcoin mainnet technology to achieve seamless cooperation between stakers, LST issuers, staking protocols, and other staking service providers, while simplifying user interactions with Bitcoin staking protocols.

For the Bitcoin staking ecosystem to grow larger, a universal security layer is needed. Solv, being the largest in scale, is one of the most suitable choices to lead this initiative.

Betting on the entire sunrise sector with action

With a market value of over a trillion dollars, Bitcoin's liquidity has primarily been released in the form of wrapped tokens (like WBTC), allowing it to cross-chain to the Ethereum network and participate in DeFi and other on-chain scenarios through coupling with the EVM ecosystem. However, the actual liquidity released has only been around ten billion dollars.

In the investment field, myths are easily created, but the underlying logic is quite realistic. Regarding Masayoshi Son's investment in Alibaba, there was once a so-called story of "closing the deal in six minutes."

The reality is that Jack Ma's team was not Son's first or only choice for collaboration. On that day, nearly ten internet companies, including Jack Ma, gathered in the same office, waiting to meet with Son and his team.

Behind immaturity lies opportunity; betting on the entire sunrise sector with action.

I strongly agree with a viewpoint from Pantera partner Franklin Bi—if DeFi reaches the same proportion on Bitcoin as it does on Ethereum, it would mean the total value of DeFi applications on Bitcoin would reach $340 billion (25% of Bitcoin's market value). Over time, its scale could fluctuate between $108 billion and $680 billion (8% and 50%).

In fact, I have invested in Solv twice, essentially buying into my own investment:

- The first investment was because the founder Ryan is one of the few highly promising founders I have encountered. Humble, sunny, direct; although young, every time I meet him, I can see his cognitive upgrades. Over the two years of interaction, I have essentially witnessed a rapid iteration of a person. This is undoubtedly a strong boost for investors;

- The second investment was due to Solv's current achievements. Especially during the crypto market's bull and bear cycles, Solv has led to early profitability. As the market changes, Solv has undergone business iterations or transformations, but as long as it acts, it is the first. The underlying logic is a profound insight into DeFi, a firm belief, and strong execution power.

However, the Staking/Re-staking sector is facing common secondary market pressures—as more projects enter the listing stage, the heavy selling pressure has been brought to the market to enhance the pre-listing FDV. Therefore, although many projects have impressive TVL and income structures, the performance of their token prices has remained sluggish, leading to doubts about the operational models of some early projects and even dragging down the performance of related staking assets.

If BTCFi wants to break the curse of the sector, it is not an easy task. Balancing the performance of token prices in the secondary market is essential to allow investors to see the greater potential of the Bitcoin staking ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。