Original Author: YettaS (X: @YettaSing)

Introduction: Money is the sexiest business, but it must be accompanied by the struggle between new and old powers.

How to find the breakthrough point of the scene (utility), how to deepen its liquidity, and how to let the two enter a positive flywheel—all of this requires finding one's own development path after gaining insight into the power structure.

Every step is like walking on thin ice; the victor and the vanquished.

With its extensive circulation and massive asset scale globally, USDT has become the most important liquidity tool in the offshore market. However, our questions about Tether have never ceased: Why is Tether said to be the de facto central bank of our industry? Why is the U.S. regulatory attitude towards it so ambivalent—neither completely suppressing it nor providing clear support? What does its existence mean for the U.S. financial market? In this tug-of-war, where is its breaking point? This article will help you think about the significance of stablecoins from a more macro perspective, which is a prerequisite for breakthroughs in this field.

What Makes Tether a Good Business?

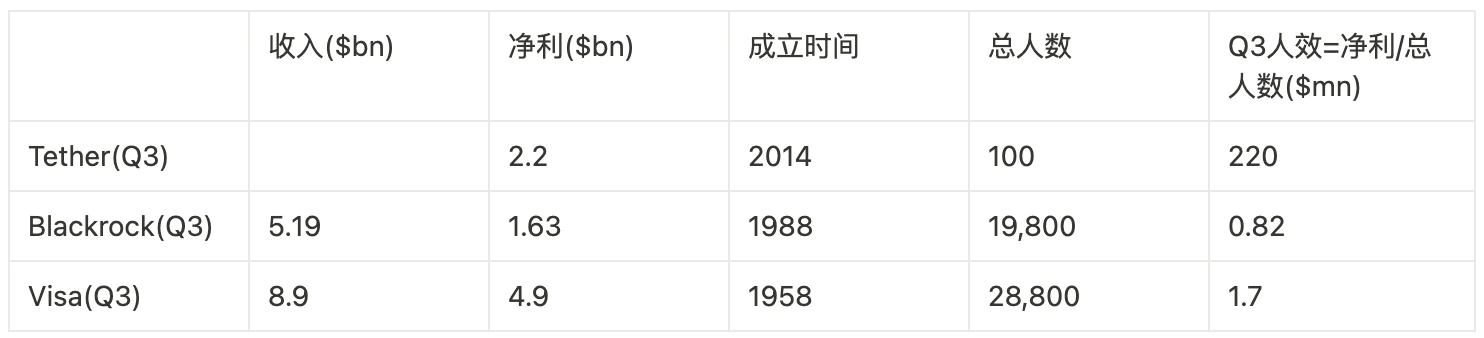

Tether's latest Q3 data showcases its strong profitability. As of Q3, its total assets reached $125 billion, with approximately $102 billion in U.S. Treasury bonds, a net profit of $2 billion for Q3, and a cumulative profit of $7.7 billion for the year. In comparison, BlackRock's Q3 profit was $1.6 billion, and Visa's was $4.9 billion, while Tether's workforce is less than one percent of theirs, achieving over a hundred times their efficiency.

source: primitive ventures

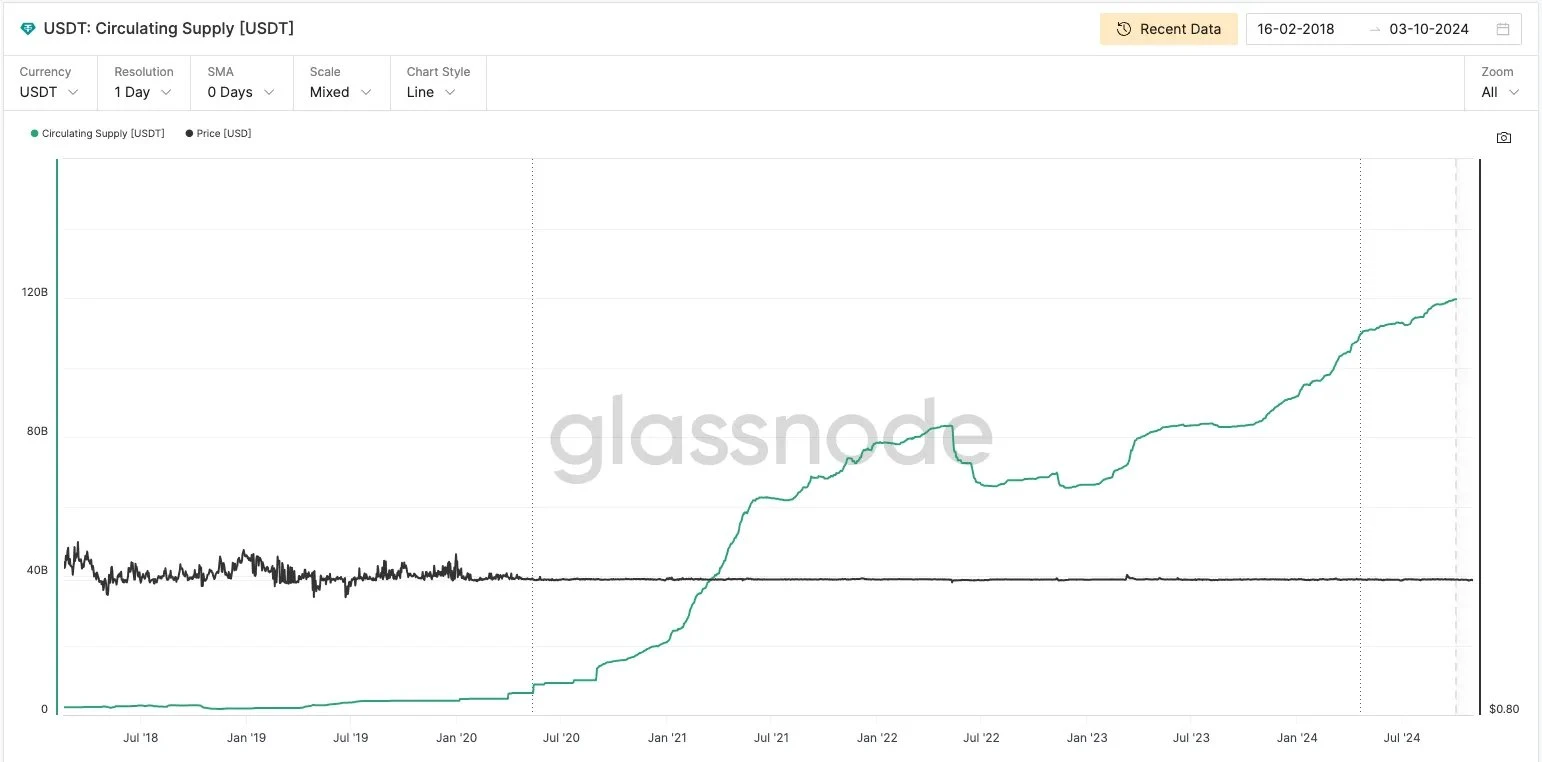

In fact, Tether did not have a spectacular start; it began with a small demand. At that time, all exchanges had BTC trading pairs, with prices fluctuating on both sides, making settlement inconvenient. Bitfinex identified this issue and launched USDT as a unit of account (UoA), which was its first identified scenario. In 2019, Sun discovered the cross-chain demand for stablecoins between exchanges; ETH transfers to USDT were expensive and slow, while on Tron, they were cheap and fast. Sun immediately began large-scale subsidies to capture the market, spending hundreds of millions (of course, from Tron node profits) to subsidize TRC20-USDT exchange deposits and withdrawals, where users could enjoy returns of 16%-30% at that time. As a medium of exchange (MoE) for inter-exchange transfers, this was its second identified scenario. The subsequent story is well-known; USDT was widely adopted in the off-chain world as a store of value (SoV) in countries with hyperinflation and as a medium of exchange (MoE) in various gray areas, becoming the shadow dollar, which is its third scenario. Through three evolutions, Tether has grown alongside the market value and liquidity of USDT.

Regarding how to create a good stablecoin, Dovey's article provides very detailed guidance, welcome to learn.

source: Glassnode

Currently, over 80% of Tether's assets are invested in U.S. Treasury bonds, which gives Tether characteristics similar to a U.S. government money market fund, namely high asset safety and ample liquidity. As a SoV, its safety is higher than that of deposits, which carry risks from the bank's asset side; the impact of SVB's bankruptcy on USDC is an example, while Treasury bonds are the lowest-risk financial products.

At the same time, it also surpasses money market funds because money market funds do not have currency settlement functions; they are merely products for sale and cannot become the currency itself. This is also why Tether can achieve such high efficiency; USDT, as an MoE, significantly reduces the friction of currency circulation compared to existing cross-border settlement or payment channels. As the nominal shadow dollar and the strongest consensus UoA, various channels and exchange platforms have become Tether's workers, helping it expand its network globally.

This is the charm of the money business; Tether combines payment, settlement, and treasury management to become the de facto Federal Reserve of our industry, which was unimaginable before crypto. Its network effect expands as liquidity grows, and this cannot be overturned by simply distributing a 5% yield to users and using token vampire attacks.

With this in mind, we can understand why PayPal wants to issue a stablecoin, as its business expansion has already achieved capital accumulation and payment settlement, and stablecoins are the best vehicle for all of this. From another perspective, won't U.S. banks and money market funds be envious of this business?

From Big and Unbreakable to Deep and Unbreakable

It is actually very simple for the U.S. to eliminate Tether because the custody of U.S. Treasury bonds is very centralized. Since Tether was investigated by the Department of Justice in 2021 and handed over to the Southern District of NY's prominent prosecutor, Darmian William, at the end of 2022 (who handles almost all high-profile crypto crime cases, including the SBF case), it is not that it cannot be done, but that they do not want to. So why don't they want to?

First, there is the liquidity risk in the U.S. Treasury market. Since 80% of Tether's assets are U.S. Treasury bonds, if regulators take extreme restrictive measures against it, forcing Tether to sell off Treasury bonds on a large scale, this could trigger turmoil or even a collapse in the Treasury market. This is the "big and unbreakable" aspect.

More importantly, there is the global expansion of USDT as a shadow dollar. In regions with severe global inflation, USDT is seen as a means of storing value; in areas with financial sanctions and capital controls, USDT becomes the circulating currency for underground transactions; it can be seen in places involving terrorist organizations, drugs, fraud, and money laundering. As USDT is used in more countries and through more channels and scenarios, its anti-fragility will be greatly enhanced. This is the "deep and unbreakable" aspect.

The Federal Reserve must be pleased with this; on the surface, the Fed has a dual mission of maintaining price stability and achieving full employment, but at a deeper level, it aims to strengthen dollar hegemony and control global capital flows. It is precisely the widespread circulation of USDT and USDC that helps the dollar expand its offshore liquidity. USDC is a regulated dollar on/off-ramp tool, while USDT, through its extensive channels, penetrates the dollar globally. The underground banking system and gray remittance services of USDT actually facilitate the circulation of the dollar and cross-border payments. This helps the U.S. continue to play a dominant role in the global financial order, further deepening dollar hegemony.

Where Does the Resistance to Tether Come From?

Although Tether has helped sustain U.S. financial hegemony in many ways, its struggle with U.S. regulatory agencies still exists. Hayes once said, "Tether could be shut down by the U.S. banking system overnight, even if it is operating completely according to the rules."

First, it cannot support the Fed's monetary policy. As a fully reserved stablecoin, Tether does not adjust liquidity in accordance with the Fed's monetary policy, and it cannot participate in the Fed's quantitative easing or tightening like commercial banks. This independence, while enhancing its credibility, also makes it difficult for the Fed to achieve its monetary policy goals through it.

Second, the Treasury must be wary of the turmoil it could cause in the Treasury market. If Tether were to collapse due to an unexpected event, it would have to sell off a large amount of Treasury bonds, which would put immense pressure on the Treasury market. This was widely discussed at the Treasury Borrowing Advisory Committee meeting on October 29, considering whether it might be possible to directly tokenize Treasury bonds to mitigate USDT's impact on the Treasury market.

Finally, and most importantly, Tether effectively squeezes the survival space of banks and money market funds. The high liquidity and high yields of stablecoins attract more and more users, posing a significant challenge to banks' deposit-raising capabilities and the appeal of money market funds. Meanwhile, Tether's business is incredibly profitable, so why can't banks and money market funds do the same? This April, the Lummis-Gillibrand Payment Stablecoin Act was proposed, which encourages more banks and trust institutions to participate in the stablecoin market as evidence.

Tether's development is indeed a grand struggle, burdened by original sin and regulatory arbitrage, which has provided it with immense opportunities and space for growth. Now, it finally has some leverage to begin to contend with old powers. Where it can go is uncertain, but any breakthrough innovation is a redistribution of past power and interest structures.

The Possibility of a Supranational Currency System

To transcend the dollar system, Tether's future lies not only in maintaining its role in global payments and liquidity but also in thinking more deeply about how to construct a truly supranational currency system. I believe the key lies in its linkage to BTC. In 2023, Tether took the first step, allocating 15% of its profits to purchase Bitcoin, which is not only an attempt to diversify its asset reserves but also effectively makes BTC an important component supporting its stablecoin ecosystem.

In the future, as Tether's payment network expands and BTC deepens its role as a supranational currency in the global market, we may witness a brand new financial order.

A revolution often begins at the margins, sprouting in the cracks of the old era's beliefs. The worship of Rome turned the dominance of Roman civilization into a "self-fulfilling prophecy."

The birth of a new god may be random, but the twilight of the old gods is already destined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。