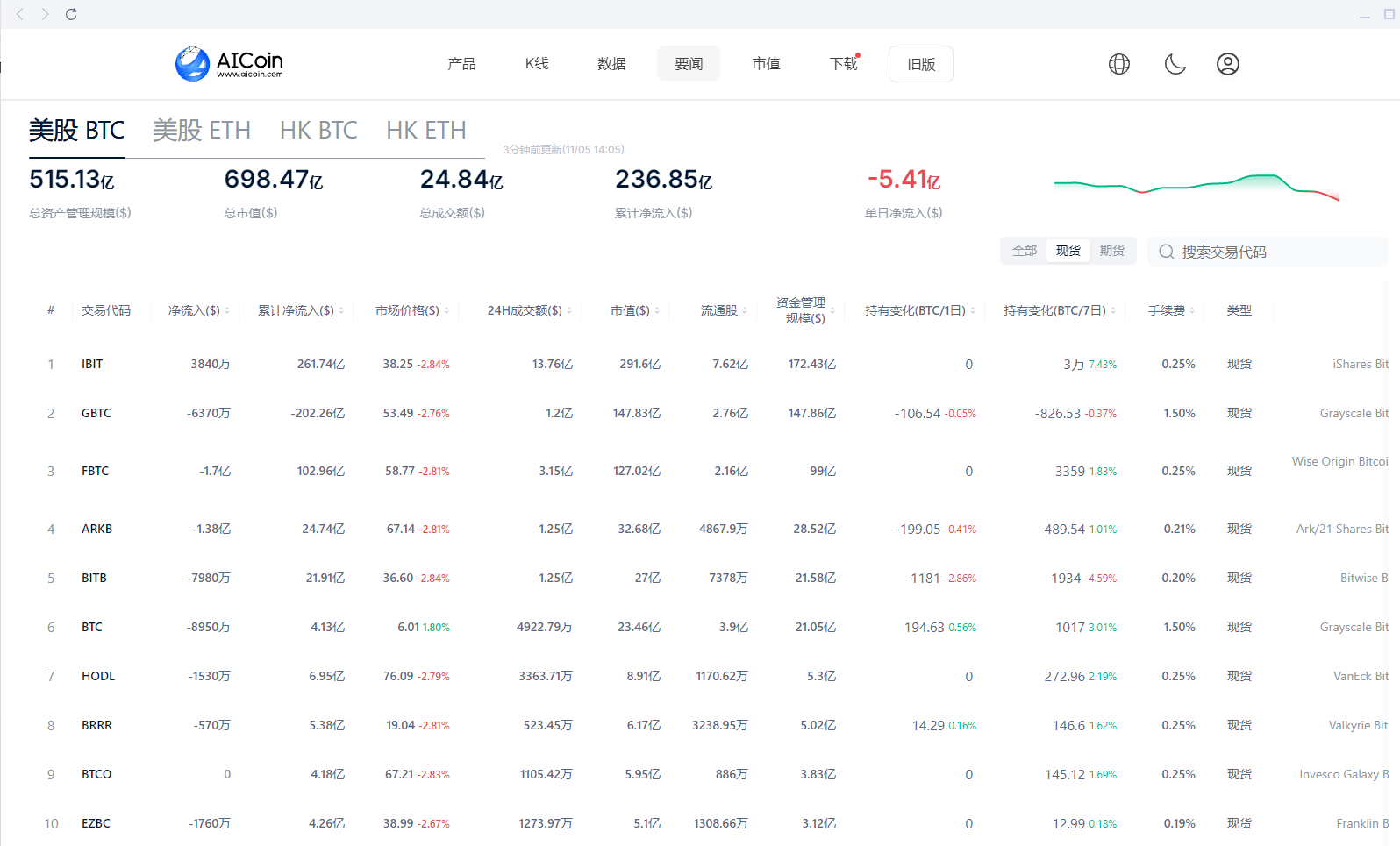

BTC Spot ETF Sees $540 Million Outflow in One Day, Setting Second Highest Record in History

According to AICoin data, yesterday (Eastern Time, November 4), the BTC spot ETF experienced a single-day outflow of $540 million, marking the second highest single-day net outflow record in history, with multiple institutions reporting net outflows from their spot BTC ETFs.

Among them, Grayscale's ETF GBTC and Grayscale Bitcoin Trust ETF BTC saw significant net outflows, with GBTC experiencing a net outflow of $63.7 million in one day, and historically, GBTC has also recorded a cumulative net outflow of $20.226 billion. The Grayscale Bitcoin Trust ETF BTC had a net outflow of $89.5 million in one day.

In the top ten by assets under management, Fidelity's FBTC and ARKB saw outflows exceeding $100 million, with outflows of $170 million and $138 million, respectively.

Image Source: AICoin

It is noteworthy that the only Bitcoin spot ETF among the top ten institutions to achieve a net inflow in one day was BlackRock's ETF IBIT, which saw an inflow of $38.42 million. Currently, IBIT has a total historical net inflow of $2.6174 billion. For more details, you can download the AICoin app at https://www.aicoin.com/download

Major ETF products like FBTC and Grayscale's GBTC have experienced significant capital withdrawals in the short term. Although BlackRock's IBIT has seen a slight inflow, overall market sentiment remains subdued.

Investor Caution Ahead of the Election

The election results will have a significant impact on the Bitcoin market. Political uncertainty often exacerbates market volatility, and the introduction of new policies may affect the regulatory environment for cryptocurrencies. If the election results reduce market uncertainty, it could boost market confidence in the short term; conversely, if the policy direction is unclear or leans towards strict regulation, it may lead to further market turmoil.

The uncertainty brought by the election can lead to market fluctuations, as investors find it difficult to predict what policies the new leader or the incumbent president will implement, how these policies will affect different industries, and what overall direction they will take the economy. Historical data shows that BTC typically exhibits significant volatility during elections, but the market often stabilizes once the results are clear.

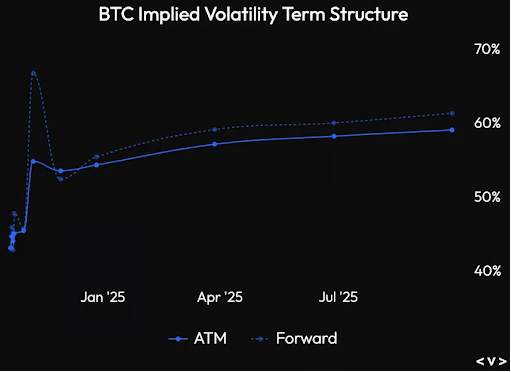

Bitfinex analysts also noted, "In the options market, the implied volatility of the soonest expiring contracts is unusually low ahead of the election day (November 5). This subdued volatility indicates that investors are waiting for clarity. However, volatility is expected to spike around November 5 to 8, which could trigger significant fluctuations."

Image Source: Bitfinex Report

It was also pointed out that "the market believes that a victory for Republican candidate Trump is favorable for BTC, while a win for Democratic candidate Harris makes the outlook more uncertain. The average betting odds for Trump’s victory have dropped from 64.9% to 56%."

The performance of the ETF market reflects investors' attitudes towards Bitcoin; when market conditions are favorable, there is a noticeable inflow of funds, but under macroeconomic pressure, investors tend to withdraw. The FOMO (fear of missing out) mentality may lead to short-term market volatility, as investors rush into the market when they see prices rising but quickly withdraw during heightened uncertainty.

Conclusion

Overall, the cautious stance of investors ahead of the election reflects the market's heightened attention to and uncertainty about the election results. Investors generally adopt conservative strategies, waiting for the election results to become clear before making investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。