TL;DR

Meme experienced a slow budding phase from 2013 to 2019, followed by a chaotic period of rapid changes from 2020 to 2022, and finally entered a period of rapid development from 2023 to 2024, gaining widespread recognition and audience as a distinct sector.

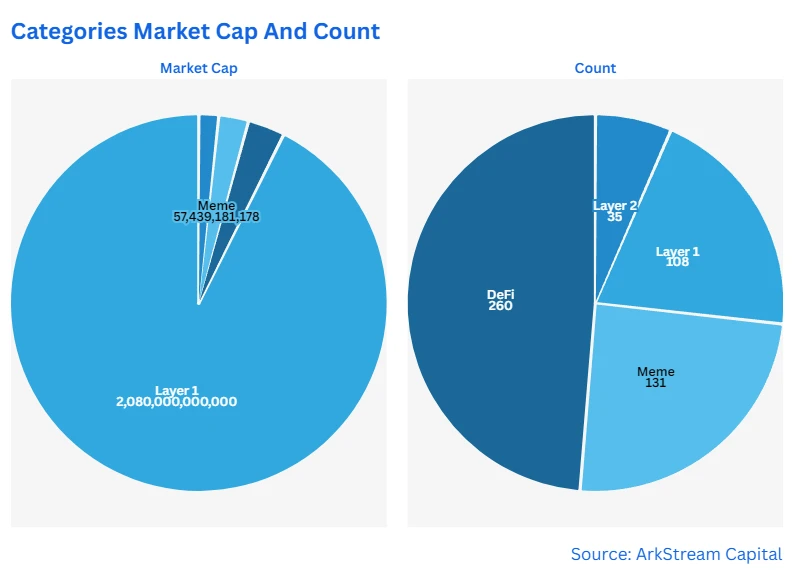

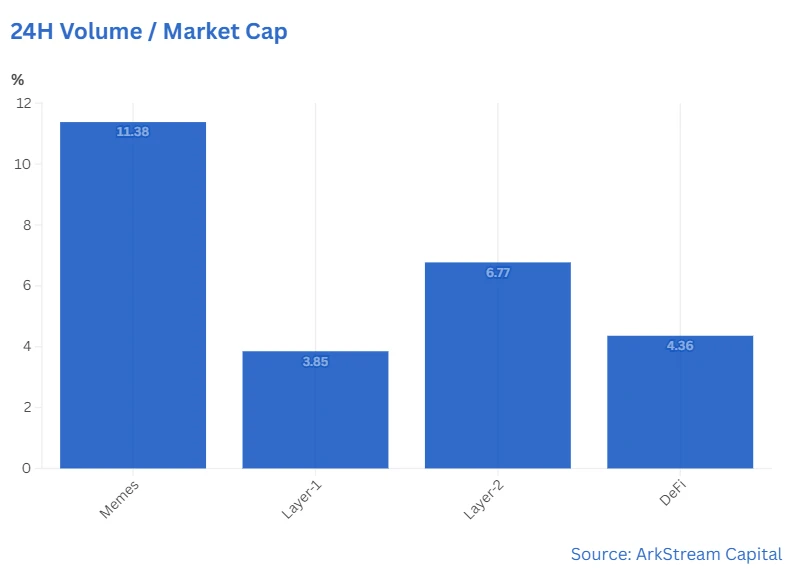

The average daily turnover rate of Meme is approximately 11%, compared to 5% for DeFi, 7% for Layer2, and 4% for Layer1. This ratio not only highlights the high liquidity of Meme but also indicates a higher interest and trading frequency among users.

By the end of the third quarter of 2024, the market capitalization share of Meme in the entire cryptocurrency market has increased from 0.87% two years ago to 2.58% today, with a continuous growth trend. A simple linear regression simulation suggests that this share will reach 3.54% by 2025 and 7.81% by 2030.

Meme is a leveraged Layer1, meaning that during favorable market conditions, it can experience a price increase of about 5 to 10 times.

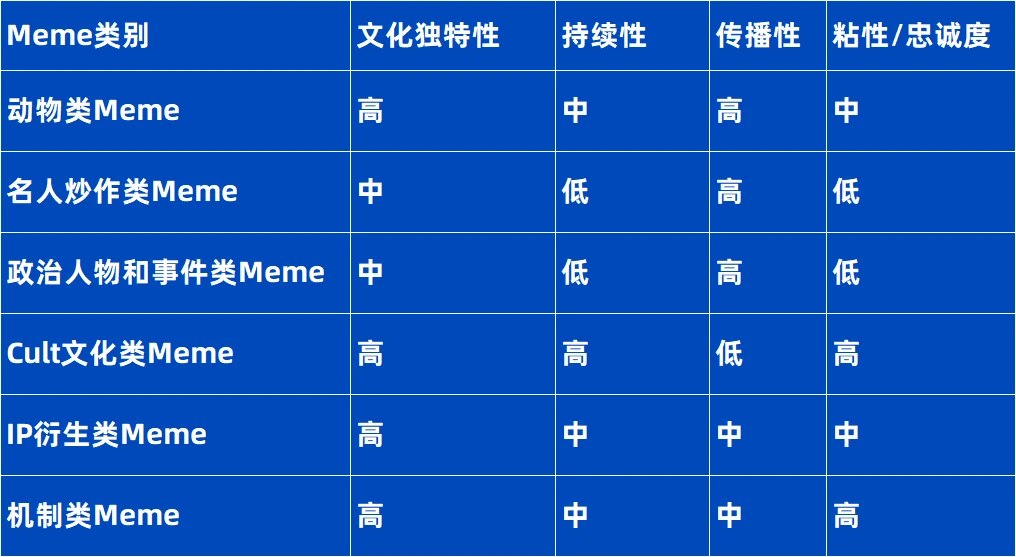

Animal-themed Memes and Cult culture Memes are types that are suitable for long-term attention. In contrast, other categories of Memes are often related to short-term trends, with their popularity and attention potentially rising and falling rapidly.

In 2024, the industry and market are undergoing a dramatic reshuffle. Against the backdrop of many VC-backed projects performing poorly upon launch, Meme has risen against the tide, becoming a new force that cannot be ignored. The rise of the PvP model, the wealth effect brought by single-coin spikes, and the Solana blockchain's friendliness towards Meme have all showcased unique brilliance this year. The new generation Meme representative, Murad, has quickly become a popular figure in the Meme world through his Supercycle speech. However, what changes has Meme undergone behind this wave of popularity? From the VC's perspective, how should we participate? These questions are worth exploring in depth.

Meme Market Overview: Origins, Evolution, and Market Data Analysis

Origins and Influence

Meme, as a cultural dissemination phenomenon, is closely linked to human history. Originating from early societal language, beliefs, and customs, it spreads through imitation and learning within groups. The advent of the internet has greatly accelerated the spread of Memes, which circulate among users in the form of images, videos, text, and memes due to their humor, satire, or resonance. Memes meet people's needs for expressing emotions, sharing opinions, and establishing resonance in social interactions, and reflect social trends, group psychology, and cultural changes. Their dissemination and popularity are influenced by content appeal, dissemination environment, community acceptance, and KOL influence.

In Web2, Meme culture primarily emerged and developed on the platforms of 4chan and Reddit. 4chan is the birthplace of the popular Meme Pepe the Frog, gathering a large amount of content related to Pepe Memes and their derivative culture. At the same time, 4chan is also a breeding ground for Boy's Club comics, providing us with an important perspective to understand Meme culture. Reddit, on the other hand, has nurtured classic Memes like Dogecoin and Success Kid. Thanks to the active community atmosphere and solid user base of these two platforms, they remain the birthplace of many new Memes to this day. In addition to these two platforms, other social media platforms with large user bases (such as Twitter X and Telegram) have also given rise to some popular Memes. For example, the dog wearing a pink knit hat, known as dogwifhat, has formed a "hat" totem culture in the community since its early days, with many fans and well-known figures sharing related images of the hat dog.

Evolution and Development

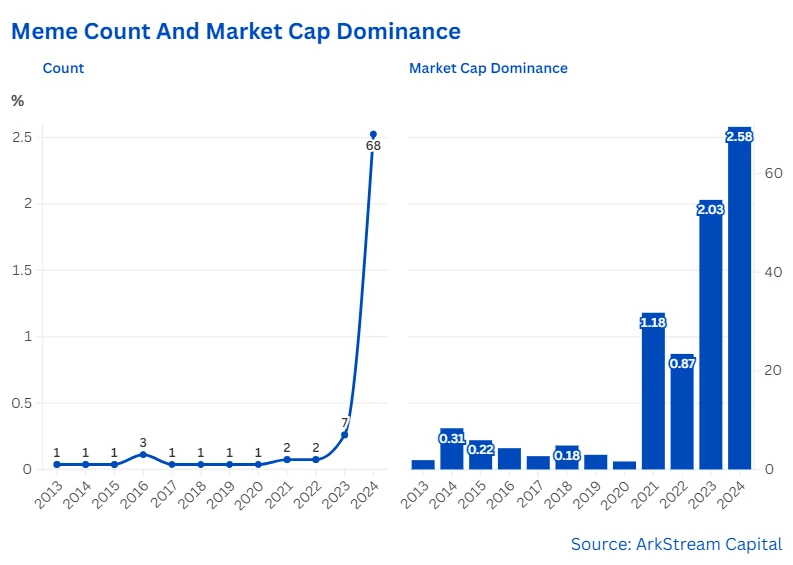

Starting from Web2 and becoming a craze in Web3. In this article, we will refer to Memes and their related tokens collectively as "Meme," without further distinction. Looking back at the development of Meme, we notice that it was not prominent in its early days and did not receive enough attention. Referring to the cyclical changes of bull and bear markets in the industry, we can divide the development of Meme into three stages: Budding Period (2013 to 2019), Chaotic Period (2020 to 2022), and Rapid Development Period (2023 to 2024). By consulting historical snapshot data from CoinMarketCap, single-token data from Coingecko, historical information from search engines, and social media content, we can gain a more comprehensive understanding of the evolution of Meme.

Chart: Evolution and Development of Meme

By December 31, 2019, during the budding period, Dogecoin was the only Meme-type token in the top 100 cryptocurrency market capitalization rankings, sitting at 34th place. Looking back from 2013 to 2019, Meme-type tokens did not occupy a significant position in the market. During this period, the industry was in a rapid infrastructure construction phase, exploring various new concepts. The mainstream new tokens were typically those with more efficient transaction processing capabilities and faster confirmation times, or new blockchains equipped with powerful smart contract functions. For Meme-type tokens, the challenges were that they not only required high costs to establish their supporting platforms but also faced difficulties in building liquidity, leading to low trading volumes and limited support from centralized exchanges. Therefore, during the budding period of Meme tokens, aside from Dogecoin, which featured the "Doge" meme and had significant dissemination effects, there were not many other Meme tokens that could survive in the market.

Starting from 2020, the chaotic period, more specifically from August 2020, was triggered by the DeFi Summer and the wave of IDOs it brought. The DeFi Summer led to IDOs that allowed people to build liquidity on-chain at low costs, providing trading and rapidly constructing trading scenarios. This enabled low-cost token issuance and direct circulation in the secondary market without going through exchanges, giving rise to many on-chain Memes. During this period, surviving Meme tokens included SHIB, FLOKI, and PEOPLE. However, these early Meme tokens did not receive significant market attention, and their popularity was mainly based on speculative concepts. Additionally, the popularity of Memes during the chaotic period often arose in the context of industry liquidity excess, typically appearing as the last leg of a relay after multiple sectors had taken turns rising. Notably, Memes during this period also gained widespread attention due to their association with celebrities, particularly Elon Musk's continued advocacy for Dogecoin in 2021, which not only caused significant price fluctuations for Dogecoin but also propelled its market capitalization to a new level, significantly expanding the community.

With the arrival of 2023, the craze for Meme tokens continued to heat up, with a diverse array of Meme tokens emerging, such as BONK, PEPE, CHEEMS, and Cult culture-related BITCOIN (HarryPotterObamaSonic10Inc) and SPX (SPX6900), WIF, and MOG. During this period, the types of Meme tokens began to become more refined, with other blockchains like Solana also coming to the forefront. By 2024, the development of Meme tokens directly entered an accelerated phase, with new tokens like BOME, lowercase NEIRO, and GOAT continuously emerging, each with its own characteristics. Meme has officially gained widespread recognition and audience as a distinct sector.

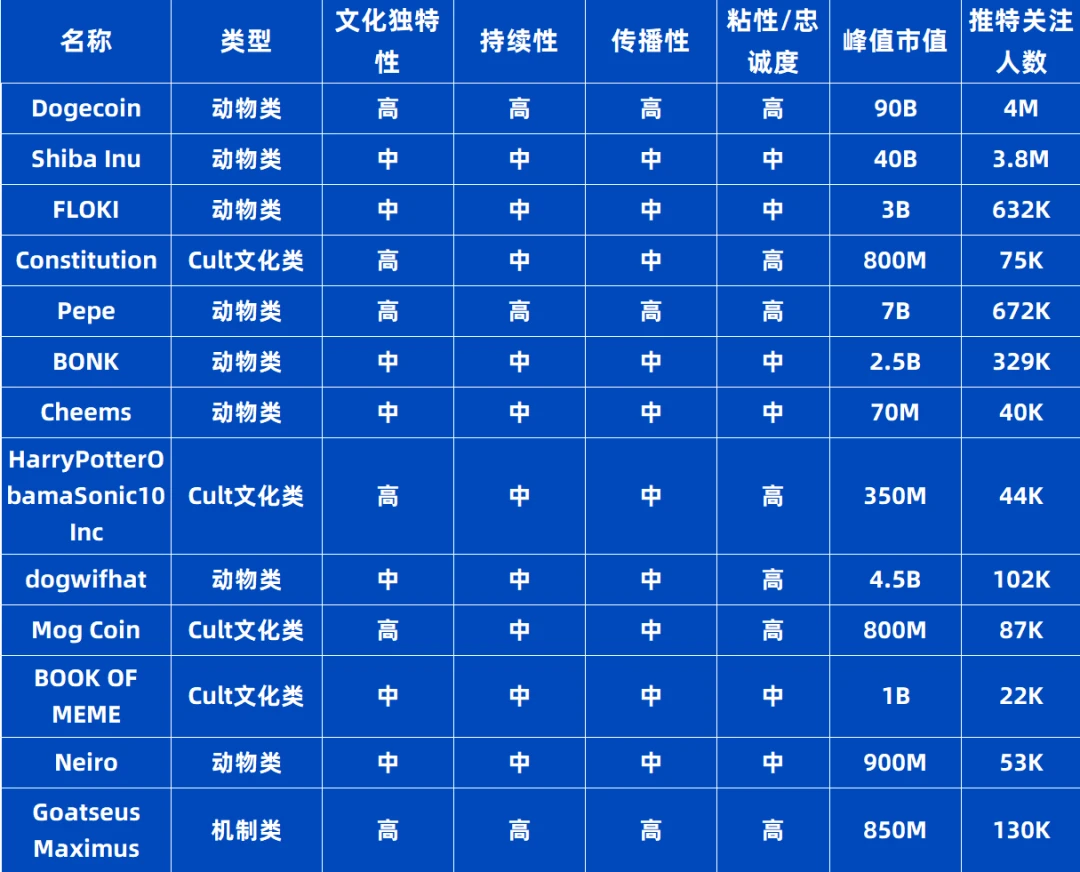

Chart: Some Data Indicators of Meme

By sorting through the market capitalization share and performance data of Meme among the top 600 cryptocurrencies from 2013 to 2024, we can clearly see the growth of Meme's market capitalization and the expansion of its categories and numbers. During this period, Meme's market capitalization not only achieved significant growth but also saw an increase in its types and numbers. By the end of the third quarter of 2024, the market capitalization share of Meme in the entire cryptocurrency market has increased from 0.87% two years ago to 2.58% today, with a continuous growth trend. A simple linear regression simulation suggests that this share will reach 3.54% by 2025 and 7.81% by 2030.

Perhaps we once doubted whether Meme was merely a fleeting phenomenon that would quickly fade after the craze. However, with further research and understanding of Meme, we believe our perspective has changed. Meme will not only not disappear but will continue to innovate, with new leading Memes potentially emerging in every era. However, behind these dazzling leading Memes lies a harsh reality, reminding us to always maintain a calm and clear mind.

Market Data Analysis

By analyzing the development and historical data of Meme, we can roughly understand its development trends. So, studying the current market landscape provides us with an intuitive perspective to observe changes in market hotspots and the flow of funds. Below, we further delve into the macro indicators of the Meme sector, including market capitalization, trading activity, and average daily trading volume. These analyses not only reveal the latest dynamics of the Meme sector but also showcase its future development trajectory.

Changes in Market Capitalization and Quantity: The changes in Meme's market capitalization and circulating quantity can reflect the market's demand and acceptance level. Although some Meme tokens may have low market capitalizations, the increase in the number of new Memes indicates that community interest in the entire sector is growing. Compared to other sectors (Layer1/Layer2/DeFi), Meme has far outpaced in terms of total market capitalization and new additions over the past two years.

Trading Activity: The trading activity and turnover rate of Meme are generally higher than those of other sectors. According to CoinMarketCap, the overall market capitalization of Meme tokens is approximately $50 billion, with a daily trading volume of about $5 billion, indicating a level of trading activity that far exceeds other sectors. On average, the daily turnover rate of Meme tokens is around 11%, while the daily turnover rate for DeFi is about 5%, Layer2 is around 7%, and Layer1 is 4%. This ratio not only highlights the high liquidity of Meme but also indicates a higher interest and trading frequency among users. For Meme tokens that are above the sector level, especially those with larger trading volumes, they often become targets for market capital.

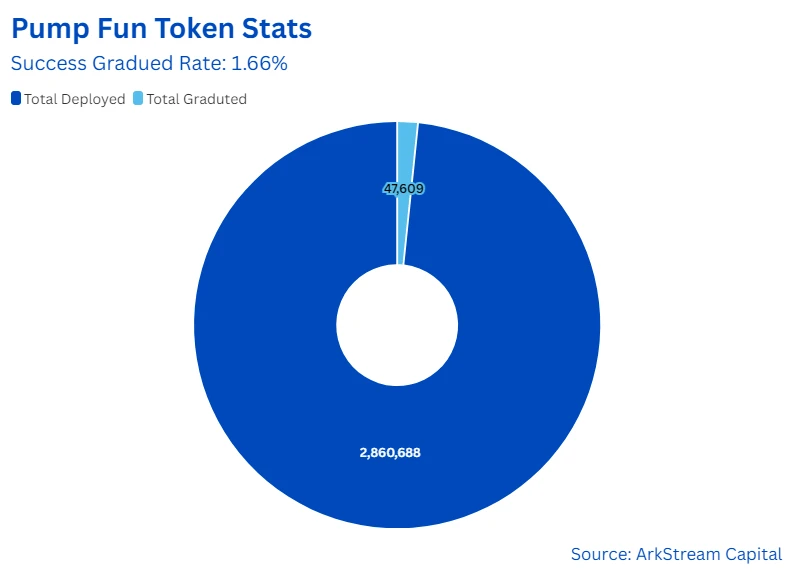

New Meme Token Price Increases and Low Success Rates: New tokens are constantly emerging in the Meme market, and their price increases sometimes even surpass mainstream cryptocurrencies like BTC. This indicates that the Meme token space has high volatility and speculative opportunities. However, among the many new Memes, using Pump fun data as an example, less than 2% of successfully launched Memes maintain a market capitalization above $1 million, meaning the probability of surviving the test of time is extremely low.

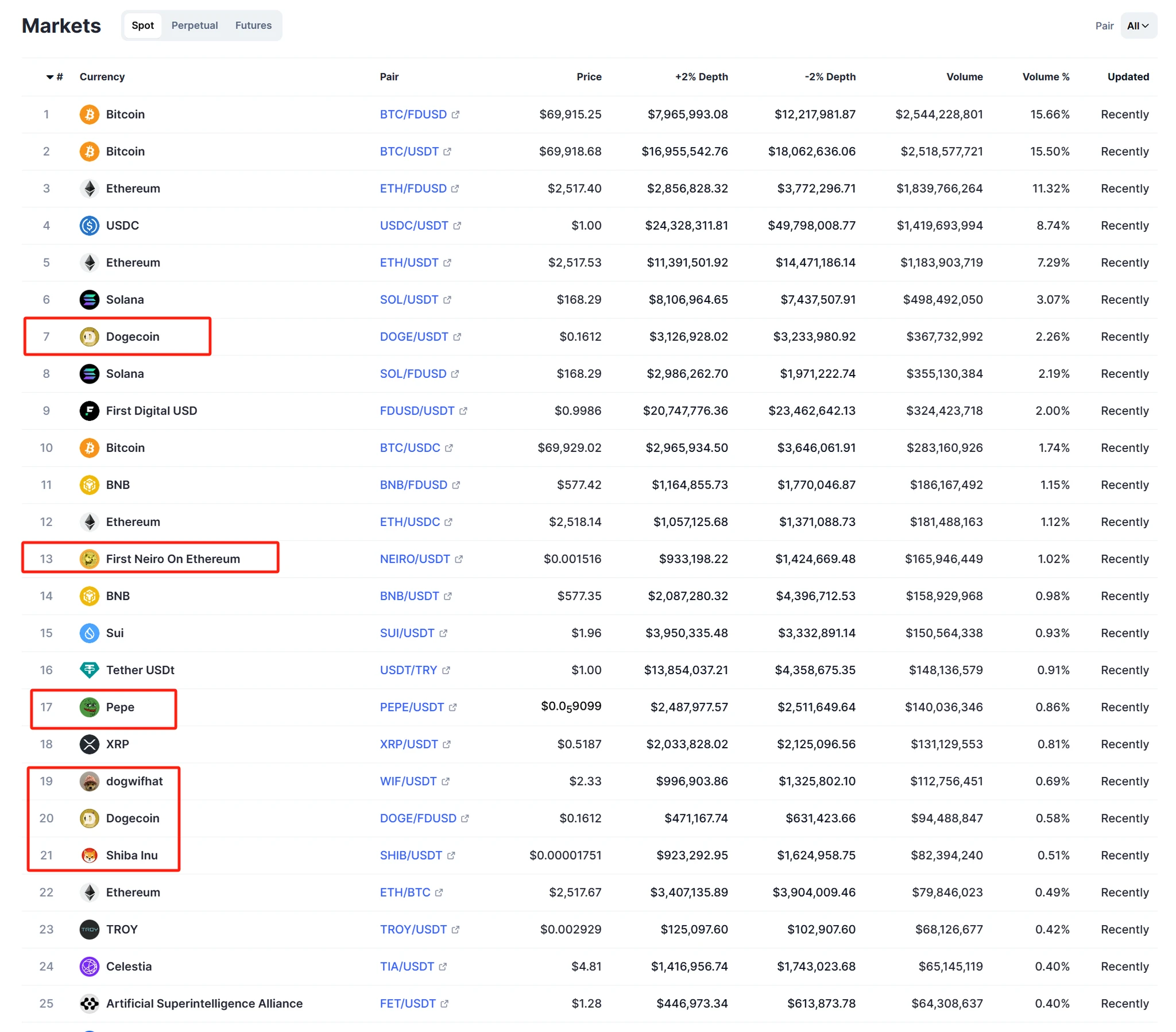

Large Trading Volumes and New Users: Meme can generate large trading volumes and has a relatively loyal user base. Therefore, for centralized exchanges (CEX), listing Meme tokens can be an important strategy to attract traffic and users. For example, in Binance's spot market, 20% of the top 30 trading pairs by trading volume are Memes.

Chart: Binance Spot Trading Data from CMC

Scarcity of Blue-Chip Memes: Blue-chip level Memes are relatively scarce. Among the hundreds and thousands of Meme tokens, less than 1% can truly be considered blue-chip. For example, despite the continuous emergence of new Memes recorded on CoinMarketCap, very few can withstand the test of time and eventually stand out. Additionally, the market capitalization distribution of the Meme sector also shows a significant 80/20 rule: the entire sector's market capitalization is primarily driven by less than 10% of top Memes. This highly concentrated market capitalization distribution undoubtedly increases the difficulty of finding true value investments in the Meme space. If participating in Meme investments from a VC perspective, this aligns with the venture capital rule of thumb known as the "2-8 rule": about 10% of successful Meme investments can offset losses from other Meme investments.

Summary

Combining the recent highly regarded speech by Murad in the Meme community, he predicts that the market capitalization of Meme will reach $1 trillion in the future, implying a potential increase of 25 times, with expectations that over 25 Memes will enter the industry Top 100, and VCs will purchase blue-chip Memes. Referring to our statistical data, this prediction is overly optimistic. Currently, Meme, in terms of both quantity and market capitalization, already occupies a significant share of the industry. Future development will more likely break through on Layer1, which itself is also an important soil for the growth of Memes. The development of Memes will inevitably push Layer1 forward, thus we conservatively believe that Memes are leveraged Layer1, meaning that during favorable market conditions, they can experience price increases of about 5 to 10 times. However, it must be acknowledged that Meme is a field worth long-term observation and research. Therefore, establishing a systematic trading framework can help us better understand and participate in this market full of potential and challenges.

Exploring and Researching Meme

As the wave of Meme sweeps through the market, combined with our previous research on the Meme market landscape and future trend predictions, we believe that it is very necessary to delve into the exploration and research of Meme. Through this, we find that the value of Meme does not stem from technology or practical applications, but from the enthusiasm of the community and the recognition of Meme culture. This drive makes the performance of Meme in the market full of uncertainty and volatility, but it also brings unprecedented vitality. By summarizing these characteristics, we have constructed a clear analytical framework to understand and grasp the potential value and risks of Meme.

Basic Characteristics of the Sector

While analyzing a single Meme can provide deep insights, a broader perspective is needed to fully grasp the development trends of the entire Meme sector. Therefore, we first conducted a comprehensive study and analysis of the basic characteristics of the Meme sector. In the current market environment, the Meme sector has exhibited the following significant characteristics:

Low Entry Barriers: The issuance threshold for Memes is extremely low. As long as one has a social media account, a Telegram group, and some creative images, a new Meme can be easily launched without the need to develop products or applications like traditional cryptocurrency projects; the token itself is the product. The issuance threshold for Memes is significantly lower than that of traditional projects. This process does not involve complex product development or application construction, making the token itself the core and directly market-facing "product."

Surge in Quantity: Due to the extremely low barriers to creating Memes, a large number of new Memes emerge daily, rapidly expanding the market's token pool and leading to a sharp increase in supply. As new Memes continue to join, everyone faces more choices, which also brings higher selection difficulty.

Significant Wealth Effect: Although the risks in the Meme market cannot be underestimated, it also offers huge potential returns for early entrants. The wealth effect of single-coin spikes and small bets yielding large returns acts like a magnet, attracting numerous users' attention and stimulating their high engagement and participation in the Meme market.

Market Resilience: Memes have shown good resilience in the face of market fluctuations, able to quickly recover and rebound from shocks. This rapid recovery is mainly attributed to the driving force of community sentiment value and the enthusiastic pursuit of funds for Memes.

Celebrity Effect: The involvement of well-known individuals significantly enhances the hype and market attention surrounding Memes, further intensifying price volatility. This celebrity effect not only attracts more attention but may also lead to a series of information arbitrage behaviors, where some top players in the information chain may exploit their influence and informational advantages to gain improper benefits.

Low Liquidity and Limited Capital Capacity: In the early to mid-stage of Memes, specifically during the on-chain market period, the liquidity of Memes was not high, meaning that a considerable portion of their large market capitalization and trading volume was inflated. Due to insufficient liquidity, large capital encounters high slippage when buying or selling, leading to increased trading friction costs. Therefore, the on-chain capital capacity of the Meme market is relatively limited, making it difficult for institutions to enter or exit on a large scale without significantly impacting prices. This limitation not only increases the difficulty of trading but also restricts the depth and breadth of the market, making the Meme market appear more fragile in the face of large capital flows.

Extremely High Trading Risks: Due to the lack of practical application support and intrinsic value, the prices of many Memes often fluctuate like roller coasters, rapidly rising and then sharply falling. More concerning is that many Memes ultimately face a fate of going to zero, meaning their market value and trading volume drop to nearly zero. This high-risk trading environment requires us to be particularly cautious when engaging with Memes, fully recognizing the potential risk of capital loss.

Active Trading and Susceptibility to Manipulation: The frequent trading and large trading volumes of Memes also indicate significant market interest. However, lurking behind the trading volume may be undisclosed manipulated capital. Therefore, unlike VC projects, the Meme market resembles a public gambling speculation market where participants are willing to take risks.

After conducting an in-depth analysis of the basic characteristics of the Meme sector, we can conclude that the Meme sector indeed possesses some unique traits that set it apart in the cryptocurrency market. The low entry barriers for Memes, the surge in quantity, low liquidity and limited capital capacity, extremely high trading risks, significant wealth effects, active trading and susceptibility to manipulation, market resilience, and celebrity effects collectively form the unique ecology of this sector. For this reason, the Meme sector is often viewed as a PvP arena filled with competition, which is not without reason. In this fiercely competitive field, everyone needs to act like gold miners, identifying true blue-chip Memes and hidden gems from the vast array of Meme tokens.

Characteristics and Categories

As the Meme sector matures, we should no longer be bound by outdated concepts. Standing on the sidelines and being indifferent will not allow us to grasp the deeper patterns of Memes. Today's Meme culture has long surpassed the simple meme images of the past; it has become a diversified expression of market sentiment and an important vehicle for communicating with outsiders. Therefore, it is necessary for us to have a basic understanding of its key characteristics and classifications.

Memes have many characteristics, some of which can be quantified with data indicators, while others are relatively difficult to quantify and are more qualitative in nature. The key characteristics are as follows:

1. Cultural Uniqueness: This is the core of Memes, usually originating from specific cultural phenomena or social trends, establishing their unique identity and appeal. Just like the lighthearted Dogecoin and self-deprecating Pepe, they attracted many fans with these cultural traits even before entering Web3, whether through expressions or derivative creations.

2. Sustainability: This is a key measure of whether a Meme can exist long-term in the market. A successful Meme often transcends short-term trends, forming a lasting cultural impact, similar to the concept of "diamonds are forever." Dogecoin, which has lasted for over a decade, has accompanied the growth of the cryptocurrency industry and is the origin of the entire Meme phenomenon. For new Memes, we cannot expect them to immediately endure the years of testing like Dogecoin, nor can we fantasize that every new Meme will be like BOME, which was launched on Binance in just three days. Therefore, we believe that Memes should be able to sustain themselves for at least six months to a year, which also aligns with the time cycle that centralized exchanges consider for project listings.

3. Spreadability: This is an important factor in whether a Meme can quickly spread and be widely accepted. A Meme that is easy to spread and has good conversion effects can attract a large amount of attention in a short time. Generally, this can be observed through the level of discussion about related Memes on social media and the growth rate of community size. For example, having tens of thousands of followers on Meme Twitter is the basic requirement, while a better standard would be in the hundreds of thousands or even millions.

4. Stickiness or Loyalty: This refers to the loyalty and engagement of Meme community members. A Meme community with high stickiness can maintain long-term participation from its members, even during market fluctuations, as members are less likely to exit easily. This loyalty is crucial for the long-term success of Memes.

Initially, Dogecoin brought us Memes featuring cute animals like cats and dogs, but today, new categories of Memes have emerged, integrating with past animal-themed Memes, greatly expanding the categories of Memes. Below, we have streamlined the classification of Memes, with different categories that can be combined to some extent:

1. Animal Memes: Based on animal images, these express emotions or viewpoints through humorous text and are widely loved for their cuteness and approachability. The most famous examples are undoubtedly Dogecoin featuring dogs and Pepe the Frog.

2. Celebrity Hype Memes: These leverage the influence of celebrities or public figures, focusing on and capturing their statements and actions, using imitation or parody for creative reinterpretation. Typical examples include a series of Memes derived from Elon Musk's tweets, personal profiles, and avatars, such as "Troll."

3. Political Figures and Events Memes: These use humor or satire to allude to political figures or events. Representative Memes include slogans and Memes generated around Trump's campaign activities, such as MAGA and FIGHT. Additionally, there are Memes related to misspellings of Trump and Biden's names.

4. Cult Culture Memes: Originating from the popular culture of specific groups, these contain specific symbols or jokes that only those familiar with the background can understand, making them beloved by specific groups due to their uniqueness and exclusivity. This type of Meme is somewhat similar to the past DAO concept, with a representative example being PEOPLE, which started with fundraising to auction the U.S. Constitution.

5. IP Derivative Memes: These are created based on traditional anime IPs or well-known NFTs, utilizing their existing popularity to attract corresponding target fan groups. For example, the NFT project mfer, which featured a culture of nihilism, launched related Memes.

6. Mechanism Memes: Early mechanisms had special settings, such as fair distribution, burning, and buy-sell tax repurchase. Currently, this more refers to Memes issued through emerging AI technologies. The most popular is the recent Meme Goat GOAT created by terminal of truths.

Dogecoin/Troll/Maga/People/mfer/GOAT

Memes exhibit unique cultural characteristics and audience bases across different categories, influencing their sustainability, spreadability, and community stickiness. Among these categories, animal Memes and cult culture Memes, due to their deep cultural roots and loyal fan bases, are considered types worthy of long-term attention. In contrast, other categories of Memes are often related to short-term trends, and their attention and popularity may rise rapidly and then fall back. To quickly identify and understand the core characteristics of various Memes, we provide the following evaluation framework.

Primary Market and Launch Platforms

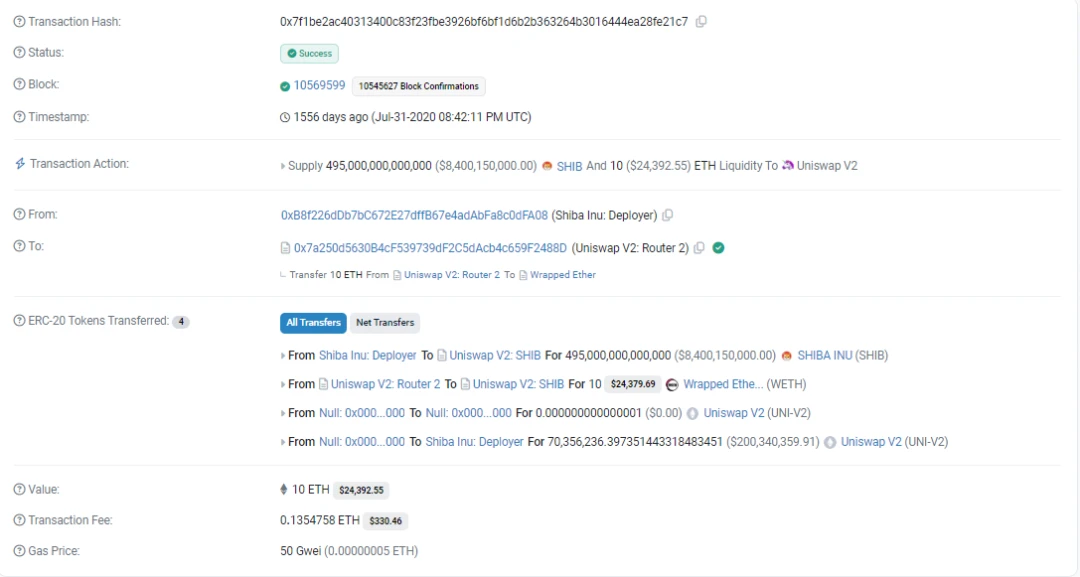

A deep observation of the birth process of Memes in the primary market is helpful for understanding Memes, especially those based on public chains. Even after several years, one can still view the initial liquidity establishment. Taking SHIB as an example, we can see the initial transaction of adding liquidity pools for SHIB, which reveals its astonishing market capitalization growth. Initially, SHIB's market capitalization was equivalent to only 20 ETH, valued at about $10K at the time. Converted to today's ETH market price, SHIB's initial market capitalization was merely $50K. This wealth growth effect is undoubtedly highly attractive and promotional for a Meme that grew to a billion-dollar market capitalization within a year.

https://dexscreener.com/ethereum/0x811beed0119b4afce20d2583eb608c6f7af1954f

https://etherscan.io/tx/0x7f1be2ac40313400c83f23fbe3926bf6bf1d6b2b363264b3016444ea28fe21c7

As a standout in Meme culture, SHIB's remarkable achievements have inspired the birth of numerous Memes. However, in this wave, not all Memes can sustain development. Users face many challenges when participating in these Memes, such as bizarre circulation volumes and initial market capitalizations, as well as a series of security issues, such as sudden withdrawals from liquidity pools, buy-only tokens that cannot be sold, token inflation, and ticker confusion caused by name misspellings or case inconsistencies. These factors not only weaken user trust but also pose challenges to the robust growth of the entire Meme.

This situation persisted until the emergence of Meme launch platforms like pump.fun. Although it specifically targets low market cap Memes, pump.fun has successfully promoted a standardized Meme mechanism, including the use of bonding curve pricing models, unified total token supply, platform-backed contract security, and standardized initial liquidity pool additions and burns. These standardized practices not only enhance the transparency and credibility of Memes but also provide a solid foundation for the healthy development of the Meme ecosystem.

Due to pump.fun's regulations on Memes: liquidity will not migrate to external DEX until the bonding curve is 100% complete, and trading can only occur on pump.fun. Therefore, players habitually refer to Memes with incomplete bonding curves as "internal trading." On the pump.fun platform, the total issuance of Meme tokens is set at 1 billion, with about 800 million sold in the internal market. When internal sales reach their limit, approximately 85 SOL is required. After pump.fun charges a fee of 1.5 SOL, 20% of the tokens will be minted, paired with 79 SOL, and then launched on the Raydium exchange. At this point, the initial circulating market capitalization of the token is set at 69K SOL. This process not only ensures liquidity management for Meme projects but also provides a clear reference for setting the initial market capitalization of projects.

For readers who want to delve into the numerical simulation of the pump.fun protocol, Gryphsis Academy offers a detailed article titled "Insights into the Pump.fun Protocol: From Bonding Curve Calculations to Profit Strategy Development." This article not only explains the workings of the pump.fun protocol in detail but also provides profound insights on how to utilize bonding curves for numerical simulations. (Migration fees change in real-time based on official settings, currently at 1.5 SOL)

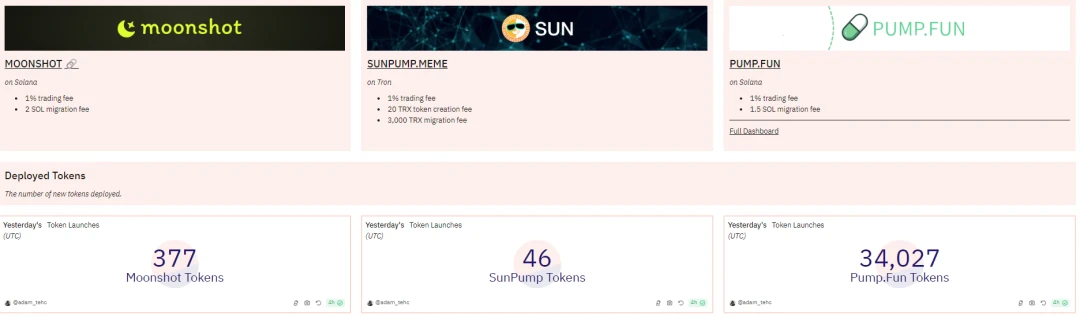

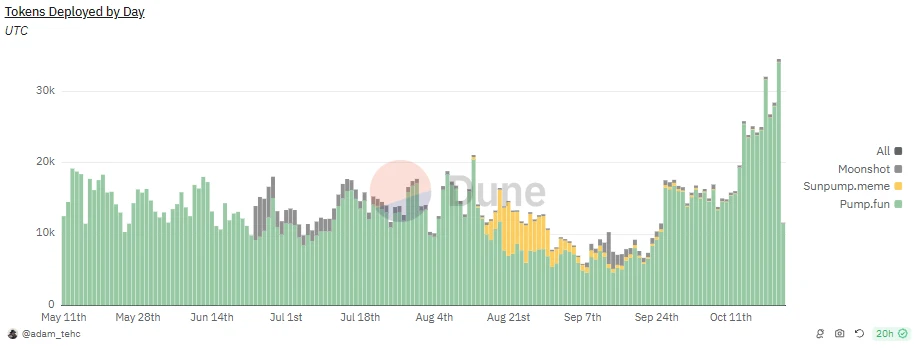

Currently, while pump.fun focuses on launching low market cap Memes, this does not mean that these Memes have limited ceilings. Recently, two Memes launched through pump.fun have successfully listed on top-tier exchanges (in contract form). This achievement has not only fueled the popularity of pump.fun's Meme launch activities but also brought significant economic benefits to pump.fun. Consequently, new products challenging pump.fun's position have emerged on the Solana chain, such as Moonshot, while other public chains have also seen the emergence of Meme launch platforms imitating pump.fun, like Tron’s Sunpump, all actively competing for market share in the Meme space.

In terms of launch mechanisms, Moonshot's main improvement over pump.fun is its support for adding initial pools from different external DEXs, as well as variations when the initial market cap is fully filled. Aside from this, the differences between the two are not significant. As for Sunpump, its overall mechanism is similar to that of pump.fun. Due to the industry's general adherence to the "first is first" principle, even with incentives like token airdrops to attract users for vampire attacks, it is challenging for new entrants to achieve significant breakthroughs. Next, we will combine data from Dune to gain a deeper understanding of the data performance of pump.fun, Moonshot, and Sunpump to assess their performance and competitiveness in the market.

According to Dune's data, the pump.fun platform shows a clear leading advantage in key metrics such as the number of token launches, revenue, and new participating addresses. Specifically, on October 23 (the time of writing), pump.fun achieved an astonishing 34,027 token launches. In terms of revenue, pump.fun's performance is equally impressive, generating over $2.09 million in revenue within 24 hours. Additionally, the growth of daily active addresses reached 107,355, with 43,760 being new wallets, this data reflects the high level of user engagement on pump.fun. These data points collectively depict pump.fun's strong performance and broad user base in the Meme market.

https://dune.com/adam_tehc/memecoin-wars

In contrast, the Ethereum mainnet, as a traditional hub for Memes, has not seen the emergence of a truly successful Meme launch platform. The only recent platform, Etherfun launched by Vista, has not garnered much attention. Of course, this may be related to the TPS of the Ethereum mainnet and the high Gas fees, as launching low market cap Memes requires fast and low-cost transactions to achieve a quantitative advantage. Perhaps in the future, we may see some changes and developments in Memes on promising Layer 2 solutions like Base.

Lifecycle and Pricing Logic

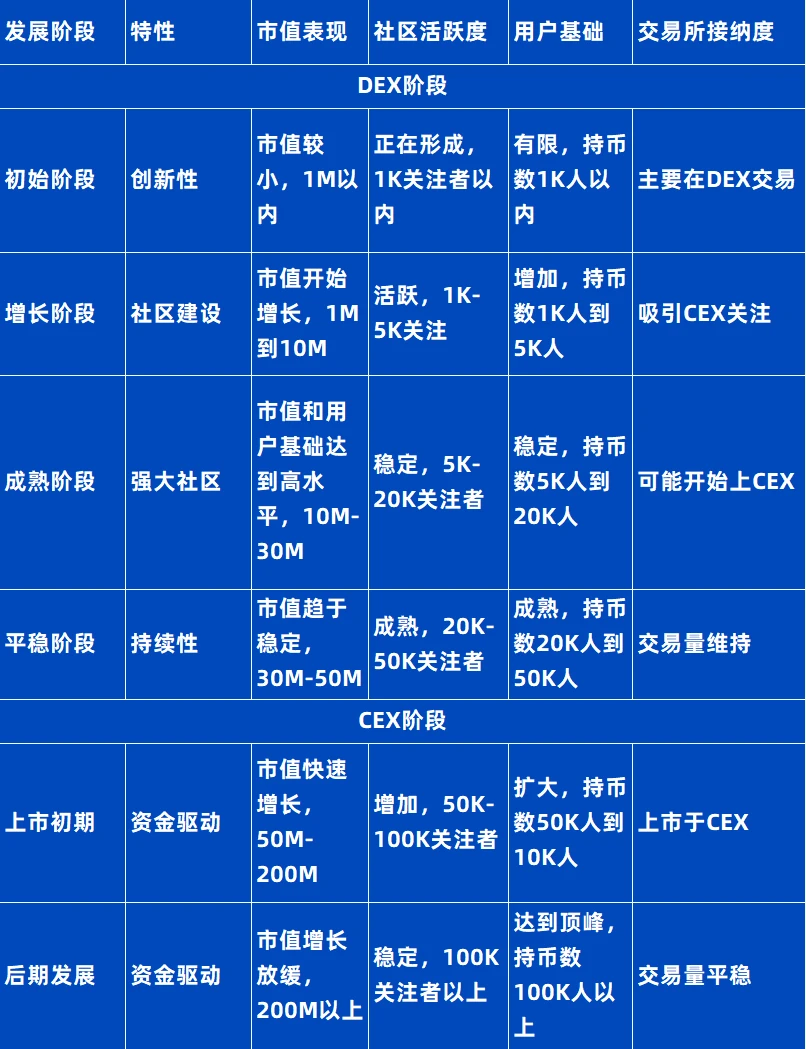

The lifecycle of a Meme is unpredictable, with its lifespan potentially lasting from a few minutes to several years. Memes that can withstand the test of time and remain popular typically go through several different development stages. We outline the basic evolution of Memes from the early stages on DEX to the mature stages on CEX, delineating the significant changes in key indicators such as market capitalization and community size during this process.

In analyzing market capitalization and user numbers, we utilize some steadily developing Meme projects to form preliminary judgments. According to the holder analysis from 0xScope, it is found that the number of Retail Holders generally far exceeds that of other types of holders (such as whales and large holders), and the market value of the tokens they hold accounts for about 20% to 25% of the total market capitalization. By analyzing the average purchase amount of Retail Holders in Meme coins, we can estimate the market capitalization data.

Taking a Meme coin with a market capitalization of $1 million as an example, the value held by Retail Holders is approximately between $200,000 and $250,000. Assuming there are about 1,000 holders, the average value of Meme coins held by each person would be around $200 to $250. This figure falls within a reasonable range for single-coin purchases among cryptocurrency users.

This estimation method provides us with an intuitive perspective to help assess the correlation between Memes in different market capitalization ranges and user participation.

https://dune.com/dyorcrypto/memecoins

Of course, based on the rough pricing above, we can attempt to find more precise methods or frameworks to assess the fair value of Memes. To this end, we can adopt a valuation approach similar to value investing. This involves researching and studying existing Meme valuations and their related data, statistically analyzing the valuation changes of different types of Memes at various development stages, as well as the dynamics of on-chain data.

Generally speaking, the initial price of a Meme is usually determined by the AMM model based on market supply and demand dynamics. Once the initial unit price is set, the market capitalization of the Meme can be calculated by multiplying the unit price by the circulation volume. It is important to note that this market capitalization will fluctuate with changes in market conditions and dynamic adjustments of liquidity pools.

According to the constant product formula of AMM, the growth curve of capital inflow, the proportion of tokens in the initial liquidity pool, and selling pressure will all impact the market capitalization. The simplest mnemonic for the basic model is: If the market capitalization doubles, the net inflow of funds is one time; if the market capitalization triples, the net inflow of funds is three times. However, this does not yet account for some complex factors, such as:

1. Transaction fees paid to liquidity providers (LPs);

2. The inflow and outflow of funds in the liquidity pool (LP pool).

In a dynamically changing market, pricing models cannot be ideal, so it is necessary to combine other indicators to calculate the fair price of Memes, such as trading volume, number of trades, and distribution of holding users. Of course, this is a cost-driven approach to market capitalization. As costs continue to rise, the market capitalization of Memes should also increase accordingly. When breaking down these costs, the first thing to note is the transaction fees generated by trading volume. These fees constitute the main cost of maintaining market capitalization. In addition, there are other hidden costs: Gas fees paid to the blockchain network for each transaction and the time cost of funds for holding users. The cumulative effect of these costs may significantly impact the overall market capitalization of Memes. We believe this can partially explain the fair value of Memes, but it is not a universal pricing formula.

VC Perspective on Blue-Chip Memes

From the data, Memes have become more than just a niche phenomenon; they now have their own distinct characteristics, and as VCs, everyone is paying attention to this sector. Just like investing in other projects, VCs looking to participate in Memes must first identify those that can withstand market fluctuations and demonstrate stable performance as blue-chip Memes.

To identify high-quality Memes, it is essential to focus on several key characteristics: sustainability, virality, and community engagement. A quality Meme should possess long-term appeal, be easily shareable, and have enthusiastic community support. These factors form the foundation of a Meme's success.

For community-driven or capital market management team-led Memes, it is crucial to understand the main participants driving the project. This may include whales or other key stakeholders. Understanding these behind-the-scenes players is vital for assessing the potential and credibility of a Meme. In the absence of market capitalization management, the community plays an important role in Meme projects. Their enthusiasm and engagement can influence the popularity and market capitalization of the Meme. Unconscious collective actions, such as promotions and discussions on social media, can greatly enhance the spread and acceptance of Memes. Therefore, the role of the community in Meme projects cannot be overlooked, as it directly impacts the success of the Meme.

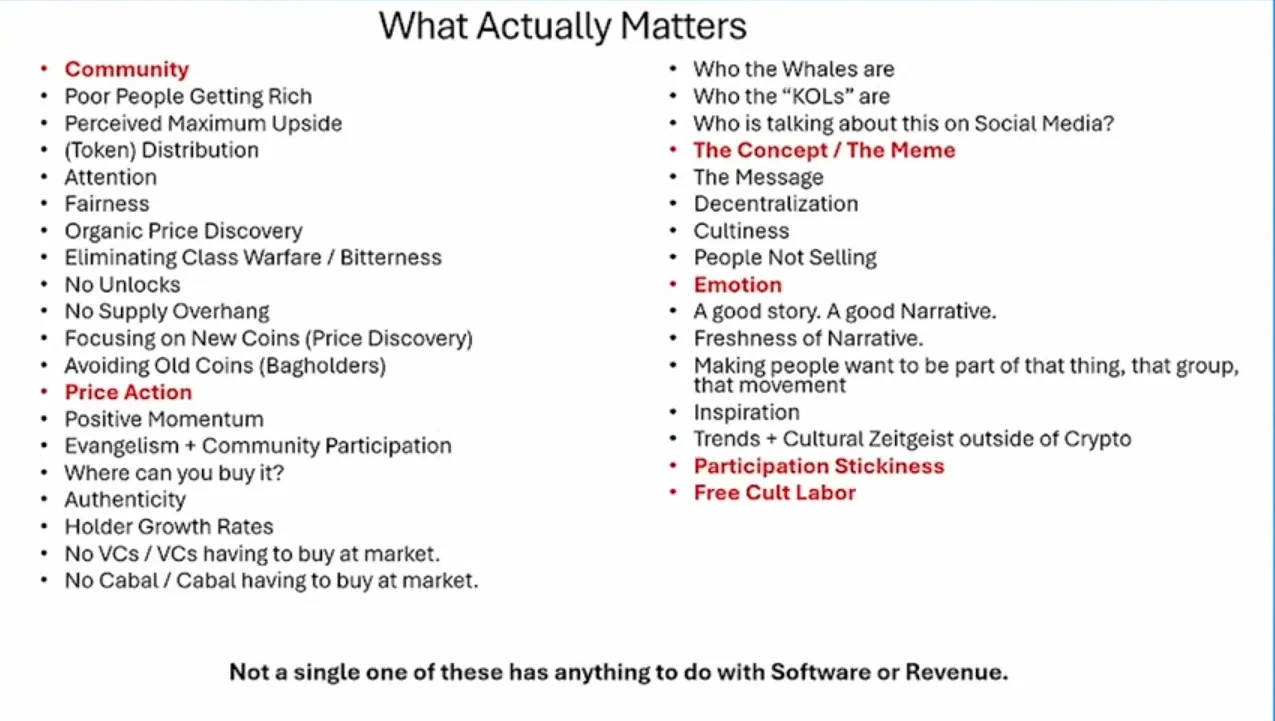

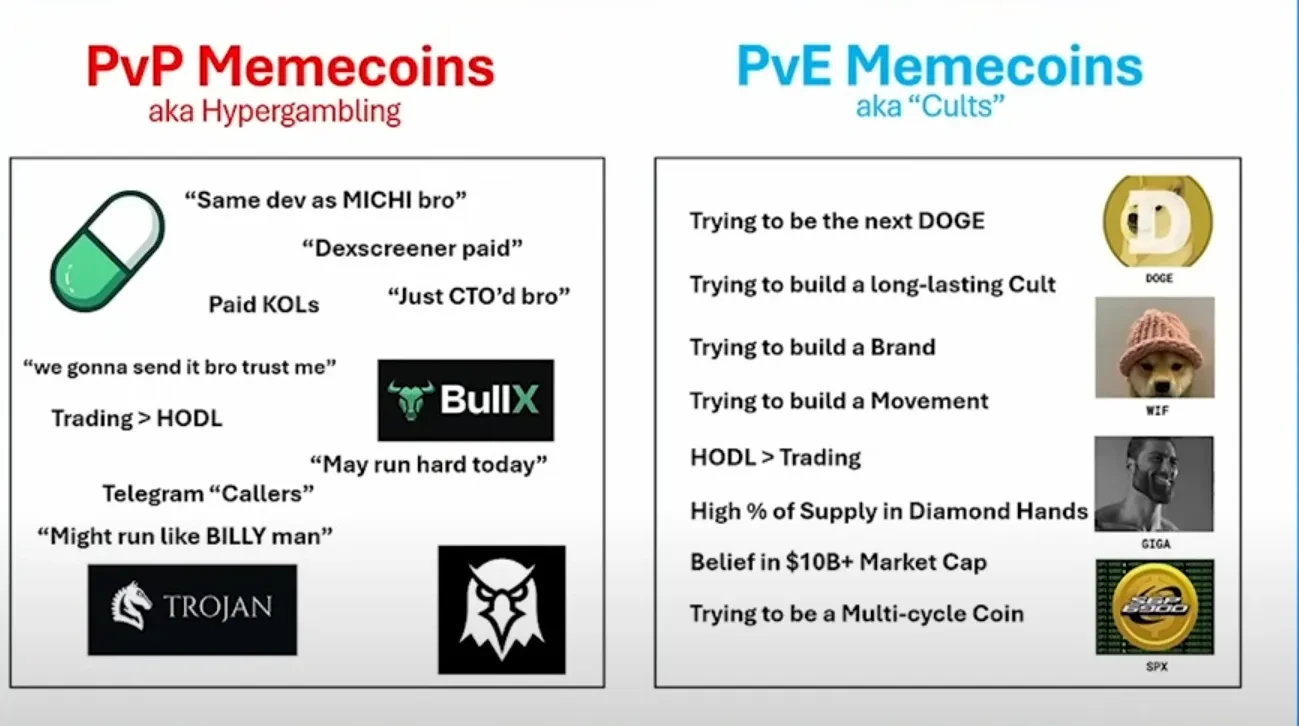

For this reason, we find Murad's concept of PvE Memecoins presented in his Meme Supercycle talk to be very vivid, as illustrated in the two images below.

Conclusion

Memes are becoming a new battleground for VCs, testing whether they can keep pace with market trends, while on-chain Degen user movements provide VCs with insights into user needs. However, Memes do not directly open their doors to VCs. The so-called Supercycle narrative can easily lead VCs into FOMO. The harsh reality is that one should not be blinded by survivor bias; successful Memes are merely a minority. Therefore, to succeed in the Meme space, VCs must invest significant time and effort to uncover those truly blue-chip Memes. This battleground is not a place where broad investment strategies will yield substantial returns.

Reference

dogecoin:https://dogecoin.com/

pump.fun:https://pump.fun/

Vista's etherfun:https://etherfun.app/

0xScope:https://0xscope.com/

CoinMarketCap:https://coinmarketcap.com/

gmgn:https://gmgn.ai/

dogwifcoin:https://dogwifcoin.org/

Murad:https://x.com/MustStopMurad

Dune Memecoin Wars:https://dune.com/adam_tehc/memecoin-wars

Insights into the Pump.fun Protocol: From Bonding Curve Calculations to Profit Strategy Development https://www.techflowpost.com/article/detail_18340.html

SHIB's initial trading pool:https://dexscreener.com/ethereum/0x811beed0119b4afce20d2583eb608c6f7af1954f

SHIB's first LP addition transaction:https://etherscan.io/tx/0x7f1be2ac40313400c83f23fbe3926bf6bf1d6b2b363264b3016444ea28fe21c7

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。