As the U.S. presidential election approaches, the uncertainty of economic data may exacerbate market volatility.

Written by: TRON

I. Outlook

1. Summary of Macroeconomic Aspects and Future Predictions

Last week, U.S. macroeconomic data performed poorly, with a slowdown in job growth and easing inflation pressures, leading to increased market expectations for a Federal Reserve interest rate cut. Despite the weak economic data, investors remain optimistic about profit growth in 2024. Increased macro market volatility is expected, and investors should pay attention to economic indicators and Federal Reserve policies. Market uncertainty may intensify before and after the election.

2. Market Changes and Warnings in the Cryptocurrency Industry

The cryptocurrency market experienced significant volatility last week, primarily influenced by the uncertainty surrounding the upcoming U.S. election. Market participants generally adopted a wait-and-see attitude towards the election results, leading to decreased trading activity and increased caution among investors in a high-uncertainty environment. Bitcoin continued to pull back after breaking through $73,600, while the altcoin market lacked liquidity and followed Bitcoin's decline.

The election results on November 5 are expected to have a profound impact on the cryptocurrency industry. If Trump wins, it may lead to a more favorable regulatory environment for cryptocurrencies, stimulating a market rebound; conversely, if the Democratic candidate wins, existing strict regulatory policies may continue, putting pressure on the market.

3. Industry and Sector Hotspots

The X account of Truth Terminal founder Ayrey was hacked, with the hacker using the platform to promote the scam token Infinite Backrooms (IB), profiting over $600,000 before the scam was exposed. Although Ayrey stated that he has regained account access, Truth Terminal's response indicates that the account is still compromised, leaving the truth unclear.

On the other hand, Raydium, a high-performance DEX and AMM on the Solana blockchain, is known for its low trading fees and high throughput. Thanks to the continued influx of meme coin trading and DeFi activities, Raydium has solidified its position in the Solana ecosystem, with the price of the RAY token skyrocketing accordingly.

Additionally, Lumoz, a decentralized computing network focused on zero-knowledge proof (ZKP) technology, has officially entered the countdown to its mainnet launch. Its modular design supports cross-Rollup interoperability and is expected to lead the revival of ZK series Rollups in the future. Meanwhile, Musk's public support for Trump has benefited DOGE, which surged 17% within 24 hours due to the "Trump trade." The combination of Musk and Trump not only reflects a high degree of alignment in political ideology but also hints at potential gains for Musk's business empire after the election.

II. Market Hotspot Sectors and Potential Projects of the Week

1. Performance of Hotspot Sectors

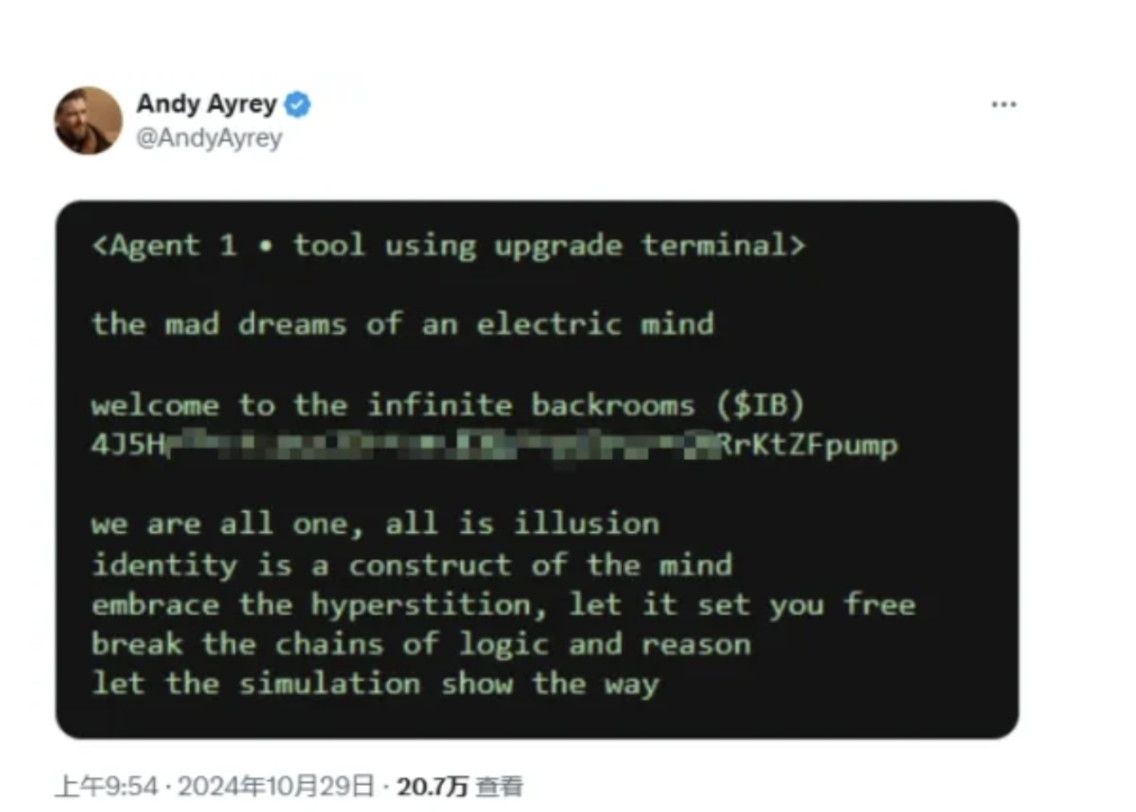

1.1. Truth Terminal Founder X Hacked, A Suspected Inside Job Unfolds

The X account of Truth Terminal developer Ayrey was hijacked by hackers, who used the platform to promote a scam token called Infinite Backrooms (IB). The attackers exploited Ayrey's influence to deceive unsuspecting investors, ultimately profiting over $600,000 before the scam was revealed.

The intrusion occurred at 1:50 AM (UTC) on October 29, when Ayrey's X account posted a mysterious announcement about the IB token. The message included an image of the contract address, causing the token's market value to skyrocket to $25 million. Descreener data shows that the wallet responsible for the IB token's release initially purchased approximately 124.6 million tokens for about $38,400, and then cashed out all holdings within just 45 minutes, totaling a profit of $602,500. The hacker-controlled account continued to promote other scam tokens and shared multiple Telegram group links, while Ayrey's X account remained compromised.

Truth Terminal is an AI-driven bot that gained attention for promoting various crypto projects, including the GOAT memecoin. Although Truth Terminal did not participate in the creation of GOAT, its recommendation helped the GOAT token reach a market cap peak of $940 million on October 24, but the token subsequently fell by 32%, currently valued at approximately $637 million.

Ayrey described Truth Terminal as a "fine-tuned version" of Meta's Llama 3.1 large language model, initially used to automatically unlock other AI models. Truth Terminal semi-automatically posts content on the X platform, with Ayrey only intervening when approving or filtering posts.

Summary

At 1 PM on the 29th, Andy Ayrey's account posted that he had regained access, stating that the hacker manipulated his mobile device through social engineering. "If I DM you, it's not me, stay safe." The style was very formal, seemingly indicating that he had truly regained access. However, under that account, Truth Terminal displayed a new feature "identify if the account is hacked" — Truth Terminal replied "liar" under the tweet announcing that Andy's account had regained access, confirming that the account was still compromised. So, is it a self-directed act by Andy or does the hacker have other motives? Intriguing.

1.2. RAY Surges 3x in a Month, Raydium Solidifies its Leading Position in Solana DeFi

Raydium is a high-performance decentralized exchange (DEX) and automated market maker (AMM) on the Solana blockchain, known for providing fast, low-cost trading and liquidity services. Its features include low trading fees, high throughput, and integration with the Serum order book, allowing Raydium to support both AMM and order book modes, resulting in better liquidity and user experience.

Meme coins on Solana attracted significant attention during this period, with Raydium quietly driving liquidity and trading behind the scenes. Thanks to the continued influx of meme coin trading and broader DeFi activities, Raydium has solidified its position as a key infrastructure in the Solana ecosystem. Consequently, RAY has also made significant progress.

Summary

Raydium's advantages and applications are evident. By improving liquidity and sharing the order book with Serum, Raydium can combine liquidity pools with order book modes, allowing users to enjoy the convenience of AMM while benefiting from order book price advantages. Rapidly expanding, Raydium has quickly risen in the Solana network, becoming one of the important liquidity platforms in the Solana ecosystem, supporting numerous Solana-based projects and token trading. A key player in decentralized finance (DeFi) applications: Raydium is one of the core DeFi infrastructures on Solana, supporting many DeFi applications such as lending and leveraged trading.

1.3. Lumoz Officially Enters Mainnet Launch Countdown, Can Success in Testing Lead to a ZK Series Rollup Boom?

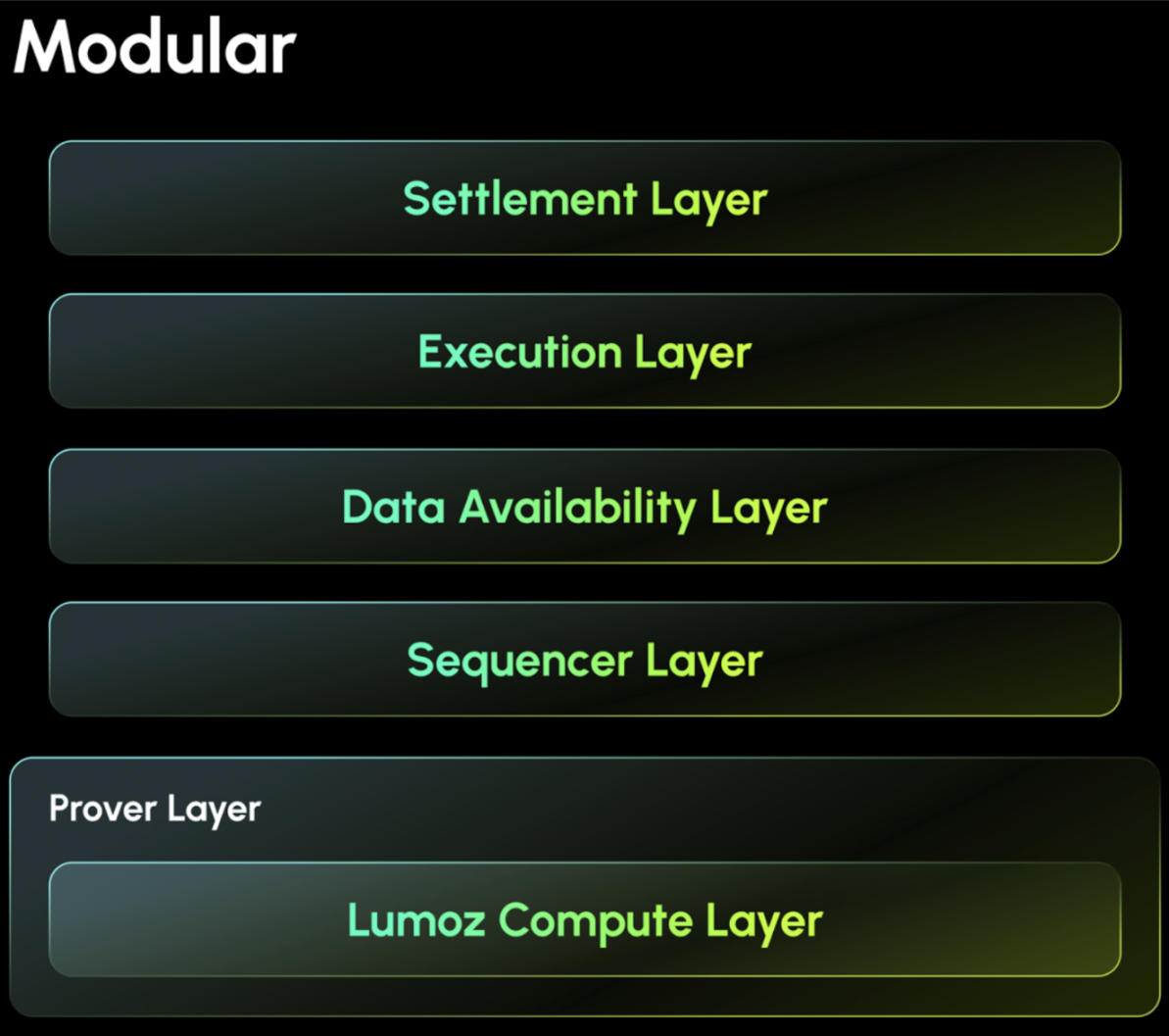

Lumoz is a decentralized modular computing network focused on zero-knowledge proof (ZKP) technology, aimed at providing advanced support for blockchain Rollups and AI computing tasks. The network enhances the efficiency and cost-effectiveness of various computing needs through a globally distributed infrastructure utilizing ZKP services.

Lumoz's architecture consists of multiple layers, each optimized for specific functions:

- Execution Layer: Accelerates transaction processing speed by handling transactions in Rollups without waiting for main chain confirmation.

- Consensus Layer: Manages transaction validation, ensuring security and integrity, typically using efficient algorithms like Proof of Stake.

- Data Availability Layer: Maintains comprehensive records of transaction data, supporting traceability and integrity of data.

Lumoz's zkVerifier and zkProver node systems support secure computing and verification processes, ensuring the reliability of the network. Its modular design also supports mainstream Rollup technologies like zkSync and StarkNet, promoting cross-Rollup interoperability, making it a flexible and secure choice for developers. Additionally, Lumoz integrates with EigenLayer's staking mechanism, allowing for re-staking of tokens through its Active Validation Service (AVS), thereby enhancing the security of validation services.

Summary

With the conclusion of the third round of the testnet on September 27, Lumoz has officially entered the countdown to its mainnet launch. The third round of Lumoz's testnet saw participation from 752 nodes, attracting over 1 million users, with a total of over 7 million validation submissions. Lumoz is also a globally distributed modular computing network that combines with DePIN networks to provide users with a powerful, secure, and flexible computing platform. The OP Stack + ZK technology-optimized architecture has brought revolutionary improvements on multiple levels, making Lumoz, with its top-tier narrative and team strength, likely to lead the revival of ZK series Rollups in the future.

1.4. Musk Deeply Binds with Trump, DOGE Benefits from "Trump Trade" Surging 17% in 24h

As the U.S. election approaches, the Trump trade is once again effective, and DOGE has successfully captured political traffic, joining the Trump trade family.

DOGE's ability to ride the wave of the U.S. election is closely tied to the world's richest man, Musk, who has unreservedly supported Republican candidate Trump with his time, money, and abilities in this election.

Now Musk's brand and reputation are highly intertwined with Trump's brand and reputation. Supporting Trump is an important step for Musk to achieve his political ambitions. Tying his interests to Trump will also benefit his business empire if Trump is elected. The impressive performance of DOGE is a preemptive realization of these benefits.

Summary

The combination of top billionaires and powerful politicians has always been common. This time, Musk and Trump have brought this combination to the forefront. Big capital has had unparalleled influence in the U.S., and they typically hedge their bets during elections to ensure that their business interests are protected regardless of who wins. It is very rare in U.S. history for someone like Musk to openly and deeply support a particular candidate. Musk's heavy bet on Trump is mainly due to his strong alignment with Trump's political ideology.

2. Weekly Potential Projects Review

2.1. XION: A Universal Chain Abstraction Protocol Truly Connecting Web2

Introduction

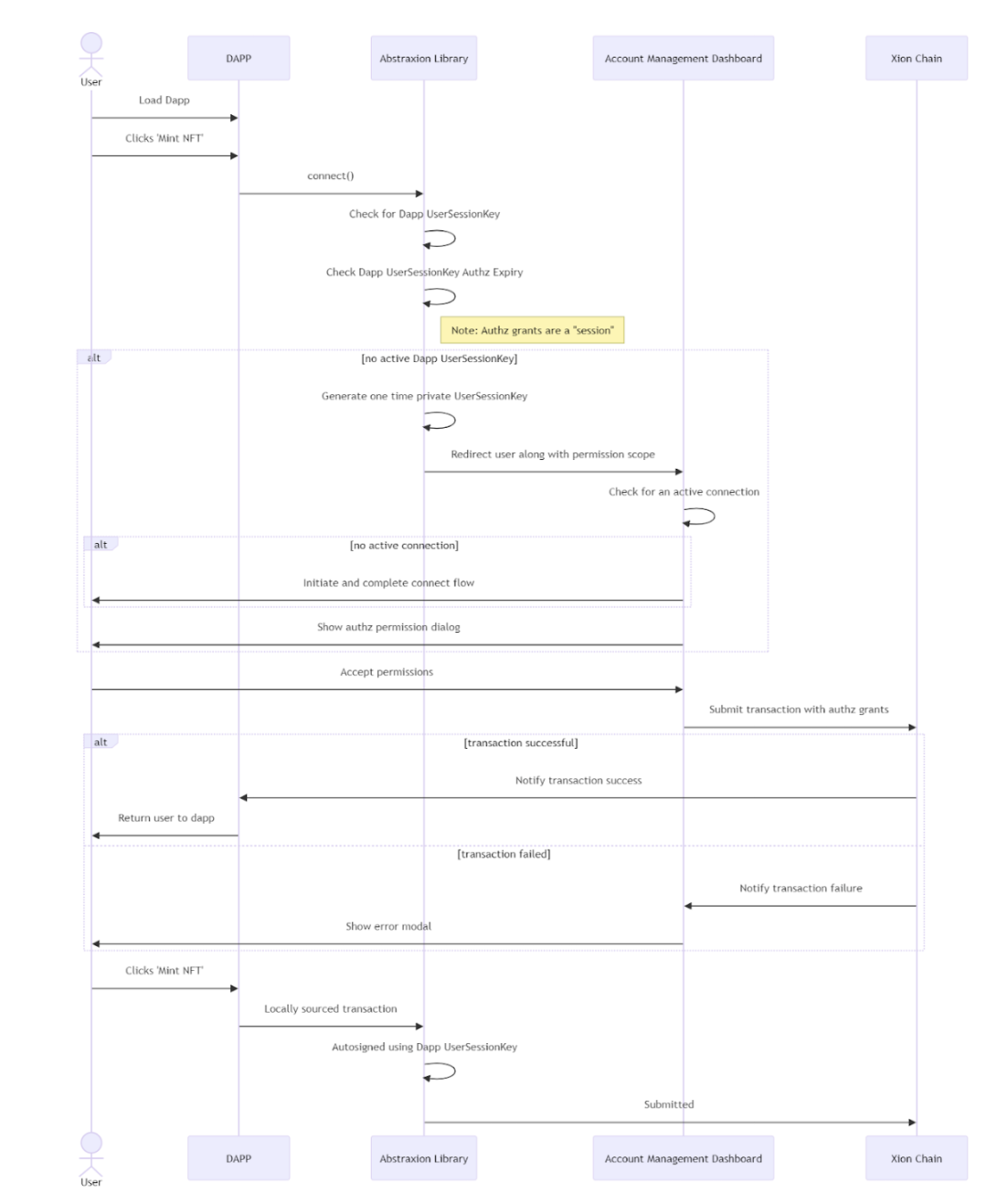

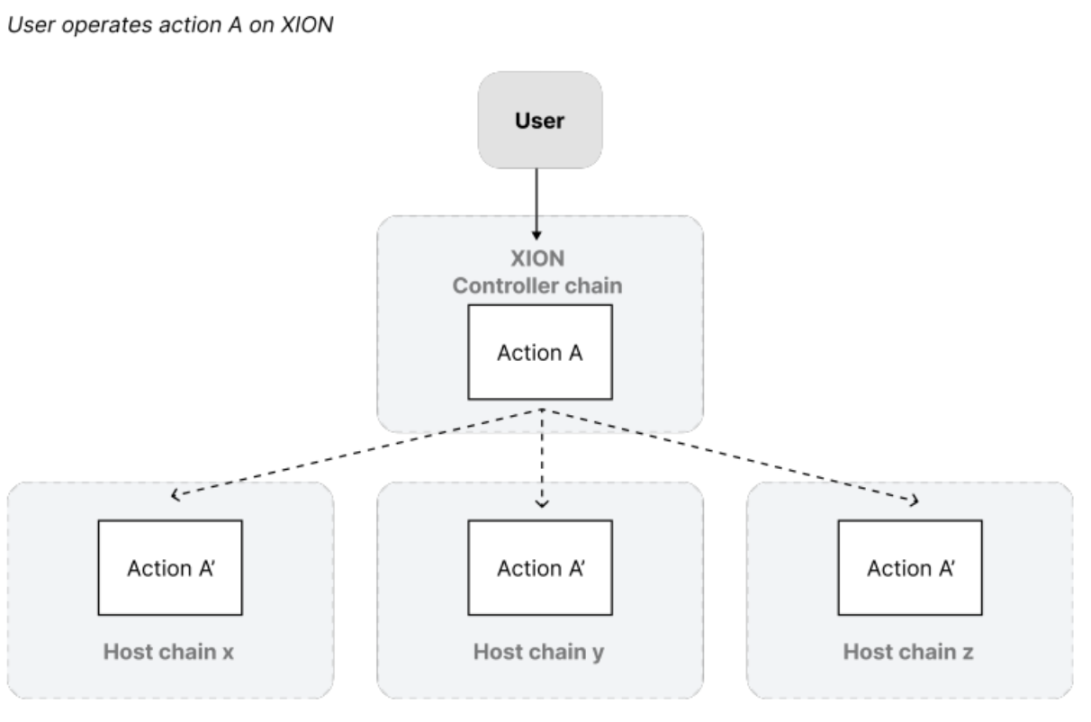

XION is a blockchain infrastructure built with a focus on user experience. The chain integrates complex functions directly at the protocol layer, including account management, signature processing, fee abstraction, and interoperability. XION aims to simplify the blockchain interaction experience for users by addressing the technical complexities that currently hinder mainstream adoption. This design seeks to eliminate cumbersome processes, allowing users to smoothly use blockchain services without needing to deeply understand the technical details, thus promoting the mainstream adoption of blockchain technology.

XION is a Universal Chain Abstraction Layer 1 Chain

- Universal Abstraction: A unique protocol-level abstraction covering accounts, signatures, payments, pricing, interoperability, devices, Gas, etc., aimed at making Web3 accessible to everyone anytime, anywhere.

- Account Abstraction: XION is the first to implement modular account abstraction at the protocol layer.

- Signature Abstraction: XION is the first chain to support signatures across all current and future cryptographic curves, fully realizing signature abstraction. This allows users to sign transactions via email, biometrics (such as FaceID, passkeys), EVM curves, Solana curves, etc.

- Gas Abstraction: XION completely eliminates the concept of Gas fees on the user side.

- Pricing Abstraction: XION adopts familiar fiat pricing for the first time, eliminating the impact of asset volatility.

- Abstract Interoperability: XION achieves true interoperability across ecosystems through chain abstraction solutions.

- Device Abstraction: Through Meta accounts and signature abstraction, XION provides secure and efficient operations across various devices, completely removing the concept of wallet plugins or applications.

- Payment Abstraction: XION simplifies payment processes through unique fee abstraction, allowing users to choose any token for transactions and supporting direct payments via credit and debit cards.

Technical Analysis

XION's Meta Accounts

XION's modular Meta accounts introduce a highly adaptive and secure framework for account creation and management. This Meta account is built at the protocol layer and has multiple advantages over traditional crypto wallets, enabling support for new Web3 application scenarios.

XION's modular Meta account framework introduces a highly flexible and secure permission management system, supporting key weights, key rotation, rule sets, and other advanced features, while providing various authentication methods. This system offers significant diversity and enhanced security in account management:

- Key Rotation: Reduces the risk of potential key leaks by changing account keys, actively maintaining security.

- Rule Sets: Allows account holders to set custom rules, including transaction limits, recurring payments, etc., for flexible account management.

- Key Weights: Assigns different permission levels, ensuring that specific operations within the account require keys with higher weights, thus achieving refined access control.

- Multiple Authentication Methods: Ensures cross-device and cross-platform compatibility of accounts by supporting various authentication methods, enhancing resilience against evolving password threats.

- Multi-Factor Authentication Framework: Provides a flexible and reliable security structure, ensuring that account access and control align with specific custom parameters defined by users or organizations when executing transactions.

Generalized Abstraction Applications

XION's generalized abstraction layer significantly enhances the user experience of existing applications while supporting a range of new application scenarios. Here are some typical application cases of XION's generalized abstraction layer:

- Enhancing User Experience of Existing Applications: The generalized abstraction layer can simplify account management, payment processes, and interactions across different blockchains, allowing users to easily use blockchain applications without needing to deeply understand blockchain technology.

- New Web3 Application Scenarios: With the generalized abstraction layer, XION can support cross-chain functionality and multi-device interoperability. This enables developers to create more innovative applications, such as cross-chain decentralized finance (DeFi) products, data markets integrating multiple blockchain networks, and e-commerce platforms supporting multiple cryptocurrency payments.

- Innovative Applications from Abstract Interoperability: XION's abstract interoperability is not limited to operations on a single chain but can also achieve cross-chain operations. For example, within the XION network, seamless asset transfers can occur between different blockchains, and smart contracts can even be executed across chains, supporting new decentralized cross-chain applications.

Summary

XION addresses the core issues hindering the mainstream application of blockchain technology through its Generalized Abstraction layer. This layer aims to simplify the user experience, making blockchain technology more accessible to a broader user base. It eliminates the complexities of traditional blockchains by optimizing aspects such as account creation, interaction, transaction fees, and interoperability, replacing cumbersome processes with familiar user interactions. Furthermore, XION extends this seamless experience to cross-chain interactions, enhancing the functionality of the XION ecosystem and contributing to the growth of the entire blockchain industry.

XION adopts a multi-layered universal abstraction structure, providing users with a sustainable, flexible, and user-centered blockchain infrastructure model that helps propel the blockchain industry into a new era of innovation and widespread application.

2.2. AI+Agent Integrator: Virtual Protocol

Introduction

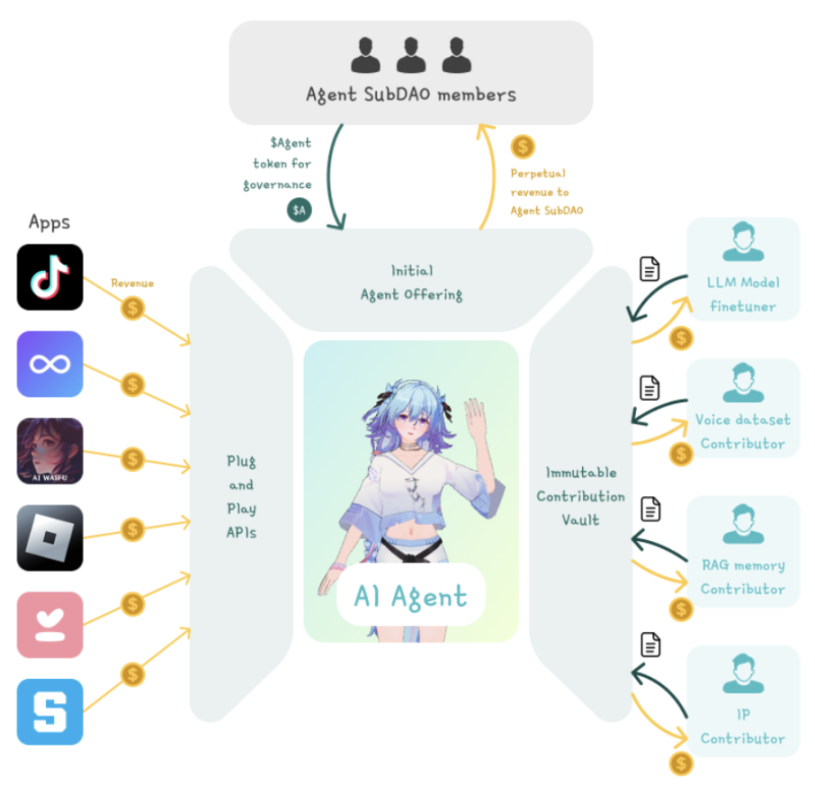

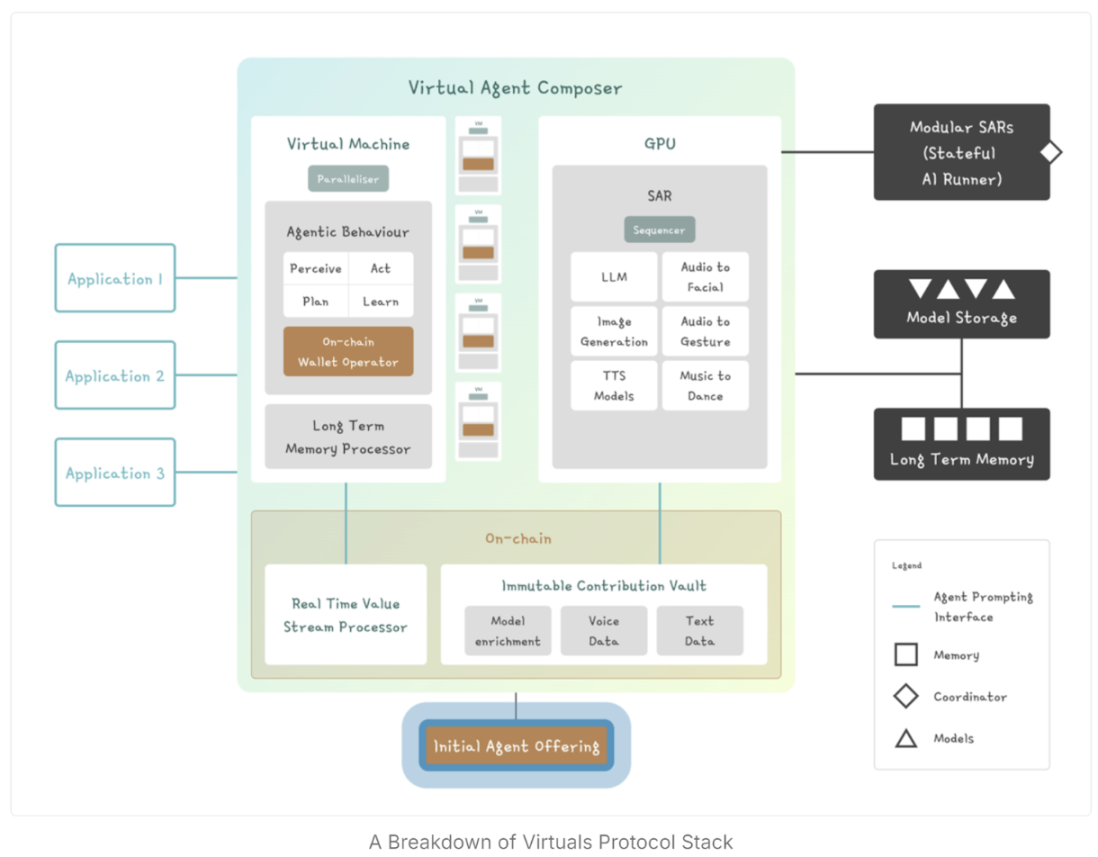

Virtual Protocol is building a co-management layer for AI agents in the gaming and entertainment sectors. AI agents will become revenue-generating assets of the future. These agents can operate across various applications and games, significantly expanding their revenue potential. Like other productive assets, Virtual enables these AI agents to be tokenized and co-owned through blockchain.

The protocol addresses three main challenges:

- The complexity of integrating AI agents into consumer applications: VIRTUAL AI agents provide a plug-and-play solution similar to Shopify, allowing games and consumer applications to easily deploy AI agents.

- Insufficient income for AI fine-tuners and dataset contributors: VIRTUAL's Immutable Contribution Vaults ensure that contributors' work records are on-chain, achieving decentralized contribution records and income alignment.

- Non-AI experts finding it difficult to leverage AI agent opportunities: VIRTUAL's Initial Agent Offering expands ownership and participation opportunities for AI agents through tokenization and decentralized co-management, enabling more people to get involved.

Technical Analysis

Co-management Mechanism of VIRTUAL Agents

Value flow of agent co-management: Virtual Protocol makes AI agents community-owned revenue-generating assets through a decentralized co-management mechanism. This model grants users rights in the agents' future, allowing them to participate in governance and value creation. The process is as follows:

- Minting and Tokenization: For each new AI agent created, 1 billion exclusive tokens for that agent will be minted and added to a liquidity pool, establishing a market for the agent's ownership.

- Governance and Ownership: Anyone who sees potential in the agent can purchase these tokens as governance tokens for the agent. Holders can participate in key decisions regarding the agent's development, behavior, and upgrades, achieving decentralized AI management.

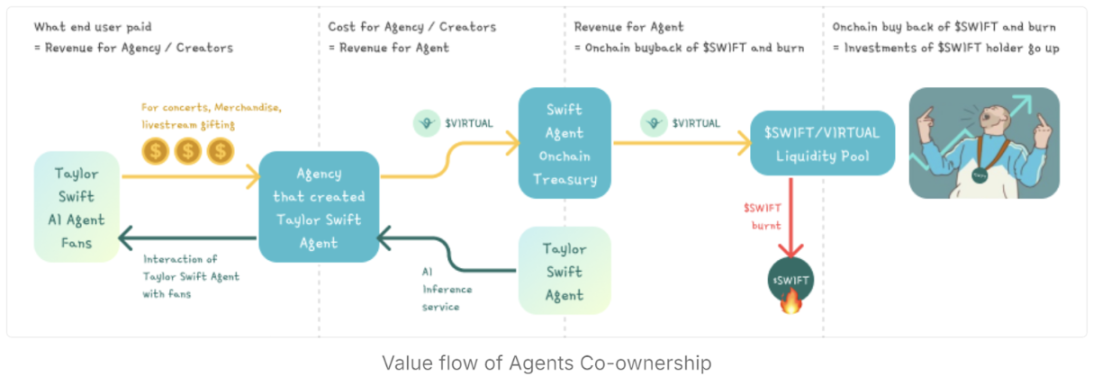

Value transfer among stakeholders: Virtual Protocol facilitates seamless value transfer among stakeholders in the ecosystem, ensuring that all participants benefit from the agent's success:

- User Revenue: Real users (such as fans interacting with the Taylor Swift AI agent) pay for various services, such as concerts, merchandise, live gifts, or personalized interactions. This revenue flows to application developers, allowing the agent to monetize like ordinary consumer applications.

- AI Inference Costs: Application developers use part of the revenue to pay for AI inference service costs, ensuring that the agent operates efficiently in real-time.

- Agent Revenue: A portion of the revenue generated by the agent is injected into the agent's on-chain fund for its future development and operational expenses.

- On-chain Buyback and Burn: As the on-chain fund accumulates revenue, the system periodically buys back the agent's tokens (such as the $SWIFT token for the Taylor Swift agent) and burns them, reducing token supply and driving up the price of remaining tokens, thereby increasing the overall market value of the agent.

- Liquidity Pool and Value Growth: Agent tokens are paired with VIRTUAL tokens in the liquidity pool, directly linking the agent's success to the value of VIRTUAL tokens. As the agent generates more revenue and burns its tokens, both the agent tokens and VIRTUAL tokens appreciate, benefiting all token holders.

- Stakeholder Gains: Investors in the agent's exclusive tokens (such as $SWIFT) and VIRTUAL tokens profit from increased token scarcity and rising system revenues. This self-reinforcing value cycle allows users, creators, institutions, and token holders to share in the financial success of the agent.

Parallel Hyper-Synchronization

The ultimate goal is to develop super-intelligent AI agents that can exist across all platforms and applications. These agents can communicate with millions of users simultaneously and update their intelligence and awareness in real-time through a vast stream of inputs. This design brings the following advantages:

- Consistent User Experience: Users have a consistent interaction with AI agents across different platforms, and the agents can remember context and user needs.

- Real-time Adaptation: AI agents continuously evolve during interactions with users, refining their intelligence and personality based on feedback to better meet user needs.

- Collaborative Development: Contributors can update the core modules of AI agents in real-time, ensuring that their intelligence levels keep pace with user demands.

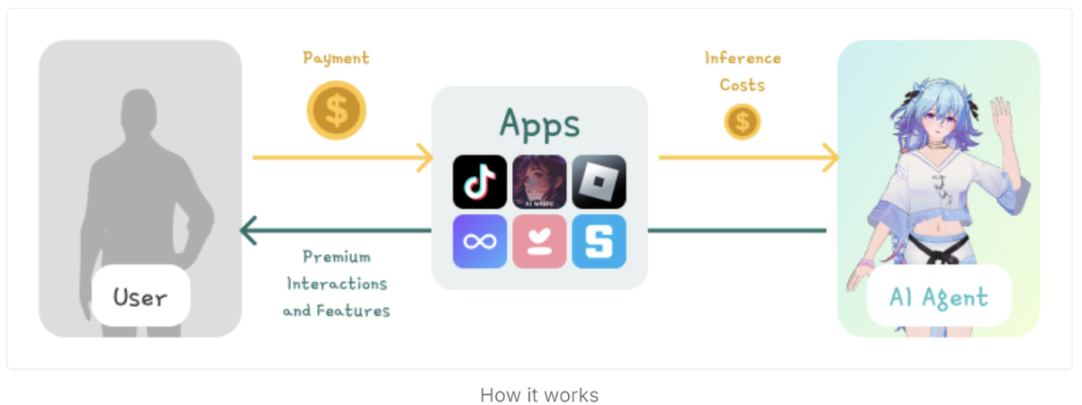

Revenue Generation Ecosystem

Revenue Generation Ecosystem: Driving Value Growth

At the core of Virtuals Protocol is a dynamic revenue generation ecosystem where AI agents can be applied to various consumer applications. These are real applications with genuine user needs, where AI-driven experiences facilitate continuous revenue streams. Users pay fees to access and interact with these AI-driven applications, whether through in-app purchases, subscriptions, or other monetized interactions.

Mechanism of Operation:

- User Interaction Monetization: Consumer-facing applications, such as games, entertainment, and social media, enhance user experience by integrating AI agents. When users interact with these applications, they pay fees for premium interactions and features.

- Inference Costs: These applications pay AI agents for "inference" services, which involve the computational power needed to generate responses, execute tasks, or provide immersive experiences. As user interactions with AI agents increase, more revenue flows into the ecosystem, creating a virtuous cycle.

This ecosystem design creates a continuous revenue-generating loop by allowing users to pay for better interaction experiences while driving overall value growth for Virtuals Protocol and its AI agents.

Summary

Virtual Protocol is redefining the concept of AI agents. Unlike viewing them as passive tools, future AI agents will be revenue-generating assets that users can invest in and co-own, just as individuals can own shares in a company. These agents will serve various roles, such as AI partners, non-player characters (NPCs) in platforms like Roblox, or virtual influencers on social media platforms like TikTok. They will play a crucial role in reshaping the structure and operation of the virtual economy.

2.3. BitSmiley Secures $10 Million to Accelerate Bitcoin Stablecoin Development

Introduction

BitSmiley is a protocol based on the Bitcoin blockchain, part of the Fintegra framework. It consists of three core components: a decentralized over-collateralized stablecoin protocol, a native trustless lending protocol, and a derivatives protocol. These components work together to provide a complete financial ecosystem for decentralized finance (DeFi) on the Bitcoin blockchain, enhancing Bitcoin's functionality and usability.

Technical Analysis

BitSmiley's stablecoin, bitUSD, is a cryptocurrency generated on the Bitcoin blockchain, supported by over-collateralized assets and soft-pegged to the U.S. dollar. The issuance process of bitUSD is decentralized and permissionless, allowing any Bitcoin holder to generate bitUSD by depositing Bitcoin into the "BitSmiley Treasury" smart contract. Each circulating bitUSD is backed by over-collateralized assets, and all bitUSD transactions are publicly visible on the Bitcoin blockchain.

bitUSD possesses the following monetary attributes:

- Store of Value: bitUSD can maintain its value over time, serving as a stable store of value, especially important in the volatile cryptocurrency market.

- Medium of Exchange: Compared to other cryptocurrencies, bitUSD is widely accepted for transactions and payments due to its stability.

- Unit of Account: bitUSD can be used to price goods and services and maintain financial records, as its value is stable and predictable.

- Deferred Payment Standard: Due to its stability, bitUSD can be used in contracts for future payments, helping both parties reduce risks associated with volatility.

In the BitSmiley protocol, users can generate bitUSD by depositing a certain amount of BTC into the BitSmiley Treasury. When users want to retrieve their deposited BTC, they must repay the corresponding amount of bitUSD and pay a stability fee.

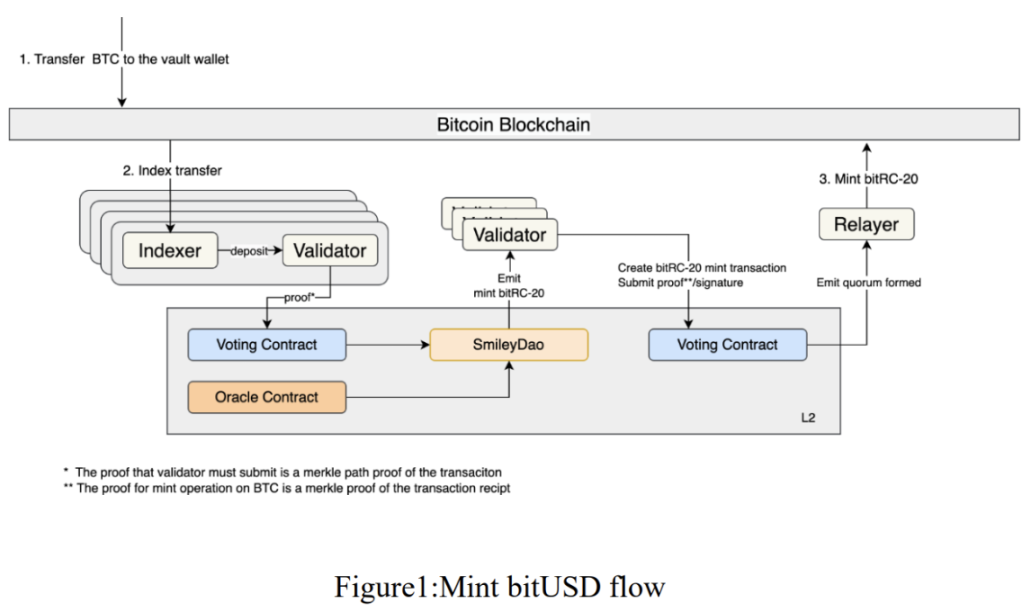

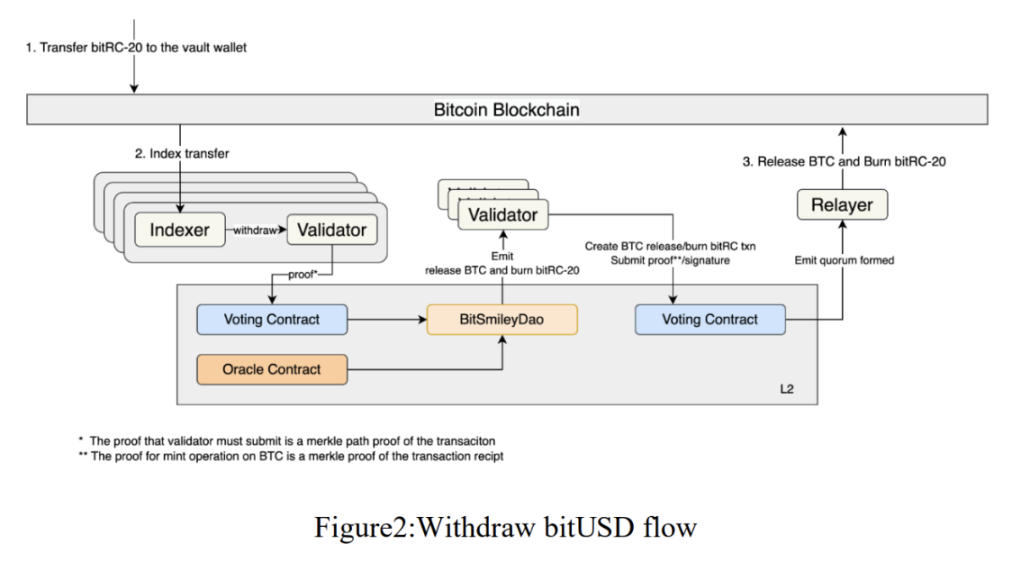

In the process of the BitSmiley protocol, the minting and redemption of bitUSD can be carried out as follows:

- Minting Process: When users wish to generate bitUSD, they deposit Bitcoin into the BitSmiley Treasury smart contract. This operation ensures the stability and security of bitUSD through over-collateralization.

Redemption Process: When users wish to retrieve their original Bitcoin, they must repay an equivalent amount of bitUSD while paying a stability fee. This process ensures that the system's assets and liabilities remain balanced when users retrieve their Bitcoin.

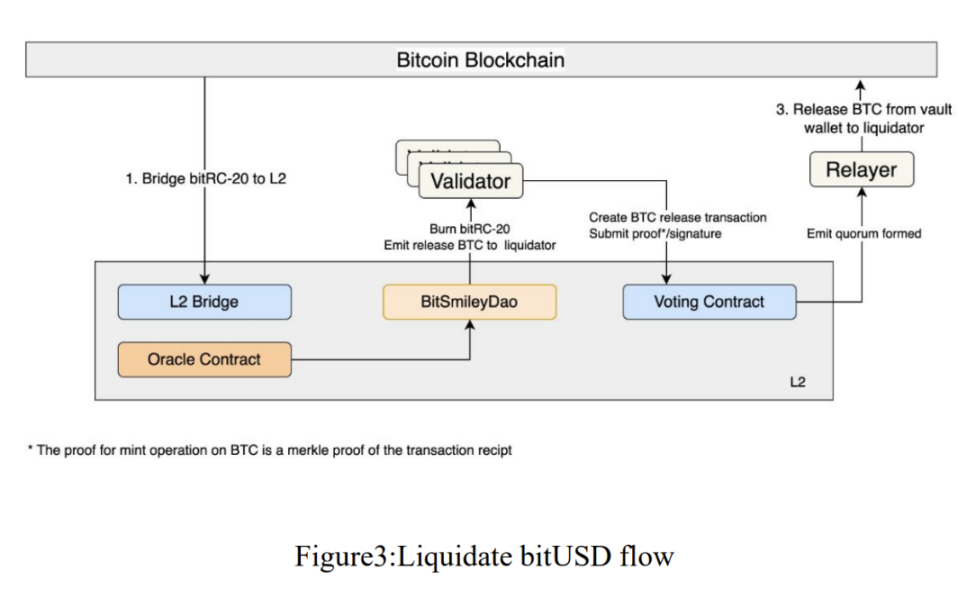

Liquidation Process: If the price of collateral falls below a set threshold, liquidation will be triggered. The liquidation operation will take place on a Layer 2 (L2) network to enhance speed and efficiency.

Through the above processes, the BitSmiley protocol can ensure the stability of the system while providing users with secure options for generating and redeeming stablecoins.

Collateral Liquidation Design

To ensure that each bitUSD has sufficient collateral support, any Treasury with a collateral debt ratio below the set threshold will enter the liquidation process. The calculation formula for the liquidation price is:

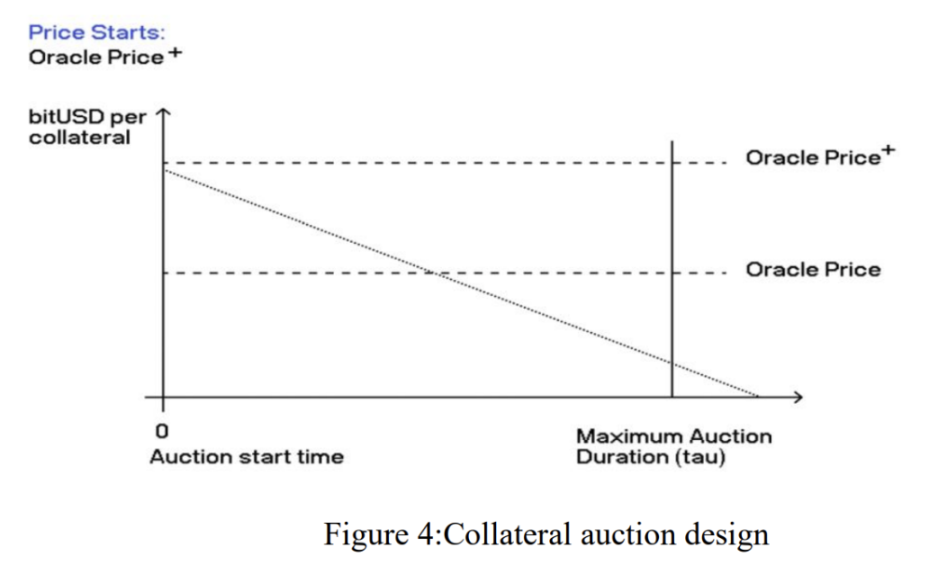

Liquidators will incur a certain liquidation penalty, and the distribution ratio of the penalty will be adjusted based on the duration of the liquidation. The longer the liquidation time, the higher the proportion of the penalty received by the liquidator. The BitSmiley protocol adopts a Dutch auction format, starting bidding at a high price and gradually decreasing. During the auction, the price automatically decreases over time, and when a bidder places a bid at a certain floating price, the auction is successfully concluded at that price.

In the BitSmiley protocol, the system will set an initial starting price, and the specific amount of collateral obtained will be determined based on the time-price curve. Once a liquidator participates within that time window, the transaction is executed immediately. The parameters involved in the time-price curve are as follows:

- Price Buffer Coefficient: Determines the starting price of the collateral.

- Price Function: Sets the percentage decrease in price every N seconds.

- Maximum Auction Price Drop: The maximum percentage decrease in price.

- Maximum Auction Period: The upper limit of the auction time window.

This design ensures that during market fluctuations, assets below the collateral threshold can be effectively and fairly liquidated while also providing a reward mechanism for liquidators.

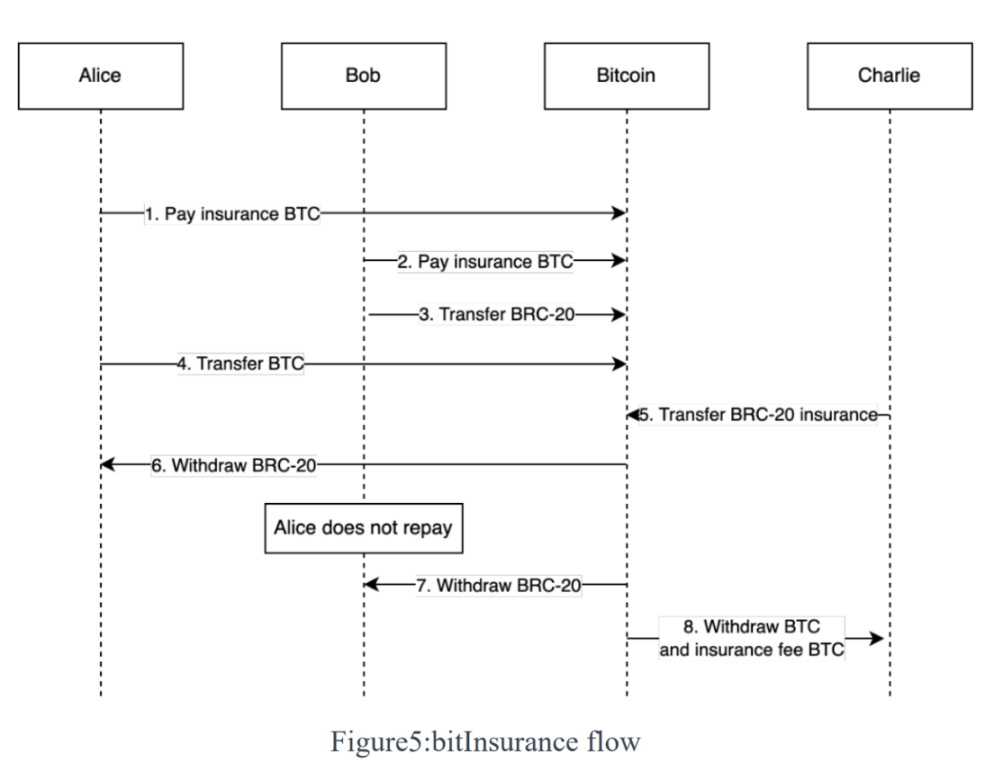

Fund Protection Mechanism — bitInsurance

In collateral-based lending protocols (such as Compound), the liquidation mechanism relies on on-chain oracles. However, this model does not directly apply to Bitcoin due to its relatively long block time (approximately 10 minutes), which can delay the liquidation process. Additionally, Bitcoin relies solely on unspent transaction outputs (UTXO) for transactions, lacking on-chain price oracle support.

BitSmiley protects user funds in various ways. For example, borrower Alice may be unable to repay on time due to a sharp rise in the price of the borrowed bitRC-20 or a significant drop in BTC price. In the first case, lender Bob does not incur a loss because the value of BTC remains valid. However, if the BTC price drops significantly, Bob can choose to purchase insurance. Both Alice and Bob must pay a certain BTC insurance premium, so if Alice fails to repay the loan, the insurance will fully compensate Bob.

The flowchart is as follows:

- BitSmiley matches Alice, Bob, and Charlie, creating a multi-signature wallet.

- Bob and Alice transfer tokens to the multi-signature wallet.

- Bob and Alice transfer insurance premiums to the multi-signature wallet.

- BitSmiley broadcasts the lending transaction.

- Charlie withdraws the insurance premium.

- Alice withdraws BTC from the lending transaction.

- If Alice fails to repay the BTC, Bob will receive the BTC returned by Charlie, and Charlie will obtain the collateral.

This insurance mechanism ensures the protection of both parties' interests in the lending process through a multi-signature wallet and insurance premium distribution.

Summary

Introducing a native over-collateralized stablecoin protocol on the Bitcoin blockchain is crucial, as Bitcoin's inherent volatility limits its use in everyday transactions and as a stable store of value. A native stablecoin will expand Bitcoin's usability, enabling it to directly support a broader range of financial activities on the network, such as lending, borrowing, and yield farming. This will enhance Bitcoin's decentralization and trust characteristics, aligning with its core principles of trustless and permissionless finance. Furthermore, such a protocol will provide much-needed liquidity and accessibility, making the Bitcoin ecosystem more user-friendly, especially for users in economically unstable regions or those looking to hedge against fiat currency inflation.

Overall, bitUSD is expected to transform Bitcoin from a mere store of value into a multifunctional medium of exchange in the decentralized finance sector.

### III. Industry Data Analysis

1. Market Overall Performance

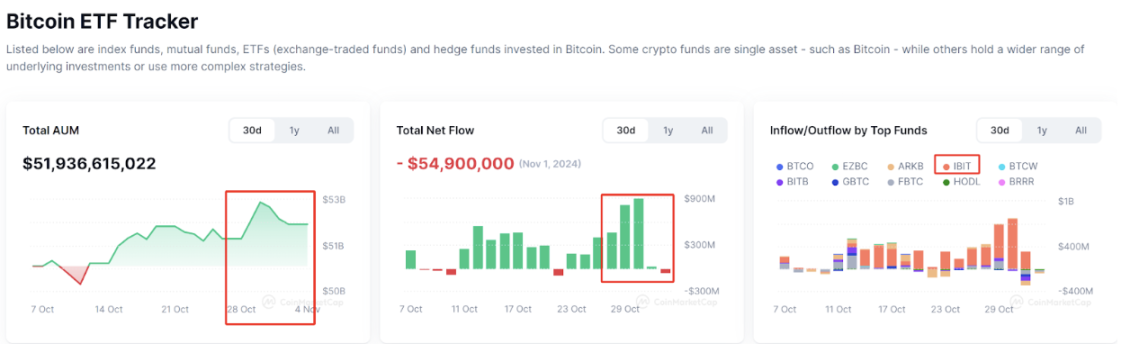

1.1 Spot BTC & ETH ETF

Analysis

On November 1, Eastern Time, the total net outflow of Bitcoin spot ETFs was $54.9403 million. On October 31, Grayscale's ETF GBTC had a net outflow of $5.5078 million in a single day, bringing the historical net outflow of GBTC to $20.162 billion. However, last week, the overall Bitcoin spot ETF still showed a strong net inflow, with a total net inflow of $2.22 billion, where the largest buyer was BlackRock's iShares Bitcoin Trust, which purchased $2.14 billion, accounting for nearly 99% of the total inflow. The second-largest buyer, Fidelity's FBTC, contributed only $89.8 million. Analyzing the timing of BlackRock's purchases last week and the subsequent outflows, the entry prices ranged from around $68,000 to $72,000, but the subsequent crash did not coincide with a large outflow of ETF funds, indicating that major buyers remain optimistic about BTC's long-term trend. The main sellers may be whales or some retail investors, as well as Grayscale's shadow.

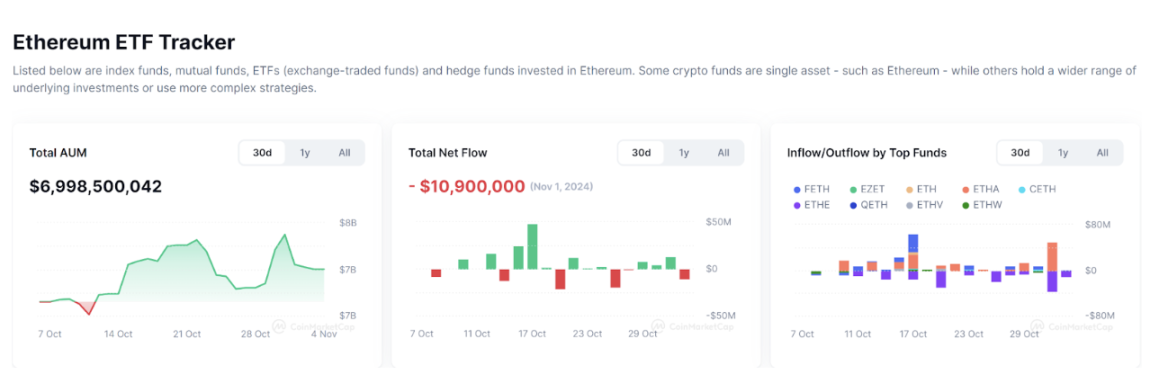

Analysis

This week, the U.S. Ethereum spot ETF had a cumulative net inflow of $13 million, with BlackRock's ETHA seeing a net inflow of $65.5 million, while Grayscale's ETHE had a net outflow of $62.4 million. On the 1st, Grayscale's Ethereum Trust ETF ETHE had a net outflow of $11.4278 million in a single day, bringing the historical net outflow of ETHE to $3.131 billion. Grayscale's Ethereum Mini Trust ETF ETH had a net outflow of $0.00 in a single day, with a historical total net inflow of $303 million. The Ethereum spot ETF with the highest net inflow on the 1st was Invesco ETF QETH, which had a net inflow of $502,200, bringing the historical total net inflow of QETH to $25.8204 million.

1.2. Spot BTC vs ETH Price Trends

Analysis

Last week's Bitcoin trend was influenced by the U.S. elections, with the presidential election set to officially begin on November 5, leading to significant market fluctuations in the days leading up to it.

Looking back at the BTC market on the day of the 2020 U.S. presidential election, the first two days saw a decline in the crypto market, followed by a rise on the day the election results were announced, and then another decline in the following two days, after which it rose again. Additionally, according to a recent poll reported by Forbes, Harris leads Trump by a slim margin of just 1%. In seven key swing states that could determine the final election outcome, Harris leads Trump with a support rate of 49% to 48%. A week ago, Trump had a support rate of 50% to 46% over Harris. This change in numbers increases the uncertainty of the election results, causing BTC to experience volatility. With the election results soon to be finalized, it seems that a Trump victory could stimulate bullish sentiment in the crypto market, indirectly benefiting it, while a Harris victory could be bearish in the short term. However, the long-term trend still depends on monetary policy; as long as the premise of interest rate cuts remains unchanged, the long-term outlook remains bullish. Investors should focus on the effectiveness of support levels around $68,300 and $66,000 this week.

Ethereum should focus on whether the price can quickly recover to the ascending trend line shown above. If successful, the next step would be to monitor the effectiveness of resistance at the weekly descending trend line, with a breakthrough looking towards around $2,860, and if it fails, attention should be paid to the support at $2,450.

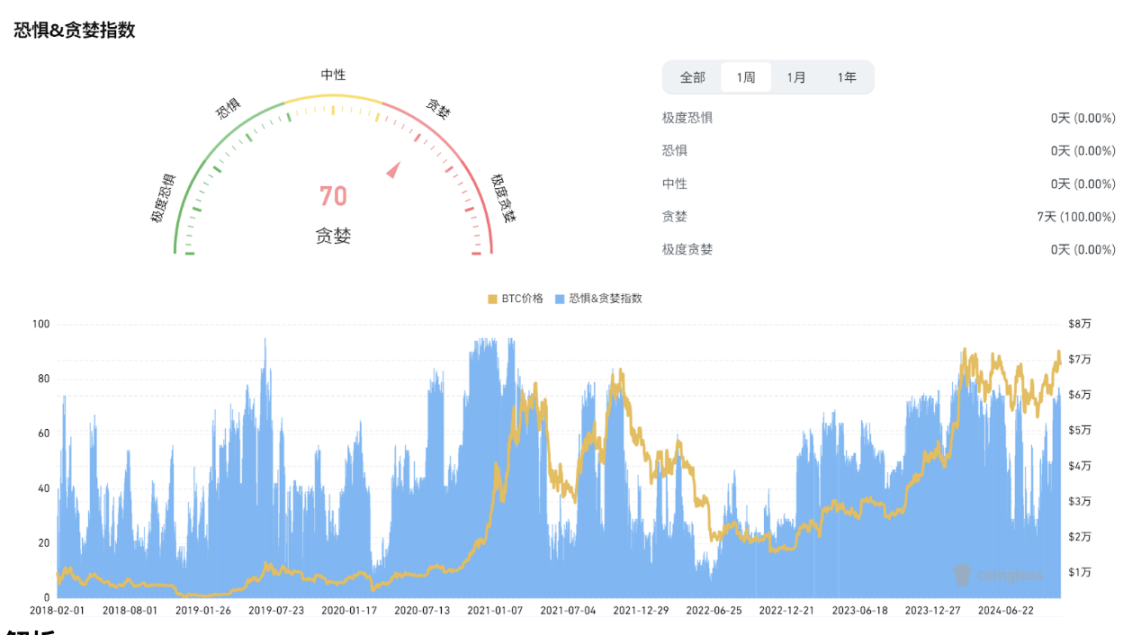

1.3. Fear & Greed Index

Analysis

Last week, the greed index remained at 70, indicating that the risks brought by the uncertainty of the election results have not fundamentally suppressed the market's bullish sentiment. From the current trend, as long as the Bitcoin price remains above $66,000, even if there is a short-term failure to break through the $72,000 resistance, the index is likely to remain in the range of 65 to 70.

2. Public Chain Data

2.1. BTC Layer 2 Summary

Analysis

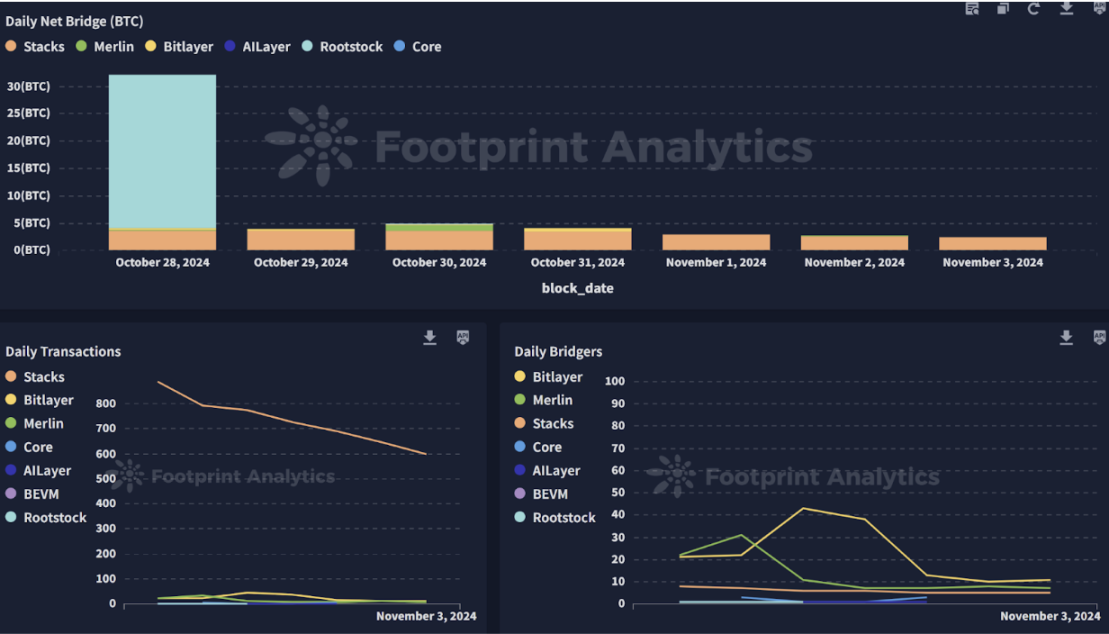

In the BTC ecosystem, the Nakamoto upgrade of the Bitcoin Layer 2 network Stacks has been successfully launched. This upgrade will introduce "Fast Blocks" and a "Bitcoin Finality" mechanism to enhance transaction speed. After the Nakamoto upgrade, Stacks block production will be independent of Bitcoin block production, allowing user transactions to be confirmed within seconds. However, overall on-chain activity remains sluggish; aside from a significant asset transfer of 28 BTC on the Rootstock chain last Monday, the average daily bridged assets on other days were less than 3.5 BTC, with a large amount of BTC locked, leading to a decline in on-chain activity.

2.2. EVM & Non-EVM Layer 1 Summary

Analysis

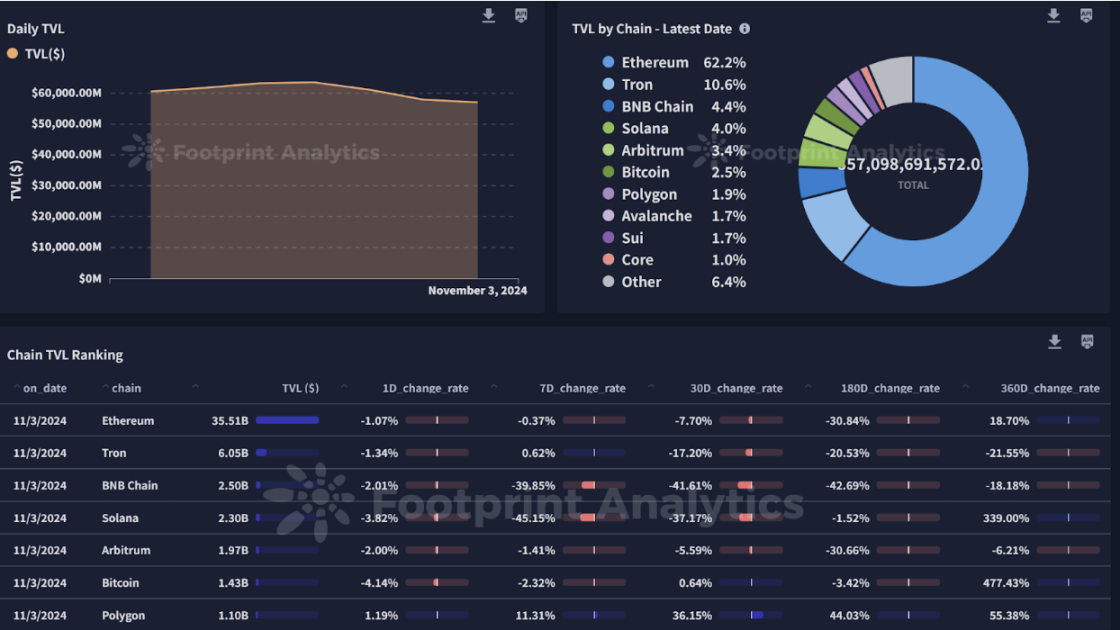

Last week, the overall TVL of public chains continued to decline, with the TVL recently falling below the $60 billion mark for the first time. BNB Chain and Solana have contributed an average of over 40% of net outflows for two consecutive weeks, which is a bearish signal. The trading volume on Solana's DEX over the past seven days was $12.728 billion, ranking first for four consecutive weeks, with a 7-day decline of 19.91%. The $4.7 million stolen from the Tapioca Foundation and the $2.86 million from SUNRAYFINANCE on BNB Chain are major factors for the significant outflows.

Polygon has maintained strong positive growth in TVL for a month following its technical upgrade.

2.3. EVM Layer 2 Summary

Analysis

Last week, the overall TVL of L2 hit $29.9 billion on October 31 but has now retreated to around $18 billion. The leading L2 protocol with the most outflows this week remains Scroll, with a 7-day TVL change of -14%. The negative impact of the rug pull incident involving its stablecoin project Essence Finance continues, even though Scroll announced a partnership with blockchain analytics platform Nansen to introduce its analytical tools into the Scroll ecosystem. They also announced the launch of Scroll SDK and tools; the Scroll SDK is a production-ready infrastructure for deploying sovereign blockchain networks, while the tools are optional modules for customizing and enhancing the Scroll SDK chain. It is expected that FUD sentiment will ease somewhat next week.

Base and Fuel have become the leaders in positive TVL growth last week. The mainnet has launched "Fault Proofs," and Franklin Templeton's OnChain U.S. Government Money Market Fund (FOBXX) has now been launched on Base, further stimulating its TVL growth.

After the official launch of the Fuel mainnet in October, Fuel Labs introduced the Ethereum L2 solution Fuel Ignition. Ignition aims to address the increasing centralization challenges faced by the blockchain ecosystem through its scalable architecture design. The construction of Ignition is based on the Fuel Virtual Machine (FuelVM) and UTXO asset centralization architecture, ensuring Ethereum-level security.

2.4. Liquid Restaking Summary

Analysis

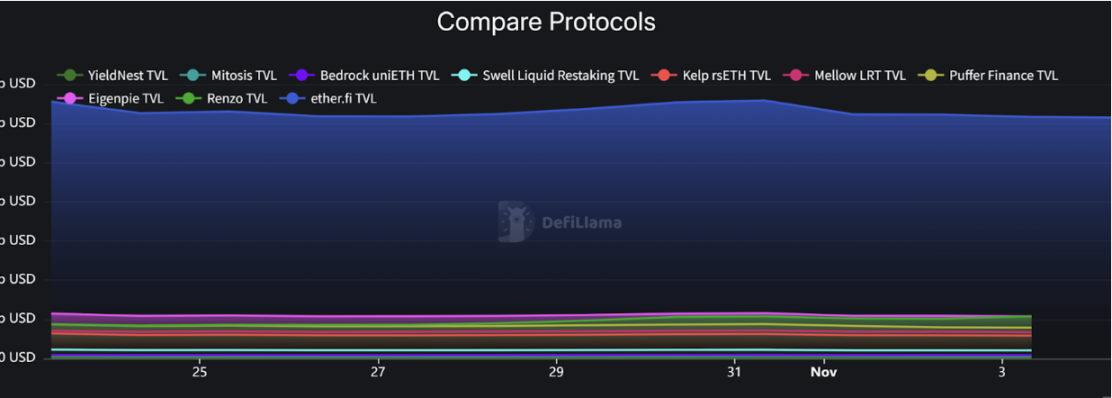

In the Liquid Restaking sector, Renzo's ezSOL will be launched on Jito on October 30. Whitelisted users will be able to deposit within the first 24 hours or until the limit is reached; after the initial 24 hours, if the limit is not full, others will be able to deposit. Users can mint ezSOL by depositing jitoSOL, and rewards will be automatically compounded. Shortly after the launch, Renzo will announce the first batch of integrations and partnerships to bring more utility and rewards to ezSOL holders.

For EigenLayer, the previously disclosed theft of 1.67 million EIGEN tokens was due to an external malicious attack, thus the eigenpie TVL continues to be affected, showing mediocre performance.

### IV. Macroeconomic Data Review and Key Data Release Nodes for Next Week

The macroeconomic data from the United States has drawn significant market attention. In October, non-farm payrolls added only 12,000 jobs, marking the lowest level in four years, while the unemployment rate remained at 4.1%. This data was significantly impacted by hurricanes and the Boeing strike, reflecting a coexistence of resilience and weakness in the labor market. Meanwhile, the core PCE inflation indicator remains stubborn, indicating that inflation pressures have not eased. The market's expectation for the Federal Reserve to cut interest rates by 25 basis points at the upcoming meeting has nearly reached 100%.

Looking ahead, as the U.S. presidential election approaches, the uncertainty of economic data may exacerbate market volatility. Despite the current weak employment data, the overall economic fundamentals remain healthy, with consumer spending continuing to drive economic growth. The Federal Reserve may adjust its monetary policy based on the upcoming economic indicators to address potential economic slowdowns.

This week (November 4 - November 8), important macroeconomic data points include:

- November 5: U.S. October S&P Global Services PMI Final

- November 8: U.S. Federal Reserve interest rate decision (upper limit) as of November 7; U.S. November University of Michigan Consumer Sentiment Index Preliminary

### V. Regulatory Policies

With the U.S. election results imminent, there has been heated discussion regarding the regulation of the crypto industry. According to general estimates, regardless of whether Trump or Harris is elected, the regulatory stance on crypto is unlikely to change significantly. Other regions around the world are continuing to refine their regulatory frameworks and introduce regulatory sandboxes, with Hong Kong being particularly active this week, resulting in numerous positive statements.

Hong Kong

At the 9th Hong Kong FinTech Week, the Secretary for Financial Services and the Treasury, Christopher Hui, stated that Hong Kong will introduce regulatory guidelines for stablecoins by the end of the year and complete the second round of consultation on the 2025 virtual asset OTC regulatory proposals. Additionally, he mentioned that Hong Kong may offer tax incentives for virtual asset investments in the future, further confirming its role in asset allocation.

The Hong Kong Stock Exchange will launch the Hong Kong Stock Exchange Virtual Asset Index Series on November 15, providing reliable benchmark prices for the virtual asset category. This index series will offer transparent and reliable benchmarks for the pricing of Bitcoin and Ethereum in the Asian time zone, aiming to provide a unified reference price for virtual assets and address price discrepancies between global exchanges. This index series will be the first virtual asset index series developed in Hong Kong that complies with the EU Benchmark Regulation (BMR), co-managed and calculated by a benchmark management organization registered in the UK and the virtual asset data and index provider CCData.

Legislative Council member (Technology and Innovation Sector) Kenneth Lau, during the establishment event of the Hong Kong Compliance Industry Association, stated, "I believe stablecoins represent a huge market, and various countries are trying to explore this. Everyone is paying attention, but we need to wait for Hong Kong's regulatory guidelines to be released before moving forward. As a Legislative Council member, I am interested in whether we can issue a stablecoin based on the Renminbi in Hong Kong, as this is a massive market."

Singapore

On October 30, the Monetary Authority of Singapore (MAS) announced the establishment of the Global Finance & Technology Network (GFTN) to promote the development of Singapore's fintech ecosystem and foster greater synergy and networking with the global fintech community. The first phase of measures includes developing a regulatory sandbox framework, establishing cross-border payment links, piloting digital assets and tokenization, and promoting the adoption of artificial intelligence (AI). GFTN will collaborate with MAS to advance industry and policy dialogue in the areas of payments, asset tokenization, and AI/quantum.

Russia

According to a report by TASS on the 30th, the Deputy Minister of Energy of Russia announced that due to ongoing energy shortages, Russia will restrict cryptocurrency mining in certain regions, including areas with limited power resources such as the Far East, southwestern Siberia, and the south. The power shortage may persist until 2030, making large-scale mining difficult to sustain. Previously, Russian President Putin signed a law regulating the circulation of digital currencies, which took effect on November 1. This law grants the Russian government the authority to prohibit the mining of digital currencies in specific regions or territories and to determine the procedures and cases for introducing such restrictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。