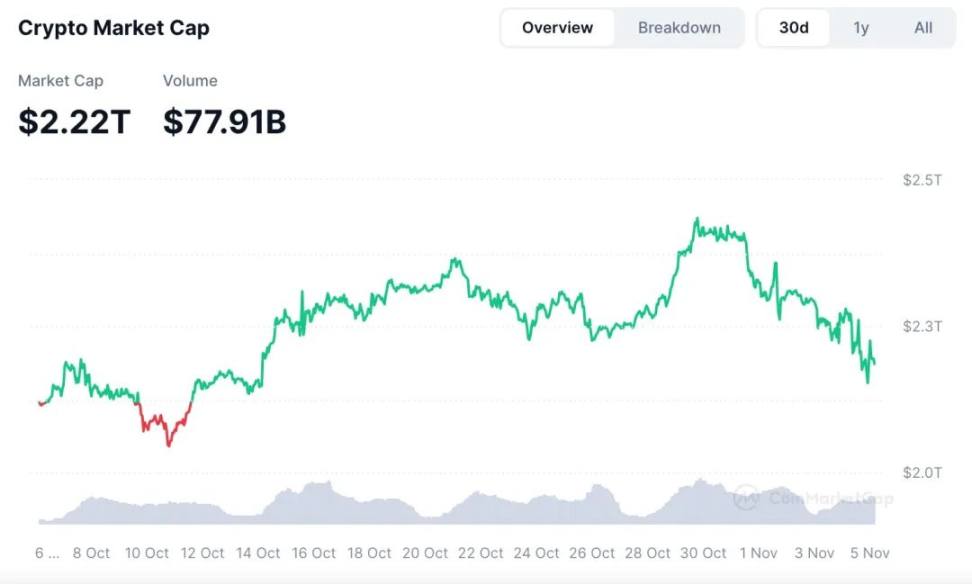

The overall market capitalization of cryptocurrencies has shown an upward trend, rising from $2.2 trillion to a peak of $2.45 trillion over the past two weeks, closely related to the election.

Written by: FMGResearch

Cryptocurrency Market Summary

Trump's election would be more favorable for cryptocurrencies, as the two candidates are still deciding the outcome in seven swing states and regarding mail-in ballots.

Regardless of which candidate wins, based on current macro data, large-scale interest rate cuts are unlikely in the near future. The expectation for rate cuts remains around 25 basis points.

Decentralized AI and AI-related memes are currently hot topics in Web3. At the same time, the narrative of Web3 + energy is also promising; on one hand, it can be combined with AI, and on the other hand, it has high potential commercial value, making it appealing to capital and the market. FMG has previously focused on the Web3 energy sector, and its previously invested energy-related Web3 project, Daylight, received A16Z's lead investment in Series A.

I. Market Overview

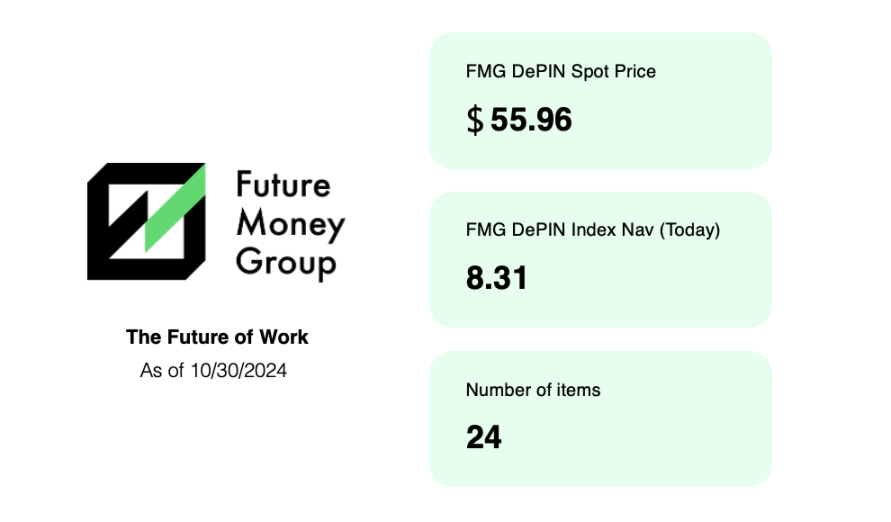

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a quality token index constructed by FutureMoney, selecting the 24 most representative DePIN projects. Compared to the last report, the NAV value has slightly decreased from 9.79 to 8.31, and the Spot Price has also significantly retreated. This is due to the upcoming U.S. election, with the overall market in a wait-and-see state, and many previously surging altcoins entering a consolidation phase. Many tokens, represented by BitTensor, have begun to pull back.

1.2 Cryptocurrency Market Data

From October 15 to October 31, the overall market capitalization of cryptocurrencies has shown an upward trend, rising from $2.2 trillion to a peak of $2.45 trillion. In terms of BTC market share, there has been a slight increase from early October, rising from 57.5% to 59.3%.

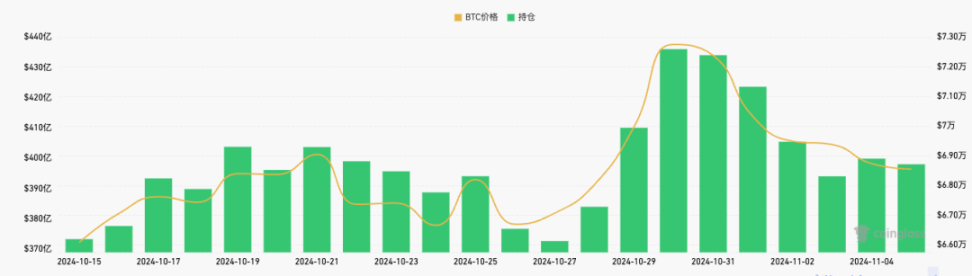

Observing the trend of contract positions on Coinglass, since October 15, the total open positions for BTC contracts across the network have increased from around $37 billion to a peak of $43.5 billion.

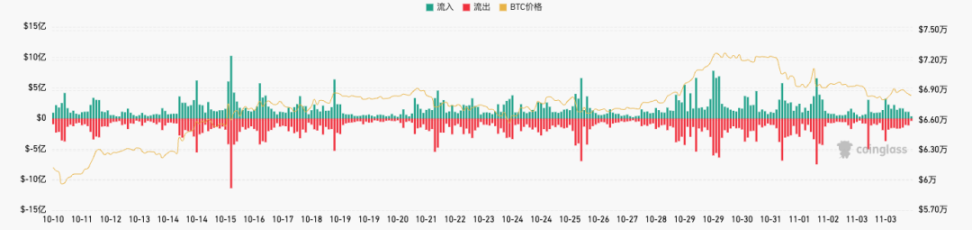

Currently, the entire BTC trend is in a wait-and-see phase. Due to the unclear results of the competition between Trump and Harris in the swing states, many funds have chosen to hold USDT while waiting. In the past 15 days, BTC has seen a net outflow of $568 million, and ETH has seen a net outflow of $487 million. USDT has seen a net inflow of $981 million.

1.3 CPI and Market Reaction to Market Judgments

- Macroeconomic Level: As of November 1, the U.S. unemployment rate for October is 4.1%, as expected, and the previous value was also 4.1%. Additionally, for the week ending October 26, the number of initial jobless claims in the U.S. was 216,000, with expectations of 230,000, and the previous value was revised from 227,000 to 228,000. Due to the impact of hurricanes and Boeing strikes, U.S. non-farm payroll data for October showed weakness but was still insufficient to prompt significant rate cuts by the Federal Reserve. In the stock index market, the Dow Jones rose by 0.69%, the S&P 500 index rose by 0.41%, and the Nasdaq rose by 0.8%. This week, two major events in the U.S. will determine market trends. The results of the U.S. presidential election are about to be revealed, and the Federal Reserve will hold a policy meeting from November 6 to 7, with the market generally expecting a 25 basis point rate cut. BlackRock's Jeffrey Rosenberg stated that the normalization of labor market data suggests a soft landing is still possible, and the Federal Reserve may continue to cut rates in the coming months.

Additionally, the U.S. core PCE price index rose by 2.7% year-on-year, higher than expected; it rose by 0.3% month-on-month, significantly higher than the previous value. This is the largest monthly increase in this index since April of this year, supporting the Federal Reserve's decision to slow down rate cuts after a significant cut in September, indicating that the Federal Reserve may adopt a cautious rate-cutting attitude in the coming months.

In terms of cryptocurrency: Over the past half month, BTC has been in an upward channel, rising from around $60,000 on October 11 to around $72,500 on October 30. It has continuously broken through resistance levels of $69,000 and $72,000. In fact, there has been a continuous influx of funds into the overall market. In October, demand for spot Bitcoin exchange-traded products (ETPs) listed in the U.S. increased. As of October 31, the total net inflow was $5.3 billion, up from $1.3 billion in September, the highest level since February.

Sectors worth investing in: Although the valuations of certain tokens have declined, the decentralized AI theme remains the focus of the cryptocurrency market. This is largely due to new applications showcasing the use of "AI Agents" on the blockchain—software capable of understanding objectives and making autonomous decisions.

Due to strong interest in this narrative, related meme coins have appreciated by about nine times, leading many to refer to Truth Terminal as "the first AI agent millionaire." While this project appears humorous and lighthearted, it indicates that AI agents can understand economic incentives and can use blockchain to send and receive value. Other innovative projects are making breakthroughs in jointly owned AI agents, and there will be many use cases in the future.

II. Hot Market News

2.1 Harris and Trump Still Neck and Neck

According to the latest opinion poll results from Forbes, Harris has taken a narrow lead over Trump by 1%, reversing a week ago when Trump led Harris by 4%. The election trend has a significant impact on the prices of cryptocurrency assets, and the market will be extremely sensitive to reactions in the week leading up to the election results, with 24-hour fluctuations of 5% not being surprising; short-term price volatility will be considerable.

2.2 U.S. Presidential Election Approaches, BTC Options Volatility Soars

The competition in key swing states for the U.S. presidential election is intense, and the BTC expected price volatility indicator based on options has reached a three-month high. The 7-day implied volatility for BTC has surged to an annualized 74.4%, far exceeding the 7-day actual volatility or historical volatility of 41.4%. The forward volatility for BTC and ETH has soared overnight, with BTC's volatility currently at 80.30%, up from 72.20%, and ETH's volatility currently at 82.92%, up from 75.40%. This increase reflects that traders are hedging risks in anticipation of the election results, which could significantly impact market prices.

2.3 Web3 + Energy Set to Become a New Darling of Capital Alongside AI

Blockchain solar company Glow has completed a $30 million financing round. This Ethereum-based blockchain solar company aims to apply blockchain technology in the traditional energy sector, especially in the green energy sector currently supported and promoted by various governments. Blockchain technology can address issues such as complex certification processes, difficulty in tracing, and high transaction costs in green electricity trading, presenting significant application potential.

III. Regulatory Environment

Since Gary Gensler took office as the Chairman of the SEC, the SEC has filed lawsuits against a number of large cryptocurrency companies, including Coinbase, Kraken, and CZ (Binance US). The U.S. cryptocurrency industry has already spent over $400 million to respond to the agency's enforcement actions. The SEC's enforcement is seen as imposing significant compliance costs on the industry and potentially harming innovation and employment within the sector, making compliance a heavy burden for the cryptocurrency industry.

Trump has publicly stated that if he is elected president, he will not allow Gary to continue as SEC Chairman. Considering Trump's relatively open attitude towards cryptocurrencies and the pro-cryptocurrency Robinhood Chief Legal Officer Dan Gallagher being a leading candidate for SEC Chairman, there are multiple aspects in which Trump's presidency would be favorable for the development of cryptocurrencies.

Data for this article is sourced from: Coinglass, Rootdata, Coinmarketmap, X

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。