For the cryptocurrency industry, the recently concluded October saw most indicators finally beginning to rebound. This article will review the state of the cryptocurrency market over the past month with 11 charts.

Written by: Lars, Research Director at The Block

Translated by: Jordan, PANews

For the cryptocurrency industry, the recently concluded October saw most indicators finally beginning to rebound. This article will review the state of the cryptocurrency market over the past month with 11 charts.

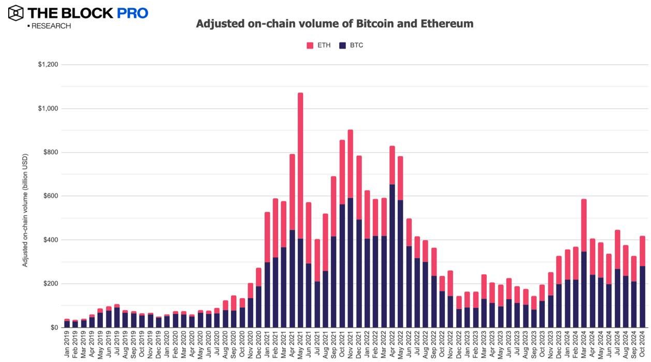

- In October, the total on-chain transaction volume for Bitcoin and Ethereum increased by 28.1% after adjustments, reaching $420 billion, with Bitcoin's adjusted on-chain transaction volume rising by 32.1% and Ethereum's by 20.9%.

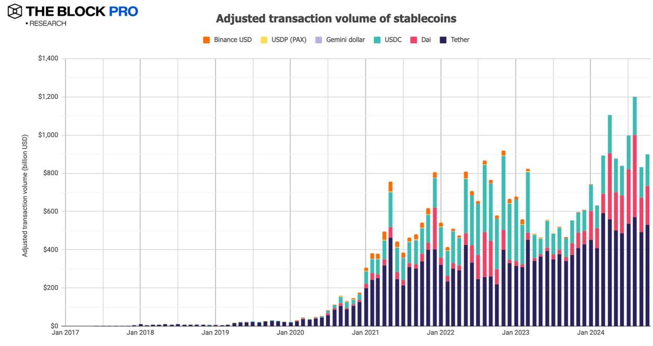

- The adjusted on-chain transaction volume of stablecoins in October increased by 8%, reaching $899 billion, while the supply of stablecoins decreased by 0.7% to $149.3 billion, with USDT and USDC holding market shares of 79.5% and 16.9%, respectively.

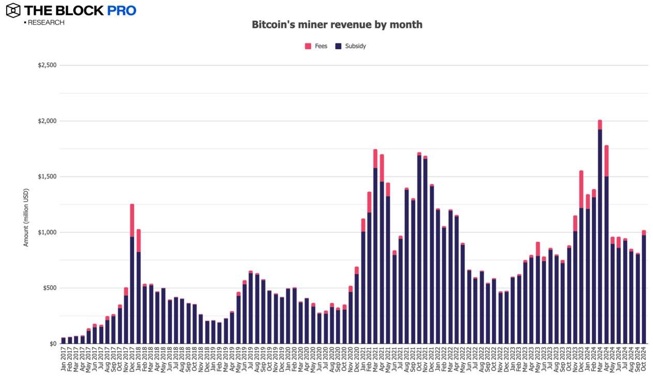

- Bitcoin miner revenue rose by 25.4% in October, reaching $1.02 billion. Additionally, Ethereum staking revenue also rebounded to $221.5 million, an increase of 5.8%.

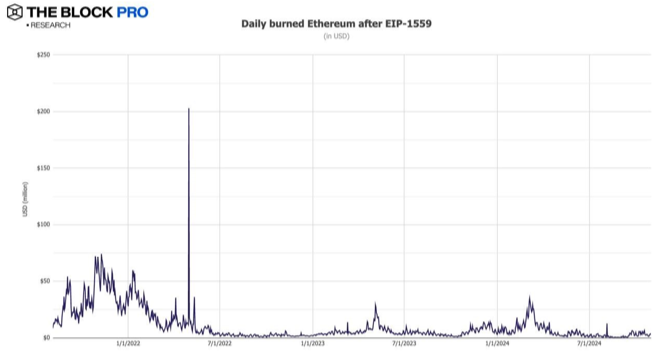

- In October, the Ethereum network burned a total of 41,648 ETH, worth approximately $10.5 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has burned a total of about 4.43 million ETH, valued at approximately $12.5 billion.

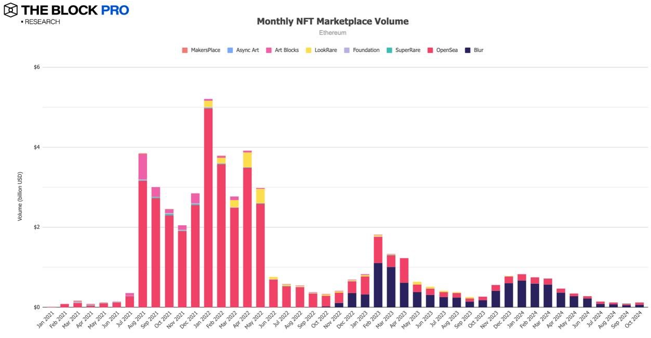

- The on-chain NFT market for Ethereum rebounded in October, with a growth rate of 26.5%, reaching approximately $12.16 million.

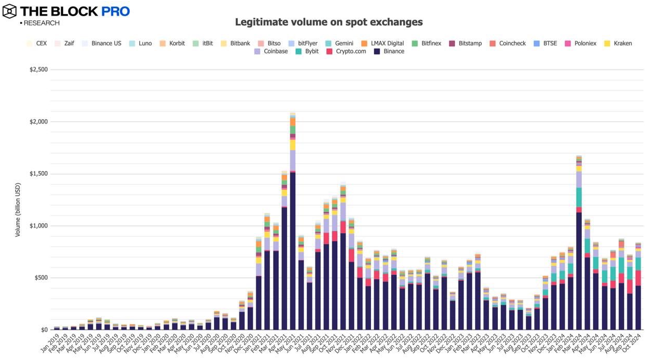

- The spot trading volume of compliant centralized exchanges (CEX) increased by 16.3% in October, reaching $843 billion.

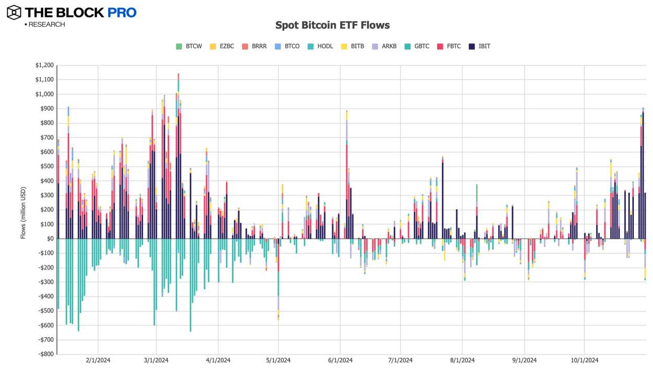

- In October, the net inflow of spot Bitcoin ETFs showed positive growth, with an inflow amount of approximately $5.3 billion. On October 30, the inflow for BlackRock's IBIT reached $872 million, setting a new record.

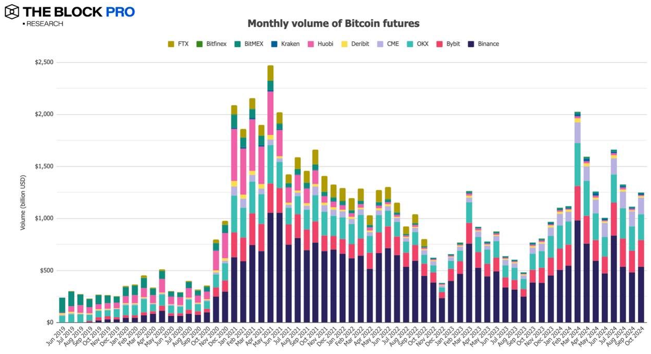

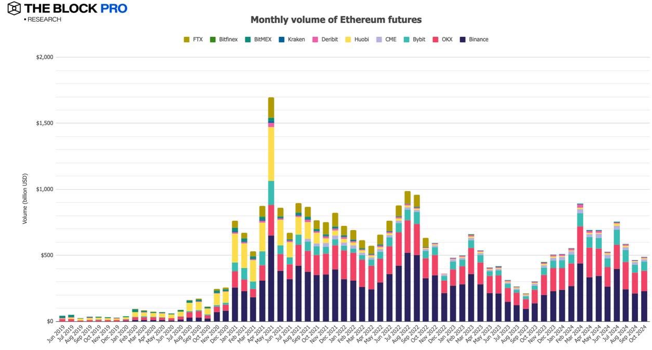

- In terms of cryptocurrency futures, the open interest for Bitcoin futures increased by 22.9% in October; the open interest for Ethereum futures rose by 14.6%. In terms of trading volume, Bitcoin futures trading volume increased by 12.1% in October, reaching $1.25 trillion, while Ethereum futures trading volume grew by 4.8%.

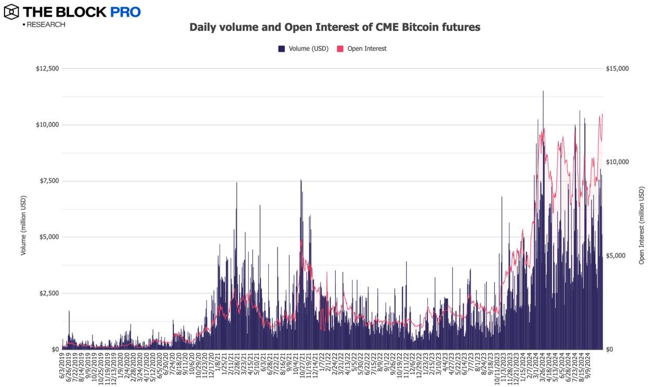

- In October, the open interest for Bitcoin futures on the Chicago Mercantile Exchange increased by 21.5%, reaching $12.5 billion (a historical high), and the daily average trading volume rose by 9.6%, reaching approximately $5.3 billion.

- The average monthly trading volume for Ethereum futures in October grew to $488.8 billion, an increase of 4.8%.

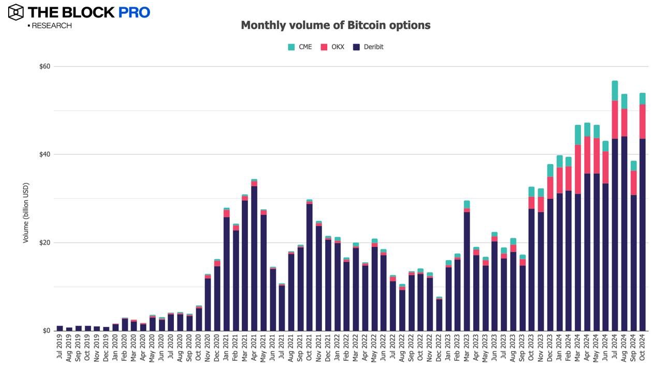

- In the cryptocurrency options market, the open interest for Bitcoin options increased by 35.76%, while the open interest for Ethereum options remained unchanged. Additionally, in terms of trading volume, Bitcoin monthly options trading volume reached $54 billion, up 39.8%; Ethereum options trading volume was $10.2 billion, with an increase of 4.7%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。