Original Author: IOSG Ventures

Preface

Uniswap's recent major directions are Uniswap X, Uniswap V4, and Unichain.

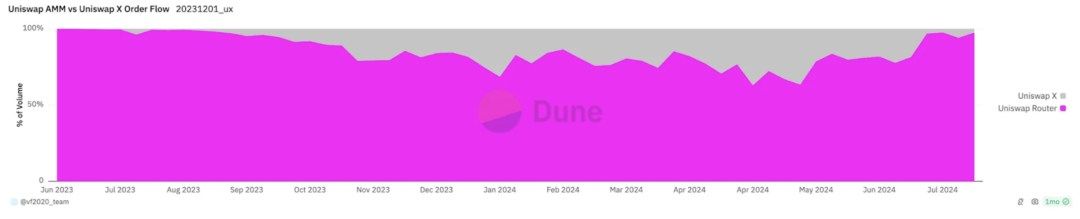

Uniswap introduced the intent trading network Uniswap X last year, currently capturing up to 10%-20% of trading volume, while during the same period, 1Inch, 0x, and Cowswap also introduced similar intent trading experiences.

In the past few months, the landscape of DEX has shifted towards intent-based protocols, unifying on-chain and off-chain liquidity, allowing traders to achieve a better user experience and lower prices. These protocols have introduced market makers, seekers, solvers, and other roles that obtain quotes from the front end of DEX and connect to any liquidity source, including CEX. With the launch of Uniswap X and the default activation of the front end, Uniswap has become an important participant in the impact of intent protocols on AMM liquidity.

Uniswap completed its contract audit in September and is about to launch V4. The contents included in V4 are Hooks, single contract design, gas fee optimization, flash contracts, etc. The single contract design of Uniswap V4 integrates all liquidity pools into one smart contract, rather than creating separate contracts for each trading pair as in V3. This design can significantly reduce trading costs, especially in the case of multi-pool swaps and complex trading paths. Additionally, this integration can make liquidity more concentrated, improving trading efficiency. In V4, due to the single contract design and the new Hook system, Uniswap V4 has lower gas fees when executing complex trades.

Hooks build a variety of DeFi services on the basis of AMM through a plugin model. They allow developers to insert custom logic during the trading process, such as setting dynamic fees, liquidity management strategies, and independent control over specific trading pairs. Hooks provide unprecedented flexibility for AMM, enabling developers to construct more complex liquidity strategies and even dynamically adjust trading parameters under different market conditions.

Unichain itself focuses more on the role of a liquidity hub within the OP Superchain, also addressing issues related to traders and LP experiences. This article will not delve deeply into Unichain, but will provide updates on related research in the future.

In addition to Uniswap, we also see many protocols making similar innovations, with many researching directions related to Hooks, including Balancer and Ekubo on Starknet; there are also modular DEXs achieving similar effects to Hooks, such as Valantis. Around the Hook model, more protocols that originally focused on AMM-related issues, such as liquidity management protocols, have found better entry points. In terms of intent, Cowswap, 1inch Fusion, and even more long-tail DEXs are building their own trading intent networks, with PMM and AMM competing behind the scenes—PMM continuously eroding the on-chain liquidity market and on-chain protocols continuously improving to retain more on-chain liquidity.

In response to the current changes in DEX, this article will explore three viewpoints regarding the development trends we will focus on in the near future:

AMM will address current issues and expand its scope, using plugin/module capabilities to solve liquidity management, asset issuance, personalized financial services, trading strategies, and more DeFi scenarios.

Under intent-centered DEX design, the importance of the front end diminishes, and LPs face vertical competition in the trading supply chain.

AMM will focus on long-tail markets in the future, but we also need to continuously optimize the gradually dominant PMM landscape.

1. AMM Solving Current Issues and Expanding

The expansion of AMM aims to address several core pain points and capture market shares that previous AMMs could not.

The main changes come from Hooks. Hooks are a core innovation in Uniswap V4, allowing developers to insert custom logic during the trading process, such as setting dynamic fees, liquidity management strategies, and independent control over specific trading pairs. Hooks provide high flexibility for AMM, enabling it to expand its business scope, allowing developers to construct more complex liquidity strategies and adapt to different market conditions.

1.1 Addressing LP Management Issues Based on AMM

- Impermanent Loss (IL)

Impermanent loss is currently the biggest issue faced by LPs. When LPs deposit assets into a liquidity pool, the AMM algorithm automatically adjusts their holdings to maintain balance between assets. When prices fluctuate, the assets held by LPs may incur disproportionate losses, leading to a decrease in the value of their holdings compared to simply holding the assets.

Impermanent loss is primarily due to the "negative gamma" characteristic of AMM. In a financial context, gamma represents the rate of change of delta, which is the sensitivity of the portfolio value to the price of the underlying asset. In the context of AMM, price fluctuations affect asset ratios, making it easier for LPs to hold underperforming assets.

For example, when the price of one asset in the pool rises, the AMM will rebalance by selling the appreciating asset and buying the depreciating asset. This prevents LPs from profiting from the appreciating asset, instead leading them to hold more depreciating assets. This negative gamma effect is particularly evident in AMMs like Uniswap v2, as LP positions grow in a square root proportion with price changes. The concentrated liquidity mechanism of Uniswap v3 further exacerbates this non-linear characteristic, making impermanent loss a risk that LPs need to pay special attention to.

- Strategies to Mitigate Impermanent Loss

To combat impermanent loss, LPs have adopted various hedging strategies to reduce volatility risk and achieve more stable returns. Some effective methods include:

Using perpetual contracts for gamma hedging: LPs can hedge their impermanent loss risk by trading perpetual futures or options contracts. For example, employing a straddle strategy (simultaneously buying call and put options) can reduce the risk of price fluctuations in both directions. Additionally, perpetual contracts provide continuous price hedging without an expiration date, making them particularly suitable for volatile environments.

Selling options (LP as option sellers): Since LPs' revenue model is similar to that of option sellers, protocols like Panoptic allow LPs to sell their positions as options, selling volatility, which is especially suitable for low-volatility markets. Panoptic's model essentially transforms LP positions into tradable financial instruments, allowing LPs to earn fees through option premiums.

Liquidity management protocols: Active position management and rebalancing

In addition to hedging strategies, LPs can also reduce impermanent loss and increase profitability by actively managing their liquidity positions.

Market indicator-based rebalancing: LPs can utilize technical indicators such as MACD, TWAP, and Bollinger Bands to trigger rebalancing strategies. By monitoring these indicators, LPs can adjust their liquidity ranges and risk exposures, reducing downside risk in highly volatile markets.

Inventory management strategies: LPs can adopt inventory management techniques to adjust their held assets based on market conditions. Protocols like Charm Finance and ICHI help LPs dynamically manage liquidity, ensuring their positions are adjusted according to volatility or price changes to avoid excessive losses.

Additionally, there are liquidity management protocols, such as Bunniswap, which builds liquidity management tools based on Uniswap V4 Hooks, helping users directly optimize liquidity management methods and gain more layers of incentives.

- Latency Risk (LVR)

AMMs operate on-chain, and due to the lag in block update times and the submission of trades at the same time, price updates are often slower than CEX, allowing arbitrageurs to exploit price differences, causing LPs to sell assets at less favorable prices and incur losses.

According to a16z researcher Tim Roughgarden, LVR causes LPs in ETH-USDC to lose 11% of their principal annually. If the LVR risk is reduced by 50%, it could translate to an actual annual yield increase of 5.5% for LPs.

To mitigate this latency risk, several innovative solutions have been proposed:

Pre-confirmation protocols: Protocols like MEV-boost and PBS allow block builders to pre-confirm transaction execution prices, thereby reducing the price manipulation space for arbitrageurs. This solution is particularly prominent in Unichain.

Oracle-based price data: By using real-time price data from CEX, protocols like Ajna Finance ensure that AMMs maintain accurate market prices, reducing the risk of losses due to price lag.

Intent-based AMM: Intent AMMs allow LPs to set trading conditions, executing trades only at the most favorable prices, using RFQ (Request for Quote) mechanisms to reduce latency-driven arbitrage.

Enhancing LP Returns through Active Management

Many liquidity management protocols can maximize LP returns, essentially by better estimating implied volatility and making appropriate asset adjustments, i.e., extracting implied volatility data from trading volume and liquidity patterns, assessing potential risks, and adjusting positions accordingly. By comparing the potential returns from LP fees with option costs, LPs can better decide when to hedge and when to hold positions. For example, the Gamma strategy employs a MACD-based hedging strategy, instantaneously hedging LP risk as a financial product to generate more returns for LPs.

- RFQ for MEV Avoidance and Capture, Dynamic Fee Structures

MEV capture mechanisms redistribute profits by auctioning off the rights to extract MEV, ensuring that LPs not only earn fees from regular trades but also benefit from arbitrage opportunities.

CoW swap is a pioneer in capturing MEV to protect traders and LPs. Through its CoW AMM's batch auction trading packaging and solver bidding, it ensures that trades are completed at a unified price at the same time, eliminating the MEV created by LVR. Angstrom from Sorella Labs has built an off-chain auction system using Uniswap V4 hooks to prevent arbitrage from occurring.

Apps like Unichain, through TEE-secured block construction environments and the provision of pre-confirmation, reduce the MEV that traders and LPs may face.

With Hooks, Uniswap V4 can implement a dynamic fee structure. Unlike traditional fixed fees, dynamic fees can be adjusted based on market conditions and the needs of liquidity providers. For example, during periods of high volatility, fees may increase to compensate liquidity providers for their risk, while in stable periods, fees may decrease. This flexible fee mechanism not only enhances returns for LPs but also allows traders to obtain better prices.

For instance, Arrakis's HOT AMM introduces a dynamic fee model that identifies arbitrage trades and applies higher fees to mitigate latency risk, helping LPs capture more value from high-frequency and arbitrage trading.

1.2 Personalized Business Logic

Different users have varying subjective preferences regarding the weighting of risk and return. A lack of differentiated approaches fails to explain user behavior, missing opportunities to enhance user stickiness, incentivize positive behavior, and optimize capital utilization.

The liquidity pools in V4 support more flexible configurations, allowing developers to create different types of pools using hooks and custom logic. For example, dedicated pools can be created for hedging market risks or for specific arbitrage strategies, such as the Cork protocol, which is building an AMM for trading de-pegged risk tokens like LRT ETH through Hooks. This brings more innovation to DeFi applications and aggregates direct application opportunities into AMM, transforming Uniswap from merely a trading platform into an open platform for liquidity and trading strategies. Verifiable off-chain computation will become increasingly important, such as ZK co-processors like Brevis, which, combined with the development of verifiable computation, introduce external data to optimize AMM's personalized services for users. At the same time, it will better reduce the trust assumptions of solvers in the intent network.

1.3 Asset Issuance

The most interesting aspect that AMM can expand and capture will be its ability related to asset issuance. Liquidity bootstrapping capabilities, such as LBP, which Uniswap could not previously achieve, can also be addressed by building Hooks, such as the one being developed by Doppler. Further innovations can emerge from this, essentially allowing Uniswap to derive countless asset issuance capabilities, even surpassing pump.fun, directly capturing the value of asset issuance.

2. Under Intent-Centered DEX Design, the Importance of Strongly-Bound Front Ends Diminishes, and LPs Face Vertical Competition in the Trading Supply Chain

2.1 Diminished Importance of Front Ends, Strengthened Vertical Competition

The overall relevance of front ends will decline as an efficient solver market eliminates the advantages of executing trades using protocol-specific front ends. The diversification of pools brought by V4, along with the potential for toxic traffic in Hooks, leads to pools dominated by various Hooks not being directly routed by Uniswap. This is also the situation of AMM after future modularization—most pools will operate behind the scenes, routed directly by intermediaries—solvers—rather than directly interacting with users from the front end.

The intent-centered future will significantly impact our understanding of value capture in the trading supply chain, the design of protocols like LPs and bridges, and the overall user experience. In such a scenario, the role of the front end will gradually diminish. Protocols will compete on efficiency rather than focusing on front-end user acquisition. In fact, this trend began with DEX aggregators, as some DEXs gained substantial trading volume through aggregators, but their protocol-specific front end had very few users.

We are even beginning to see DEXs like Ekubo on StarkNet that do not provide a swap front end at all, relying entirely on DEX aggregators, and in future solutions, routing swaps through their liquidity, accounting for about 75% of all trading volume on StarkNet.

2.2 Current Limitations of RFQ

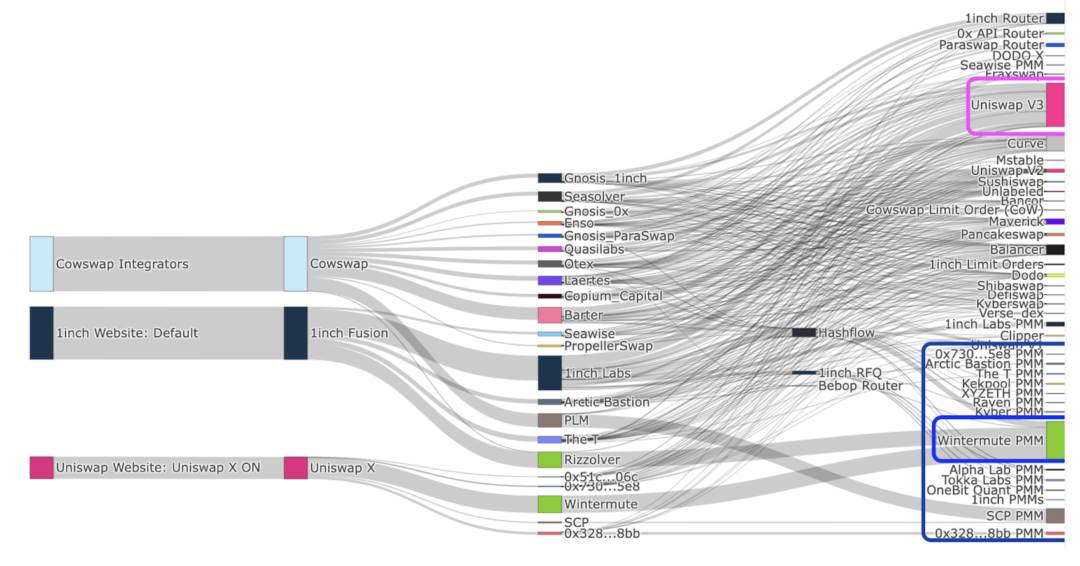

Most intent protocols on Ethereum are isolated primitive intent systems where users express protocol-specific intents, primarily around trading. Major protocols include CoW Swap, 1inch Fusion, and UniswapX.

One of the biggest issues with the current RFQ system is the lack of composability of intents, necessitating a potential universal intent network and architecture to address this limitation. Teams like Essential are working on establishing open, universal intent standards, such as ERC-7521, to help various participants, including users and solvers, achieve a better user experience.

Especially for solvers, serving various protocols across stacks, including building efficient on-chain routing, maintaining off-chain liquidity sources, and private order flows, is crucial to minimize latency between different protocols. In addition to inter-protocol unification, vertically integrating roles in the trading supply chain also becomes particularly important. Similarly, for pools and liquidity providers, the best way to capture traffic in the intent network is to become solvers themselves. To better protect the interests of all parties in the various potential loss scenarios mentioned above, collaboration with block builders becomes especially important. This has led to a situation where participants under the current RFQ are vertically integrating, with solver service providers offering their liquidity through off-chain/AMM pools and directly collaborating with builders. This also brings potential centralization issues, as reduced competition in solver auctions may make the envisioned price efficiency more difficult to achieve.

3. AMM Will Focus on Long-Tail Markets in the Future, Needing Continuous Optimization as PMM Gradually Dominates

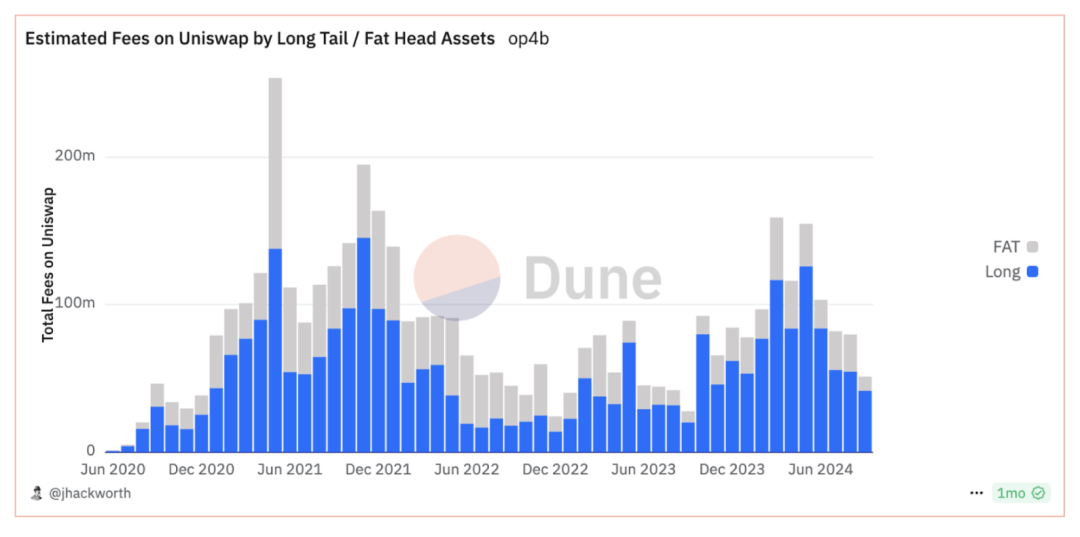

The long-tail effect of crypto assets is very evident, with blue-chip pools being captured by off-chain liquidity—highly liquid top assets, i.e., large market cap tokens, will ultimately be filled by off-chain resources, especially PMM, while long-tail liquidity small-cap tokens will route to AMM. In fact, this has already become a reality to some extent.

Approximately 60-80% of the total weekly trading volume on Uniswap Labs' front end is filled by AMM. From the perspective of individual trades, intent-based systems currently account for about 30% of all DeFi trading volume. Since early 2022, this has remained around 30% of DeFi trading volume. PMM occupies the vast majority of intent-driven order flow, with Wintermute dominating, having accounted for at least 50% of intent-driven flow facilitated by PMM since September 2023.

As the adoption rate of intent increases, PMM is beginning to receive more and more non-toxic traffic. However, AMM fills not only long-tail liquidity: in ETH/USDC trades through UniswapX and the Uniswap front end, only 30% of the trading volume routes to AMM. The advantage of PMM, or private market makers, lies in providing liquidity to capture non-toxic traffic.

3.1 Disadvantages of AMM

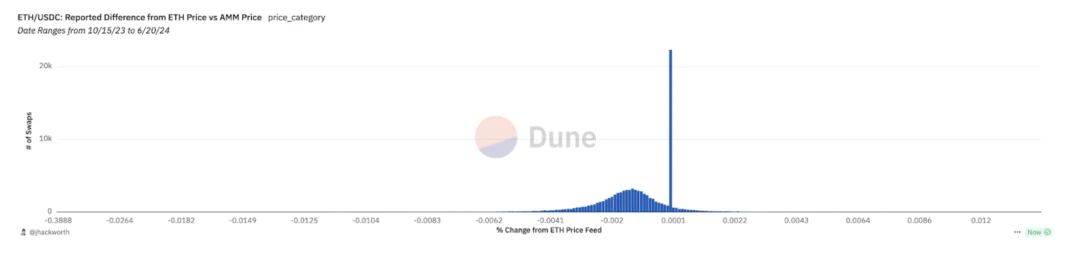

- From the Perspective of LP Price Lag

Due to the lag in LP price updates, AMM may quote expired prices that are better than the market, while market prices are typically set by CEX. This can explain part of the traffic flowing to AMM.

This point can be observed in Variant's analysis of Uniswap X. The following chart shows the difference between DEX quotes and market prices estimated using CEX APIs for trades routed to AMM, with liquidity routed to AMM averaging lower than market prices. This indicates that the reason for traffic flowing to AMM is that LPs provide better expired prices.

- From the Perspective of Intent Economics

For long-tail assets, the cost of off-chain liquidity fillers as a percentage of trading volume decreases as trade size increases, while AMM's costs decline more slowly than off-chain fillers, meaning AMM's economies of scale are weaker. As trade size increases, it becomes cheaper to use off-chain liquidity to fill orders. The only fees for fillers come from lower filling gas efficiency and hedging costs.

- From the Perspective of AMM's Interests

Uniswap's trading volume is increasingly concentrated in top assets, while the fee trend is completely opposite. In most months, the majority of fees come from long-tail asset trading pairs. This is because Uniswap V3 introduced lower fee tiers, compressing competition for more liquid top assets. Long-tail liquidity is more valuable than top liquidity because it is less sensitive to fees, more scarce, and for these assets, price discovery is often more important than price efficiency.

3.2 Advantages and Potential Issues of PMM

As PMM attracts more traffic through intent-based systems, LPs on AMM will face a greater proportion of arbitrage-related toxic traffic. In this environment, LPs will suffer more losses because they rely on non-toxic flow fees to offset losses caused by toxic flow. New AMM designs that want to capture non-toxic flow will need to compete with PMM.

The actual entities behind these PMMs include traditional market makers such as Jump, Jane Street, GSR, Alameda, and Wintermute.

These market makers bring higher profit margins by verticalizing every level of the MEV supply chain. In the current environment, they can perform better than in previous purely on-chain liquidity provision environments and collaborate with builders and other MEV participants to execute MEV strategies and produce blocks.

However, in the long-tail asset space, on-chain AMM LPs still have advantages, primarily because CVMMs have their own inventory risks when making markets, necessitating the provision of corresponding hedging strategies, which is still challenging to execute for long-tail assets.

This ultimately is a war between on-chain liquidity and off-chain market makers. As market makers erode on-chain liquidity, if future price discovery is gradually dominated by off-chain liquidity, it will lead to a shrinkage of liquidity in on-chain DEXs. Our ultimate goal should be to shift liquidity on-chain, rather than merely making it easier to obtain off-chain liquidity.

Arrakis is vertically integrating into the MEV supply chain through a next-generation AMM called HOT. This solution aims to reclaim MEV for LPs, with the goal of establishing a healthier and fairer on-chain market. Centered around HOT AMM, Arrakis is taking the first step to address the CVMM issues in DeFi by protecting on-chain LPs. HOT is a liquidity module that provides modular capabilities through Valantis.

4. Conclusion

With the development of DEX RFQ networks like Uniswap X and Arrakis, and modular DEX architectures like Uniswap V4 and Valantis, the landscape of DEXs will enter a new phase.

First, many issues within the AMM business segment will be resolved, while the scope of business will greatly expand. The most pressing issue is that of LPs. The LP issue can be divided into two types of losses: IL (impermanent loss) and LVR (liquidity value risk), which can be addressed through various liquidity management protocols, derivatives (which can be integrated as modular capabilities into AMM), and RFQ systems, thereby increasing the upper limit of on-chain liquidity provision. Additionally, there are personalized business logic, cross-chain trading, asset issuance capabilities, etc. This will allow AMMs to capture more financial limits and business scenarios, and we are optimistic about any protocol innovations that can effectively broaden the business scenarios of AMMs.

Secondly, under the current intent landscape, there are still many RFQ-related issues that need to be resolved. The entire trading supply chain has undergone significant changes, similar to what happens in block production, where vertically integrated service providers have gained greater advantages.

Finally, AMMs will focus on long-tail markets in the future, optimizing the gradually dominant PMM landscape. With the development of the intent network, centralized market makers that have vertically integrated trading links will have absolute advantages in the liquidity of most blue-chip assets, leading to an increase in toxic flow for on-chain native liquidity providers and a decrease in returns. In order to enhance the decentralized trading landscape on-chain, exploring how to increase AMM's competitive advantage in asset endpoints, especially for long-tail assets, is also a direction we continue to focus on.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。