Gaining users means gaining the world.

Written by: Deep Tide TechFlow

Even giants like Binance cannot ignore the rise of Meme coins.

How did this super cycle of a Meme pandemic come to be?

Recently, Binance Research released a report titled “Understanding the Rise of Meme Coins”, which provides a comprehensive analysis of the phenomenon of Meme coins, the macroeconomic factors behind it, its value propositions, and its potential impact on the cryptocurrency industry.

Deep Tide TechFlow has refined and interpreted this report to help everyone quickly grasp its key points.

Key Points

- Background: Global Monetary Supply Expansion and Investment Behavior

In the context of rapid global monetary supply expansion, high-risk investments have become more attractive. This phenomenon can be divided into several layers:

Most funds flow into traditional assets, such as the S&P 500 and real estate. Some funds flow into major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

At the far end of the risk spectrum, Meme coins have emerged as high-risk, high-reward investment tools, attracting some excess capital.

- Environment: Retail Investors Seeking New Wealth Growth Avenues

Many retail investors are exploring new channels for wealth creation, reflecting a shift in their views on traditional finance.

Meme coins attempt to embody these principles by reducing internal advantages and increasing equal availability for global investors.

- Trend: Financialization of Internet Culture

Since the early days of the internet, memes have exhibited viral spread and community-driven appeal. This phenomenon has now extended into the financial realm through cryptocurrency technology, achieving the financialization of memes.

- Insight: Extracting the Essence

Key features such as fair issuance and low circulation token economics have been successfully demonstrated by well-known Meme coins; these features are worth considering for any project planning future token issuance.

Meme Macroeconomic Data

What do Memes represent? Another side of the industry: a greater focus on financial profit rather than technological advancement.

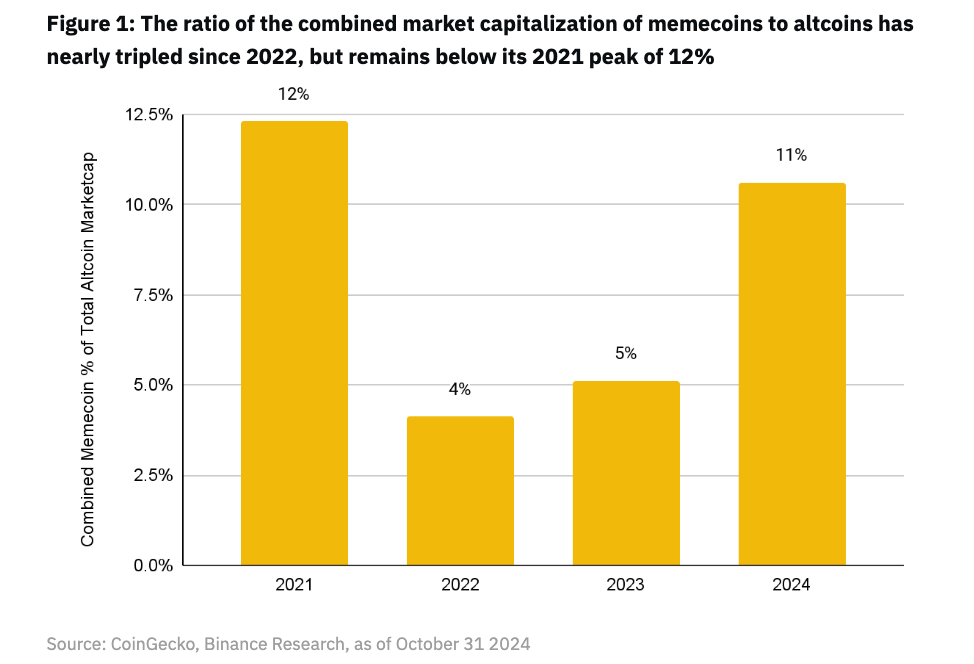

Since 2022, the total market capitalization share of Meme coins (excluding BTC, ETH, and stablecoins) has increased from 4% to 11% in 2024.

This proportion is still below the peak in 2021, when the market capitalizations of $DOGE and $SHIB reached $80 billion and $39 billion, respectively.

From 2022 to 2024, the market capitalization share of Meme coins nearly tripled.

Global Economic Context of Memes: Excessive Monetary Expansion and Financial Nihilism Among Youth

Fiat Currency Printing Money, Global Monetary Supply Increases

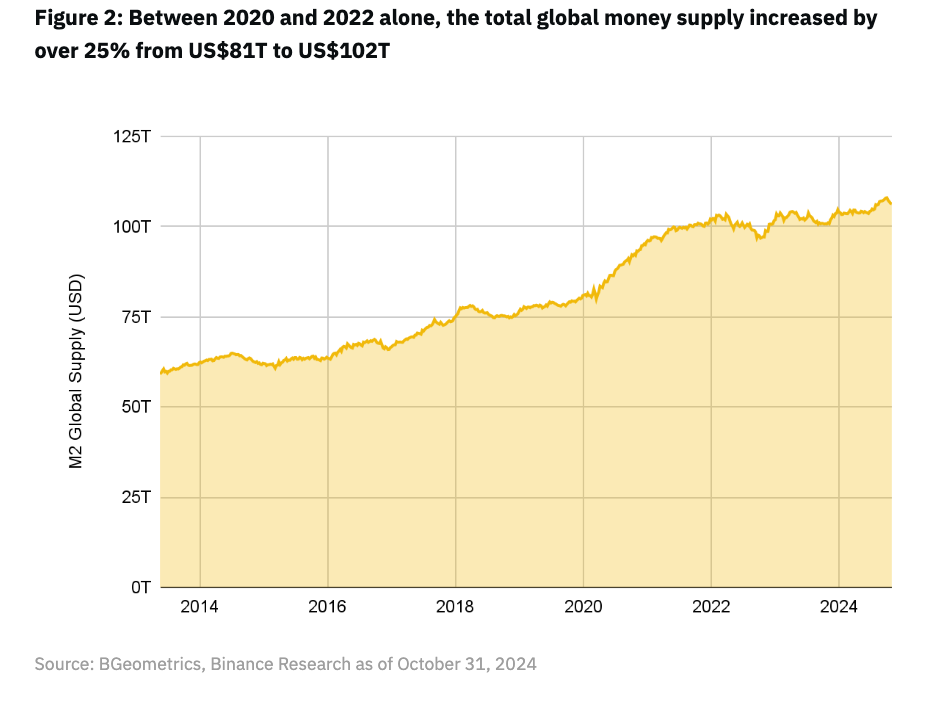

During the COVID-19 crisis in 2020, global central banks increased the supply of fiat currency at an unprecedented rate.

Figure 2 shows that from 2020 to 2022, the total global money supply increased from $81 trillion to $102 trillion, an increase of over 25%.

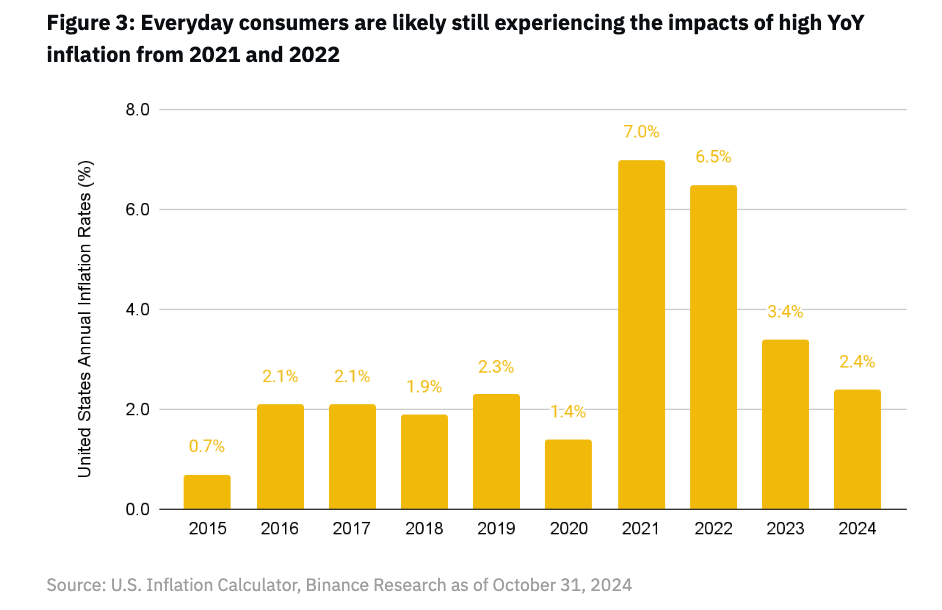

Inflation and Rising Commodity Prices

- The U.S. inflation rate reached 7% in 2021 and 6.5% in 2022.

In the face of currency devaluation, rational actors invest funds into assets deemed to have long-term value.

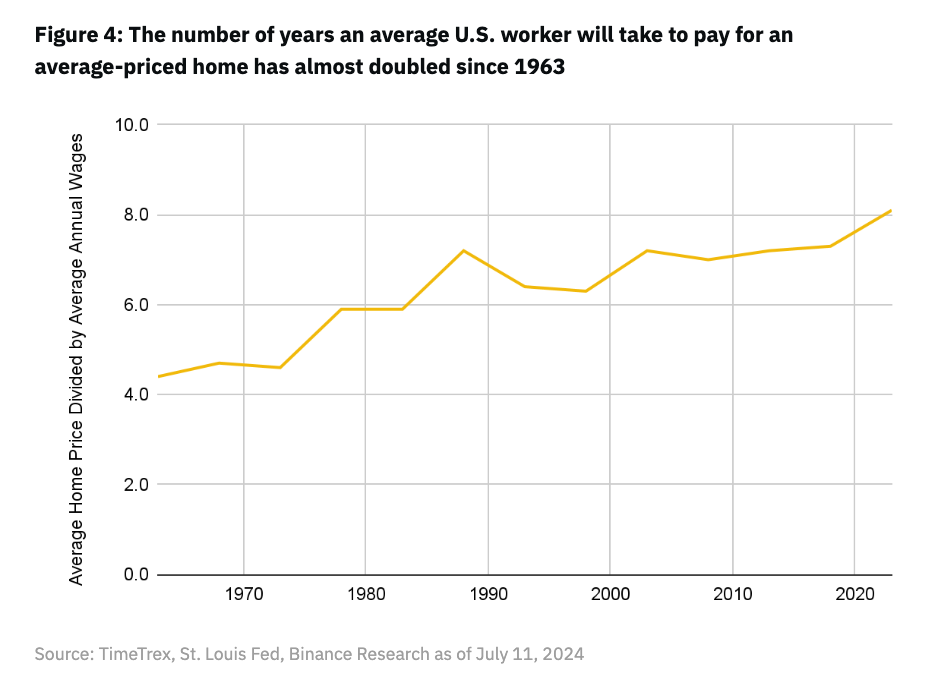

Wage growth has not kept pace with rising housing prices. Figure 4 shows that the average number of years of average wages required to purchase an average-priced home increased from 4.4 years in 1963 to 8.1 years in 2021, nearly doubling.

Attitudes of the Younger Generation: Financial Nihilism

The macroeconomic situation has put pressure on the younger generation. Young people have lost faith in the traditional financial system, especially evident in the cryptocurrency market.

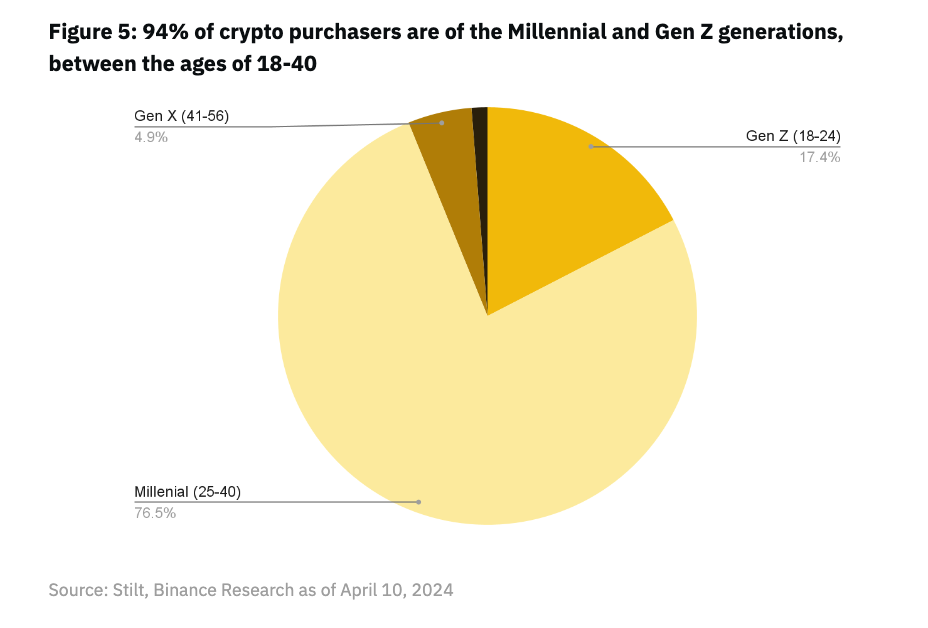

94% of cryptocurrency buyers are millennials and Gen Z, aged 18-40.

Key event: The GameStop short squeeze in 2021 reflected young investors' skepticism towards traditional financial structures.

Value Proposition of Meme Coins: No Practicality, but Attractive

Definition of Meme Coin Nihilism: Based on internet culture, memes, or popular trends; typically lacking clear practicality or intrinsic value.

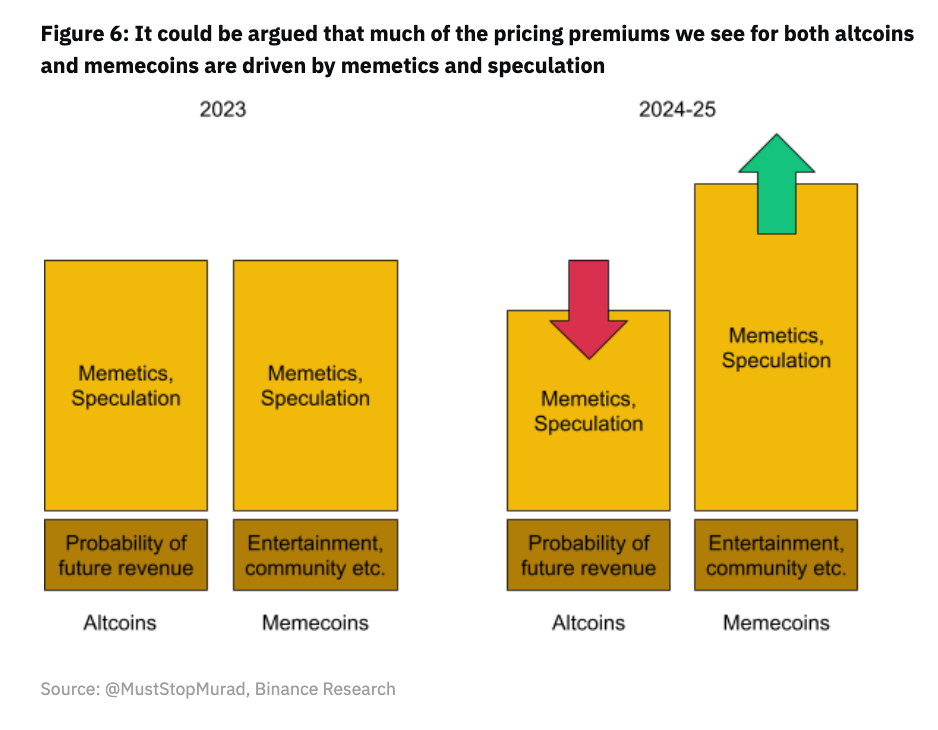

- Since 2020, the number of Meme coins has surged. 75% of Meme coins were created in the past year.

Alternative Appeal: Represents a newer, fairer, and more accessible opportunity for wealth creation.

No pre-mining, team allocation, or venture capital allocation.

All tokens are equally available to all participants at the time of issuance.

Typically have simple, easy-to-understand narratives, making it easier for ordinary investors to comprehend and participate.

Largely driven by investor sentiment and group psychology.

Risk Considerations

Nine Lives, Manipulation Unabated

97% of Meme coins have failed. Only a few Meme coin projects can survive long-term and maintain relevance.

Conspiracy groups and rug pulls are everywhere; you might just be the “exit liquidity.”

Low liquidity can lead to severe price volatility and difficulty exiting investments.

Market Saturation, Innovation Stagnation

New projects may struggle to gain attention and investment, or attention may remain limited.

The Meme coin market may already be saturated. Its prevalence may divert attention and resources away from truly innovative projects, affecting the long-term development and innovation of the entire cryptocurrency industry.

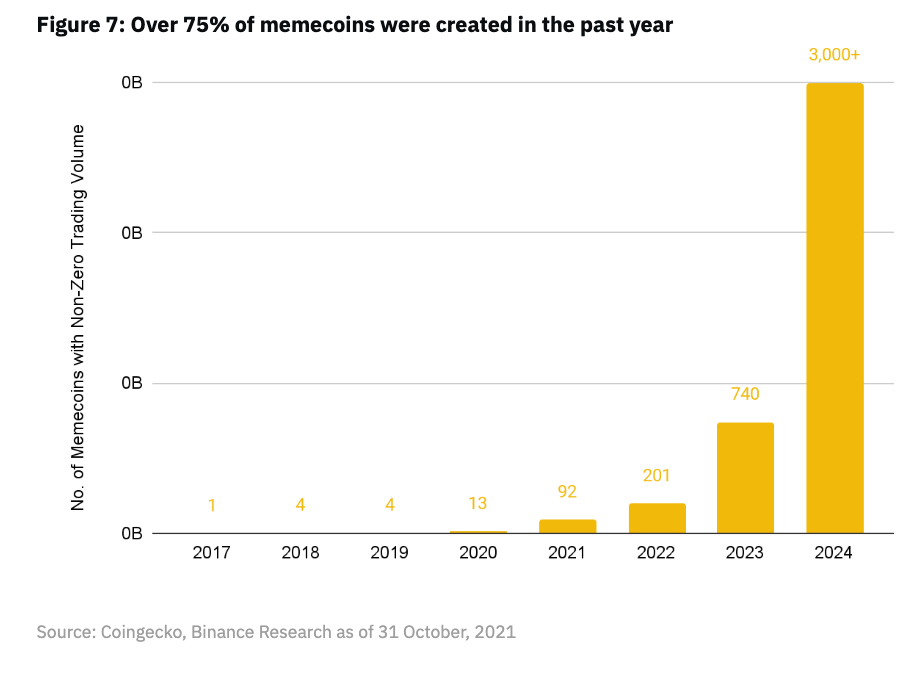

Outlook: Tokenized Software Business vs. Tokenized Concepts

Altcoins vs. Memes

We can describe technology-driven altcoins as tokenized on-chain software businesses, while Meme coins can be described as tokenized concepts and narratives.

In the long run, the most successful altcoins need to create and maintain useful, sufficiently differentiated software products with real market fit.

The most successful Meme coins may need to create and maintain differentiated, unique narratives and concepts.

Gaining Users Means Gaining the World

Meme coins demonstrate significant retail demand for tokens that are fairly issued and open to all blockchain participants from the start.

The brand and networking resources provided by mature venture capital firms (obtained through private token sales) may be attractive to new projects, but ultimately, the user base of any product will consist of retail participants.

Providing retail participants the opportunity to invest from the early stages of a project and grow alongside the team is crucial for cultivating a strong, loyal community around any crypto asset.

Globalization of Price Discovery Mechanisms

The rise of Meme coins indicates that tokens issued in this manner can achieve market capitalizations in the millions or even billions through organic price discovery mechanisms, driven by the borderless, permissionless nature of decentralized markets.

The rise of Meme coins is an exciting new trend that powerfully demonstrates the ability of blockchain technology to unite individuals globally and cultivate organic communities around tokenized assets, a capability that seems stronger than ever before.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。