L2 is trapped in a development deadlock, perhaps the answer lies here.

Written by: Haotian

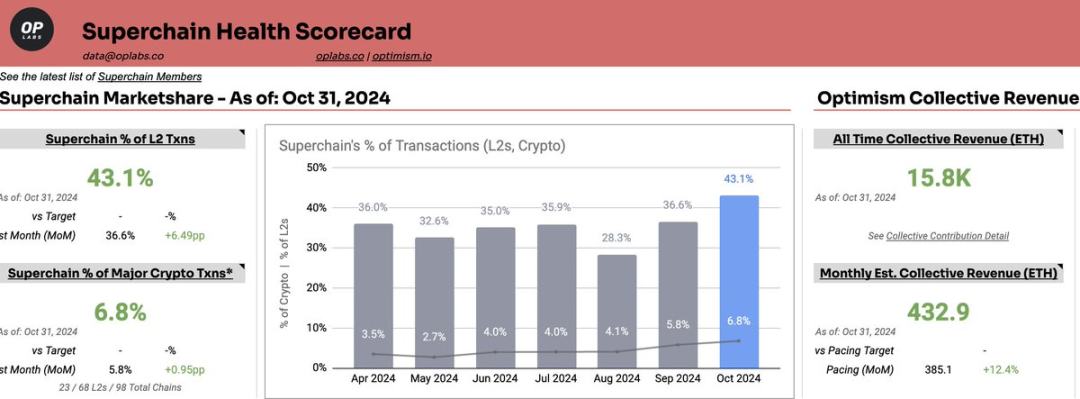

After looking at the table of profits and various ecological data from @Optimism Superchain over the past year, I extracted a few key indicators to share:

1) As of now, OP Superchain has generated a total revenue of 15,849 ETH, with @base contributing 2,878 ETH. The revenue composition is: on-chain net profit from OP Mainnet + 15% of on-chain net profit share from OP Stack chain / 2.5% of total revenue); since there are no direct comparisons with revenue data from other L2s, I won't comment further.

2) The OP Superchain ecosystem has expanded to 35 chains, including 33 L2s and 2 L3s; the statistics may not be complete, as more than half have not launched yet, but it is evident that the development speed of OP Stack is rapid.

3) The Base chain is the best-performing chain in the Superchain ecosystem, with daily transactions of 6.9M and monthly transactions of 205M, which is ten times that of OP Mainnet's 22M. It is clear that the decision to include Base under the superchain has been very successful.

4) In April, when the market was doing well, Superchain's monthly revenue was 1,189 ETH, with Base accounting for 48.4% and OP Mainnet for 51%, while other chains accounted for a total of 0.6%; this shows that the strategic effect of OP Stack is currently evident on the Base chain, while other L2 alliances have yet to gain momentum.

5) The 48.4% revenue contribution from the Base chain to the superchain only accounts for 15% of its total revenue, while the 51% contribution from OP Mainnet represents its entire net profit, indicating that the actual revenue from the Base chain is quite considerable, approximately more than six times that of OP Mainnet.

Overall, this data can accurately reflect the current development status of OP SuperChain, which is still in the early stages, with only the Base chain having emerged, while other chains are still in their infancy.

Strangely, this table does not specify the expenditure situation of OP Superchain, but we can roughly estimate it through other public data.

Recently, OP provided 25 million OP tokens to Kraken to develop the new OP Stack layer2 network Ink, which is quite a significant investment. Its six rounds of RetroFund have also distributed over 60M OP tokens, with the OP tokens promised to the Base network accounting for 2.75% of the total supply (distributed over six years), in addition to occasional sponsorships or resource exchanges for specific networks. This part of the expenditure is not small: (the following is a rough estimate, not accurate and for reference only)

Excluding the investment in incentives for developers and the community ecosystem, let's calculate an investment and return based on Base.

Investment: 4.3 billion OP * 2.75% = 118 million OP % 6 = 20 million OP / year; Revenue: contributed 2,500 ETH in the past year (since Base has been online for 15 months, totaling 2,878 ETH minus 3 months of revenue). Estimating based on the current prices of ETH and OP, this is equivalent to an investment of $30 million for a return of $6.25 million.

Literally comparing, it is definitely a "losing" business. Of course, if the OP Foundation does not consider the $OP expenditure as "cost"…

I have always struggled to understand why layer2 is trapped in a development deadlock; this problem is too difficult to solve, but seeing the details may reveal the issue within these data points.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。