Author: Nan Zhi, Odaily Planet Daily

Meme trading on Solana is often regarded as a "PvP battlefield," with rapid trading rhythms and fierce market fluctuations. On the other hand, news reports often highlight that a certain smart money address reaps a thousandfold increase only after holding the tokens for several days or even dozens of days.

So, what type of trading style is more "correct"? Is the winning factor "diamond hands," high leverage, or other trading characteristics? Odaily will conduct a data backtest in this article to try to find the "Holy Grail" of Meme trading.

Basic Information

Data Source

This article selects the most recent 2000 transactions from MOODENG and LUCE, deduplicates the addresses, and filters all transactions conducted by these addresses, with the filtering criteria being profits greater than $5000 and losses greater than $2000. In total, there are 1084 addresses and 8858 transactions.

(Note: The author initially selected the earliest 2000 transactions from MOODENG but found that only 89 addresses completed these transactions, revealing a strong "conspiracy" vibe. However, this is not within the scope of this article, and readers can conduct their own research. To ensure randomness of addresses, the most recent 2000 transactions were chosen.)

Trading Characteristics

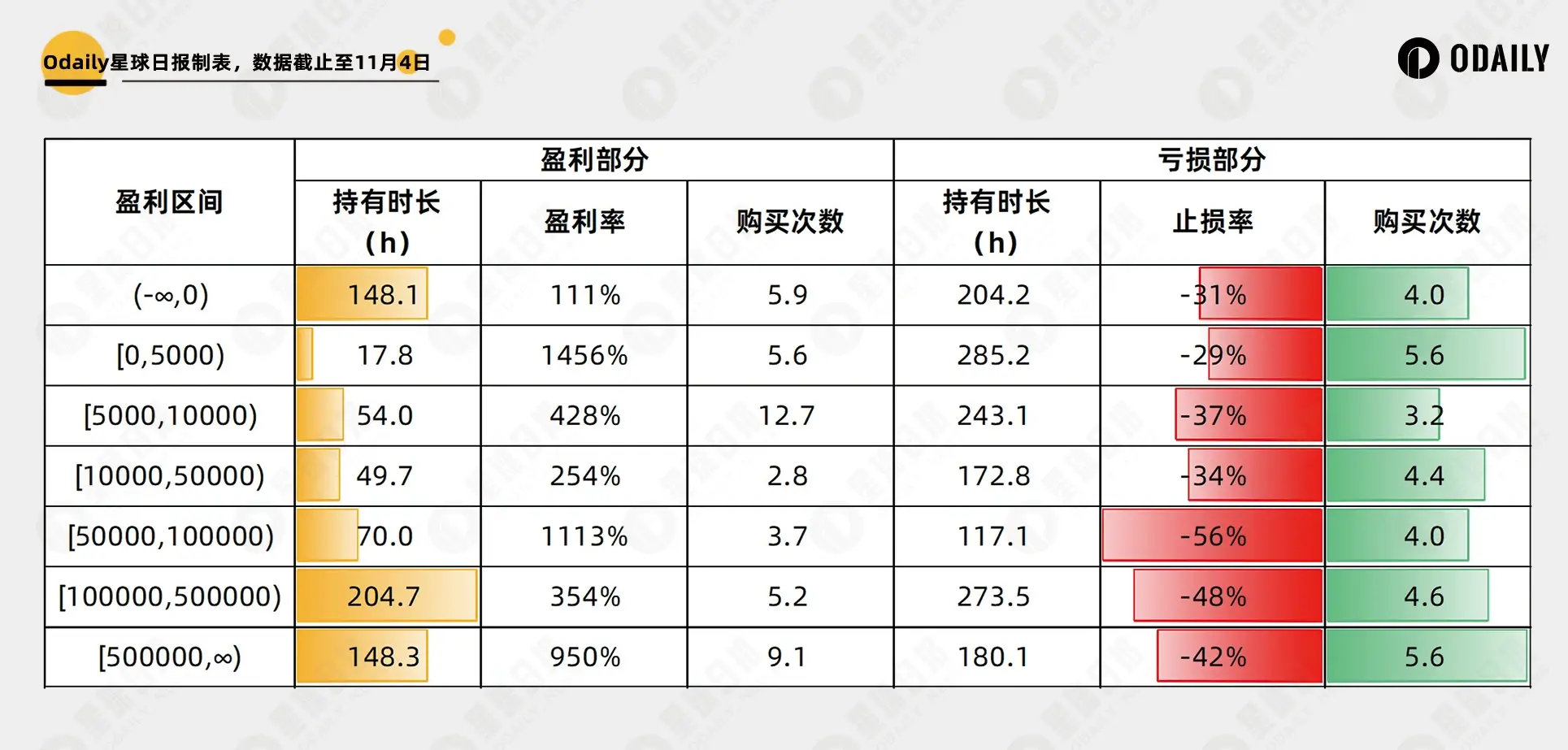

Based on the final total profit of the tokens, this article categorizes all transactions into profitable and losing categories, and then separately counts the profitable transactions for each wallet:

Token holding duration: The time interval from the first purchase to the first sale

Profit rate: Total profit of the token ÷ Total investment cost of the token

Number of purchases: How many purchases were made before the first sale

The statistics for losing transactions include:

Token holding duration and number of purchases as above

Stop-loss rate: Total loss of the token ÷ Total investment cost of the token

Here, the token holding duration represents the "diamond hands" coefficient, the profit rate and stop-loss rate represent the address's profit-loss preference, and the number of purchases indicates whether the approach is to buy once after identifying the opportunity or to trade multiple times to average the cost.

Diamond Hands, High Odds? What is the Winning Factor?

For readers not interested in the process, the conclusion is as follows. Addresses with high profits clearly differ in terms of the holding duration of the profitable portion and the stop-loss rate of the losing portion, demonstrating far greater holding patience than regular addresses, as well as wider stop-loss conditions.

Cut Losses, Let Profits Run

Livermore once said: "After years of wandering on Wall Street, after making and losing millions of dollars, I want to tell you this: My thoughts have never helped me make big money. It is always the steadfastness that earns me money."

The most obvious distinguishing feature between top addresses and others is that their holding duration far exceeds that of regular addresses, showing a significant positive correlation, approximately holding for 6-8 days, which is close to the fermentation duration of top tokens on Solana.

However, we also see that "addresses with overall losses" have holding times very similar to "addresses with profits exceeding $500,000." Upon verification, these losing addresses involve a total of 817 profitable tokens. While we cannot backtrack the trends of each token, the data indicates that the profit difference comes from the "profit rate," meaning they "picked the wrong target."

Another factor that shows a clear positive correlation is the stop-loss rate. As profits increase, stop-loss conditions are also relaxed, but the differences across intervals are not significant.

Interpretation of Irrelevant Factors

Surprisingly, the profit rate has no direct relationship with the address's profitability, with a Pearson correlation coefficient of only 0.04, indicating almost no linear relationship. The variability in profit rates suggests that the overall profitability of the address is related to "win rate," meaning that identifying the right opportunity and holding long-term are the roots of profit differentiation.

Another factor that is significantly unrelated to the address's profitability is the "number of purchases." Whether buying once after identifying the opportunity or trading multiple times to average the cost can both work. The reason for focusing on the number of trades is that the author previously suggested in "Meme Cultivation Manual: Rebirth, I Want to Be a Diamond Hand (III)" that following trades should ideally avoid situations of multiple purchases, and this viewpoint was further confirmed after a week of testing.

Therefore, the number of purchases can be overlooked when assessing the address's profitability, but it should be a key factor to consider when determining whether it is suitable as a following target.

Summary

This article analyzes from a macro perspective which factors are the key to winning in Solana Meme trading, serving as a further in-depth analysis of the previous article "A Glimpse into a Thousand Solana 'Smart Wallets': Who is Making a Fortune? What Can We Learn from It?" The conclusion is clearer—"diamond hands" are the core and key to achieving top-level profits. However, for readers with limited capital, imitating such strategies may be challenging, and it is recommended that users further assess based on their own circumstances.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。