Bitcoin (BTC) is becoming even more dominant in crypto markets and is growing in importance against U.S. Treasuries, the bedrock of the American financial system and among the world's largest and most liquid markets, in a signal some investors may be looking to take on more risk in the search for greater returns.

Last week, as the world's largest cryptocurrency approached March's all-time high above $73,000, it was trading at a record 800 times the value of BlackRock's iShares 20+ Year Treasury Bond ETF (TLT). That's up from 466 at the time of BTC's previous peak, in November 2021.

Treasuries, backed by the credit of the government of the world's largest economy, are considered among the safest assets to own. They are held by many central banks worldwide as reserve assets because they're seen as a reliable store of value. They also serve as a benchmark for interest rates worldwide, and when yields increase, the price falls and vice versa.

That may be an issue for some investors. Since interest rates started rising during the Covid-19 pandemic, we appear to have entered an era of economic uncertainty. Rates are unlikely to drop back to 0% for several reasons: stubborn services inflation, the U.S.'s nearly $2 trillion budget deficit — almost 100% debt to GDP — and conflicts in eastern Europe and the Middle East.

The absence of an incentive for price gains may be why the ETF which has $60 billion in total assets, has lost 7% this year, while bitcoin has rallied 55%. The relative performance might indicate that investors could be moving parts of their portfolio to bitcoin from long-term Treasuries.

Due to the fundamental properties of bitcoin and with the huge success of the U.S.-listed spot ETFs this year, bitcoin may be starting to emerge as a relatively safe asset for some global investors as economic uncertainty continues.

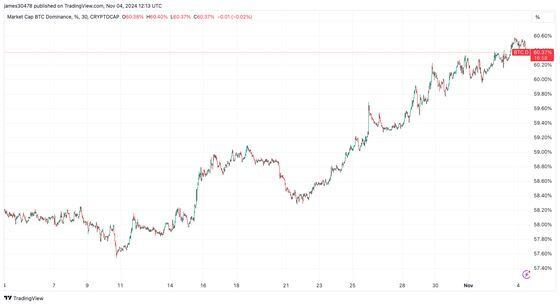

Bitcoin's rally has driven its share of the total cryptocurrency market capitalization to a new cycle high of 60.56%. For crypto investors, this may, conversely, indicate a risk-off move, as they shed holdings of riskier alternative currencies (altcoins) in favor of the market leader ahead of the U.S. election.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。