Author: Ice Frog

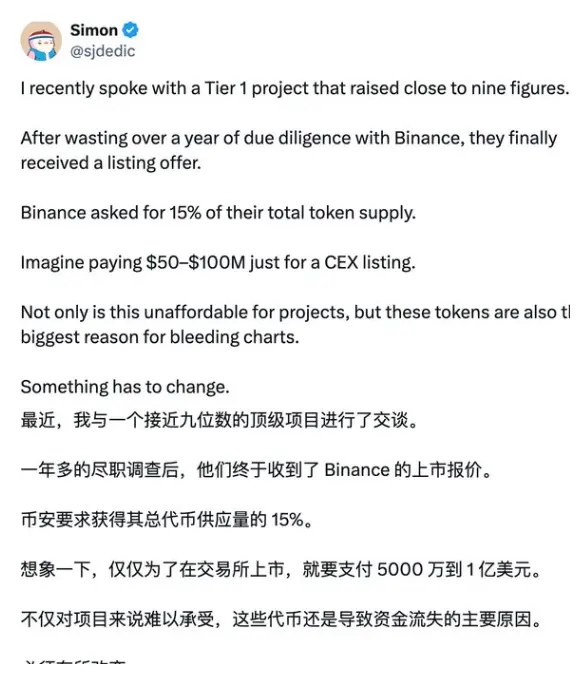

As the top player in the industry and at the pinnacle of the pyramid, Binance has recently faced an increasing wave of market FUD. Simon, marked as the CEO of MoonrockCapital on platform X, claimed that Binance requires a fee of 15%-20% of the total token supply as a condition for listing, which stirred up a storm of discussion in the market. The intensity of the debate quickly escalated, with both supporters and opponents voicing their opinions. Some emotionally charged individuals even consider Binance to be the biggest tumor in the industry, while opponents argue that this is not Binance's responsibility, but rather an issue with the project parties or the development of the industry itself.

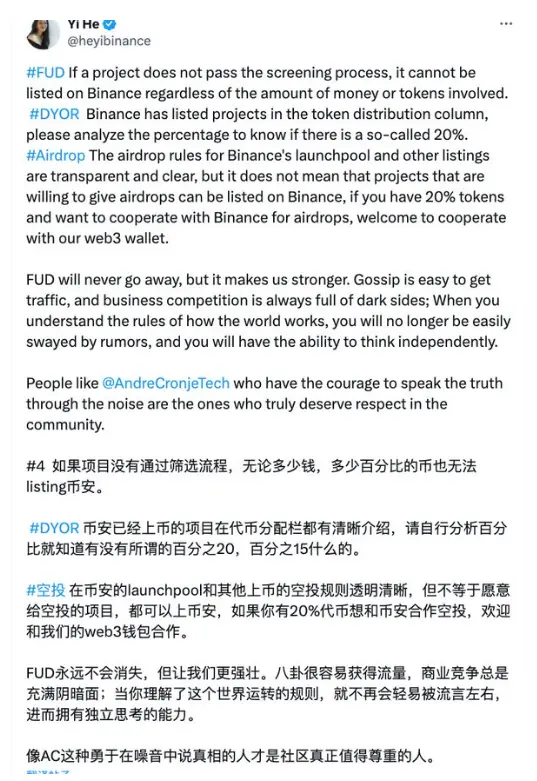

Ultimately, Binance's top female executive publicly responded on social media: If a project has not passed Binance's screening, no matter how much money or listing fee is offered, it cannot be listed on Binance. Token distribution is transparent, and Binance cannot charge such a high percentage of token distribution.

Regardless of whose statements are the truth behind the mutual accusations, or if it is merely a commercial competition, at least from the response of the top female executive, we see her using her own reputation to salvage Binance's reputation. Her proactive and timely response to such doubts shows that she has earned the community's respect with her candid and direct attitude in the past and present.

However, such doubts are not new, nor will they be the last. This also highlights the development dilemma Binance has faced in recent years, with external regulatory crackdowns and peer squeezes; internally, there are community doubts. The real crisis has never been hidden in surface challenges, just as defeating Binance will not come from another Binance.

1. Is FUD really just rumors: "Victim mentality" and "Who is the enemy?"

Let’s assume the top female executive's response is genuine, and FUD is a dark side of commercial competition. Unfortunately, the public never possesses independent thinking; otherwise, it cannot be called the public. From countless historical examples, one obvious truth is that the collapse of rumors never relies on the self-awareness of the public but on irrefutable factual truths. The guidance of KOLs only temporarily disrupts perceptions and does not mean the disappearance of doubts; it may even be the cause of the next more intense FUD.

When attributing all FUD to commercial competition conspiracies, the underlying victim mentality is unhelpful in eliminating disputes. Perhaps there are indeed peers fanning the flames, but that may not be the whole story. When a platform has sufficiently persuasive evidence, no one would choose to challenge an industry leader using such a thankless method; this method only becomes effective when you have flaws yourself. This is the most basic business logic.

In the face of FUD, one should first look for problems within rather than suspect competitors; this is the posture a great company should have. The real enemy has always been one's own arrogance, not others. If FUD is seen as a commercial tactic, it actually overlooks the real hidden crisis.

2. Where does the crisis come from: The transfer of pricing power and liquidity

1. Liquidity determines pricing power, but the source of liquidity is users

Binance, at least for now, remains the largest liquidity center in the industry. Whoever controls liquidity controls pricing power; this is an unchanging truth in the financial world. However, from a longer-term perspective, short-term pricing power is generally determined by institutions/exchanges, but in the long run, it always returns to users. If pricing power is abused, the speed of this transfer will further accelerate.

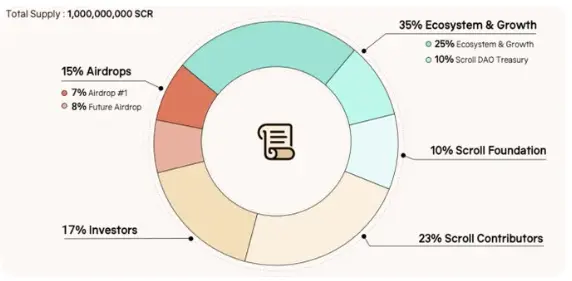

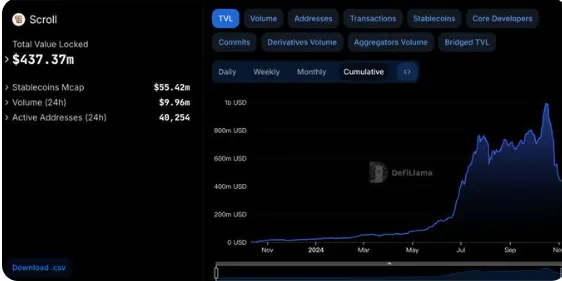

A significant sign of the abuse of pricing power is the indulgence of projects with extremely unbalanced chip structures and poor reputations. Among the projects listed on Binance, there are many with low circulation and high market value, coupled with Binance taking a considerable portion of the chips. This results in investment institutions, project parties, exchanges, and market makers controlling the vast majority of chips, leaving retail investors to passively take over. A recent example is Scroll.

The initial circulation accounted for only 19% of the total circulation, with an additional 5.5% allocated for Binance mining, and the remaining tokens included various unlocking requirements over time. A simple arithmetic question arises: with such a large and continuous selling pressure, who will take it on? Assuming the project party has a good reputation and self-sustaining capabilities, the selling pressure could receive some feedback, further smoothing the entire price curve. The reality is that after the airdrop and TGE, the data was almost cut in half in a short time. Worse still, this fundamental collapse could be 100% foreseen before listing on Binance.

Here comes the question:

1) Everyone knows that this is a situation where the fundamentals are bound to remain poor, the token distribution is extremely unreasonable, and the reputation is very bad, making it easy to form continuous control and selling pressure. Why did Binance choose to list it?

2) From the perspective of interests, which side does Binance's screening mechanism stand on?

Combining these two questions, at least one conclusion can be drawn: from the perspective of interests/user experience, Binance gives the impression that it does not stand with users or at least does not largely consider users' interests.

If it truly stood on the side of user interests, no competitor could tarnish Binance's reputation, because the sustainable wealth effect in the crypto world is the greatest truth.

A more significant comparison reflects the role of users as the ultimate pricing power, which is the Grass project, whose financing amount is less than 1/10 of Scroll's. The former currently has a total market value of over $1 billion, while the latter is over $500 million.

Even in terms of selling pressure from token unlocks, Grass's early circulation was not proportionally large. However, its fair and sustainable airdrop earned the project a good reputation among users, ultimately reflected in substantial user purchases, leading the project to continue increasing incentives for users, thereby further benefiting them.

In the same environment, similar projects have different fates. It clearly reveals that no matter how top-notch the technology or glamorous the financing background, even with the boost of a top exchange, if users do not buy in, the collapse speed of this harvesting chain will only accelerate, and each collapse consumes the foundation on which Binance stands, while the transfer of pricing power will also accelerate.

2. The transfer of liquidity: Human nature pursues greed, but the premise is fairness and transparency; on-chain Dex has an incomparable advantage.

Whether the crypto world is a big casino is debatable, but it absolutely adheres to the basic rules of survival in a casino: it’s not afraid of you making money, just afraid you won’t play. Contrary to most people's intuition, legitimate casinos in Macau almost always put great effort into fairness, justice, and transparency to dispel gamblers' concerns. Casinos do not rely on cheating to make money; they rely on statistical advantages to amplify profits.

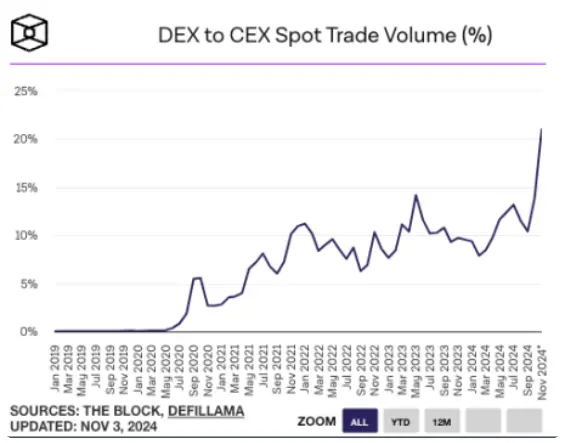

In terms of fairness, transparency, and justice, decentralization naturally has a stronger advantage than centralization. The growth of Dex is mainly constrained by user experience, but in the face of wealth effects, the impact is minimized. Data confirms this: according to The Block & Defillama, as of October, the ratio of Dex to Cex spot trading volume has risen to a historical high of 13.84%, and this ratio is steadily expanding.

Not to mention that recently, due to the popularity of MEME, platforms like Pump.fun have successively birthed several MEME tokens worth over $1 billion, with daily transaction counts exceeding 670 and average daily trading volumes exceeding $1 billion.

The data reflects that liquidity is gradually being seized by on-chain Dex or hot topics like MEME. Although the risks on-chain pose a higher risk level for novice players, few question the issues of decentralized platforms because they provide a relatively fair gaming environment.

The key difference between Cex and Dex is that the foundation of centralized exchanges is established on the premise that users return the power of token selection to the platform. Either you treat everyone equally with no thresholds or low thresholds, or you set high thresholds but must have sustainable value. The worst-case scenario is setting high thresholds while choosing a garbage project.

There is also a misconception that some centralized exchanges easily fall into an elite agency model. They do not believe they are selecting a garbage project; most personnel responsible for such businesses have impressive resumes and institutional backgrounds. They overly trust that capital can change the world and have unrealistic fantasies about so-called technology, naturally leaning towards believing institutions or thinking they can see the future direction of the industry, calling it: the direction of the industry.

Taking Scroll as an example again, aside from the technology seeming advanced and the financing impressive, what is its real value? Is it truly irreplaceable? If it is not irreplaceable, what is the logic behind choosing it? The so-called strict screening mechanism, if it does not consider the project's reputation and the founding team's vision, what is the significance of this screening?

Binance's listing signifies the success or failure of a project, which is the power entrusted to Binance by users. If this power is not well utilized, then users' doubts are naturally justified.

3. Some discussions: The crisis of Binance and the crisis of the industry

Behavioral economics expert and Nobel laureate Richard Thaler has a famous theory: people’s weighing of interests in decision-making is unbalanced, with considerations of "avoiding harm" outweighing "seeking benefit."

From "anti-VC coins" to "MEME craze," this is essentially a vivid manifestation of this theory. Within the visible range, the risks of buying VC coins continue to increase. If we factor in the time cost of being stuck and the limited upside of high valuations, the profit space becomes extremely narrow. Thus, VC coins on Binance have become an event where the "harm" outweighs the "benefit" for ordinary users.

You might say that Binance is just a trading venue, like a casino, an objectively neutral third party, and trading naturally has wins and losses. However, the objective fact cannot replace the objective reality. The true objective reality is that even casinos do not offer games where you lose ten times for every ten bets. In the case of VC coins, retail investors have almost never won, and this consensus is currently indisputable.

Moreover, in terms of project selection, if an exchange is truly objective and neutral, the rules should be transparent, just like the New York Stock Exchange and NASDAQ. Currently, in this industry, the listing process of top exchanges remains a black box, relying on people's speculation and inference, thus possessing supreme power; some exchanges have a semi-transparent listing process, offering a near-zero threshold (you can get listed by paying). Both are undesirable because the former specializes power, which, even without corruption, can easily breed arrogance and a small circle of vested interests; the latter monetizes power, charging exorbitant tolls, which can increase project costs and slow down innovation.

From a broader perspective, the current industry crisis is evident. Without a larger liquidity overflow, BTC is independent of the entire crypto market, gradually being controlled and priced by Wall Street capital. Other altcoins either, like Ethereum, cannot find a way to break through, or they completely turn to MEME. A sense of worthlessness envelops the entire crypto space, especially after most valuable coins have been repeatedly debunked, leading more users to lose confidence in whether projects are actually building. After all, when the largest exchange chooses to believe in these so-called project parties rather than the users, this confidence and sense of worthlessness collapse even more rapidly. The rise of MEME itself is a loss of faith in the so-called narrative value of industry development.

As the de facto spokesperson of the industry, Binance should shoulder more responsibility and meet user expectations. Shifting the problem to peers is less effective than confronting its own systemic flaws. Users need fairness, and damn it, they need fairness. In cases like Scroll, Binance took a large proportion of the chips with almost no cost, making it hard to argue that this is fair, and it is also difficult to say that this benefits the project and industry development.

From the perspective of traffic and status, one might say there is no problem, but let’s not forget where the traffic comes from, along with an old saying: "Water can carry a boat; it can also capsize it."

Do we still need Binance? Undoubtedly, yes. No one denies the significant contributions Binance has made to the industry. We still believe in the professional ethics of pillars like CZ and He Yi in the industry. However, as mentioned earlier, this is not an individual issue; it involves the operation of the entire mechanism and the ecological issues of the broader environment. How to solve these problems remains unresolved, and there is still no clear path. What we hope for is that Binance truly stands on the side of users, using its influence and immense energy to reverse the current situation, allowing users to rebuild their confidence in "valuable coins" and in the entire industry.

From Binance's own perspective, whether users can do without Binance and whether its irreplaceability is declining are questions worth pondering for Binance's management, especially in an industry environment where Dex trading volume continues to rise, on-chain MEME remains hot, regulation is becoming stricter, and competition is intensifying.

Remember, historically, no company has gone bankrupt due to too many rumors; most have declined due to rumors being confirmed, ultimately succumbing to arrogance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。