🧐 What is BTCFI competing for? | Core, BOB, and Corn: A New Era for BTCFi and How It Drives Bitcoin DeFi Prosperity:

🚨 One question: Where will you choose to stake your Bitcoin?

BTCFI has clearly become the most important cornerstone and a trend of continuous growth in the Bitcoin ecosystem. Bitcoin staking will eventually become a trend;

Thus, the question above is a topic that Bitcoin HOLDERS cannot ignore;

Currently, the TVL of BTC pegged assets in L2 and sidechain expansion networks is about $1.6 billion, but this portion of assets only accounts for 0.14% of the total market cap of BTC ——

As BTC liquidity is gradually being released, the scale of BTC assets across various chains and the application scenarios of the BTCFi ecosystem still have enormous growth potential;

We can see that this is a sustainable development track,

This article is well-written; it examines how BTCFI is developing and competing based on the liquidity of BTC pegged assets on-chain;

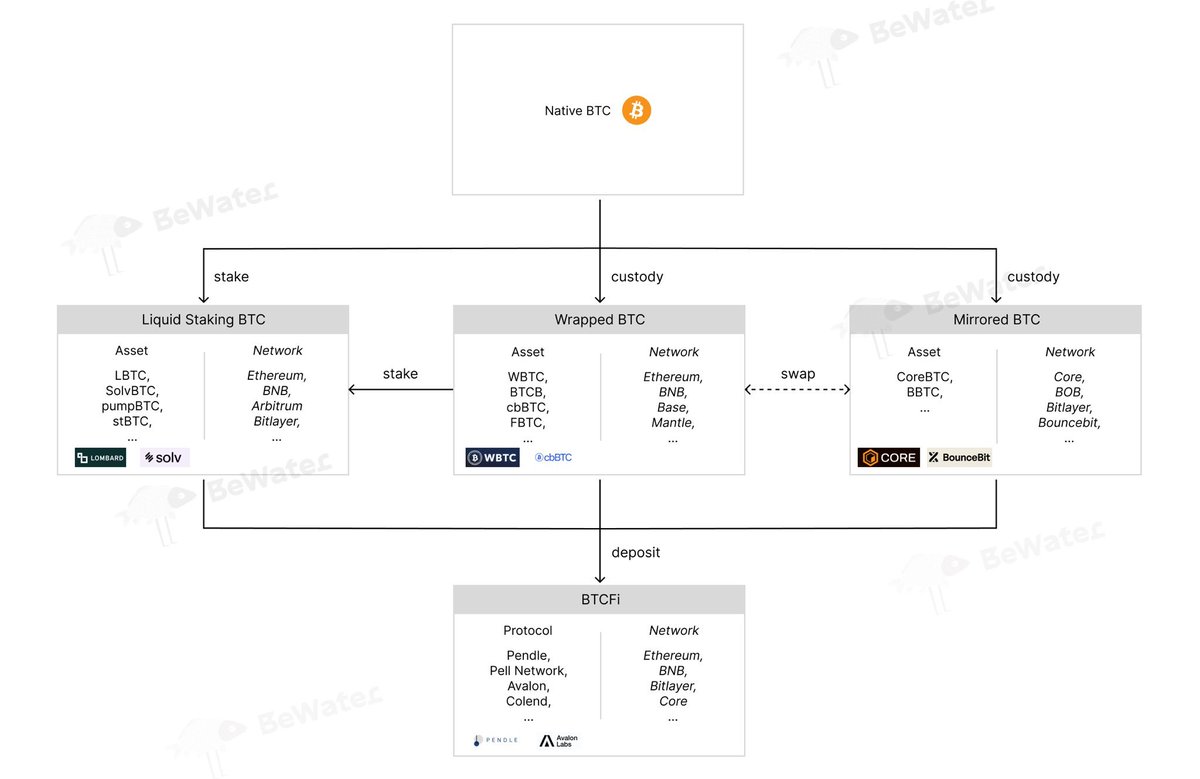

Currently, the flow direction of BTC and its pegged assets on-chain can be divided into the following three layers:

1️⃣ First Layer:

Native BTC;

2️⃣ Second Layer:

(1) Wrapped BTC based on centralized custody issuance

(2) Mapped assets running on BTC L2 and SideChain

(3) Liquid staking BTC

3️⃣ Third Layer:

BTC derivative assets in various downstream DeFi scenarios;

In fact, the key to effectively achieving ecological capital accumulation lies in unlocking and incentivizing large-scale incremental pegged assets, and forming combinable yield strategies through diversified DeFi applications while providing multi-party incentive expectations. The synergy will drive the activity and liquidity of BTC pegged assets across various chains.

This article illustrates this by comparing the development trends of Core, BOB, and Corn;

Additionally, it can be seen that non-custodial staking and dual staking mechanisms may be the ways that large holders are more willing to participate;

Where do you prefer to stake your BTC?

From: @BeWaterOfficial

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。