This week is the U.S. election week, and there is a lot of uncertainty surrounding the U.S. elections. Over the past month, Trump's popularity has been high, but Harris's chances of winning are gradually increasing during the election process. The U.S. elections have a significant impact on the entire market, and there is also a monetary policy meeting on Friday, where the market generally expects a 25 basis point rate cut. Currently, the cryptocurrency market is mainly in a wait-and-see mode for risk aversion. The implied volatility (IV) of options at the money this week has risen to 80%, and the IV of options this month is significantly higher than that of long-term options. There may be significant market movements in the coming days.

Chu Yuechen: 11.4 Bitcoin ETH Market Analysis and Trading Reference

The most important news right now is tomorrow's U.S. election. If Trump is elected, it will be bullish for Bitcoin; if Harris is elected, it will be bearish for Bitcoin. We will wait for the results tomorrow. At the same time, important events may trigger significant volatility, with an expected volatility of over 10%. This could result in Bitcoin price fluctuations exceeding 7000 points. Therefore, everyone must set stop-loss orders in their trades.

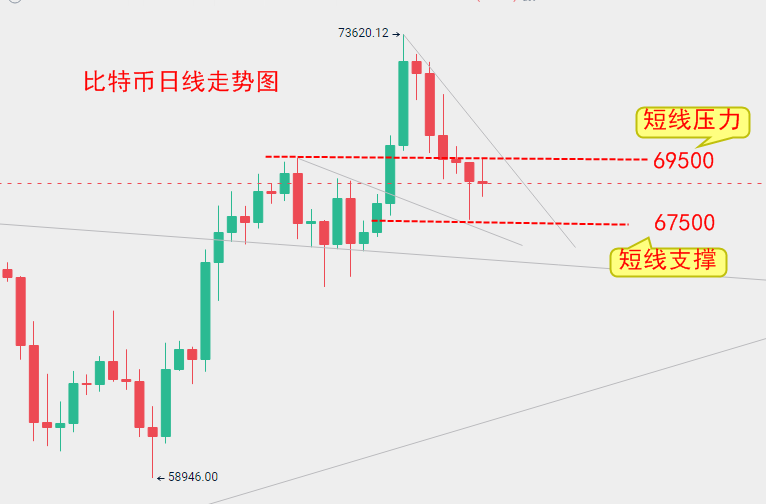

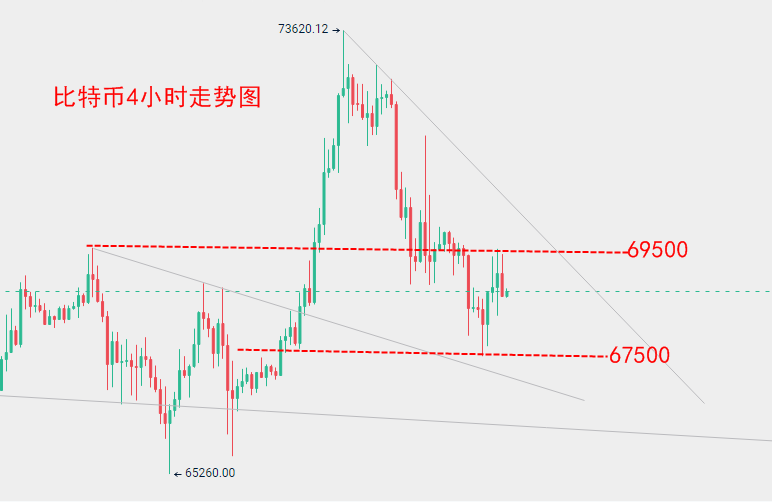

Today is Monday, and the market is not very volatile, with a trading range between 67500 and 69500, showing a narrow fluctuation of two thousand points. Therefore, today's Bitcoin operations will also revolve around this range. For Bitcoin, short at 67500—69500 and long at the same range, with a stop-loss of 1000 points and a take-profit of 2000 points.

Since there is significant news on Wednesday, there is no need to focus on technical analysis, as it is not very relevant.

The most important thing now is to wait for the announcement of the U.S. election results on Wednesday. We will notify our thoughts and operations in real-time in the group, and everyone can use it as a reference.

As for ETH, there is no need to discuss it separately; it will follow Bitcoin's direction, with price fluctuations being weaker than Bitcoin. For operations, ETH should be traded in the range of 2400—2500, short at the high and long at the low, with a stop-loss of 50 points and a take-profit of 100 points.

If the market breaks through the range, we will adjust our thoughts and operations in the group in a timely manner, with everything based on actual operations.

Specific Operation Suggestions (based on actual market price orders)

Bitcoin 67500—69500, short at high and long at low, with a stop-loss of 1000 points and a take-profit of 2000 points.

ETH range 2400—2500, short at high and long at low, with a stop-loss of 50 points and a take-profit of 100 points.

Market conditions change in real-time, and there may be delays in article publication. The strategy points are for reference only and should not be used as the basis for entry. Investment carries risks, and profits and losses are the investor's responsibility. Daily real-time market analysis, along with experience exchange groups and practical trading groups, welcome to get real-time guidance. Irregular live broadcasts explaining real-time market conditions in the evening.

For more real-time market analysis, please follow the public account: Chu Yuechen

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。