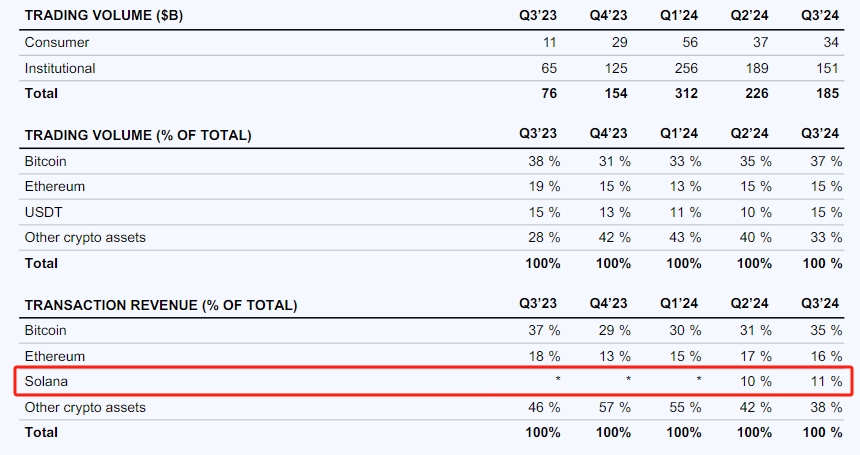

Recently, #Coinbase's Q3 financial report was released. Although the data is average, one thing is explosive: #SOL's share of trading revenue on #Coinbase reached 11%, up 1% from Q2. Meanwhile, ETH dropped from 17% in Q2 to 16% in Q3! Can you handle that? ETH is a crypto project backed by an ETF!

You need to know one thing: Coinbase is basically the playground for institutional players. Q3 data shows that Coinbase's institutional investor trading volume was $15.1 billion, accounting for 81.6% of total trading volume, maintaining dominance! This indicates that U.S. institutions are optimistic about #SOL! You know what I mean!

Holding #SOL during this period won half the battle, while engaging with the #SOL ecosystem and MEME won the other half!

Other data from Coinbase:

- In terms of crypto asset trading structure:

Bitcoin's trading share rose to 37%, an increase of 2 percentage points quarter-over-quarter.

Ethereum remained at 15%.

USDT's trading share rebounded from 10% to 15%.

Other crypto assets' share decreased to 33%.

- Trading volume data:

Total trading volume was $18.5 billion, down 18% from Q2 (from $22.6 billion to $18.5 billion).

Institutional investor trading volume was $15.1 billion, accounting for 81.6% of total trading volume, continuing to maintain dominance.

Retail investor trading volume was $3.4 billion, accounting for 18.4%.

- Cathie Wood's fund heavily invested in Coinbase in Q3.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。