Regardless, the clarity after the election usually drives a rebound in Bitcoin.

Author: arndxt

Translation: Deep Tide TechFlow

Some noteworthy trending topics include Memes, AI, BRC-20, and RWA.

In a bull market, my strategy is to double down on already successful projects and closely follow these trends.

Trends to watch in November.

Weekly Update

Market Momentum from the Election

Bitcoin is nearing historical highs, but the calm in the market shows a sense of anticipation. As the U.S. election approaches, significant market volatility may occur.

Despite Trump leading in Polymarket predictions, the election results remain very close. Candidates can no longer ignore a $200 billion industry and millions of holders. A victory for cryptocurrency supporters could become a breakthrough opportunity for the market.

Bitcoin After the Election: Preparing for a Rebound

Trump's position is clear—he supports the leadership of cryptocurrency, Bitcoin reserves, and a new SEC leadership. Harris has expressed support, but her stance is still unclear. Regardless, clarity after the election usually drives a rebound in Bitcoin. Some volatility is expected, but patience will ultimately pay off.

Why This Setup is Crucial

Despite historical highs being within reach, retail funds have not yet poured in significantly.

The supply of Bitcoin on exchanges is rapidly decreasing.

Gold and the S&P 500 are climbing to new highs.

Interest rate cuts may be on the horizon.

All conditions are in place. There may be volatility in the short term, but the overall outlook for returns remains optimistic.

Hot Trends for 2024

What are the hot trends? Memes, AI, BRC-20, and RWA.

Future strategy: double down on successful projects. As the market cycle heats up, sticking to these trends will provide a competitive edge.

Weekly alpha source @TheDeFinvestor

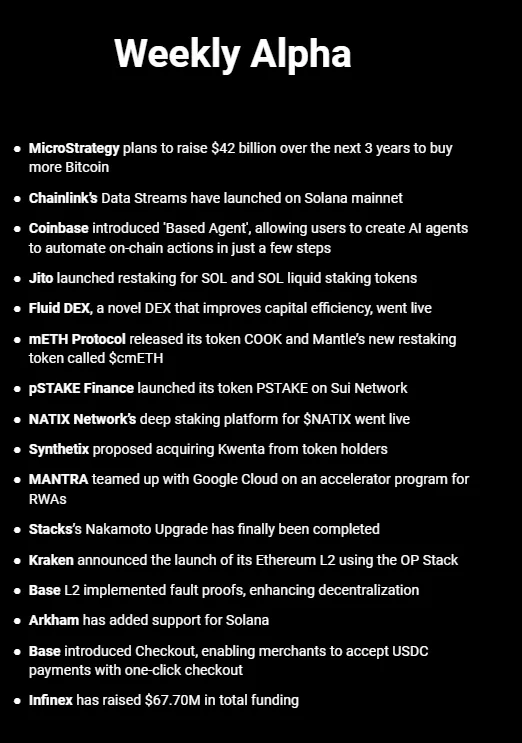

Weekly Alpha

MicroStrategy plans to raise $42 billion over the next three years to purchase more Bitcoin.

Chainlink's data streaming feature has launched on the Solana mainnet.

Coinbase has launched "Based Agent," allowing users to create AI agents to automate on-chain operations in just a few steps.

Jito has launched a re-staking feature for SOL and SOL liquid staking tokens.

Fluid DEX is an innovative decentralized exchange designed to improve capital efficiency, now live.

mETH Protocol has released its token COOK and a new re-staking token $cmETH for Mantle.

pSTAKE Finance has launched its token PSTAKE on the Sui network.

NATIX Network's $NATIX deep staking platform is now live.

Synthetix has proposed to acquire Kwenta from token holders.

MANTRA has partnered with Google Cloud to launch an accelerator project for RWA.

Stacks' Nakamoto upgrade has been successfully completed.

Kraken has announced the launch of an Ethereum L2 based on OP Stack.

Base L2 has implemented fault proofing, further enhancing decentralization.

Arkham has increased support for Solana.

Base has launched a one-click checkout feature for merchants to accept USDC payments.

Infinex has raised a total of $67.7 million.

Narrative Overview

The real strategy is to avoid chasing the hype of newly launched meme coins.

The true investment opportunities lie in those established meme coins that have weathered market turbulence.

Why Buying Newly Issued Coins is a Trap for Most Traders

Murad recently spoke at the Token2049 conference, and the $SPX he recommended surged. But the core of his argument is to look for survivors in the market.

In on-chain investing, to maximize expected value (EV), "old" meme coins with historical volatility—especially those that have dropped at least 80% from their historical highs—are the real gold mines.

Let’s analyze this gold mine strategy in detail.

The Problem with Chasing New Coins

In fact, for every coin that rises 50 or 100 times, there are hundreds that go to zero. Only the top traders, equipped with high-end tools and relentless effort, can consistently achieve positive expected returns in such an environment.

A Better Strategy: Target Cryptocurrencies with Huge Growth Potential

Most newly issued coins will disappear within hours or days. However, when a coin can survive for months and still not collapse after a significant drop, it shows resilience. These coins may not immediately yield 100 times returns, but this investment strategy has significant advantages.

Launched for several months

Down 80% or more from historical highs

Charts show a stable or upward trend (higher lows)

Has an active and loyal community, not just relying on bots or hype

Possesses unique meme and "fervor" potential

Has higher market recognition relative to market cap

Lower market cap

Other Updates

Runes' Surge

Activity in Runes is rapidly increasing, with trading volume tripling since August and the number of transactions surging fourfold. Bitcoin's on-chain fees have also risen by 32% due to Runes, demonstrating Bitcoin's adaptability and resilience.

The Role of Magic Eden

Magic Eden dominates Runes trading, attracting 90% of user activity in the Bitcoin ecosystem. As Runes brings true fungibility to Bitcoin, it has become more than just digital gold; it has turned into a platform for memes and collectibles. High fees and slow speeds? These issues have become a thing of the past with the innovations of Runes and OP_CAT, potentially triggering a "meme coin supercycle" on Bitcoin.

Major Drivers

$DOG currently leads, but emerging tokens like $PUPS, $GIZMO, and $BDC (especially with OP_CAT launching soon) are shifting the focus to cat-themed tokens.

Growth Potential

The market cap of BTC meme coins is $2 billion, only 0.11% of Bitcoin's $1.9 trillion market cap. In contrast, ETH meme coins have a market cap of $20 billion, while SOL's is $12 billion. The BTC meme coin market has significant growth potential, and early listings on CEX could yield substantial returns for current investors.

Token Unlock Dynamics

This week has seen significant volatility for token unlocks:

$PORTAL: Typical cryptocurrency volatility, with price swings of up to 10%.

$TIA: Dropped 21% ahead of a major upcoming unlock.

Focus on $TIA

With an upcoming increase of 92.3 million TIA, this unlock is one of the biggest events of the year. Open interest is nearing historical highs, and the market is responding cautiously—this month's strategy appears more thoughtful than the frenzied 30% surge in September.

Despite recent price declines, early $TIA investors have still seen substantial returns: seed investors profited 526 times, Series A investors 50 times, and Series B investors 5 times.

BlackRock's Bitcoin ETF is Setting Records

BlackRock's Bitcoin ETF is making history, reaching an asset management scale of $30 billion in less than a year, becoming the fastest-growing ETF to date. This is not just a trickle of institutional interest, but a flood.

A Broader Perspective

Capital inflows continue to grow, with daily inflows exceeding $1 billion just in March. This strong interest indicates that we are at the forefront of a new wave of institutional adoption. Keep an eye on daily capital inflows—they hint at an impending wave of mass adoption.

BTC Price Trend: Bullish Bias in Consolidation

BTC is in a consolidation phase, but the long-term trend remains bullish. The current price is above the 50-day moving average, close to previous historical highs, and preparing for a potential breakout.

The current breakout could trigger the next significant surge, or BTC may experience a slight pullback to prepare for a new accumulation wave before rising again. A distributed collapse would be concerning, but no signs of that have been observed so far.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。